Caledonia Mining Corporation Plc (“Caledonia” or the

“Company”) (NYSE AMERICAN: CMCL; AIM: CMCL; VFEX: CMCL) is

pleased to announce an update to the NI 43-101 compliant Mineral

Resources and Reserves estimates at its 64 per cent owned

subsidiary, the Blanket Mine in Zimbabwe (“Blanket”)1. The total

Measured and Indicated Mineral Resources estimate (“M&I”) at

Blanket, inclusive of Mineral Reserves, has increased by fifty-two

percent to 1,095,000 ounces of gold and the total Mineral Reserves

estimate at Blanket has increased by one percent to 395,000 ounces

of gold, in each case as compared to the adjusted figures explained

further below2.

Minxcon (Pty) Ltd were

commissioned by the Company to produce updated Mineral Resources

and Mineral Reserves estimates based upon existing data, reflecting

the completion of Central Shaft, and the migration to fully digital

estimation protocols. The report was commissioned based upon data

struck at March 31, 2022 for Mineral Resources and September 1,

2022 for Mineral Reserves.

Commenting on

the Mineral Resources and Mineral Reserves update, Mark Learmonth,

Chief Executive Officer said:

“I am delighted to be publishing this report

reflecting the completion of Central Shaft which not only has

increased M&I by 52% to over 1 million ounces, but also

increased Mineral Reserves by 1% to 395,000 ounces, thus securing

the long-term future of Blanket. The slight reduction in Inferred

Mineral Resources is partly due to our long track record of growing

Mineral Resources and successfully converting Inferred Mineral

Resources into M&I, but also reflects the constrained deep

level exploration due to sinking and equipping Central Shaft. We

are pleased to have established new drilling platforms with resumed

drilling.”

“In 2022, the Company achieved its long-term

target of producing 80,000 ounces of gold at Blanket - this,

coupled with a high gold price, puts the Company in a good position

to start to progress our new portfolio of assets supported by cash

generated from stable production at Blanket.”

The tables below

compare the new NI 43-101 Mineral Resources estimate at March 31,

2022 and Mineral Reserves estimate at September 1, 2022 to the 1300

S-K TRS Mineral Resources and Reserves which were stated with an

effective date of December 31, 2021 (see footnote 2 above for an

explanation of column B below).

|

Mineral Resources Comparison |

|

|

A |

B |

C |

Variance % (B to C) |

|

Effective Date |

December 31, 2021 |

December 31, 2021 |

March 31, 2022 |

|

|

Source |

1300 S-K TRS |

1300 S-K TRS butcalculated at 100% |

NI-43-101 to bepublished on SEDAR |

|

|

Basis |

Inclusive of MineralReserves64%

Attributable |

Inclusive of TotalMineral

ReservesNon-Attributable |

Inclusive of TotalMineral

ReservesNon-Attributable |

|

|

Mineral Resources Classification |

Tonnes |

Grade |

AuContent |

Tonnes |

Grade |

AuContent |

Tonnes |

Grade |

AuContent |

Tonnes |

Grade |

AuContent |

|

kt |

g/t |

koz |

kt |

g/t |

koz |

kt |

g/t |

koz |

kt |

g/t |

koz |

|

Measured |

1,215 |

3.06 |

119 |

1,899 |

3.06 |

187 |

5,065 |

3.32 |

541 |

167 |

% |

8 |

% |

190 |

% |

|

Indicated |

3,347 |

3.18 |

342 |

5,229 |

3.18 |

535 |

5,659 |

3.04 |

554 |

8 |

% |

-4 |

% |

4 |

% |

|

Total M&I |

4,562 |

3.15 |

462 |

7,129 |

3.15 |

721 |

10,724 |

3.18 |

1,095 |

50 |

% |

1 |

% |

52 |

% |

|

Inferred |

5,419 |

3.17 |

552 |

8,467 |

3.17 |

863 |

8,995 |

2.92 |

844 |

6 |

% |

-8 |

% |

-2 |

% |

Mineral Resources (March 31, 2022)Notes:

- Cut-off applied

1.5 g/t.

- No geological

loss applied for Measured, 5% for Indicated and Inferred.

- Gold price:

USD1,600/oz.

- Mineral

Resources for NI 43-101 are stated inclusive of Mineral

Reserves.

- Mineral

Resources for NI 43-101 are reported as total Mineral Resources and

are not attributed.

- All orebodies

are depleted for mining.

|

Mineral Reserves Comparison |

|

|

A |

B |

C |

Variance % (B to C) |

|

Effective Date |

December 31, 2021 |

December 31, 2021 |

September 1, 2022 |

|

|

Source |

SK-1300 TRS |

1300 S-K TRS butcalculated at 100% |

NI-43-101 to bepublished on SEDAR |

|

|

Basis |

64% Attributable MineralReserves |

Total Mineral

ReservesNon-Attributable |

Total Mineral

ReservesNon-Attributable |

|

|

Mineral Reserves Classification |

Tonnes |

Grade |

AuContent |

Tonnes |

Grade |

AuContent |

Tonnes |

Grade |

AuContent |

Tonnes |

Grade |

AuContent |

|

kt |

g/t |

koz |

kt |

g/t |

koz |

kt |

g/t |

koz |

kt |

g/t |

koz |

|

Proven |

656 |

3.11 |

66 |

1,025 |

3.11 |

103 |

1,978 |

3.30 |

210 |

93 |

% |

6 |

% |

105 |

% |

|

Probable |

1,751 |

3.30 |

186 |

2,736 |

3.30 |

290 |

1,964 |

2.94 |

185 |

-28 |

% |

-11 |

% |

-36 |

% |

|

Total |

2,407 |

3.25 |

251 |

3,761 |

3.25 |

393 |

3,942 |

3.12 |

395 |

5 |

% |

-4 |

% |

1 |

% |

Mineral Reserves

(September 1, 2022)Notes:

- Mineral Reserve

cut-off of 2.1 g/t applied.

- The gold price

that has been utilised in the economic analysis to convert diluted

Measured and Indicated Mineral Resources in the life of mine plan

(“LOMP”) to Mineral Reserves is an average real term price of

USD1,650/oz over the LOMP, as compared to USD1,622/oz for the 1300

S-K TRS.

- Mineral Reserves

are reported as total Mineral Reserves and are not attributed in

the NI 43-101.

Enquiries:

|

Caledonia Mining Corporation PlcMark

LearmonthCamilla Horsfall |

Tel: +44 1534 679 800Tel: +44 7817 841793 |

|

Cenkos Securities plc (Nomad and Joint

Broker)Adrian HaddenNeil McDonaldPearl Kellie |

Tel: +44 207 397 1965Tel: +44 131

220 9771Tel: +44 131 220 9775 |

|

Liberum Capital Limited (Joint Broker)Scott

Mathieson/Kane Collings |

Tel: +44 20 3100 2000 |

|

BlytheRay Financial PRTim Blythe/Megan Ray |

Tel: +44 207 138 3204 |

|

3PPBPatrick ChidleyPaul Durham |

Tel: +1 917 991 7701Tel: +1 203

940 2538 |

|

Curate Public Relations (Zimbabwe)Debra

Tatenda |

Tel: +263 77802131 |

|

IH Securities (Private) Limited (VFEX Sponsor –

Zimbabwe)Dzika DhanaLloyd Mlotshwa |

Tel: +263 (242) 745

119/33/39 |

|

|

|

The information contained within this announcement is

deemed by the Company to constitute inside information under the

Market Abuse Regulation (EU) No. 596/2014.

Glossary

|

Unit |

Definition |

|

% |

Percent |

|

/ |

Per |

|

± or ~ |

Approximately |

|

° |

Degrees |

|

°C |

Degrees Celsius |

|

a |

Year |

|

cm |

Centimetre |

|

d |

Day |

|

g |

Grammes |

|

g/cm3 |

Grammes per cubic centimetre |

|

g/t |

Grammes per tonne |

|

Ga |

Billion years (1,000,000,000 years) |

|

ha |

Hectares |

|

hr |

Hour |

|

kg |

Kilogram (1,000 g) |

|

kL |

Kilolitres (1,000 l) |

|

km |

Kilometre (1,000 m) |

|

km2 |

Square kilometres |

|

koz |

Kilo ounces (1,000 oz) |

|

kt |

Kilotonnes (1,000 t) |

|

ktpm |

Kilo tonnes per month |

|

kV |

Kilovolt (1,000 volts) |

|

kVA |

Kilovolt ampere |

|

kW |

Kilowatt (1,000 W) |

|

l |

Litre |

|

m |

Metre |

|

m2 |

Square metres |

|

m3 |

Cubic metres |

|

mm |

Millimetre |

|

Moz |

Million ounces (1,000,000 oz) |

|

Mt |

Million tonnes (1,000,000 t) |

|

Mtpa |

Million tonnes per annum |

|

MVA |

Megavolt ampere |

|

oz |

Troy Ounces |

|

t |

Tonne |

|

t/m³ |

Tonnes per cubic meter |

|

tpd |

Tonnes per day |

|

V |

Volts |

|

x |

By / Multiplied by |

| |

|

The following abbreviations were used

in the Report:

|

Abbreviation |

Description |

|

2018 Report |

National Instrument 43-101 Technical Report on the Blanket Mine,

Gwanda Area, Zimbabwe (Updated February 2018) |

|

AC |

Asbestos Cement |

|

amsl |

Above Mean Sea Level |

|

BETS |

Employee Trust for the benefit of the present and future employees

of Blanket Mine |

|

BIF |

Banded Iron Formation |

|

Blanket Mine Company |

Blanket Mine (1983) (Pvt) Ltd |

|

Blanket or the Mine |

Blanket Gold Mine |

|

BQR |

Blanket Quartz Reef |

|

Caledonia or the Company |

Caledonia Mining Corporation Plc |

|

CAPM |

Capital Asset Pricing Model |

|

CBDZ |

Colleen Bawn Deformation Zone |

|

CIL |

Carbon-in-Leach |

|

CIM |

Canadian Institute of Mining, Metallurgy and Petroleum |

|

CMS |

Central Main Shaft |

|

CPI |

Consumer Price Indices |

|

CRM |

Certified Reference Material |

|

DCF |

Discounted Cash Flow |

|

DSR |

Disseminated Sulphide Reefs |

|

DSR |

Disseminated Sulphide Reefs |

|

EIA |

Environmental Impact Assessment |

|

EM Act |

Environmental Management Act (Chapter 20:27) No. 13/2002 |

|

EMA |

Environmental Management Agency |

|

Epoch |

Epoch Resources (Pty) Ltd |

|

FCFE |

Free Cash Flow to Equity |

|

FCFF |

Free Cash Flow to Firm |

|

Fidelity |

Fidelity Printers and Refiners Limited |

|

Fremiro |

Fremiro Investments (Private) Limited |

|

FW |

Footwall |

|

G&A |

General and Administrative |

|

GCSOT |

Gwanda Community Share Ownership Trust |

|

GGB |

Gwanda Greenstone Belt |

|

GMS |

Greenstone Management Services (Pty) Limited |

|

HG |

High Grade |

|

HW |

Hanging Wall |

|

IL |

Intensive Leach |

|

Kinross |

Kinross Gold Corporation |

|

KNA |

Kriging Neighbourhood Analysis |

|

LG |

Low Grade |

|

LIMS |

Laboratory Information Management System |

|

LoM |

Life of Mine |

|

Minxcon |

Minxcon (Pty) Ltd |

|

ML40 |

Mining Lease with registered number 40 |

|

MMA |

Mines and Minerals Act (Chapter 21:05) of 1961 |

|

MMCZ |

Minerals Marketing Corporation of Zimbabwe |

|

MSO |

GEOVIA Stope Shape Optimiser |

|

NI 43-101 |

National Instrument 43-101, Form 43-101 F1 and the Companion Policy

Document 43-101CP |

|

NIEEF |

National Indigenisation and Economic Empowerment Fund |

|

NIR |

Not-In-Reserve |

|

NMD |

Nominal Maximum Demand |

|

NPV |

Net Present Value |

|

NSR |

Net Smelter Royalty |

|

NWGDZ |

Northwest Gwanda Deformation Zone |

|

OHL |

Overhead Powerlines |

|

PEM |

Prospectivity Enhancement Multiplier |

|

PPE |

Personal Protective Equipment |

|

PSA |

Pressure Swing Absorption |

|

QAQC |

Quality Assurance and Quality Control |

|

QP |

Qualified Person |

|

RoM |

Run of Mine |

|

RoR |

Rate of Rise |

|

SG |

Specific Gravity |

|

SGDZ |

South Gwanda Deformation Zone |

|

SoR |

Slope of Regression |

|

The Act |

Indigenisation and Economic Empowerment Act |

|

this Report |

NI 43-101 Technical Report on the Blanket Gold Mine, Zimbabwe” with

an effective date of 1 January 2023 |

|

TMM |

Trackless Mobile Machinery |

|

TSF |

Tailings Storage Facility |

|

WACC |

Weighted Average Cost of Capital |

|

ZESA |

Zimbabwe Electricity Supply Authority |

|

ZINWA |

Zimbabwe National Water Authority |

|

ZMDC |

Zimbabwe Mining Development Corporation |

| |

|

Cautionary Note Concerning

Forward-Looking Information

Information and statements contained in this

news release that are not historical facts are forward-looking

information and forward-looking statements (collectively,

“forward-looking information”) within the meaning of applicable

securities legislation that involve risks and uncertainties

relating, but not limited, to Caledonia’s current expectations,

intentions, plans, and beliefs. Forward-looking information

can often be identified by forward-looking words such as

“anticipate”, “envisage”, “believe”, “expect”, “goal”, “plan”,

“target”, “intend”, “estimate”, “could”, “should”, “may” and “will”

or the negative of these terms or similar words suggesting future

outcomes, or other expectations, beliefs, plans, objectives,

assumptions, intentions or statements about future events or

performance. Examples of forward-looking information in this news

release include: estimates of Mineral Resources and Mineral

Reserves; the projections used in developing such estimates; the

filing of a new NI 43-101 technical report; future production and

cash generation at Blanket; and the progression of the Company’s

assets. This forward-looking information is based, in

part, on assumptions and factors that may change or prove to be

incorrect, thus causing actual results, performance or achievements

to be materially different from those expressed or implied by

forward-looking information, including interpretations of

exploration results and assumptions relating to future costs and

commodity prices.

Securityholders, potential securityholders and

other prospective investors should be aware that these statements

are subject to known and unknown risks, uncertainties and other

factors that could cause actual results to differ materially from

those suggested by the forward-looking information. Such

factors include, but are not limited to: risks relating to

estimates of Mineral Reserves and Mineral Resources proving to be

inaccurate, fluctuations in gold price, increases in capital or

operating costs, risks and hazards associated with the business of

mineral exploration, development and mining, risks relating to the

credit worthiness or financial condition of suppliers, refiners and

other parties with whom the Company does business; inadequate

insurance, or inability to obtain insurance, to cover these risks

and hazards, employee relations; relationships with and claims by

local communities and indigenous populations; political risk; risks

related to natural disasters, terrorism, civil unrest, public

health concerns (including health epidemics or outbreaks of

communicable diseases such as the coronavirus (COVID-19));

availability and increasing costs associated with mining inputs and

labour; the speculative nature of mineral exploration and

development, including the risks of obtaining or maintaining

necessary licenses and permits, diminishing quantities or grades of

Mineral Reserves as mining occurs; global financial condition, the

actual results of current exploration activities, changes to

conclusions of economic evaluations, and changes in project

parameters to deal with unanticipated economic or other factors,

risks of increased capital and operating costs, environmental,

safety or regulatory risks, expropriation, the Company’s title to

properties including ownership thereof, increased competition in

the mining industry for properties, equipment, qualified personnel

and their costs, risks relating to the uncertainty of timing of

events including targeted production rate increase and currency

fluctuations, and the other risk factors discussed in the Company’s

reports filed with the SEC on www.sec.gov and with Canadian

securities regulators on www.sedar.com. Shareholders are

cautioned not to place undue reliance on forward-looking

information. By its nature, forward-looking information

involves numerous assumptions, inherent risks and uncertainties,

both general and specific, that contribute to the possibility that

the predictions, forecasts, projections and various future events

will not occur. Caledonia undertakes no obligation to update

publicly or otherwise revise any forward-looking information

whether as a result of new information, future events or other such

factors which affect this information, except as required by

law.

National Instrument

43-101 - Standards of Disclosure for Mineral Projects (“NI 43-101”)

is a rule of the Canadian Securities Administrators which

establishes standards for all public disclosure an issuer makes of

scientific and technical information concerning mineral projects.

Unless otherwise indicated, all Reserves and Resource estimates

contained in this press release have been prepared in accordance

with NI 43-101 and the Canadian Institute of Mining, Metallurgy and

Petroleum Classification System. These standards differ from the

requirements of 1300 S-K adopted by the SEC, and Reserve and

Resource information contained in this press release may not be

comparable to similar information disclosed by U.S. companies. The

requirements of NI 43-101 for identification of Reserves and

Resources are also not the same as those of 1300 S-K, and any

Reserves or Resources reported in compliance with NI 43-101 may not

qualify as “Reserves” or “Resources” under 1300 S-K. Accordingly,

the Mineral Reserve and Resource information set forth herein may

not be comparable to information made public by companies that

report in accordance with United States standards.

1 This news release has been approved by

Mr Dana Roets (B Eng (Min.), MBA, Pr.Eng., FSAIMM,

AMMSA), Chief Operating Officer, the Company’s qualified person as

defined by Canada’s National Instrument 43-101

- Standards of Disclosure for Mineral Projects (“NI

43-101”). The Company’s independent qualified persons as defined by

NI 43-101, Mr Uwe Engelmann (BSc (Zoo. & Bot.), BSc Hons

(Geol.), Pr.Sci.Nat. No. 400058/08, FGSSA) in respect of the

Mineral Resources estimate and Mr Daniel van Heerden (B Eng (Min.),

MCom (Bus. Admin.), MMC) in respect of the Mineral Reserves

estimate each of Minxcon (Pty) Ltd have verified the data

disclosed herein, including sampling, analytical and test data

informing the Mineral Resources and Mineral Reserves estimates, by

reviewing the methodologies, results and all procedures undertaken

in a manner consistent with industry practice, and all matters were

consistent and accurate according to their professional judgement.

There were no limitations on the verification process. A

technical report prepared in accordance with NI 43-101 for Blanket

will be filed by the Company on SEDAR (www.sedar.com) within 45

days of this news release.

2 The percentage

changes are based on the Technical Report Summary on Blanket Mine

(the “1300 S-K TRS”) prepared in compliance with the SEC’s

technical disclosure requirements for mining companies under new

subpart 1300 of Regulation S-K (“1300 S-K”) which was filed as

exhibit 15.4 to the Annual Report on Form 20-F of the Company that

had an effective date of December 31, 2021 and which was filed on

EDGAR (www.sec.gov/edgar) on May 17, 2022, and which contains the

Company’s most recently published Mineral Resources and Reserves

estimates. Mineral Resources and Reserves are stated in the 1300

S-K TRS pursuant to 1300 S-K on an attributable basis (i.e. 64%,

based on the Company’s percentage ownership of Blanket Mine) and

Mineral Resources are stated exclusive of Mineral Reserves. Given

that under NI 43-101 Mineral Resources and Reserves are stated on a

100% (i.e. non attributable basis) and Mineral Resources are

inclusive of Mineral Reserves, the estimates in the 1300 S-K TRS

(the “TRS Mineral Resources and Reserves”) as shown in this

announcement and to which the new estimates have been compared have

also been grossed up to 100% (i.e. non attributable) and are shown

on an inclusive basis in order to correlate with the methodology

used to estimate the new NI 43-101 Mineral Resources and Reserves

and thus provide a meaningful comparison to the previously

published estimates in the 1300 S-K TRS – see table below with full

details.

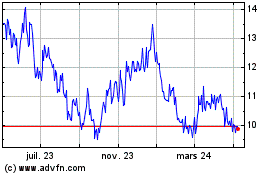

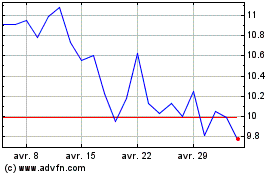

Caledonia Mining (AMEX:CMCL)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Caledonia Mining (AMEX:CMCL)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024