(NYSE AMERICAN: CMCL; AIM: CMCL; VFEX:

CMCL) Caledonia Mining Corporation Plc (“Caledonia”

or the “Company”) is pleased to announce that it has signed an

agreement to purchase Bilboes Gold Limited, the parent company

which owns, through its Zimbabwe subsidiary, Bilboes Holdings

(Private) Limited (“Bilboes Holdings”), the Bilboes gold project in

Zimbabwe (“Bilboes” or the “Project”) for a total consideration of

5,123,044 Caledonia shares representing approximately 28.5 per cent

of Caledonia’s fully diluted equity, and a 1 per cent net smelter

royalty (“NSR”) on the Project’s revenues (the “Transaction”).

Based on yesterday’s closing share price on NYSE American of $10.40

per share, the value of the new shares that will be issued as

consideration is currently $53,279,658. Completion of the

Transaction will be subject to several conditions set out below.

Highlights

-

Bilboes is a large, high grade gold deposit located approximately

75 km north of Bulawayo, Zimbabwe. Historically, it has been

subject to a limited amount of open pit mining.

-

The Project has NI43-101 compliant proven and probable mineral

reserves of 1.96 million ounces of gold at a grade of 2.29 g/t and

measured and indicated mineral resources of 2.56 million ounces of

gold at a grade of 2.26 g/t and inferred mineral resources of

577,000 ounces of gold at a grade of 1.89 g/t. The Project has

produced approximately 288,000 ounces of gold since 1989.

-

A feasibility study prepared by the vendors (the “DRA Feasibility

Study”) indicates the potential for an open-pit gold mine producing

an average of 168,000 ounces per year over a 10-year life of

mine.

-

Caledonia will conduct its own feasibility study to identify the

most judicious way to commercialise the Project to optimize

shareholder returns. One approach that will be considered is a

phased development which would minimise the initial capital

investment and reduce the need for third party funding.

-

Prior to completion of the Transaction, Caledonia will enter a

tribute arrangement with Bilboes Holdings so that oxide operations

can be re-started with the expectation that Bilboes Holdings will

return to profitable operations within 6 months. This also has the

benefit of an element of pre-stripping for the main development of

the Project.

-

The Transaction is subject to several conditions including:

-

that Bilboes Holdings receives confirmation from the Zimbabwe

authorities that it will, for the life of the mine, be able to

export gold directly and to retain 100 per cent of the sale

proceeds in US dollars with no requirement to convert US dollar

gold revenues into domestic currency; and

-

an arrangement with or confirmation from the Zimbabwe authorities

and/or an independent power producer regarding the future

availability of a sufficiently reliable and affordable electricity

supply to the Project.

-

Caledonia will, subject to satisfaction of conditions and any

customary adjustments to the purchase price to account for any

extraordinary liabilities incurred before completion, purchase

Bilboes Gold Limited (“Bilboes Gold”) for a consideration to be

settled by the issue to the sellers of 5,123,044 new shares in

Caledonia and a 1 per cent NSR on the Project’s revenues. Based on

yesterday’s closing share price on NYSE American of $10.40 per

share, the value of the new shares that will be issued as

consideration is currently $53,279,658.

Commenting on the announcement, Mark Learmonth, Chief Executive

Officer, said:

“We are delighted to have signed an agreement

for the purchase of Bilboes, the premier gold development project

in Zimbabwe, and indeed one of the best gold development projects

in Africa.

“This is a transformational asset for Caledonia,

as we embark on the next step in our journey to become a

multi-asset, mid-tier gold producer. Once in full production (which

will be subject to financing of the capex) Caledonia’s management

believes that Bilboes could produce three times our current 64 per

cent attributable share of gold production from Blanket, resulting

in production from the enlarged Caledonia group being potentially

four times its current size.

“The acquisition of Bilboes will build on the

recent acquisition of the Maligreen claims which host NI 43-101

compliant inferred mineral resources of 940,000 ounces of gold in

15.6 million tonnes at a grade of 1.88g/t1. We continue our work at

Maligreen which is focused on increasing the confidence level of

the resource base.

“We have followed the progress of Bilboes for

several years and today’s announcement marks the culmination of

many years of hard work on the part of both the Caledonia and

Bilboes management teams.

“The proposed acquisition of Bilboes is well

timed following the completion of the Central Shaft project at

Blanket in 2021 as we look to reinvest some of our surplus cash

flow in this exciting new growth opportunity.

“I look forward to updating shareholders as we

review the investment plan for Bilboes and as we continue work at

Maligreen.”

About Bilboes

Bilboes was formerly owned and explored by Anglo

American Corporation Zimbabwe Limited prior to its exit from the

Zimbabwean gold sector in 2003. The project is approximately 75km

north of Bulawayo with a total land package comprising mining

claims covering 6,870 hectares and exclusive prospecting orders

totaling approximately 92,000 hectares. Bilboes Gold is owned by

the following:

-

Toziyana Resources Limited (“Toziyana”) (50 per cent) – a private

Mauritius company wholly owned by GAT Investments (Private)

Limited, a Zimbabwe company which is controlled by Mr. Victor

Gapare, a prominent Zimbabwean mining entrepreneur. Mr Gapare was

previously the Operations Director for the gold and pyrites

business of Anglo American Corporation Zimbabwe Limited when

Bilboes was part of its portfolio, prior to a management buyout in

which he was involved, and is a former President of the Chamber of

Mines Zimbabwe. Following the successful completion of the

Transaction, Mr Gapare will be appointed as an executive director

of Caledonia;

-

Baker Steel Resources Trust Limited (“BSRT”) (24 per cent) – a

London-listed investment trust managed by Baker Steel Capital;

and

-

Infinite Treasure Limited (“Infinite Treasure”) (26 per cent) – a

British Virgin Islands registered subsidiary of Shining Capital

Holdings LP. II, a Cayman Islands registered investment fund.

The Project has produced a total of

approximately 288,000 ounces of gold since 1989 of which

approximately 90,000 ounces were produced by the current owners.

Bilboes has also completed a total of 93,400 meters of drilling

over a total strike length of 7.4km. Approximately 60 per cent of

this drilling was diamond core drilling.

Bilboes Gold had an unaudited loss before tax

for the year ended 31 December 2021 of $1.5m and unaudited net

assets at 31 May 2022 of $23m. The audit process is progressing and

audited results for the year ended 31 December 2021 are expected to

be completed prior to the Transaction completing. Investors should

note that the historic financial performance of the business

relates primarily to the legacy oxide mining operations and not the

larger scale sulphide project.

Bilboes Holdings engaged DRA Projects (Pty) Ltd

(“DRA”) to complete the DRA Feasibility Study with an effective

date of 15 December 2021 for the Project, a copy of which is being

filed on SEDAR today2. The mineral resources and reserves set out

in the report are summarised below:

|

Mineral Resources (Cut off grade 0.9g/t) |

|

Category |

Tonnes (Mt) |

Grade (g/t) |

Ounces (koz) |

|

Measured |

6.128 |

2.51 |

495 |

|

Indicated |

29.052 |

2.21 |

2,061 |

|

Total M&I |

35.180 |

2.26 |

2,555 |

|

Inferred |

9.475 |

1.89 |

577 |

|

In Situ Mineral Reserves |

|

Category |

Tonnes (Mt) |

Grade (g/t) |

Ounces (koz) |

|

Proven |

5.858 |

2.42 |

456 |

|

Probable |

20.785 |

2.26 |

1,509 |

|

Total Proven & Probable |

26.644 |

2.29 |

1,964 |

- Mineral resources are inclusive of mineral reserves.

- Mineral resources that are not mineral reserves do not have

demonstrated economic viability.

- Mineral resources have been assessed using a long term gold

price of $2,400/oz and mineral reserves have been assessed using a

long term gold price of $1,500/oz

- CIM definitions (May 10, 2014) observed for classification of

mineral resources.

- Block bulk density interpolated from specific gravity

measurements taken from core samples.

- Resources are constrained by a Lerchs-Grossman (LG) optimized

pit shell using Whittle software.

- Mineral resources are not mineral reserves and have no

demonstrated economic viability. The estimate of mineral resources

may be materially affected by mining, processing, metallurgical,

infrastructure, economic, marketing, legal, environmental, social

and governmental factors (“Modifying Factors”).

- Numbers may not add due to rounding.

- Effective date of resource estimate is 25th of October

2021.

- DRA is confident that enough geological work has been

undertaken, and sufficient geological understanding gained, to

enable the construction of an ore body model suitable for the

derivation of mineral resource and mineral reserve estimates. DRA

considers that both the modelling and the grade interpolation have

been carried out in an unbiased manner and that the resulting grade

and tonnage estimates should be reliable within the context of the

classification applied. In addition, DRA is not aware of any

metallurgical, infrastructural, environmental, legal, title,

taxation, socio-economic, or marketing issues that would impact on

the mineral resource, or reserve statements as presented in the DRA

Feasibility Study.

Feasibility studies

Caledonia will conduct its own feasibility study

to identify the most judicious way to commercialise the Project to

optimise shareholder returns, having regard to the availability of

debt and equity on acceptable terms to augment the cash that is

expected to be generated from Caledonia’s existing gold operation

in Zimbabwe, the Blanket Mine. One approach that will be considered

is a phased development which would minimise the initial capital

investment and reduce the need for third party funding.

For information purposes only, the DRA

Feasibility Study indicates the potential for an open-pit gold mine

producing an average of 168,000 ounces per year over a 10-year life

of mine.

Specifically, the DRA Feasibility Study has the

following highlights:

|

Life of Mine |

10 Years |

|

Planned Production Rates |

Isabella & McCays 2.88MtpaBubi 2.160Mtpa |

|

Life of Mine Gold Production (Oz) |

1.673 million ounces |

|

Average Annual Nine Year Steady state LOM Production (koz) |

168koz per year |

|

Peak Production (koz) |

208koz per year |

|

LOM C1 Cash Cost ($/oz) |

$719/oz |

|

Peak Funding Requirement ($m) |

$250m |

|

Economic Analysis as at 15thDecember 2021 |

|

|

Gold Price ($/oz) |

$1,350/oz |

$1,500/oz |

$1,650/oz |

|

Post Tax NPV (10%) ($m) |

$126.9m |

$225.2m |

$323.3m |

|

Post Tax IRR (%) |

20.5% |

27.3% |

33.4% |

|

AISC ($/oz) |

$811/oz |

$818/oz |

$826/oz |

The ore at the Bilboes deposits is refractory

and will require specialised metallurgical processing. DRA has

conducted work on the metallurgical processing which concludes that

approximately 84 per cent of the gold contained can be recovered

using Biox technology in conjunction with gravity and

carbon-in-leach processing. DRA’s work has been reviewed by

Caledonia’s internal team and technical consultants during the due

diligence process.

As indicated above, Caledonia believes the

development plan outlined in the DRA Feasibility Study can be

modified to a phased approach with lower initial production and a

lower peak funding requirement. Based on Caledonia’s assessment of

the existing capital intensity of the Project and Caledonia’s

experience of project development in Zimbabwe, Caledonia estimates

that the peak up-front capital investment could be reduced to less

than $100m for the construction of a mine with an initial

production capacity of approximately 60,000 ounces per year before

increasing the operation in subsequent phases to achieve an

operation of similar scale to that described in the DRA Feasibility

Study, being approximately 168,000 ounces per year. Caledonia

intends to spend approximately 12 months following completion of

the Transaction further reviewing the DRA Feasibility Study with a

view to formulating a project development plan that takes into

account Caledonia’s future cash generation profile from the Blanket

Mine and the oxide mining and processing operations at Bilboes

(described further below), the availability of additional funding

on acceptable terms and Caledonia’s experience of developing

large-scale mining projects in Zimbabwe over the past 6 years (e.g.

the Central Shaft project). Accordingly, readers should treat the

foregoing economic highlights as indicative only and as subject to

change following the finalisation of Caledonia’s revised

development plan. Caledonia will update the market when the results

of its own feasibility study review are complete.

The Transaction

Subject to the satisfaction of various

conditions precedent, Caledonia will purchase Bilboes Gold for a

total consideration comprising 5,123,044 Caledonia shares and a 1

per cent NSR from the Project at completion (the “Consideration”).

Subject to receipt of the necessary regulatory approvals, the

Consideration will be split amongst the current Bilboes Gold

shareholders as follows:

- 2,863,336 new

shares in Caledonia will be issued to Toziyana of which

approximately 441,000 Caledonia shares will be withheld by

Caledonia and will be issued to Infinite Treasure in settlement of

a separate commercial arrangement between Toziyana’s holding

company and Infinite Treasure. The issue of the withheld shares to

Infinite Treasure is subject to Reserve Bank of Zimbabwe approval

for the commercial arrangement between Toziyana’s holding company

and Infinite Treasure:

- 800,000 new

shares in Caledonia and the 1% NSR will be issued to BSRT; and

- 1,459,708 new

shares in Caledonia will be issued to Infinite Treasure. As noted

above, Infinite Treasure will also receive a further approximately

441,000 Caledonia shares from Toziyana’s allocation of

Consideration shares in settlement of their separate commercial

arrangement.

The Consideration shares shall be subject to

sale restrictions for a 6-month period following completion of the

Transaction. The NSR is perpetual but will be capped at a figure to

be agreed between the parties but is currently indicated to be a

theoretical maximum of $75million (which would require the Project

to produce revenues of $7.5billion).

Toziyana, as the largest new holder of shares

and Caledonia will enter into a relationship agreement with

customary terms upon the new Consideration shares being issued.

Caledonia currently has 12,833,126 shares in

issue. The issue of an additional 5,123,044 new shares (on the

basis that all shares are issued and there is no adjustment to the

consideration) would result in the total number of shares in issue

increasing to 17,956,170, giving the current owners of Bilboes Gold

Limited an aggregate of 28.5 per cent of the post Transaction

shares in issue.

The Transaction will be subject to several

conditions precedent including but not limited to:

- An arrangement with the Zimbabwe

authorities which allows inter alia:

- that Bilboes Holdings will, for the

life of the mine, be able to export gold directly and to retain 100

per cent of the sale proceeds in US dollars; and

- that there will be no requirement

for Bilboes Holdings to convert US dollar gold revenues into

domestic currency;

- an arrangement with the Zimbabwe

authorities, or an independent power producer regarding the future

availability and cost of a sufficiently reliable electricity supply

to the Bilboes mining and processing operations;

- Zimbabwean regulatory approvals

from the Zimbabwe Competition and Tariff Commission, the Zimbabwe

Revenue Authority and the Reserve Bank of Zimbabwe; and

- approvals for

the listing of the Consideration shares from applicable securities

exchanges.

Under the terms of the Transaction, Caledonia

will take on the working capital obligations of the Bilboes group

at the time of completion. The Bilboes group is estimated to have a

current net working capital liability of approximately $6

million.

On completion of the acquisition, Mr Gapare is

expected to be appointed as an executive director with specific

responsibility for government relations in Zimbabwe, the

implementation of Caledonia’s environmental and sustainability

strategy and participation in investor relations, with a salary of

US$470,000 and short and long-term incentives that are offered to

other senior executives. His extensive experience of both the

Project and mining in Zimbabwe will be an invaluable addition to

the Board.

Tribute arrangement to generate short-term

cashflow

Bilboes currently has a functional oxide mining

and metallurgical plant at the Project site which has historically

produced up to 20,000 ounces of gold per annum but is currently on

care and maintenance. Caledonia will enter into a tribute agreement

with Bilboes Holdings to mine the oxide and transitional ore. This

tribute agreement will commence as soon as it has been registered

with the relevant authorities and will continue until completion of

the Transaction. The objective of the tribute arrangement is to

create short term cash flow and allow Bilboes Holdings to maintain

its operational integrity in the period up to completion of the

Transaction and the commencement of sulphide mining operations.

Under the terms of the tribute agreement, Caledonia will fund the

necessary capital and operational costs and will receive 100 per

cent of the revenue from the mining operation while paying a 5 per

cent royalty to Bilboes Holdings which it will apply to its working

capital liabilities. The cumulative maximum funding cost to restart

the oxides is expected to be in the range of $3 million to $5

million and the oxide mining operation is expected to take

approximately 6 months to restart and repay the initial funding

costs. On completion of the Transaction or if the Transaction fails

to complete and Caledonia has recouped its investment at an

adequate internal rate of return, the tribute agreement will be

terminated. On completion of the Transaction, Caledonia expects to

continue to mine and process the oxides and transitional ore and to

use the proceeds to contribute towards funding the capital cost of

the larger scale sulphide project.

Rothschild & Co acted as financial advisor

to Caledonia. Hannam & Partners acted as financial advisor to

Bilboes.

Caledonia’s Chairman, Leigh Wilson, also commented on the

announcement, saying:

“It gives me great satisfaction to sign an

agreement for the purchase of Bilboes, a transformational asset for

our business. Today’s announcement represents the culmination of

many months of hard work on behalf of both parties for which I

extend my and the board’s sincere appreciation.

“I would like to extend a welcome to Bilboes’

existing shareholders as they become significant shareholders in

Caledonia on completion and I look forward to their long-term

support as we continue to grow the business. I would also like to

extend a warm welcome to all the employees of Bilboes as we look

forward to them becoming our colleagues.

“As with many deals of this nature there remain

several significant conditions precedent which I am confident that

both parties will continue to work to resolve. Pending the

successful resolution of these matters and the subsequent

completion of the Transaction, I look forward to working with

Victor as a fellow director.

“Lastly, I would like to take this opportunity

to thank our existing shareholders, many of whom have been

investors in Caledonia for over a decade. Their patience has been

rewarded as we have delivered on our strategy over the last decade,

and I look forward to their continued support as we embark on the

next phase of growth.”

Conference Call Details

Management will host a conference call / webinar

at 2pm British Summer Time on July 28, 2022.

Details for the call are as follows:

When: July 28, 2022 at 02:00 PM London Topic:

Webinar for Caledonia Shareholders

Register in advance for this

webinar:https://caledoniamining.zoom.us/webinar/register/WN_iuYwxS76Q8yNMNhPC94Dgw

After registering, you will receive a

confirmation email containing information about joining the

webinar.

|

Caledonia Mining Corporation Plc |

|

|

Mark LearmonthCamilla Horsfall |

Tel: +44 1534 679 802Tel: +44 7817 841793 |

|

Cenkos Securities plc (Nomad and Joint

Broker) |

|

|

Adrian HaddenNeil McDonaldPearl Kellie |

Tel: +44 207 397 1965Tel: +44 131 220 9771Tel: +44 131 220

9775 |

|

Liberum Capital Limited (Joint Broker) |

|

|

Scott Mathieson/Kane Collings |

Tel: +44 20 3100 2000 |

|

BlytheRay Financial PR |

|

|

Tim Blythe/Megan Ray |

Tel: +44 207 138 3204 |

|

3PPB |

|

|

Patrick ChidleyPaul Durham |

Tel: +1 917 991 7701Tel: +1 203 940 2538 |

|

Curate Public Relations (Zimbabwe) |

|

|

Debra Tatenda |

Tel: +263 77802131 |

|

Rothschild & Co (Financial Advisor to

Caledonia) |

|

|

Giles Douglas Muhammad Jaffer |

Tel: +27 11 428 3700 Tel: +44 20 7280 5000 |

Note: The information contained within

this announcement is deemed by the Company to constitute inside

information under the Market Abuse Regulation (EU) No.

596/2014 (“MAR”) as it forms part

of UK domestic law by virtue of the European Union (Withdrawal) Act

2018 and is disclosed in accordance with the

Company's obligations under Article 17 of MAR.

Cautionary Note Concerning

Forward-Looking InformationInformation and statements

contained in this news release that are not historical facts are

“forward-looking information” within the meaning of applicable

securities legislation that involve risks and uncertainties

relating, but not limited, to Caledonia’s current expectations,

intentions, plans, and beliefs. Forward-looking information can

often be identified by forward-looking words such as “anticipate”,

“believe”, “expect”, “goal”, “plan”, “target”, “intend”,

“estimate”, “could”, “should”, “may” and “will” or the negative of

these terms or similar words suggesting future outcomes, or other

expectations, beliefs, plans, objectives, assumptions, intentions

or statements about future events or performance. Examples of

forward-looking information in this news release include:

production guidance, estimates of future/targeted production rates,

the completion of the sale and purchase agreement, the satisfaction

of all conditions precedent in connection with the acquisition, the

completion of the acquisition and the issuance of the acquisition

consideration, our plans regarding a modified development plan with

a phased approach with lower initial production and a lower peak

funding requirement and our plans and timing regarding further

exploration and drilling and development. The forward-looking

information contained in this news release is based, in part, on

assumptions and factors that may change or prove to be incorrect,

thus causing actual results, performance or achievements to be

materially different from those expressed or implied by

forward-looking information. Such factors and assumptions include,

but are not limited to: the establishment of estimated resources

and reserves, the grade and recovery of minerals which are mined

varying from estimates, success of future exploration and drilling

programs, reliability of drilling, sampling and assay data, the

representativeness of mineralization being accurate, success of

planned metallurgical test-work, capital availability and accuracy

of estimated operating costs, obtaining required governmental,

environmental or other project approvals, inflation, changes in

exchange rates, fluctuations in commodity prices, delays in the

development of projects, the assessment of the existing capital

intensity of the Bilboes gold project and Caledonia’s experience of

project development in Zimbabwe and other factors.

Security holders, potential security holders and

other prospective investors should be aware that these statements

are subject to known and unknown risks, uncertainties and other

factors that could cause actual results to differ materially from

those suggested by the forward-looking statements. Such factors

include, but are not limited to: risks relating to the completion

of the acquisition, risks relating to estimates of mineral reserves

and mineral resources proving to be inaccurate, fluctuations in

gold price, risks and hazards associated with the business of

mineral exploration, development and mining, risks relating to the

credit worthiness or financial condition of suppliers, refiners and

other parties with whom the Company does business; inadequate

insurance, or inability to obtain insurance, to cover these risks

and hazards, employee relations; relationships with and claims by

local communities and indigenous populations; political risk; risks

related to natural disasters, terrorism, civil unrest, public

health concerns (including health epidemics or outbreaks of

communicable diseases such as the coronavirus (COVID-19));

availability and increasing costs associated with mining inputs and

labour; the speculative nature of mineral exploration and

development, including the risks of obtaining or maintaining

necessary licenses and permits, diminishing quantities or grades of

mineral reserves as mining occurs; global financial condition, the

actual results of current exploration activities, changes to

conclusions of economic evaluations, and changes in project

parameters to deal with unanticipated economic or other factors,

risks of increased capital and operating costs, environmental,

safety or regulatory risks, expropriation, the Company’s title to

properties including ownership thereof, increased competition in

the mining industry for properties, equipment, qualified personnel

and their costs, risks relating to the uncertainty of timing of

events including targeted production rate increase and currency

fluctuations. Security holders, potential security holders and

other prospective investors are cautioned not to place undue

reliance on forward-looking information. By its nature,

forward-looking information involves numerous assumptions, inherent

risks and uncertainties, both general and specific, that contribute

to the possibility that the predictions, forecasts, projections and

various future events will not occur. Caledonia undertakes no

obligation to update publicly or otherwise revise any

forward-looking information whether as a result of new information,

future events or other such factors which affect this information,

except as required by law.

National Instrument 43-101 - Standards of

Disclosure for Mineral Projects (“NI 43-101”) is a rule of the

Canadian Securities Administrators which establishes standards for

all public disclosure an issuer makes of scientific and technical

information concerning mineral projects. Unless otherwise

indicated, all reserves and resource estimates contained in this

press release have been prepared in accordance with NI 43-101 and

the Canadian Institute of Mining, Metallurgy and Petroleum

Classification System. These standards differ from the requirements

of the U.S. Securities and Exchange Commission (the “SEC”), and

reserve and resource information contained in this press release

may not be comparable to similar information disclosed by U.S.

companies. The requirements of NI 43-101 for identification of

reserves and resources are also not the same as those of the SEC,

and any reserves or resources reported in compliance with NI 43-101

may not qualify as “reserves” or “resources” under SEC standards.

Accordingly, the mineral reserve and resource information set forth

herein may not be comparable to information made public by

companies that report in accordance with United States

standards.

This news release is not an offer of the shares

of Caledonia for sale in the United States or elsewhere. This news

release shall not constitute an offer to sell or the solicitation

of an offer to buy, nor shall there be any sale of the shares of

Caledonia, in any province, state or jurisdiction in which such

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of such province, state

or jurisdiction.

1 Refer to technical

report entitled “Caledonia Mining Corporation Plc NI 43-101 Mineral

Resource Report on the Maligreen Gold Project, Zimbabwe” by Minxcon

(Pty) Ltd dated November 2, 2021 and filed on SEDAR (www.sedar.com)

on November 3, 2021.2 Refer to the technical report entitled

“BILBOES GOLD PROJECT FEASIBILITY STUDY” with effective date 15

December 2021 prepared by DRA Projects (Pty) Ltd which is being

filed by the Company on SEDAR (www.sedar.com) today. This news

release has been approved by Mr Dana Roets (B Eng (Min.), MBA,

Pr.Eng., FSAIMM, AMMSA), Chief Operating Officer, the Company's

qualified person as defined by Canada's National Instrument 43-101

- Standards of Disclosure for Mineral Projects ("NI 43-101”). Mr.

James Gemmell of DRA Projects (Pty) Ltd, the qualified person

responsible for the report, has also approved this news release.

Mr. Sivanesan (Desmond) Subramani has verified the data disclosed

herein, including sampling, analytical and test data informing the

mineral resource and Mr. David Alan Thompson has reviewed the

reserve estimate by reviewing the methodologies, results and all

procedures undertaken in a manner consistent with industry

practice, and all matters were consistent and accurate according to

his professional judgement. There were no limitations on the

verification process.

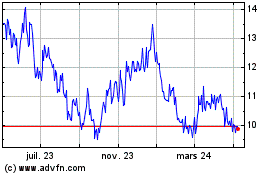

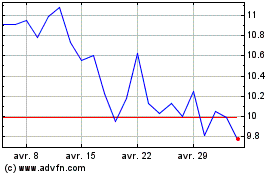

Caledonia Mining (AMEX:CMCL)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Caledonia Mining (AMEX:CMCL)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024