|

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-255500

|

|

PROSPECTUS SUPPLEMENT

|

|

(To Prospectus dated May 18, 2021)

|

CALEDONIA MINING CORPORATION PLC

Up to $30,000,000

Common Shares

Caledonia Mining Corporation Plc (the “Company” or “Caledonia”)

is hereby offering to sell common shares (“Common Shares”) having an aggregate offering price of up to $30,000,000

under this prospectus supplement (the “Prospectus Supplement”) to the accompanying prospectus of the Company which

was declared effective by the United States Securities and Exchange Commission (the “SEC”) on May 18, 2021 (the “Prospectus”).

The Company entered into a sales agreement dated May 17, 2023 (the “Sales

Agreement”), with Cantor Fitzgerald & Co. (the “Agent”) relating to the sale of Common Shares. In accordance

with the terms of the Sales Agreement and this Prospectus Supplement, the Company may offer and sell Common Shares having an aggregate

offering price of up to $30,000,000 (the “Offering”) from time to time, on or after the date hereof, through the Agent.

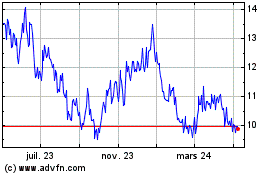

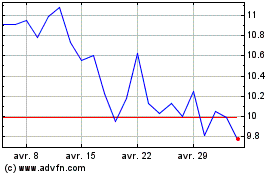

Our Common Shares are listed on the NYSE American LLC (“NYSE American”)

under the symbol “CMCL”, depositary interests in our Common Shares are admitted to trading on the AIM of the London Stock

Exchange Group plc (the “AIM”) under the symbol “CMCL” and depositary receipts representing our Common

Shares are listed on the Victoria Falls Stock Exchange (the “VFEX”) under the symbol “CMCL”. On May 16,

2023, the closing price of the Common Shares and depositary interests on the NYSE American was $13.13 and on AIM was £10.70 respectively.

On April 21, 2023, which was the last date that depositary receipts traded on the VFEX, the closing price on the VFEX was $16.00. We have

applied to list up to 2,000,000 Common Shares distributed under this Prospectus Supplement on the NYSE American. Listing will be subject

to us fulfilling all of the listing requirements of the NYSE American.

Upon our delivery of a placement notice and subject to the terms and conditions

of the Sales Agreement, sales of Common Shares, if any, under this Prospectus Supplement and the accompanying Prospectus are anticipated

to be made in transactions that are deemed to be an “at the market offering” as defined in Rule 415(a)(4) promulgated under

the Securities Act of 1933, as amended (“Securities Act”). Subject to the terms of the Sales Agreement, the Agent is

not required to sell any specific number or dollar amounts of securities but will act as a sales agent using commercially reasonable efforts

consistent with its normal trading and sales practices, on mutually agreed terms between the Agent and us. There is no arrangement for

funds to be received in any escrow, trust or similar arrangement.

The Company will pay the Agent compensation for their services in acting

as agent in the sale of Common Shares pursuant to the terms of the Sales Agreement. The Company will pay the Agent compensation up to

but not exceeding 3% of the gross proceeds from sales of Common Shares made thereunder. In connection with the sale of Common Shares on

our behalf, the Agent will be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation

of the Agent will be deemed to be underwriting commissions or discounts.

An investment in our Common Shares involves a high degree

of risk and must be considered speculative due to the nature of our business and the present stage of exploration and development of certain

of our properties. Prospective investors should carefully consider the risk factors described in this Prospectus Supplement and the Prospectus

under “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” and the risk factors discussed

in our annual report on Form 20-F for the year ended December 31, 2022, which are incorporated by reference into this Prospectus Supplement

and the Prospectus.

Neither the United States Securities and Exchange Commission,

nor any state securities regulator, has approved or disapproved the securities offered hereby or passed upon the accuracy or adequacy

of this Prospectus Supplement or the Prospectus. Any representation to the contrary is a criminal offence.

The Common Shares offered by this Prospectus Supplement

have not been qualified for distribution by a prospectus in Canada and may not be offered or sold in Canada during the course of their

distribution.

This Prospectus Supplement is not directed at, and may

not be acted on, by anyone in the United Kingdom. The Common Shares are not intended to be offered, sold or otherwise made available to

and should not be offered, sold or otherwise made available to any investor in the United Kingdom. This Prospectus Supplement is not a

compliant prospectus for the purposes of the Prospectus Regulation (EU) 2017/1129 (to the extent brought into UK law by the European Union

(Withdrawal) Act 2018 (EUWA) (as amended)) because it is not a public offer in the UK. It is a financial promotion for the purposes of

section 21 Financial Services and Markets Act 2000 (“FSMA”), but neither has it been issued by, nor has its content been approved

by, a person authorised and regulated under FSMA. This Prospectus Supplement is being addressed only to persons outside the UK and it

therefore is an exempt promotion. Reliance on this document for the purpose of engaging in any investment activity may expose an individual

to a significant risk of losing all of the property or other assets invested. Any person who is in any doubt about the subject matter

to which this document relates should consult a person duly authorised for the purposes of FSMA who specialises in the acquisition of

shares and other securities.

A copy of this Prospectus Supplement and the Prospectus

have been delivered to the Jersey Registrar of Companies in accordance with Article 5 of the Companies (General Provisions) (Jersey) Order

2002, and the Jersey Registrar of Companies has given, and has not withdrawn, consent to its circulation.

The Jersey Financial Services Commission (“JFSC”)

has given, and has not withdrawn, its consent under Article 2 of the Control of Borrowing (Jersey) Order 1958 to the issue of shares in

the Company. The JFSC is protected by the Control of Borrowing (Jersey) Law 1947 against any liability arising from the discharge of its

functions under that law.

It must be distinctly understood that, in giving these

consents, neither the Jersey Registrar of Companies nor the JFSC takes any responsibility for the financial soundness of the Company or

for the correctness of any statements made, or opinions expressed, with regard to it. If you are in any doubt about the contents of this

Prospectus Supplement or the Prospectus, you should consult your stockbroker, bank manager, solicitor, accountant or other financial adviser.

The price of shares and the income from them can go

down as well as up. Nothing in this Prospectus Supplement, the Prospectus or anything communicated to holders or potential holders of

any of our shares (or interests in them) by or on our behalf is intended to constitute or should be construed as advice on the merits

of the purchase of or subscription for any shares (or interests in them) for the purposes of the Financial Services (Jersey) Law 1998.

The directors of the Company have taken all reasonable

care to ensure that the facts stated in this Prospectus Supplement and Prospectus are true and accurate in all material respects, and

that there are no other facts the omission of which would make misleading any statement in the Prospectus Supplement or Prospectus, whether

of facts or opinion. All of our directors accept responsibility accordingly.

Cantor

The date of this Prospectus Supplement is May 18, 2023.

TABLE OF CONTENTS

PROSPECTUS

ABOUT THIS PROSPECTUS SUPPLEMENT AND THE ACCOMPANYING

PROSPECTUS

This document is in two parts. The first part is the Prospectus Supplement,

including the documents incorporated by reference, which describes the specific terms of this Offering. The second part, the Prospectus,

including the documents incorporated by reference therein, provides more general information. References to this Prospectus may refer

to both parts of this document combined. You are urged to carefully read this Prospectus Supplement and the Prospectus, and the documents

incorporated herein and therein by reference, before buying any of the Common Shares being offered under this Prospectus Supplement. This

Prospectus Supplement may add, update or change information contained in the Prospectus. To the extent that any statement made in this

Prospectus Supplement is inconsistent with statements made in the Prospectus or any documents incorporated by reference herein, the statements

made in this Prospectus Supplement will be deemed to modify or supersede those made in the Prospectus and such documents incorporated

by reference.

Only the information contained or incorporated by reference in this Prospectus

Supplement and the Prospectus should be relied upon. Neither us nor the Agent has authorized any other person to provide different information.

If anyone provides different or inconsistent information, it should not be relied upon. The Common Shares offered hereunder may not be

offered or sold in any jurisdiction where the offer or sale is not permitted. It should be assumed that the information appearing in this

Prospectus Supplement and the Prospectus and the documents incorporated by reference herein and therein are accurate only as of their

respective dates. Our business, financial condition, results of operations and prospects may have changed since those dates.

This Prospectus Supplement does not constitute, and may not be used in

connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this Prospectus Supplement by any person

in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

In this Prospectus Supplement, unless stated otherwise,

the “Company,” “Caledonia” “we,” “us” and “our” refer to Caledonia Mining

Corporation Plc and its subsidiaries, and all references to “dollars” or “$” are references to U.S. dollars unless

otherwise specified.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Prospectus Supplement and the Prospectus, including the documents

incorporated herein and therein by reference, contain “forward-looking information” and “forward-looking statements”

within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities legislation

that involve risks and uncertainties relating, but not limited to, the Company’s current expectations, intentions, plans, and beliefs.

Forward-looking information can often be identified by forward-looking words such as “anticipate”, “believe”,

“expect”, “goal”, “plan”, “target”, “intend”, “estimate”, “could”,

“should”, “may” and “will” or the negative of these terms or similar words suggesting future outcomes,

or other expectations, beliefs, plans, objectives, assumptions, intentions or statements about future events or performance. Examples

of forward-looking information in this Prospectus Supplement and the Prospectus, including the documents incorporated by reference herein

and therein, include: the Company’s mineral reserve and mineral resource calculations with underlying assumptions, production guidance,

estimates of future/targeted production rates, planned mill capacity increases, estimates of future metallurgical recovery rates and the

ability to maintain high metallurgical recovery rates, the Company’s plans and timing regarding further exploration, drilling and

development, the prospective nature of exploration and development targets, the ability to upgrade and convert mineral reserves and mineral

resources, capital costs, our intentions with respect to financial position and third party financing and future dividend payments. This

forward-looking information is based, in part, on assumptions and factors that may change or prove to be incorrect, thus causing actual

results, performance or achievements to be materially different from those expressed or implied by forward-looking information. Such factors

and assumptions include, but are not limited to: failure to establish estimated mineral reserves and mineral resources, the grade and

recovery of ore which is mined varying from estimates, success of future exploration and drilling programs, reliability of drilling, sampling

and assay data, assumptions regarding the representativeness of mineralization being inaccurate, success of planned metallurgical test-work,

capital and operating costs varying significantly from estimates, delays in obtaining or failures to obtain required governmental, environmental

or other project approvals, changes in government regulations, legislation and rates of taxation, inflation, changes in exchange rates

and the availability of foreign exchange, fluctuations in commodity prices, delays in the development of projects and other factors.

Readers should be aware that these statements are subject to

known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those suggested by

the forward-looking statements. Such factors include, but are not limited to: risks relating to estimates of mineral reserves and mineral

resources proving to be inaccurate, fluctuations in gold price, risks and hazards associated with the business of mineral exploration,

development and mining (including environmental hazards, industrial accidents, unusual or unexpected geological or structural formations,

pressures, power outages, explosions, landslides, cave-ins and flooding), risks relating to the credit worthiness or financial condition

of suppliers, refiners and other parties with whom the Company does business; inadequate insurance, or inability to obtain insurance,

to cover these risks and hazards, employee relations; relationships with and claims by local communities and indigenous populations; political

risk; risks related to natural disasters, terrorism, civil unrest, public health concerns (including health epidemics or outbreaks of

communicable diseases such as COVID-19); availability and increasing costs associated with mining inputs and labor; the speculative nature

of mineral exploration and development, including the risks of obtaining or maintaining necessary licenses and permits, diminishing quantities

or grades of mineral reserves and mineral resources as mining occurs; global financial condition, the actual results of current exploration

activities, changes to conclusions of economic evaluations, and changes in project parameters to deal with un-anticipated economic or

other factors, risks of increased capital and operating costs, environmental, safety or regulatory risks, expropriation, the Company’s

title to properties including ownership thereof, increased competition in the mining industry for properties, equipment, qualified personnel

and their costs, risks relating to the uncertainty of timing of events including targeted production rate increase and currency fluctuations.

Readers are cautioned not to place undue reliance on forward-looking information. By its nature, forward-looking information involves

numerous assumptions, inherent risks and uncertainties, both general and specific, that contribute to the possibility that the predictions,

forecasts, projections and various future events will not occur. The Company undertakes no obligation to update publicly or otherwise

revise any forward-looking statements whether as a result of new information, future events or other such factors which affect this information,

except as required by law. For the reasons set forth above, investors should not place undue reliance on forward-looking statements.

Additional risks and uncertainties relating to us and our business can

be found in the “Risk Factors” section of this Prospectus Supplement and the Prospectus, as well as in our other documents

incorporated by reference herein.

DOCUMENTS INCORPORATED BY REFERENCE

Information has been incorporated by reference in this Prospectus Supplement

from documents filed with the SEC and is therefore deemed to be incorporated by reference into the Prospectus for purposes of this Offering.

Copies of documents incorporated herein by reference may be obtained on request without charge from our Company Secretary at B006 Millais

House, Castle Quay, St Helier, Jersey JE2 3EF (telephone +44 1534 679800). Our filings through the SEC’s Electronic Data Gathering,

Analysis and Retrieval system, which is commonly known by the acronym “EDGAR,” may be accessed at www.sec.gov, are

not incorporated by reference in this Prospectus except as specifically set out herein or therein.

The following documents which have been filed by us with the SEC, are also

specifically incorporated by reference into, and form an integral part of the Prospectus, as supplemented by this Prospectus Supplement:

Any documents we file with the SEC pursuant to Section

13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) after the date of this Prospectus

Supplement and prior to the termination of the offering of our common stock to which this prospectus supplement relates will automatically

be deemed to be incorporated by reference into this prospectus supplement and to be part hereof from the date of filing those documents.

Any documents we filed with the SEC pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to April 28, 2023 is superseded

by our Annual Report on Form 20-F for the year ended December 31, 2022. Any statement contained herein or in a document incorporated or

deemed to be incorporated by reference herein shall be deemed to be modified or superseded for the purposes of this Prospectus Supplement

and the Prospectus to the extent that a statement contained herein, or in any other subsequently filed document which also is incorporated

or is deemed to be incorporated by reference herein, modifies or supersedes such statement. Any statement so modified or superseded shall

not be deemed, except as so modified or superseded, to constitute a part of this Prospectus Supplement and the Prospectus.

We will provide to each person, including any beneficial owner, to whom

a Prospectus is delivered, a copy of any or all of the information that has been incorporated by reference in the Prospectus but not delivered

with the Prospectus. We will provide this information, at no cost to the requester, upon written or oral request at the following address

or telephone number: B006 Millais House, Castle Quay, St Helier, Jersey JE2 3EF (telephone +44 1534 679800).

RISK FACTORS

An investment in our Common Shares is subject to a number of risks. A prospective

purchaser of our Common Shares should carefully consider the information and risks faced by us described in this Prospectus Supplement,

the Prospectus and the documents incorporated by reference herein and therein, including without limitation the risk factors set out under

the headings “Risk Factors” in our Annual Report on Form 20-F for the year ended December 31, 2022.

Our operations are highly speculative due to the high-risk nature of our

business, which include the acquisition, financing, exploration, development of mineral infrastructure and operation of mines. The risks

and uncertainties set out below are not the only ones we face. Additional risks and uncertainties not currently known to us or that we

currently deem immaterial may also impair our operations. If any of the risks actually occur, our business, financial condition and operating

results could be adversely affected. As a result, the trading price of our shares could decline and investors could lose part or all of

their investment. Our business is subject to significant risks and past performance is no guarantee of future performance.

Risks Related to this Offering and our Common Shares

Management will have broad discretion

as to the use of the proceeds from this Offering and may not use the proceeds as proposed.

Although we expect to use the amount of net proceeds from this Offering

for investment in the development of the sulphide project owned by our subsidiary Bilboes Holdings (Private) Limited (“Bilboes

Holdings”) (“Bilboes” or the “Bilboes sulphide project”), our management team will have

broad discretion as to the application of the net proceeds from this Offering and could use them for purposes other than those contemplated

at the time of the Offering. Our management may use the net proceeds for other corporate purposes that may have an alternative effect

on our financial condition or market value.

We may incur additional costs or delays in the development, construction

and operation of the Bilboes sulphide project or improvements to it and may not be able to recover its investment or complete the project.

We propose to use the proceeds from this Offering to develop the Bilboes

sulphide project. The development, construction, expansion or modification of the project is likely to involve many risks, including:

| · | maintaining necessary or desirable government approvals, permits and licenses; |

| · | environmental remediation of soil or groundwater at the site; |

| · | unforeseen engineering, environmental and geological problems; |

| · | unanticipated cost overruns; |

| · | failure of contracting parties to perform under contracts, including engineering procurement construction

contractors; and |

| · | inability to obtain financing. |

You will experience dilution as

a result of the Offering.

Giving effect to the issuance of Common Shares in this Offering, the receipt

of the expected net proceeds and the use of those proceeds, this Offering will have a dilutive effect on our expected net income available

to our shareholders per share and funds from operations per share. The dilution per share to an investor participating in this Offering,

assuming an offering price of $13.13 per Common Share, the closing price of our Common Shares on the NYSE American on May 16, 2023, will

be $0.03 (see “Dilution” below).

You may experience future dilution

as a result of future equity offerings.

We are not restricted from issuing additional securities in the future,

including Common Shares, securities that are convertible into or exchangeable for, or that represent the right to receive, Common Shares

or substantially similar securities. To the extent that we raise additional funds through the sale of equity or convertible debt securities,

the issuance of such securities could result in dilution to our shareholders. We may sell Common Shares or other securities in any other

offering at a price per share that is less than the price per share paid by investors in this Offering, and investors purchasing Common

Shares or other securities in the future could have rights superior to existing shareholders. The price per share at which we sell additional

Common Shares, or securities convertible or exchangeable into Common Shares, in future transactions may be higher or lower than the price

per share paid by investors in this Offering.

THE COMPANY

Overview

Caledonia Mining Corporation Plc (previously Caledonia Mining Corporation)

was incorporated, effective February 5, 1992, by the amalgamation of three predecessor companies and was registered at the time under

the Canada Business Corporations Act. Following the creation of Caledonia, our Common Shares were listed on the Toronto Stock Exchange

(“TSX”).

Effective April 1, 2006, we purchased 100% of the issued shares of the

Zimbabwean company, Caledonia Holdings Zimbabwe (Private) Ltd (“CHZ”) that held 100% of the shares of Blanket Mine

(1983) (Private) Limited, the owner of the mine known as “Blanket Mine” which is located in the southwest of Zimbabwe, approximately

15 km northwest of Gwanda, the provincial capital of Matabeleland South (the “Blanket Mine”). The purchase consideration

was $1,000,000 and 20,000,000 of our shares. We acquired all the assets and assumed all the liabilities of CHZ. In 2012, we complied with

indigenization legislation in Zimbabwe which resulted in a reduction in our shareholding in Blanket Mine to 49%. We conducted share consolidations

in 2013 and 2017, at ratios of 10:1 and 5:1, respectively. We re-domiciled from Canada to Jersey using a legal process called “Continuance”

on March 19, 2016. We operate under the Companies (Jersey) Law 1991, as amended, (the “Companies Law”). We completed

a transaction in January 2020 whereby we purchased a 15% shareholding in Blanket Mine from one of the indigenous shareholders, resulting

in our current holding of 64% in Blanket Mine. Our shares began trading on the NYSE American on July 27, 2017 and on June 19, 2020 we

voluntarily delisted our Common Shares from the TSX. On December 2, 2021, we issued and listed depositary receipts representing Common

Shares on the VFEX. On January 6, 2023 we completed the acquisition of Bilboes Gold Limited (“Bilboes Gold”), the owner

of Bilboes Holdings, for a total consideration of 5,123,044 of our shares and a 1% net smelter royalty on the revenues generated by Bilboes

Holdings (“NSR”). The NSR is an agreement to pay one of the vendors of Bilboes Gold, Baker Steel Resources Trust Limited,

1% (after allowable deductions e.g. smelting charges) of revenues from any mineral, metal, aggregate or other substance produced at the

Bilboes Holdings’ mining claims area. The royalty was agreed to be granted in exchange for a proportion of shares in the Company

which Baker Steel Resources Trust Limited would have been entitled to as a seller of Bilboes Gold. The royalty is perpetual but is capped

for regulatory reasons at a maximum of $90,000,000.

Our primary focus is the operation of the production-stage Blanket Mine

(64% interest); and the exploration and development of mineral properties for precious metals, including the exploration stage Bilboes

sulphide project (100% interest) at which we have commenced mineral extraction of oxide material prior to estimating mineral reserves

or mineral resources under Subpart 1300 of Regulation S-K (“Subpart 1300”), the exploration stage Maligreen project

(100% interest) and the exploration stage Motapa project (100% interest) which is contiguous with the Bilboes sulphide project. The coordinates

of Blanket Mine and our exploration projects are as follows:

| PROJECT |

MINE |

EASTING |

NORTHING |

SURVEY SYSTEM |

| BLANKET |

BLANKET |

698186.22 |

7692882.87 |

ARC 1950 UTM ZONE 35 |

| BILBOES |

ISABELLA |

662711 |

7847486 |

ARC 1950 UTM ZONE 35K, CLARKE 1880 |

| BILBOES |

McCAYS |

666183 |

7849779 |

ARC 1950 UTM ZONE 35K, CLARKE 1880 |

| BILBOES |

BUBI |

685072 |

7864896 |

ARC 1950 UTM ZONE 35K, CLARKE 1880 |

| MOTAPA |

MOTAPA |

663715 |

7844578 |

ARC 1950 UTM ZONE 35K, CLARKE 1880 |

| MALIGREEN |

MALIGREEN |

720951 |

7895949 |

ARC 1950 UTM ZONE 35K, CLARKE 1880 |

The bulk of our activities are currently focused on the Blanket Mine in

Zimbabwe. Our business during the last three completed fiscal years has been focused primarily on increasing production to 80,000 oz.

of gold by 2022 through our investment plan. Total gold production at the Blanket Mine for 2022 was 80,775 oz. (2021: 67,476; 2020: 57,899).

Gold producers compete globally based on their operating and capital costs. Certain gold producers benefit from their ability to produce

other minerals in commercial quantities as by-products. We derive approximately 0.1% of our revenues from silver, which is insignificant.

100% of the Blanket Mine’s revenues over the last three years was derived from its operations in Zimbabwe.

Bilboes

Bilboes Gold was purchased by the Company due to the potential of the sulphide

mineralization. Before the Company signed the purchase agreement, the former owners of Bilboes Gold had completed a feasibility study

on the sulphide mineralization pursuant to Canada’s National Instrument 43-101 – Standards of Disclosure for Mineral Projects

(“NI 43-101”), with an effective date of December 15, 2021, which included an NI 43-101 compliant estimate of proven

and probable mineral reserves of 1.96 million ounces of gold in 26.64 million tonnes at a grade of 2.29 g/t and measured and indicated

mineral resources of 2.56 million ounces of gold in 35.18 million tonnes at a grade of 2.26 g/t (inclusive of mineral reserves) and inferred

mineral resources of 577,000 ounces of gold in 9.48 million tonnes at a grade of 1.89 g/t. The Company is not treating these estimates

as current estimates of mineral resources or mineral reserves pursuant to Subpart 1300 because a qualified person has not done sufficient

work to classify the estimate as a current estimate of mineral resources or mineral reserves under Subpart 1300. Until the Company has

completed a Subpart 1300 compliant technical report summary for the Bilboes project that contains an estimate of mineral reserves or mineral

resources, the project is deemed for Subpart 1300 purposes to have no mineral reserves and no mineral resources.

Bilboes owns a group of claims that consist of four open-pit mining properties

in Matabeleland North Province of Zimbabwe. These open pits are referred to as Isabella North, Isabella South, McCays and Bubi. The first

three are situated 80 km due north of Bulawayo whilst Bubi is 100 km due northeast of Bulawayo and about 32 km northeast of Isabella.

Bulawayo is the second largest city of Zimbabwe with an approximate population of 655,675 (2013) and located approximately 400km south

of Harare, the capital city of Zimbabwe.

The current feasibility study is focused on the underyling sulphide mineralization

covering 128 claim blocks wholly owned by Bilboes Holdings. Of the 128 blocks, 48 gold and base metal blocks and a Special Mine site belong

to the Isabella mining area while McCays comprises of 33 gold blocks and Bubi consists of 47 gold blocks. The claims are protected annually

against forfeiture through gold production and exploration work and Bilboes Holdings has exclusive rights to subsurface areas to produce

gold from these properties.

Bilboes Holdings also holds 3,485 ha of additional claims and 91,769 ha

of exploration license applications referred to as Exclusive Prospecting Orders “EPOs” around Isabella-McCays-Bubi and the

Gweru area. These claims and EPOs have highly prospective targets which offer Bilboes excellent prospects for organic growth. Bilboes

Holdings has applied for an extension of the EPOs tenure for a further 3 years after the initial 3-year tenure expired in July 2021.

Drilling of the sulphides to provide data for the feasibility study was

done in three phases totalling 93,400 m. The first phase by Anglo American Corporation was between 1994 and 1999 to define the initial

mineralization and the second phase by Bilboes Holdings from 2011 to 2013 was focused on expanding the mineralization. The latest drilling

was conducted by Bilboes from December 2017 to November 2018. The third campaign conducted by Bilboes from 2017 to 2018 focused on upgrading

of the mineralization, as required for the feasibility study.

The feasibility metallurgical test work was concluded in different phases

over a period extending from September 2013 to March 2019 and involved various laboratories and consultants. The metallurgical test-work

programme involved:

| · | Chemical analyses and mineralogical characterisation |

| · | Comminution covering crushability and grinding / milling testing |

| · | Process route identification which involved pilot plant testing of flotation BIOX® technology |

The metallurgical test-work study projected operational gold recovery of

approximately 84% of the gold contained using BIOX® technology in conjunction with carbon-in-leach processing. The BIOX® process

is used to pre-treat refractory sulphide gold ores to increase gold recovery rates during the metallurgical extraction process. The gold

in these sulphide ores is encapsulated in sulphide minerals which prevent the gold from being leached by cyanide. The BIOX® process

destroys the sulphide minerals and exposes the gold for subsequent cyanidation, increasing recovery rates. The process has many advantages

which include:

| • | | Improved rates of gold recovery |

| • | | Significantly lower capital costs |

| • | | Robust technology that is suited to remote areas |

| • | | Low level of skills required for operation |

| • | | Environmentally friendly |

| • | | Ongoing process development and improvement |

From past studies it has been envisaged that the sulphide ore would be

mined using the conventional open pit mining method to depths of approximately 200 – 250m. The process would require crushing, milling,

flotation to recover concentrate ore and finally gold recovery from BIOX® and Carbon in Leach cyanidation. The project would require

significant upgrade in terms of infrastructure including power, water, roads, workshops and housing and offices. A tailings storage facility

would also be constructed to accommodate the waste and waste water from the process including obtaining the requisite permits for the

operations.

The Company has commissioned its own feasibility study to identify the

most judicious way to commercialize the Bilboes sulphide project and optimize shareholder returns. One approach that is being considered

is a phased development which would minimize the initial capital investment and reduce the need for third party funding.

Additional financing and infrastructure will be required to develop the

Bilboes sulphide project.

The following is a description of the current activities and infrastructure

at Bilboes:

Oxide Mining

The extraction of overlying oxide material at the properties is not considered

material by the Company but is intended to support the operational integrity of Bilboes Holdings whilst the feasibility study is being

completed. Current oxide mining activities are centred around Isabella North, Isabella South and McCays and are summarised below. There

are no mining activities at Bubi.

Mining

Pit designs are based on the anticipated fleet likely to be used by the

oxide mining contractor and a result of pit optimisation based on financial, technical, and geotechnical parameters. It is anticipated

that the deepest portions of the pits will be 50 m. In-pit ramps and gradients are standardised based on equipment type. Waste dumps are

placed at closest possible distances from the pits to reduce haulage distance.

The Life of Mine “LoM” schedule has been developed to supply

two processing plants. These consist of McCays and Isabella at a planned processing capacity of 25,000 t and 20,000 t of ore per month

respectively. The LoM schedule for McCays considers mining from the Isabella North and McCays pits whilst that for Isabella will be based

on mining from Isabella South pit only.

Grade control is based on evaluation drilling and other sampling methods

such as blast hole and channel sampling in and around the pits and a laboratory is available at the site for sample analysis. ROM (run

of mine) ore grade is determined from sampling of crushed ore mined to the heap leach. There is limited exploration: mainly percussion

drilling and trenching in the targets around the pits to support ongoing production.

A mining contractor is used for all the open pit mining related activities

(drilling, blasting and earthmoving all included). The mining is done using conventional truck and shovel method in 4-m cuts typical of

a shallow open pit mining operation.

Waste material is hauled with 60 or 4 t haul trucks (RDTs) and dumped to

designated waste dump locations and levelled with a dozer. Ore material is loaded onto 30 or 40 t haul trucks (RDTs) and tipped into the

crushing facility or placed on the ROM pad stockpile areas. Crushed ore material is hauled from the crushing plant using 20 t rigid haul

trucks dedicated for this onto ROM pad areas for leaching.

The operation is planned on a two 10-hour shift roster throughout the year

except on public holidays.

The mining is planned to utilise mostly contractor equipment for the bulk

of the mining services with a few supporting equipment being supplied by Bilboes Holdings. All the mining and related activities are conducted

by contractors, and these include drilling, blasting, loading, and hauling activities. The key mining equipment is supplied by the contractors

and the support equipment is provided by Bilboes Holdings. The key equipment is shared between three mining areas to ensure optimum mining

operations.

Process

The process operation utilises two crushing plants at Isabella and McCays,

each with a throughput capacity of 45,000 t per month. The mines are equipped with adsorption plants for the recovery of the gold from

leached solution from the ROM leach pads. The mines have adequate leach pad space for the treatment of all the crushed ore to be mined.

Ore is transported to a crushing plant prior to being loaded onto heap

leach pads. The pads are irrigated with cyanide solution which leaches the gold. The pregnant cyanide solution gravitates into collection

ponds and the gold is adsorbed by means of activated carbon. The carbon is then eluted producing a gold eluant which is electrowon and

smelted to produce gold doré. Average gold recoveries of 50 - 70% are expected to be achieved depending on the extent of the oxidation

of the ore.

Ore is received from three main mining areas, namely Isabella South, Isabella

North and McCays pits, with production phased over the LoM based on tonnage, proximity to the process plant and loading capacity of the

leach pads. Isabella South ore is treated at Isabella plant whilst ore from McCays and Isabella North is treated at McCays plant. Additional

material from the Isabella South pit during the later period of the LoM will be treated at McCays plant.

Typical of heap leach operations, the process plant is divided into three

main areas:

| • | | Crushing (ore size reduction by crushing to facilitate liberation of the gold for downstream

processes) |

| • | | Carbon in Solution (cyanidation leaching on the leach pads and recovery of gold onto activated

carbon in the adsorption plant) |

| • | | Electrowinning and smelting (adsorbed gold is further processed in the elution plant where

it is electrowon onto mild steel wool and digested in acid, processed to a dry sludge, and smelted). Fouled carbon is reactivated using

an electric carbon regeneration kiln. |

The elution and smelting process is centralised at Isabella plant.

Crushing Plants

McCays crushing plant is an open circuit comprising of a primary crusher,

screening plant and secondary crusher with a throughput capacity of 45,000 t per month at a final particle size of -35 mm. Isabella has

a two-stage closed circuit crushing plant comprising of a primary crusher, screening plant and secondary crusher with a throughput capacity

of 45,000 t per month at a final product size of -25 mm.

The two crushing plants have adequate capacity at the planned throughput

of 25,000 t and 20,000 t of ore per month for McCays and Isabella production respectively.

Leach Pads

The existing leach pad heights are 27 m and 21 m respectively for Isabella

and McCays although Isabella has a larger footprint in comparison to McCays. The design leach pad height is 30 m leaving ore loading capacity

of 950,000 t for Isabella and 600,000 t for McCays to a total of 1,550,000 t. All the oxide ore can sufficiently be accommodated at the

two leach pads and should there be need to extend both Isabella and McCays have adequate space for leach pads extensions.

Infrastructure

Housing, office, and workshop facilities are available to support the mining

operations.

Power supply is through the 11 kV line from the 33/11 kV 5 MVA Motapa substation

that supplies the area. With a historical monthly average power outage factor of 5%. The mines have adequate back up power in 2 X 700

kVA CAT generators that will be able to run the two process plants respectively. The main sources of water for the current operation are

pit dewatering and a series of 12 boreholes located across the claims area.

Labour

Mine Employees

| Level |

Permanent |

Contractors |

Total |

| Senior Staff |

44 |

2 |

46 |

| Junior Staff |

41 |

88 |

129 |

| Total |

90 |

85 |

175 |

Total mine complement is at 175 and, of these, 90 are permanent employees

and 85 are contractors. Of the 44 senior staff, 22 come from Bulawayo where their families stay but are housed at the mine during the

week. The rest of the skilled personnel reside at the mine due to the nature of their work requiring shift work. A total 42 out of the

129 junior staff work from their homes in the nearby local villages.

The qualified persons responsible for the technical and scientific information

relating to the Bilboes project that is included or incorporated by reference in this prospectus supplement are Mr Dana Roets and Mr Craig

Harvey.

For a more detailed description of our business refer to “Item

4 – Information on the Company” in our Annual Report on Form 20-F for the year ended December 31, 2022. Our registered

and head office is located at B006 Millais House, Castle Quay, St. Helier, Jersey, Channel Islands, JE2 3EF. Our African office for our

South African subsidiaries is located at 1 Quadrum office park, 4th floor, Johannesburg, Gauteng, 2198, South Africa. We maintain

a website at http://www.caledoniamining.com that contains information about our company. Information on this web site is not part of

this Prospectus Supplement.

Summary of the Offering

The following is a summary of the principal features of the Offering

and is subject to, and should be read together with, the more detailed information, financial data and statements contained elsewhere

in, and incorporated by reference into, this Prospectus Supplement and the accompanying Prospectus.

| Issuer |

Caledonia Mining Corporation Plc |

| Securities Offered |

Common Shares having an aggregate offering amount of up to $30,000,000. |

| Manner of Offering |

Sales of Common Shares, if any, under this Prospectus Supplement and the accompanying Prospectus will be made in transactions that are deemed to be “at the market offerings” as defined in Rule 415(a)(4) of the Securities Act, including, without limitation, sales made directly on NYSE American or any other existing nationally recognized trading market for the Common Shares in the United States, in negotiated transactions, at market prices prevailing at the time of sale, or at prices relating to such prevailing market prices and/or any other method permitted by law. No Common Shares will be sold in Canada, or on any trading markets in Canada as at-the-market distributions or otherwise. See “Plan of Distribution”. |

| Use of Proceeds |

The net proceeds from the Offering, to the extent raised, are expected to be used by the Company primarily to develop the Bilboes sulphide project. See “Use of Proceeds”. |

| Risk Factors |

See “Risk Factors” in this Prospectus Supplement and the accompanying Prospectus and the risk factors discussed or referred to in the documents incorporated by reference in this Prospectus Supplement and the accompanying Prospectus for a discussion of factors that should be read and considered before investing in the Common Shares. |

| Listing |

NYSE American has authorized the listing of up to 2,000,000 Common Shares. See “Plan of Distribution”. |

| Tax Considerations |

Purchasing the Common Shares may have tax consequences. This Prospectus Supplement and the accompanying Prospectus may not describe these consequences fully for all investors. Investors should read the tax discussion in this Prospectus Supplement and accompanying Prospectus and consult with their tax advisor. See “Certain United States Federal Income Tax Considerations”. |

| Trading Symbols |

NYSE American: CMCL

|

DIVIDENDS

From 2014, the Company has paid a quarterly dividend (payable at the end

of January, April, July and October each year, except for the dividend expected to be paid in April 2020 which was delayed by a month

due to uncertainties related to the COVID-19 pandemic). The quarterly dividend was 6.875 cents per share in 2019 and was increased on

several dates during 2020 and 2021. Dividends paid over the last 3 years are as set out below:

| Payment date |

cents per share ($) |

| January 25, 2019 |

6.875 |

| April 26, 2019 |

6.875 |

| July 26, 2019 |

6.875 |

| October 25, 2019 |

6.875 |

| January 31, 2020 |

7.500 |

| May 29, 2020 |

7.500 |

| July 31, 2020 |

8.500 |

| October 30, 2020 |

10.000 |

| January 29, 2021 |

11.000 |

| April 30, 2021 |

12.000 |

| July 30, 2021 |

13.000 |

| October 29, 2021 |

14.000 |

| January 28, 2022 |

14.000 |

| April 29, 2022 |

14.000 |

| July 29, 2022 |

14.000 |

| October 28, 2022 |

14.000 |

| January 27, 2022 |

14.000 |

| April 28, 2023 |

14.000 |

The Board will consider the continuation of the dividend and any future

increases in the dividend as appropriate in line with its prudent approach to risk.

CONSOLIDATED CAPITALIZATION

Since May 15, 2023, the date of our most recently filed financial statements,

there has been no material change to our share capital.

We had 19,188,073 Common Shares, 20,000 stock options and 405,119 performance

units outstanding as at May 16, 2023.

DILUTION

As of March 31, 2023, our net tangible book value was $237.89 million,

or $13.17 per share. Net tangible book value is total assets minus the sum of liabilities, intangible assets and non-controlling interests.

Net tangible book value per share is net tangible book value divided by the total number of our Common Shares outstanding as of March

31, 2023.

Dilution in net tangible book value per share represents the difference between the amount per

share paid by purchasers of our Common Shares in this Offering and the net tangible book value per share of our Common Shares immediately

after completion of this Offering. Assuming that an aggregate of 2,284,844 Common Shares are sold at an assumed offering price of

$13.13 per share, and after deducting the commissions and estimated Offering expenses payable by us, our as-adjusted net tangible book

value as of March 31, 2023 would have been approximately $266,590,000, or $13.10 per share. This decreases the net tangible book value

per share to existing shareholders and immediate dilution in net tangible book value of $0.03 per share to investors purchasing our Common

Shares in this Offering. The following table illustrates this dilution on a per share basis:

| Assumed public Offering price per share |

$ |

13.13 |

|

| Net tangible book value per share as of March 31, 2023 |

$ |

13.17 |

|

| Decrease in net tangible book value per share attributable to this Offering |

$ |

0.07 |

|

| As adjusted net tangible book value per share as of March 31, 2023 after giving effect to this Offering |

$ |

13.10 |

|

| Dilution per share to investor participating in this Offering |

$ |

0.03 |

|

The table above assumes for illustrative purposes that an aggregate of 2,284,844 Common

Shares are sold during the term of the Offering at an Offering price of $13.13 per share, which was the last reported sale price of our

Common Shares on the NYSE American on May 16, 2023, for aggregate gross proceeds of approximately $30,000,000. As of the date of this

Prospectus Supplement, we have applied to list up to 2,000,000 Common Shares on NYSE American. The Common Shares subject to the Sales

Agreement are being sold from time to time at various prices. An increase of $2.00 per share in the price at which the shares are sold

from the assumed Offering price of $13.13 per share shown in the table above, assuming all of our Common Shares in the aggregate amount

of approximately $30,000,000 during the term of the Offering are sold at that price, would increase our adjusted net tangible book value

per share after the Offering to $13.30 per share and would dilute the net tangible book value per share to new investors in this Offering

by $1.83 per share, after deducting commissions and estimated aggregate Offering expenses payable by us. A decrease of $2.00 per share

in the price at which the shares are sold from the assumed Offering price of $13.13 per share shown in the table above, assuming all of

our Common Shares in the aggregate amount of $30,000,000 during the term of the Offering are sold at that price, would decrease our adjusted

net tangible book value per share after the Offering to $12.84 per share and would decrease the dilution in the net tangible book value

per share to new investors in this Offering by $1.71 per share, after deducting commissions and estimated Offering expenses payable by

us. This information is supplied for illustrative purposes only and may differ based on the actual Offering price and the actual number

of shares offered.

The discussion and table above are based on 18,065,061 Common Shares outstanding

as of March 31, 2023, and excludes the following, in each case as of such date:

| · | 20,000 Common Shares issuable upon the exercise of outstanding stock options having a weighted-average

exercise price of $8.18 per share; and |

| · | 232,190 Common Shares which may be, subject to election by the holder and the terms of the relevant award

agreement and as may be modified by the extent to which performance conditions are met, issuable upon vesting and exercise of outstanding

performance units. |

To the extent that any of these shares are issued upon exercise of outstanding

options, vesting and exercise of performance units or otherwise, investors purchasing our Common Shares in this Offering may experience

further dilution. In addition, we may choose to raise additional capital due to market conditions or strategic considerations even if

we believe we have sufficient funds for our current or future operating plans. To the extent that we raise additional capital through

the sale of equity or convertible debt securities, the issuance of these securities could result in further dilution to our shareholders.

Subsequent to the quarter ended March 31, 2023, we issued 1,123,012 Common

Shares pursuant to the closing of the Company’s placing of Zimbabwe Depositary Receipts in Zimbabwe and the issuance of deferred

and escrow shares in connection with the Company’s acquisition of Bilboes Gold, and our issued and outstanding Common Shares

as of May 16, 2023 were 19,188,073. On April 7, 2023 we issued a total of 79,894 and 93,035 performance units, the former amount of which

may be, subject to election by the holder and the terms of the relevant award agreement and as may be modified by the extent to which

performance conditions are met, issued in the form of Common Shares. The latter amount of performance units are only issuable in the form

of Common Shares subject to the terms of the relevant award agreement and as may be modified by the extent to which performance conditions

are met.

USE OF PROCEEDS

The net proceeds from the Offering are not determinable in light of the

nature of the distribution. The net proceeds of any given distribution of Common Shares through the Agent in an “at the market offering”

will represent the gross proceeds after deducting the applicable compensation payable to the Agent under the Sales Agreement and the expenses

of the distribution.

The proceeds of the Offering are proposed to be used to fund the development

of the Bilboes sulphide project.

PLAN OF DISTRIBUTION

The Company has entered into the Sales Agreement with the Agent under which

it may issue and sell from time to time Common Shares through the Agent. Pursuant to this Prospectus Supplement, we may issue and sell

up to an additional $30,000,000 of Common Shares through the Agent from and after the date hereof.

Sales of Common Shares, if any, will be made in transactions that are deemed

to be an “at the market offering” as defined in Rule 415(a)(4) promulgated under the Securities Act. Subject to the terms

and conditions of the Sales Agreement and upon instructions from the Company, the Agent will use its commercially reasonable efforts,

consistent with its customary trading and sales practices and applicable laws, to sell the Common Shares in accordance with the parameters

specified by the Company and as set out in the Sales Agreement. The Common Shares will be distributed at market prices prevailing at the

time of the sale. As a result, prices may vary as between purchasers and during the period of distribution.

The Company will instruct the Agent as to the number of Common Shares to

be sold by the Agent from time to time by sending the Agent a notice (each, a “Placement Notice”) that requests that

the Agent sell up to a specified dollar amount or a specified number of Common Shares and specifies any parameters in accordance with

which the Company requires that the Common Shares be sold. The parameters set forth in a Placement Notice shall not conflict with the

provisions of the Sales Agreement. The Company or the Agent may suspend the offering of Common Shares upon proper notice and subject to

other conditions set forth in the Sales Agreement.

The Company will pay the Agent for its services in acting as agent in the

sale of Common Shares, pursuant to the terms of the Sales Agreement, compensation up to but not exceeding 3% of the gross proceeds from

sales of Common Shares made thereunder. The Agent will be the only person or company paid an underwriting fee or commission in connection

with the Offering. The Company has also agreed pursuant to the Sales Agreement to reimburse the Agent for certain specified expenses,

including the fees and expenses of their legal counsel, in an amount not to exceed $75,000 but excluding reasonable and documented taxes,

disbursements other charges and certain ongoing expenses. The Company estimates that the total expenses that it will incur for the Offering

(including fees payable to stock exchanges, securities regulatory authorities, its counsel and its auditors, but excluding compensation

payable to the Agent under the terms of the Sales Agreement) will be approximately $400,000. Settlement for sales of Common Shares will

occur on the second business day following the date on which any sales are made, or on such other date as is current industry practice

for regular-way trading, in return for payment of the net proceeds to the Company. Sales of Common Shares as contemplated in this Prospectus

Supplement will be settled through the facilities of The Depository Trust Company or by such other means as the Company and the Agent

may agree upon. There is no arrangement for funds to be received in an escrow, trust or similar arrangement.

In connection with the sale of the Common Shares on behalf of the Company,

the Agent will be deemed an “underwriter” as defined in applicable securities legislation under the Securities Act, and the

compensation of the Agent will be deemed to be underwriting commissions or discounts.

The Company has agreed to provide indemnification and contribution to the

Agent against, among other things, certain civil liabilities, including liabilities under the Securities Act.

The offering of Common Shares pursuant to the Sales Agreement will terminate

in accordance with the terms of the Sales Agreement. The Agent may terminate the Sales Agreement under the circumstances specified in

the Sales Agreement. The Company and the Agent may also terminate the Sales Agreement upon giving the other party ten (10) days’

notice. In addition, the Company may terminate the Sales Agreement by providing the Agent five (5) days’ notice when no Placement

Notice is in effect.

The Agent and its respective affiliates may in the future provide various

investment banking, commercial banking and other financial services for us and our affiliates, for which services they may in the future

receive customary fees. To the extent required by Regulation M under the Exchange Act, the Agent will not engage in any market making

activities involving our Common Shares while the Offering is ongoing under this Prospectus Supplement. In the course of its business,

the Agent may actively trade the Company’s securities for the Agent’s own account or for the account of customers and, accordingly,

the Agent may at any time hold long or short positions in the Company’s securities.

This Prospectus Supplement and the accompanying Prospectus in electronic

format may be made available on websites maintained by the Agent, and the Agent may distribute this Prospectus Supplement and the accompanying

Prospectus electronically.

DESCRIPTION OF SECURITIES BEING OFFERED

The Offering consists of Common Shares having an aggregate offering price

of up to $30,000,000.

Common Shares

As of May 16, 2023, there were 19,188,073 Common Shares issued and outstanding.

The holders of our Common Shares are entitled to receive notice of all

shareholder meetings and to attend and vote at such meetings. Certificates representing the Common Shares are issued in registered form.

Registered shareholders are entitled to one vote for each Common Share held on all matters to be voted on by the shareholders. Each Common

Share is equal to every other Common Share and, subject to the rights of holders of shares ranking senior to the Common Shares, if any,

each Common Share is entitled to receive pro rata such dividends as may be declared by the board of directors out of funds legally available

therefor and to participate equally in the event of our liquidation, dissolution or winding up, whether voluntary or involuntary, or any

other distribution of our assets among the shareholders for the purpose of winding up our affairs after we have paid out our liabilities.

Common Shares are not subject to call or assessment. There are no pre-emptive or conversion rights, and no provisions at this time for

redemption, purchase or cancellation, surrender, sinking fund or purchase fund. In addition, there are no provisions in our articles of

association discriminating against any existing or prospective holders of such securities as a result of a shareholder owning a substantial

number of shares.

CERTAIN UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS

The following is a general summary of certain material U.S.

federal income tax considerations applicable to a U.S. Holder (as defined below) arising from and relating to the acquisition, ownership,

and disposition of Common Shares acquired pursuant to this Offering.

This summary is for general information purposes only and does

not purport to be a complete analysis or listing of all potential U.S. federal income tax considerations that may apply to a U.S. Holder

arising from and relating to the acquisition, ownership, and disposition of Common Shares acquired pursuant to this Offering. In addition,

this summary does not take into account the individual facts and circumstances of any particular U.S. Holder that may affect the U.S.

federal income tax consequences to such U.S. Holder, including without limitation specific tax consequences to a U.S. Holder under an

applicable income tax treaty. Accordingly, this summary is not intended to be, and should not be construed as, legal or U.S. federal income

tax advice with respect to any U.S. Holder. This summary does not address the U.S. federal net investment income, U.S. federal alternative

minimum, U.S. federal estate and gift, U.S. state and local, and non-U.S. tax consequences to U.S. Holders of the acquisition, ownership,

and disposition of Common Shares. In addition, except as specifically set forth below, this summary does not discuss applicable tax reporting

requirements. Each prospective U.S. Holder should consult its own tax advisors regarding the U.S. federal, U.S. federal net investment

income, U.S. federal alternative minimum, U.S. federal estate and gift, U.S. state and local, and non-U.S. tax consequences relating to

the acquisition, ownership, and disposition of Common Shares acquired pursuant to this Offering.

No ruling from the Internal Revenue Service (the “IRS”)

has been requested, or will be obtained, regarding the U.S. federal income tax consequences of the acquisition, ownership, and disposition

of Common Shares acquired pursuant to this Offering. This summary is not binding on the IRS, and the IRS is not precluded from taking

a position that is different from, and contrary to, the positions taken in this summary. In addition, because the authorities on which

this summary is based are subject to various interpretations, the IRS and the U.S. courts could disagree with one or more of the conclusions

described in this summary.

Scope of this Summary

Authorities

This summary is based on the Internal Revenue Code of 1986,

as amended (the “Code”), Treasury Regulations (whether final, temporary, or proposed), published rulings of the IRS,

published administrative positions of the IRS, and U.S. court decisions that are applicable and, in each case, as in effect and available,

as of the date of this document. Any of the authorities on which this summary is based could be changed in a material and adverse manner

at any time, and any such change could be applied on a retroactive or prospective basis which could affect the U.S. federal income tax

considerations described in this summary. This summary does not discuss the potential effects, whether adverse or beneficial, of any proposed

legislation that, if enacted, could be applied on a retroactive, current or prospective basis.

U.S. Holders

For purposes of this summary, the term “U.S. Holder”

means a beneficial owner of Common Shares acquired pursuant to this Offering that is for U.S. federal income tax purposes:

| · | an individual who is a citizen or resident of the U.S.; |

| · | a corporation (or other entity taxable as a corporation for U.S. federal income

tax purposes) organized under the laws of the U.S., any state thereof or the District of Columbia; |

| · | an estate whose income is subject to U.S. federal income taxation regardless of

its source; or |

| · | a trust that (1) is subject to the primary supervision of a court within the U.S.

and the control of one or more U.S. persons for all substantial decisions or (2) has a valid election in effect under applicable Treasury

Regulations to be treated as a U.S. person. |

U.S. Holders Subject to Special U.S. Federal Income Tax Rules

Not Addressed

This summary does not address the U.S. federal income tax considerations

applicable to U.S. Holders that are subject to special provisions under the Code, including, but not limited to, the following U.S. Holders

that: (a) are tax-exempt organizations, qualified retirement plans, individual retirement accounts, or other tax-deferred accounts; (b)

are financial institutions, underwriters, insurance companies, real estate investment trusts, or regulated investment companies; (c) are

broker-dealers, dealers, or traders in securities or currencies that elect to apply a mark-to-market accounting method; (d) have a “functional

currency” other than the U.S. dollar; (e) own Common Shares as part of a straddle, hedging transaction, conversion transaction,

constructive sale, or other integrated transaction; (f) acquire Common Shares in connection with the exercise of employee stock options

or otherwise as compensation for services; (g) hold Common Shares other than as a capital asset within the meaning of Section 1221 of

the Code (generally, property held for investment purposes); (h) are partnerships and other pass-through entities (and investors in such

partnerships and entities); (i) are S corporations (and Common Shareholders or investors in such S corporations); (j) own, have owned

or will own (directly, indirectly, or by attribution) 10% or more of the total combined voting power or value of the outstanding Common

Shares of the Company; (k) are U.S. expatriates or former long-term residents of the U.S., (l) hold Common Shares in connection with a

trade or business, permanent establishment, or fixed base outside the United States, or (m) are subject to special tax accounting rules

with respect to Common Shares. U.S. Holders that are subject to special provisions under the Code, including, but not limited to, U.S.

Holders described immediately above, should consult their own tax advisors regarding the U.S. federal, U.S. federal net investment income,

U.S. federal alternative minimum, U.S. federal estate and gift, U.S. state and local, and non-U.S. tax consequences relating to the acquisition,

ownership and disposition of Common Shares.

If an entity or arrangement that is classified as a partnership

(or other “pass-through” entity) for U.S. federal income tax purposes holds Common Shares, the U.S. federal income tax consequences

to such entity and the partners (or other owners) of such entity generally will depend on the activities of the entity and the status

of such partners (or owners). This summary does not address the tax consequences to any such partner (or owner). Partners (or other owners)

of entities or arrangements that are classified as partnerships or as “pass-through” entities for U.S. federal income tax

purposes should consult their own tax advisors regarding the U.S. federal income tax consequences arising from and relating to the acquisition,

ownership, and disposition of Common Shares.

Ownership and Disposition of Common Shares

The following discussion is subject in its entirety to the rules

described below under the heading “Passive Foreign Investment Company Rules”.

Taxation of Distributions

A U.S. Holder that receives a distribution, including a constructive

distribution, with respect to a Common Share will be required to include the amount of such distribution in gross income as a dividend

(without reduction for any foreign income tax withheld from such distribution) to the extent of the current or accumulated “earnings

and profits” of the Company, as computed for U.S. federal income tax purposes. A dividend generally will be taxed to a U.S. Holder

at ordinary income tax rates if the Company is a PFIC (as defined below) for the tax year of such distribution or the preceding tax year.

To the extent that a distribution exceeds the current and accumulated “earnings and profits” of the Company, such distribution

will be treated first as a tax-free return of capital to the extent of a U.S. Holder’s tax basis in the Common Shares and thereafter

as gain from the sale or exchange of such Common Shares (see “Sale or Other Taxable Disposition of Common Shares” below).

However, the Company may not maintain the calculations of its earnings and profits in accordance with U.S. federal income tax principles,

and each U.S. Holder may have to assume that any distribution by the Company with respect to the Common Shares will constitute ordinary

dividend income. Dividends received on Common Shares by corporate U.S. Holders generally will not be eligible for the “dividends

received deduction”. Subject to applicable limitations and provided the Common Shares are readily tradable on a United States securities

market, dividends paid by the Company to non-corporate U.S. Holders, including individuals, generally will be eligible for the preferential

tax rates applicable to long-term capital gains for dividends, provided certain holding period and other conditions are satisfied, including

that the Company not be classified as a PFIC (as defined below) in the tax year of distribution or in the preceding tax year. The dividend

rules are complex, and each U.S. Holder should consult its own tax advisors regarding the application of such rules.

Sale or Other Taxable Disposition of Common Shares

A U.S. Holder will generally recognize gain or loss on the sale

or other taxable disposition of Common Shares in an amount equal to the difference, if any, between (a) the amount of cash plus the fair

market value of any property received and (b) such U.S. Holder’s tax basis in such Common Shares sold or otherwise disposed of.

Any such gain or loss recognized on such sale or other disposition generally will be capital gain or loss, which will be long-term capital

gain or loss if, at the time of the sale or other disposition, such Common Shares are held for more than one year.

Preferential tax rates apply to long-term capital gains of a

U.S. Holder that is an individual, estate, or trust. There are currently no preferential tax rates for long-term capital gains of a U.S.

Holder that is a corporation. Deductions for capital losses are subject to significant limitations under the Code.

Passive Foreign Investment Company (“PFIC”)

Rules

If the Company were to constitute a PFIC for any year during

a U.S. Holder’s holding period, then certain potentially adverse rules would affect the U.S. federal income tax consequences to

a U.S. Holder resulting from the acquisition, ownership and disposition of Common Shares. The Company believes that it was not a PFIC

for its most recently completed tax year, and based on current business plans and financial expectations, the Company expects that it

will not be a PFIC for the current tax year and expects that it will not be a PFIC for the foreseeable future. No opinion of legal counsel

or ruling from the IRS concerning the status of the Company as a PFIC has been obtained or is currently planned to be requested. However,

PFIC classification is fundamentally factual in nature, generally cannot be determined until the close of the tax year in question and

is determined annually. Additionally, the analysis depends, in part, on the application of complex U.S. federal income tax rules, which

are subject to differing interpretations. Consequently, there can be no assurance that the Company has never been and will not become

a PFIC for any tax year during which U.S. Holders hold Common Shares.

In addition, in any year in which the Company is classified

as a PFIC, a U.S. Holder will be required to file an annual report with the IRS containing such information as Treasury Regulations and/or

other IRS guidance may require. In addition to penalties, a failure to satisfy such reporting requirements may result in an extension

of the time period during which the IRS can assess a tax. U.S. Holders should consult their own tax advisors regarding the requirements

of filing such information returns under these rules, including the requirement to file an IRS Form 8621 annually.

The Company generally will be a PFIC under Section 1297 of the

Code if, after the application of certain “look-through” rules with respect to subsidiaries in which the Company holds at

least 25% of the value of such subsidiary, for a tax year, (a) 75% or more of the gross income of the Company for such tax year is passive

income (the “income test”) or (b) 50% or more of the value of the Company’s assets either produce passive income or

are held for the production of passive income (the “asset test”), based on the quarterly average of the fair market value

of such assets. “Gross income” generally includes all sales revenues less the cost of goods sold, plus income from investments

and incidental or outside operations or sources, and “passive income” generally includes, for example, dividends, interest,

certain rents and royalties, certain gains from the sale of stock and securities, and certain gains from commodities transactions. Active

business gains arising from the sale of commodities generally are excluded from passive income if substantially all of a foreign corporation’s

commodities are stock in trade or inventory, depreciable property used in a trade or business or supplies regularly used or consumed in

the ordinary course of its trade or business, and certain other requirements are satisfied.

If the Company were a PFIC in any tax year during which a U.S.

Holder held Common Shares, such holder generally would be subject to special rules with respect to “excess distributions”

made by the Company on the Common Shares and with respect to gain from the disposition of Common Shares. An “excess distribution”

generally is defined as the excess of distributions with respect to the Common Shares received by a U.S Holder in any tax year over 125%

of the average annual distributions such U.S. Holder has received from the Company during the shorter of the three preceding tax years,

or such U.S. Holder’s holding period for the Common Shares. Generally, a U.S. Holder would be required to allocate any excess distribution

or gain from the disposition of the Common Shares ratably over its holding period for the Common Shares. Such amounts allocated to the

year of the disposition or excess distribution would be taxed as ordinary income, and amounts allocated to prior tax years would be taxed

as ordinary income at the highest tax rate in effect for each such year and an interest charge at a rate applicable to underpayments of

tax would apply.

While there are U.S. federal income tax elections that sometimes

can be made to mitigate these adverse tax consequences (including the “QEF Election” under Section 1295 of the Code

and the “Mark-to-Market Election” under Section 1296 of the Code), such elections are available in limited circumstances

and must be made in a timely manner.

U.S. Holders should be aware that, for each tax year, if any,

that the Company is a PFIC, the Company can provide no assurances that it will satisfy the record-keeping requirements of a PFIC, or that

it will make available to U.S. Holders the information such U.S. Holders require to make a QEF Election with respect to the Company or

any subsidiary that also is classified as a PFIC.

Certain additional adverse rules may apply with respect to a

U.S. Holder if the Company is a PFIC, regardless of whether the U.S. Holder makes a QEF Election. These rules include special rules that

apply to the amount of foreign tax credit that a U.S. Holder may claim on a distribution from a PFIC. Subject to these special rules,

foreign taxes paid with respect to any distribution in respect of stock in a PFIC are generally eligible for the foreign tax credit. U.S.

Holders should consult their own tax advisors regarding the potential application of the PFIC rules to the ownership and disposition of

Common Shares, and the availability of certain U.S. tax elections under the PFIC rules.

Additional Considerations

Receipt of Foreign Currency

The amount of any distribution paid to a U.S. Holder in foreign

currency, or payment received on the sale, exchange or other taxable disposition of Common Shares, generally will be equal to the U.S.

dollar value of such foreign currency based on the exchange rate applicable on the date of receipt (regardless of whether such foreign

currency is converted into U.S. dollars at that time). A U.S. Holder will have a basis in the foreign currency equal to its U.S. dollar

value on the date of receipt. Any U.S. Holder who converts or otherwise disposes of the foreign currency after the date of receipt may