false

0000319458

0000319458

2023-09-01

2023-09-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report September 1, 2023

(Date of earliest event reported)

Enservco Corporation

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-36335

|

|

84-0811316

|

|

(State or other jurisdiction of

incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

14133 County Road 9½

Longmont, Colorado 80504

(Address of principal executive offices) (Zip Code)

(303) 333-3678

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.005 par value

|

ENSV

|

NYSE American

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934. ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On September 1, 2023, Enservco Corporation (the “Company”) issued a Convertible Promissory Note in the aggregate principal amount of $750,000 to Cross River Partners, LP (“Cross River”), an entity controlled by Richard Murphy, our Chief Executive Officer and Chairman, in exchange for a $750,000 loan to the Company (the “CR Note”). Also on September 1, 2023, the Company issued a Convertible Promissory Note in the aggregate principal amount of $50,000 to Kevin Chesser (“Chesser”), a director of the Company, in exchange for a $50,000 loan to the Company (the “KC Note” and together with CR Note, the “Convertible Notes”). The Company expects to use the gross proceeds for general corporate purposes.

The Convertible Notes have a one year term and accrue interest at 8.00% per annum. All outstanding principal and interest on the Convertible Notes is due on the one year anniversary of their issuance.. The Company may prepay all or any portion of the outstanding principal or accrued but unpaid interest on the Convertible Notes without premium or penalty. If the Company closes on a convertible debt offering substantially on the terms attached as Annex A (the “Rapid Hot Financing”) to the Convertible Notes, then the principal balance of the Convertible Notes, together with all accrued but unpaid interest, will be exchanged on a dollar for dollar basis into such note as offered in the Rapid Hot Financing. To the extent the Rapid Hot Financing is not closed by September 30, 2023, Cross River and Chesser will have the option to have their Convertible Note secured by the Company’s real property located in Killdeer, North Dakota.

The foregoing summary of the Convertible Notes does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Convertible Notes, which are attached as Exhibit 10.1 and 10.2 to this Current Report on Form 8-K.

|

Item 2.03.

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The information set forth in Item 1.01 is hereby incorporated by reference into this Item 2.03.

|

Item 3.02

|

Unregistered Sales of Equity Securities

|

The information set forth in Item 1.01 is incorporated herein by reference into this Item 3.02. The Convertible Notes were issued to accredited investors without registration under the Securities Act of 1933, as amended (the “Securities Act”), in reliance on the exemption provided by Section 4(a)(2) of the Securities Act as transactions not involving a public offering.

(d) Exhibits

|

Exhibit Number

|

|

Description

|

|

10.1

|

|

|

|

10.2

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, on September 8, 2023.

| |

Enservco Corporation

|

| |

|

| |

|

|

| |

By:

|

/s/ Mark K. Patterson

|

| |

|

Mark K. Patterson, Chief Financial Officer

|

Exhibit 10.1

THIS CONVERTIBLE PROMISSORY NOTE AND THE SECURITIES INTO WHICH IT MAY BE CONVERTED HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR APPLICABLE STATE SECURITIES LAWS AND MAY NOT BE OFFERED, SOLD, TRANSFERRED, PLEDGED, OR HYPOTHECATED IN THE ABSENCE OF AN EFFECTIVE REGISTRATION STATEMENT UNDER THE ACT OR SUCH LAWS COVERING THE TRANSFER OR AN OPINION OF COUNSEL SATISFACTORY TO THE COMPANY THAT SUCH TRANSFER IS EXEMPT FROM SUCH REGISTRATION. THIS NOTE IS UNSECURED.

ENSERVCO CORPORATION

CONVERTIBLE PROMISSORY NOTE

No. CN-2023-B1

$750,000 |

Issuance Date: September 1, 2023 |

FOR VALUE RECEIVED, Enservco Corporation, a Delaware corporation (the “Company”), promises to pay to the order of Cross River Partners, LP, or its registered assigns (the “Holder”), pursuant to the terms set forth in this Convertible Promissory Note (this “Note”), the principal amount of Seven-Hundred-Fifty-Thousand Dollars ($750,000) (the “Principal Amount”), plus interest thereon.

1. Interest. Interest on the Principal Amount of this Note shall accrue from the Issuance Date at a rate equal to eight percent (8%) per annum until this Note is paid in full or otherwise converted pursuant to Section 4 below. Interest shall be calculated on the basis of a three hundred sixty-five (365) day year, based on the actual number of days elapsed.

2. Maturity Date. Subject to the conversion of this Note pursuant to Section 4 below, the Principal Amount of this Note, together with all accrued but unpaid interest thereon, shall be due and payable in full on the one-year anniversary of the Issuance Date (the “Maturity Date”).

3. Payment; Prepayment. Notwithstanding the foregoing, prior to the Maturity Date, the Company may prepay all or any portion of the outstanding Principal Amount or accrued but unpaid interest on this Note without premium or penalty. All payments received by the Holder hereunder will be applied first to interest and then to principal.

4. Note Exchange.

4.1. Note Exchange. If the Company closes on a convertible debt offering substantially on the terms attached hereto as Annex A (the “Rapid Hot Financing”), then the principal balance of this Note, together with all accrued but unpaid interest thereon, shall be exchanged on a dollar for dollar basis into such note as offered in the Rapid Hot Financing. To the extent the Rapid Hot Financing shall not have closed by September 30, 2023, the Holder shall have the option to have this Note secured by the Company’s real property located in Killdeer, North Dakota.

4.2. Mechanics and Effects of Exchange. Upon any exchange of this Note as provided in Section 4.1, the Holder shall surrender this Note to the Company. The Company shall, as soon as practicable thereafter, issue and deliver the note associated with the Rapid Hot Financing to the Holder at the Holder’s address or if no such address appears or is given, at such principal office of the Company.

5. Events of Default. Upon the occurrence and during the continuance of an Event of Default (as defined below), the Holder shall be entitled, by written notice to the Company, to declare this Note to be, and upon such declaration this Note shall be and become, immediately due and payable, in addition to any other rights or remedies the Holder may have under applicable law or the provisions of this Note or any related agreement between the Holder and the Company. The occurrence of any of the following events shall constitute an “Event of Default”:

(a) The Company fails to pay principal or accrued interest on this Note when due at the Maturity Date, unless this Note (or a portion thereof) is exchanged pursuant to Section 4 above;

(b) Any breach by the Company of any representation, warranty, or covenant contained in this Note , if such default has not been cured by the Company within thirty (30) days following the Company’s receipt of written notice from the Holder of such default;

(c) Any liquidation or dissolution of the Company, whether voluntary or involuntary;

(d) The institution by the Company of proceedings to be adjudicated as bankrupt or insolvent, or the consent by the Company to institution of bankruptcy or insolvency proceedings against the Company (or of any substantial part of its property) under any federal or state law, or the consent by the Company to or acquiescence in the filing of any petition relating thereto, or the appointment of a receiver, liquidator, assignee, trustee or other similar official of the Company, or the making by the Company of an assignment for the benefit of creditors, or the admission by the Company in writing of its inability to pay its debts generally as such debts become due; or

(e) Commencement of proceedings against the Company seeking any bankruptcy, insolvency, liquidation, dissolution, or similar relief under any present or future statute, law, or regulation, if such proceedings have not been dismissed or stayed within ninety (90) days of commencement thereof, or the setting aside of any such stay of any such proceedings, or the appointment without the consent or acquiescence of the equity holders of the Company of any trustee, receiver, or liquidator of the Company or of all or any substantial portion of the properties of the Company, if such appointment has not been vacated within ninety (90) days thereof.

6. Waivers; Fees. The Company hereby waives presentment, demand for payment, notice of non-performance, protest, notice of protest and notice of dishonor with respect to this Note. Other than pursuant to a writing by the Holder, no failure to convert any right of the Holder with respect to this Note, nor any delay in or waiver of the convert thereof, shall impair any such right or be deemed to be a waiver thereof. If the Holder is required to commence legal proceedings or incur any other cost to collect amounts due and payable hereunder or to enforce its rights under this Note, the Company shall be liable to pay or reimburse the Holder for all reasonable costs and expenses actually incurred in connection with the collection of such amounts and any such legal proceedings, including reasonable attorneys’ fees actually incurred.

7. Miscellaneous.

7.1. Amendment; Waiver. The amendment or waiver of any term of this Note, the resolution of any controversy or claim arising out of or relating to this Note must be in a writing signed by the parties hereto.

7.2. No Assignment by Company. The Company may not assign its rights or delegate any obligations hereunder without the prior written consent of the Holder.

7.3. Change of Control. Any transaction which results in a change of control of the Company or a substantial portion of any of its assets will not accelerate payment of any portion of the outstanding Principal Amount or accrued but unpaid interest.

7.4. Successors and Assigns. Subject to the exceptions specifically set forth in this Note, the terms and conditions of this Note shall inure to the benefit of and be binding upon the respective executors, administrators, heirs, successors and assigns of the parties.

7.5. Loss or Mutilation of Note. Upon receipt by the Company of evidence satisfactory to the Company of the loss, theft, destruction, or mutilation of this Note, together with indemnity reasonably satisfactory to the Company (in the case of loss, theft, or destruction), or the surrender and cancellation of this Note (in the case of mutilation), the Company shall execute and deliver to the Holder a new Note of like tenor and denomination as this Note.

7.6. Note Holder, Not Shareholder. This Note does not confer upon the Holder any right to vote or to consent to or to receive notice as a holder of shares of the Company, as such, in respect of any matters whatsoever, or any other rights or liabilities as a member of the Company, prior to the conversion hereof.

7.7. Officers and Directors Not Liable. In no event will any officer, manager, or director of the Company be liable for any amounts due and payable pursuant to this Note.

7.8. Governing Law. The terms of this Note shall be construed in accordance with the laws of the State of Delaware, without regard to its conflicts-of-law principles.

7.9. Notices. All notices, other communication, or payment required or permitted hereunder shall be in writing and shall be deemed to have been given upon delivery to the address provided by the Holder or to such other address as either party may designate in writing to the other.

7.10. Attorneys’ Fees. If any principal or interest represented by this Note or any part thereof is collected in bankruptcy, receivership, or other judicial proceedings, or if this Note is placed in the hands of attorneys for collection after default, the Company agrees to pay, in addition to the principal and interest payable hereunder, reasonable attorneys’ fees and costs incurred by the Holder in connection therewith.

7.11. Severability. If any term or provision of this Note is held to be invalid, illegal, or unenforceable under applicable law, such term(s) or provision(s) shall be excluded from this Note, and the balance of this Note shall be interpreted as if such term(s) or provision(s) were so excluded and shall be enforceable in accordance with its terms.

7.12. Counterparts. This Note may be executed by the Company (and accepted and acknowledged by the Holder) in two or more counterparts, each of which will be deemed an original but all of which will constitute one and the same instrument. Counterparts may be delivered via facsimile, email (including PDF or any electronic signature complying with the U.S. federal ESIGN Act of 2000, e.g., www.docusign.com) or other transmission method, and any counterpart so delivered will be deemed to have been duly and validly delivered and be valid and effective for all purposes.

[Signature Page Follows]

IN WITNESS WHEREOF, the undersigned has caused this Note to be effective as of the date first set forth above.

|

|

COMPANY:

|

|

| |

|

|

| |

ENSERVCO CORPORATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Mark K. Patterson

|

|

|

|

Name:

|

Mark K. Patterson

|

|

|

|

Title:

|

Chief Financial Officer

|

|

Accepted and Acknowledged:

HOLDER:

|

FOR INDIVIDUALS

|

|

FOR ENTITIES

|

| |

|

|

| |

|

Cross River Partners, LP |

|

(Signature)

|

|

(Name of entity)

|

| |

|

|

| |

|

Richard A. Murphy |

|

(Printed name)

|

|

(Name of signatory)

|

| |

|

|

| |

|

Managing Partner |

|

(Signature, if joint investment)

|

|

(Title)

|

| |

|

|

| |

|

/s/ Richard A. Murphy |

|

(Printed name, if joint investment)

|

|

(Signature)

|

| |

|

|

| |

|

September 1, 2023 |

|

(Date)

|

|

(Date)

|

ANNEX A

RAPID HOT FINANCING TERM SHEET

ENSERVCO CORPORATION

SUMMARY OF TERMS

CONVERTIBLE NOTE FINANCING

August 31, 2023

This “Summary of Terms” summarizes the principal terms of a convertible note financing of ENSERVCO Corporation, a Delaware corporation (the “Company”). This Summary of Terms is for discussion purposes only; there is no obligation on the part of any negotiating party until a definitive agreement is signed by all parties. The transactions contemplated by this Summary of Terms are subject to closing conditions including the satisfactory completion of due diligence and the execution of definitive financing documents by each investor:

| Amount of Financing: |

A minimum of $1,062,500.00 and a maximum of $3,000,000.00. |

| |

|

| Type of Security: |

Convertible Promissory Notes (“Notes”) in the form attached hereto as Exhibit A. |

| |

|

| Closing Date: |

September 11, 2023 with additional Closings for the balance of any unsold Notes for up to 45 days thereafter. Initial closing shall not be less than $1,062,500.00. |

| |

|

| |

Within the 45 day period after the Initial closing, Rich Murphy/Cross River will provide an additional $250,000.00, and contemporaneous therewith, the OilServ Investors will provide an additional $312,500.00. |

| |

|

| Note Term: |

Eighteen months after the closing (the “Maturity Date”), unless earlier converted in connection with a Qualified Financing (as defined below). |

| |

|

| Note Interest: |

16% simple interest from the date the Note is issued through the earlier of (a) repayment of the principal and interest, or (b) automatic conversion of the Note upon a Qualified Financing. During the first 3 months, interest will paid in Common Stock based on 5 day moving average of Closing Sales price on the NYSE/American immediately prior to calendar quarter end. After first 3 months, quarterly interest payments will be paid in cash within 10 days of the close of the calendar quarter. |

| |

|

| Conversion: |

The principal of each Note and all accrued but unpaid interest thereon shall be automatically converted, subject to any NYSE/American stockholder approval requirements, into securities of the Company upon the closing of an equity financing of the Company with gross proceeds (including the aggregate principal of the Notes) of at least $5,000,000.00 (a “Qualified Financing”). The securities issued to the holders of the Notes upon such a conversion shall be of the same class and type, at the same price and on the same terms and provisions as the securities issued to the other participants in the Qualified Financing; provided however, that the Notes shall convert at Holder’s option at (a) $0.55 per share, or (b) based on a share price which is a 25% discount to the price per share paid by the other participants in the Qualified Financing. |

| Note Repayment: |

Upon a Qualified Financing, the principal of each Note and all accrued but unpaid interest therein shall, subject to any NYSE/American stockholder approval requirements, be automatically converted as set forth above. If no Qualified Financing occurs, the principal and interest are repayable in cash, subject to the Note Term. |

| |

|

| Amendment of Notes: |

The terms and conditions of the Notes may be amended after the Closing by agreement of the Company and by the holders of a super-majority (greater than 75%) in outstanding principal of the Notes. |

| |

|

| Protective Covenants: |

Following the Closing, without the approval of the holders of a super-majority in principal of the Notes, the Company shall not (i) incur any debt which is senior or pari passu to the debt represented by the Notes other than a Qualified Financing (ii) issue any securities other than: (a) shares to be issued in conjunction with the OilServ, LLC. Rapid Hot Flow, LLC and Rapid Pressure Services, LLC asset purchase agreement (“APA”), (b) shares to be issued to Michael Lade as part of his employment and in conjunction with the APA, (c) pursuant to the Company’s existing Equity Incentive Plan and as approved by the Company’s Board of Directors, |

| |

|

| Default: |

Upon default of the payment of interest (which remains uncured for a ten day period post default), the Notes will immediately become due and payable in cash and interest shall accrue at the lesser of 22%, or the maximum rate allowable by law. |

| |

Upon default of payment of principal at maturity, the Note holder shall have the option of pursuing a cure of the default or conversion at the holder’s election. Upon a conversion, the conversion price shall be reduced to the lower of (i) 50% of the Closing Sales price on the date the default occurred, or (ii) 50% of the 5 day moving average of the Closing Sales price on the NYSE/American immediately prior to the date of conversion provided that the Note’s conversion is subject to any required NYSE/American stockholder approval |

| |

|

| Killdeer Mortgage: |

The Company will use its best efforts to secure a $500,000 mortgage on its Kildeer real property over the next 45 days. |

| |

|

| Change of Control: |

Upon a change of control prior to the maturity date, unless the Note is automatically converted in connection with a Qualified Financing associated with such change of control, the Note holders may elect to receive (i) the principal amount plus accrued interest plus a premium that is 25% of the principal amount of the Notes, or (ii) to elect an immediate conversion right at a conversion price equal to a 25% discount to the 5 day moving average of the Closing Sales price on the NYSE/American immediately prior to the closing of the change of control |

| |

|

| Board Role: |

Steve Weyel will be appointed to the Board concurrent with the closing of the OilServ acquisition.

|

| |

|

| Joint Participation: |

Rich Murphy and/or Cross River shall participate at the same or greater level as the combined participation level of OilServ, LLC Investors. |

| |

|

| Note Purchase Agreement: |

The Notes shall be issued pursuant to a Convertible Note Purchase Agreement drafted by counsel. The Convertible Note Purchase Agreement shall contain, among other things, appropriate representations and warranties of the Company and covenants of the Company reflecting the provisions set forth herein. |

| |

|

| Expenses: |

The OilServ, LLC Investors shall retain $25,000 for legal fees and expenses. |

| |

|

| No Offer: |

This Summary of Terms and any documents delivered in connection therewith are for informational purposes only and do not constitute either an offer to sell securities or the solicitation of an offer to buy securities. There will be no offer or sale of securities, or any solicitation to buy, in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction. |

| |

|

| Concurrent Closing: |

The Company acknowledges that closing will be contingent upon and concurrent with the closing of the Asset Purchase Agreement(s) related to OilServ, LLC, Rapid Hot Flow, LLC, and Rapid Pressure, LLC; and also concurrent with the execution of an Employment Agreement with Michael Lade. |

Exhibit 10.2

THIS CONVERTIBLE PROMISSORY NOTE AND THE SECURITIES INTO WHICH IT MAY BE CONVERTED HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR APPLICABLE STATE SECURITIES LAWS AND MAY NOT BE OFFERED, SOLD, TRANSFERRED, PLEDGED, OR HYPOTHECATED IN THE ABSENCE OF AN EFFECTIVE REGISTRATION STATEMENT UNDER THE ACT OR SUCH LAWS COVERING THE TRANSFER OR AN OPINION OF COUNSEL SATISFACTORY TO THE COMPANY THAT SUCH TRANSFER IS EXEMPT FROM SUCH REGISTRATION. THIS NOTE IS UNSECURED.

ENSERVCO CORPORATION

CONVERTIBLE PROMISSORY NOTE

|

No. CN-2023-B2

$50,000

|

Issuance Date: September 1, 2023

|

FOR VALUE RECEIVED, Enservco Corporation, a Delaware corporation (the “Company”), promises to pay to the order of Kevin Chesser, or his registered assigns (the “Holder”), pursuant to the terms set forth in this Convertible Promissory Note (this “Note”), the principal amount of Fifty Thousand Dollars ($50,000) (the “Principal Amount”), plus interest thereon.

1. Interest. Interest on the Principal Amount of this Note shall accrue from the Issuance Date at a rate equal to eight percent (8%) per annum until this Note is paid in full or otherwise converted pursuant to Section 4 below. Interest shall be calculated on the basis of a three hundred sixty-five (365) day year, based on the actual number of days elapsed.

2. Maturity Date. Subject to the conversion of this Note pursuant to Section 4 below, the Principal Amount of this Note, together with all accrued but unpaid interest thereon, shall be due and payable in full on the one-year anniversary of the Issuance Date (the “Maturity Date”).

3. Payment; Prepayment. Notwithstanding the foregoing, prior to the Maturity Date, the Company may prepay all or any portion of the outstanding Principal Amount or accrued but unpaid interest on this Note without premium or penalty. All payments received by the Holder hereunder will be applied first to interest and then to principal.

4. Note Exchange.

4.1. Note Exchange. If the Company closes on a convertible debt offering substantially on the terms attached hereto as Annex A (the “Rapid Hot Financing”), then the principal balance of this Note, together with all accrued but unpaid interest thereon, shall be exchanged on a dollar for dollar basis into such note as offered in the Rapid Hot Financing. To the extent the Rapid Hot Financing shall not have closed by September 30, 2023, the Holder shall have the option to have this Note secured by the Company’s real property located in Killdeer, North Dakota.

4.2. Mechanics and Effects of Exchange. Upon any exchange of this Note as provided in Section 4.1, the Holder shall surrender this Note to the Company. The Company shall, as soon as practicable thereafter, issue and deliver the note associated with the Rapid Hot Financing to the Holder at the Holder’s address or if no such address appears or is given, at such principal office of the Company.

5. Events of Default. Upon the occurrence and during the continuance of an Event of Default (as defined below), the Holder shall be entitled, by written notice to the Company, to declare this Note to be, and upon such declaration this Note shall be and become, immediately due and payable, in addition to any other rights or remedies the Holder may have under applicable law or the provisions of this Note or any related agreement between the Holder and the Company. The occurrence of any of the following events shall constitute an “Event of Default”:

(a) The Company fails to pay principal or accrued interest on this Note when due at the Maturity Date, unless this Note (or a portion thereof) is exchanged pursuant to Section 4 above;

(b) Any breach by the Company of any representation, warranty, or covenant contained in this Note , if such default has not been cured by the Company within thirty (30) days following the Company’s receipt of written notice from the Holder of such default;

(c) Any liquidation or dissolution of the Company, whether voluntary or involuntary;

(d) The institution by the Company of proceedings to be adjudicated as bankrupt or insolvent, or the consent by the Company to institution of bankruptcy or insolvency proceedings against the Company (or of any substantial part of its property) under any federal or state law, or the consent by the Company to or acquiescence in the filing of any petition relating thereto, or the appointment of a receiver, liquidator, assignee, trustee or other similar official of the Company, or the making by the Company of an assignment for the benefit of creditors, or the admission by the Company in writing of its inability to pay its debts generally as such debts become due; or

(e) Commencement of proceedings against the Company seeking any bankruptcy, insolvency, liquidation, dissolution, or similar relief under any present or future statute, law, or regulation, if such proceedings have not been dismissed or stayed within ninety (90) days of commencement thereof, or the setting aside of any such stay of any such proceedings, or the appointment without the consent or acquiescence of the equity holders of the Company of any trustee, receiver, or liquidator of the Company or of all or any substantial portion of the properties of the Company, if such appointment has not been vacated within ninety (90) days thereof.

6. Waivers; Fees. The Company hereby waives presentment, demand for payment, notice of non-performance, protest, notice of protest and notice of dishonor with respect to this Note. Other than pursuant to a writing by the Holder, no failure to convert any right of the Holder with respect to this Note, nor any delay in or waiver of the convert thereof, shall impair any such right or be deemed to be a waiver thereof. If the Holder is required to commence legal proceedings or incur any other cost to collect amounts due and payable hereunder or to enforce his rights under this Note, the Company shall be liable to pay or reimburse the Holder for all reasonable costs and expenses actually incurred in connection with the collection of such amounts and any such legal proceedings, including reasonable attorneys’ fees actually incurred.

7. Miscellaneous.

7.1. Amendment; Waiver. The amendment or waiver of any term of this Note, the resolution of any controversy or claim arising out of or relating to this Note must be in a writing signed by the parties hereto.

7.2. No Assignment by Company. The Company may not assign its rights or delegate any obligations hereunder without the prior written consent of the Holder.

7.3. Change of Control. Any transaction which results in a change of control of the Company or a substantial portion of any of its assets will not accelerate payment of any portion of the outstanding Principal Amount or accrued but unpaid interest.

7.4. Successors and Assigns. Subject to the exceptions specifically set forth in this Note, the terms and conditions of this Note shall inure to the benefit of and be binding upon the respective executors, administrators, heirs, successors and assigns of the parties.

7.5. Loss or Mutilation of Note. Upon receipt by the Company of evidence satisfactory to the Company of the loss, theft, destruction, or mutilation of this Note, together with indemnity reasonably satisfactory to the Company (in the case of loss, theft, or destruction), or the surrender and cancellation of this Note (in the case of mutilation), the Company shall execute and deliver to the Holder a new Note of like tenor and denomination as this Note.

7.6. Note Holder, Not Shareholder. This Note does not confer upon the Holder any right to vote or to consent to or to receive notice as a holder of shares of the Company, as such, in respect of any matters whatsoever, or any other rights or liabilities as a member of the Company, prior to the conversion hereof.

7.7. Officers and Directors Not Liable. In no event will any officer, manager, or director of the Company be liable for any amounts due and payable pursuant to this Note.

7.8. Governing Law. The terms of this Note shall be construed in accordance with the laws of the State of Delaware, without regard to its conflicts-of-law principles.

7.9. Notices. All notices, other communication, or payment required or permitted hereunder shall be in writing and shall be deemed to have been given upon delivery to the address provided by the Holder or to such other address as either party may designate in writing to the other.

7.10. Attorneys’ Fees. If any principal or interest represented by this Note or any part thereof is collected in bankruptcy, receivership, or other judicial proceedings, or if this Note is placed in the hands of attorneys for collection after default, the Company agrees to pay, in addition to the principal and interest payable hereunder, reasonable attorneys’ fees and costs incurred by the Holder in connection therewith.

7.11. Severability. If any term or provision of this Note is held to be invalid, illegal, or unenforceable under applicable law, such term(s) or provision(s) shall be excluded from this Note, and the balance of this Note shall be interpreted as if such term(s) or provision(s) were so excluded and shall be enforceable in accordance with its terms.

7.12. Counterparts. This Note may be executed by the Company (and accepted and acknowledged by the Holder) in two or more counterparts, each of which will be deemed an original but all of which will constitute one and the same instrument. Counterparts may be delivered via facsimile, email (including PDF or any electronic signature complying with the U.S. federal ESIGN Act of 2000, e.g., www.docusign.com) or other transmission method, and any counterpart so delivered will be deemed to have been duly and validly delivered and be valid and effective for all purposes.

[Signature Page Follows]

IN WITNESS WHEREOF, the undersigned has caused this Note to be effective as of the date first set forth above.

|

|

COMPANY:

|

|

| |

|

|

| |

ENSERVCO CORPORATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Mark K. Patterson

|

|

|

|

Name: Mark K. Patterson

|

|

|

|

Title: Chief Financial Officer

|

|

Accepted and Acknowledged:

HOLDER:

|

FOR INDIVIDUALS

|

|

FOR ENTITIES

|

| |

|

|

|

/s/ Kevin Chesser

|

|

|

| (Signature) |

|

(Name of entity) |

| |

|

|

| Kevin Chesser |

|

|

| (Printed name) |

|

(Name of signatory) |

|

|

|

|

| |

|

|

|

(Signature, if joint investment)

|

|

(Title)

|

| |

|

|

| |

|

|

| (Printed name, if joint investment) |

|

(Signature) |

|

|

|

|

| September 1, 2023 |

|

|

|

(Date)

|

|

(Date)

|

ANNEX A

RAPID HOT FINANCING TERM SHEET

ENSERVCO CORPORATION

SUMMARY OF TERMS

CONVERTIBLE NOTE FINANCING

August 31, 2023

This “Summary of Terms” summarizes the principal terms of a convertible note financing of ENSERVCO Corporation, a Delaware corporation (the “Company”). This Summary of Terms is for discussion purposes only; there is no obligation on the part of any negotiating party until a definitive agreement is signed by all parties. The transactions contemplated by this Summary of Terms are subject to closing conditions including the satisfactory completion of due diligence and the execution of definitive financing documents by each investor:

| Amount of Financing: |

A minimum of $1,062,500.00 and a maximum of $3,000,000.00. |

| |

|

| Type of Security: |

Convertible Promissory Notes (“Notes”) in the form attached hereto as Exhibit A. |

| |

|

| Closing Date: |

September 11, 2023 with additional Closings for the balance of any unsold Notes for up to 45 days thereafter. Initial closing shall not be less than $1,062,500.00. |

| |

|

| |

Within the 45 day period after the Initial closing, Rich Murphy/Cross River will provide an additional $250,000.00, and contemporaneous therewith, the OilServ Investors will provide an additional $312,500.00. |

| |

|

| Note Term: |

Eighteen months after the closing (the “Maturity Date”), unless earlier converted in connection with a Qualified Financing (as defined below). |

| |

|

| Note Interest: |

16% simple interest from the date the Note is issued through the earlier of (a) repayment of the principal and interest, or (b) automatic conversion of the Note upon a Qualified Financing. During the first 3 months, interest will paid in Common Stock based on 5 day moving average of Closing Sales price on the NYSE/American immediately prior to calendar quarter end. After first 3 months, quarterly interest payments will be paid in cash within 10 days of the close of the calendar quarter. |

| |

|

| Conversion: |

The principal of each Note and all accrued but unpaid interest thereon shall be automatically converted, subject to any NYSE/American stockholder approval requirements, into securities of the Company upon the closing of an equity financing of the Company with gross proceeds (including the aggregate principal of the Notes) of at least $5,000,000.00 (a “Qualified Financing”). The securities issued to the holders of the Notes upon such a conversion shall be of the same class and type, at the same price and on the same terms and provisions as the securities issued to the other participants in the Qualified Financing; provided however, that the Notes shall convert at Holder’s option at (a) $0.55 per share, or (b) based on a share price which is a 25% discount to the price per share paid by the other participants in the Qualified Financing. |

| |

|

| Note Repayment: |

Upon a Qualified Financing, the principal of each Note and all accrued but unpaid interest therein shall, subject to any NYSE/American stockholder approval requirements, be automatically converted as set forth above. If no Qualified Financing occurs, the principal and interest are repayable in cash, subject to the Note Term. |

| |

|

| Amendment of Notes: |

The terms and conditions of the Notes may be amended after the Closing by agreement of the Company and by the holders of a super-majority (greater than 75%) in outstanding principal of the Notes. |

| |

|

| Protective Covenants: |

Following the Closing, without the approval of the holders of a super-majority in principal of the Notes, the Company shall not (i) incur any debt which is senior or pari passu to the debt represented by the Notes other than a Qualified Financing (ii) issue any securities other than: (a) shares to be issued in conjunction with the OilServ, LLC. Rapid Hot Flow, LLC and Rapid Pressure Services, LLC asset purchase agreement (“APA”), (b) shares to be issued to Michael Lade as part of his employment and in conjunction with the APA, (c) pursuant to the Company’s existing Equity Incentive Plan and as approved by the Company’s Board of Directors, |

| Default: |

Upon default of the payment of interest (which remains uncured for a ten day period post default), the Notes will immediately become due and payable in cash and interest shall accrue at the lesser of 22%, or the maximum rate allowable by law. |

| |

Upon default of payment of principal at maturity, the Note holder shall have the option of pursuing a cure of the default or conversion at the holder’s election. Upon a conversion, the conversion price shall be reduced to the lower of (i) 50% of the Closing Sales price on the date the default occurred, or (ii) 50% of the 5 day moving average of the Closing Sales price on the NYSE/American immediately prior to the date of conversion provided that the Note’s conversion is subject to any required NYSE/American stockholder approval |

| |

|

| Killdeer Mortgage: |

The Company will use its best efforts to secure a $500,000 mortgage on its Kildeer real property over the next 45 days. |

| |

|

| Change of Control: |

Upon a change of control prior to the maturity date, unless the Note is automatically converted in connection with a Qualified Financing associated with such change of control, the Note holders may elect to receive (i) the principal amount plus accrued interest plus a premium that is 25% of the principal amount of the Notes, or (ii) to elect an immediate conversion right at a conversion price equal to a 25% discount to the 5 day moving average of the Closing Sales price on the NYSE/American immediately prior to the closing of the change of control |

| |

|

| Board Role: |

Steve Weyel will be appointed to the Board concurrent with the closing of the OilServ acquisition. |

| |

|

| Joint Participation: |

Rich Murphy and/or Cross River shall participate at the same or greater level as the combined participation level of OilServ, LLC Investors. |

| |

|

| Note Purchase Agreement: |

The Notes shall be issued pursuant to a Convertible Note Purchase Agreement drafted by counsel. The Convertible Note Purchase Agreement shall contain, among other things, appropriate representations and warranties of the Company and covenants of the Company reflecting the provisions set forth herein. |

| |

|

| Expenses: |

The OilServ, LLC Investors shall retain $25,000 for legal fees and expenses. |

| |

|

| No Offer: |

This Summary of Terms and any documents delivered in connection therewith are for informational purposes only and do not constitute either an offer to sell securities or the solicitation of an offer to buy securities. There will be no offer or sale of securities, or any solicitation to buy, in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction. |

| |

|

| Concurrent Closing: |

The Company acknowledges that closing will be contingent upon and concurrent with the closing of the Asset Purchase Agreement(s) related to OilServ, LLC, Rapid Hot Flow, LLC, and Rapid Pressure, LLC; and also concurrent with the execution of an Employment Agreement with Michael Lade. |

v3.23.2

Document And Entity Information

|

Sep. 01, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Enservco Corporation

|

| Document, Type |

8-K

|

| Document, Period End Date |

Sep. 01, 2023

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-36335

|

| Entity, Tax Identification Number |

84-0811316

|

| Entity, Address, Address Line One |

14133 County Road 9½

|

| Entity, Address, City or Town |

Longmont

|

| Entity, Address, State or Province |

CO

|

| Entity, Address, Postal Zip Code |

80504

|

| City Area Code |

303

|

| Local Phone Number |

333-3678

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

ENSV

|

| Security Exchange Name |

NYSE

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000319458

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

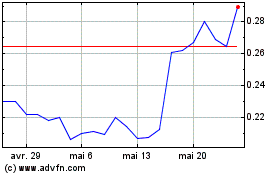

ENSERVCO (AMEX:ENSV)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

ENSERVCO (AMEX:ENSV)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024