Current Report Filing (8-k)

29 Mars 2023 - 10:05PM

Edgar (US Regulatory)

false

0001101396

0001101396

2023-03-29

2023-03-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 or 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (Date of earliest event reported): March 23, 2023

DELTA APPAREL, INC.

(Exact name of registrant as specified in its charter)

|

|

Georgia

|

|

|

|

(State or Other Jurisdiction of Incorporation)

|

|

|

|

|

|

|

1-15583

|

|

58-2508794

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

2750 Premiere Pkwy., Suite 100,

Duluth, Georgia 30097

|

|

30097

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

|

(678) 775-6900

|

|

|

(Registrant's Telephone Number Including Area Code)

|

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below)

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Large accelerated filer

|

Accelerated filer

|

Non-accelerated filer

|

Smaller reporting company |

Emerging growth company

|

|

☐

|

☒

|

☐

|

☒ |

☐

|

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common |

DLA |

NYSE American |

Item 1.01 Entry into a Material Definitive Agreement.

On March 23, 2023, Delta Apparel, Inc. and its subsidiaries, M.J. Soffe, LLC, Culver City Clothing Company, Salt Life, LLC, and DTG2Go, LLC (collectively, the “Company”) entered into a Tenth Amendment to the Fifth Amended and Restated Credit Agreement (the “Agreement”) with Wells Fargo Bank (the “Agent”) and the other lenders set forth therein (the “Tenth Amendment”) to account for specified costs and expenses in calculating EBITDA for purposes of the Agreement.

The foregoing summary of the Tenth Amendment and the transactions contemplated thereby does not purport to be complete and is qualified in its entirety by reference to the text of the Tenth Amendment, which is filed herewith as Exhibit 10.1 to this Current Report on Form 8-K and which is incorporated herein by reference.

Cautionary Note Regarding Forward-Looking Statements

This Current Report on Form 8-K may contain “forward-looking” statements that involve risks and uncertainties. Any number of factors could cause actual results to differ materially from anticipated or forecasted results, including, but not limited to, the general U.S. and international economic conditions; the impact of the COVID-19 pandemic and government/social actions taken to contain its spread on our operations, financial condition, liquidity, and capital investments, including recent labor shortages, inventory constraints, and supply chain disruptions; significant interruptions or disruptions within our manufacturing, distribution or other operations; deterioration in the financial condition of our customers and suppliers and changes in the operations and strategies of our customers and suppliers; the volatility and uncertainty of cotton and other raw material prices and availability; the competitive conditions in the apparel industry; our ability to predict or react to changing consumer preferences or trends; our ability to successfully open and operate new retail stores in a timely and cost-effective manner; the ability to grow, achieve synergies and realize the expected profitability of acquisitions; changes in economic, political or social stability at our offshore locations or in areas in which we, or our suppliers or vendors, operate; our ability to attract and retain key management; the volatility and uncertainty of energy, fuel and related costs; material disruptions in our information systems related to our business operations; compromises of our data security; significant changes in our effective tax rate; significant litigation in either domestic or international jurisdictions; recalls, claims and negative publicity associated with product liability issues; the ability to protect our trademarks and other intellectual property; changes in international trade regulations; our ability to comply with trade regulations; changes in employment laws or regulations or our relationship with employees; negative publicity resulting from violations of manufacturing standards or labor laws or unethical business practices by our suppliers and independent contractors; the inability of suppliers or other third-parties, including those related to transportation, to fulfill the terms of their contracts with us; restrictions on our ability to borrow capital or service our indebtedness; interest rate fluctuations increasing our obligations under our variable rate indebtedness; the ability to raise additional capital; the impairment of acquired intangible assets; foreign currency exchange rate fluctuations; the illiquidity of our shares; price volatility in our shares and the general volatility of the stock market; and the other factors set forth in the "Risk Factors" contained in our most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission and as updated in our subsequently filed Quarterly Reports on Form 10-Q. Except as may be required by law, Delta Apparel, Inc. expressly disclaims any obligation to update these forward-looking statements to reflect events or circumstances after the date of this Current Report on Form 8-K or to reflect the occurrence of unanticipated events.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit Number

|

Description

|

|

|

|

|

10.1

|

TenthAmendment to Fifth Amended and Restated Credit Agreement, dated March 23, 2023, among Delta Apparel, Inc., M.J. Soffe, LLC, Culver City Clothing Company, Salt Life, LLC, and DTG2Go, LLC, and the financial institutions named therein as Lenders, and Wells Fargo Bank, National Association, as agent for Lenders. |

| |

|

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

DELTA APPAREL, INC.

|

|

|

|

|

|

|

|

|

|

Date:

|

March 29, 2023

|

/s/ Justin Grow

|

|

|

|

Justin Grow

|

|

|

|

Executive Vice President and Chief Administrative Officer

|

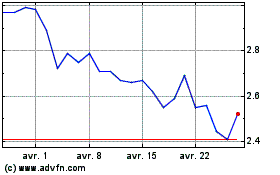

Delta Apparel (AMEX:DLA)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Delta Apparel (AMEX:DLA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024