|

UNITED STATES

|

|

SECURITIES AND EXCHANGE COMMISSION

|

|

Washington, D.C. 20549

|

Schedule 14C

Information Statement Pursuant to Section 14(c) of the Securities Exchange Act of 1934

Check the appropriate box:

|

☐

|

Preliminary Information Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

|

|

☒

|

Definitive Information Statement

|

ENSERVCO CORPORATION

(Name of Registrant As Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

|

☒

|

No fee required

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Fee computed on table in exhibit required by Item 25(b) of Schedule 14A (17 CFR 240.14a-101) per Item 1 of this Schedule and Exchange Act Rules 14c-5(g) and 0-11

|

ENSERVCO CORPORATION

14133 County Road 9 1/2

Longmont, Colorado 80504

NOTICE OF STOCKHOLDER ACTION BY WRITTEN CONSENT

To the Holders of Common Stock of Enservco Corporation,

This notice and the accompanying Information Statement are being circulated to the stockholders of record of the outstanding Common Stock, $0.005 par value per share (the “Common Stock”), of Enservco Corporation (the “Company”), as of the close of business on June 25, 2024, in connection with actions taken by the holders of a majority of the outstanding Common Stock of the Company, holding approximately 51.1% of the outstanding voting power of the outstanding Common Stock of the Company (the “Majority Stockholders”), by written consent in lieu of a special meeting. The accompanying Information Statement is being furnished to our stockholders in accordance with Rule 14c-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the rules promulgated by the Securities and Exchange Commission (SEC) thereunder, solely for the purpose of informing our stockholders of the actions taken by the written consent. This Information Statement shall be considered the notice required under Section 228(e) of the Delaware General Corporation Law (DGCL).

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

On June 25, 2024, the Majority Stockholders approved by written consent the following actions:

| |

●

|

the issuance and sale of shares of Common Stock (the “Transaction Shares”), pursuant to that certain Membership Interest Purchase Agreement (“MIPA” or “Purchase Agreement”) by and among the Company, Tony Sims and Jim Fate (together with Tony Sims, the “Sellers”), dated March 19, 2024 (the “Acquisition”), as required by Section 712(b) of the NYSE American Company Guide; and

|

| |

●

|

the issuance and sale of shares of Common Stock (the “ELOC Shares”) in excess of the exchange cap pursuant to that certain Common Stock Purchase Agreement, dated June 11, 2024, by and between the Company and Keystone Capital Partners, LLC (the “ELOC Purchase Agreement”), as required by Section 713(a) of the NYSE American Company Guide.

|

The actions taken by written consent of the Majority Stockholders will not become effective until the date that is twenty (20) calendar days following the date that this Information Statement is first mailed to holders of our Common Stock as of the Record Date (as defined below).

THIS IS NOT A NOTICE OF A MEETING OF STOCKHOLDERS AND NO STOCKHOLDERS’ MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN. YOUR VOTE OR CONSENT IS NOT REQUESTED OR REQUIRED.

| |

By Order of the Board of Directors,

|

| |

/s/ Richard A. Murphy

|

| |

Chief Executive Officer and Chairman

|

| |

July 12, 2024

|

INFORMATION STATEMENT

OF

ENSERVCO CORPORATION

14133 County Road 9 1/2

Longmont, Colorado 80504

(303) 333-3678

INFORMATION STATEMENT

PURSUANT TO SECTION 14(C)

OF THE SECURITIES EXCHANGE ACT OF 1934

AND RULE 14C-2 THEREUNDER

July 12, 2024

NO VOTE OR OTHER ACTION OF THE COMPANY’S STOCKHOLDERS IS REQUIRED IN CONNECTION WITH THIS INFORMATION STATEMENT

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY

GENERAL INFORMATION

Enservco Corporation, a Delaware corporation, with its principal executive offices located at 14133 County Rd 9 ½, Longmont, CO 80504, is sending you this Notice and Information Statement to notify you of an action that the Majority Stockholders have taken by written consent in lieu of a special meeting of stockholders. References in this Information Statement to the “Company, “we,” “our,” “us,” and “ENSV” are to Enservco Corporation, and, to the extent applicable, its subsidiaries. The entire cost of furnishing this Information Statement will be borne by the Company. We will request brokerage houses, nominees, custodians, fiduciaries and other like parties to forward the Information Statement to beneficial owners of the Common Stock held of record by them. The Company will reimburse these brokers, nominees, custodians, and fiduciaries for the reasonable out-of-pocket expenses they incur in connection with the forwarding of the Information Statement.

Copies of this Information Statement are being mailed on or about July 12, 2024, to the stockholders of record of the outstanding Common Stock as of the close of business on June 25, 2024, which we refer to as the “Record Date.”

The actions described herein were authorized and approved by the written consent of the Majority Stockholders holding approximately 51.1% of our outstanding voting stock on June 25, 2024, in lieu of a special meeting of stockholders. The approval was obtained in accordance with Section 228 of the Delaware General Corporation Law (DGCL), which provides that any action that may be taken at any annual or special meeting of stockholders may be taken without a meeting, without prior notice and without a vote, if a consent or consents in writing, setting forth the action so taken, shall be signed by the holders of outstanding common stock having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted.

Our board of directors (“Board”) previously adopted resolutions approving the issuance of the Transaction Shares in connection with the Acquisition and issuance of the ELOC Shares pursuant to the ELOC Purchase Agreement. The consent that we have obtained from the Majority Stockholders constitutes the only stockholder approval required under the NYSE American Company Guide, our Certificate of Incorporation, and our Bylaws, to approve the issuance of the Transaction Shares and the issuance of the ELOC Shares. Our Board is not soliciting your vote or your proxy in connection with these actions. Accordingly, all necessary corporate approvals of the issuance of the Transaction Shares and the issuance of the ELOC Shares have been obtained and this Information Statement is being furnished to stockholders solely for purposes of informing the stockholders of the actions in the manner required under the Exchange Act.

The actions taken by written consent of the Majority Stockholders will become effective on the date that is twenty (20) calendar days following the date that this Information Statement is first mailed or otherwise delivered to holders of our Common Stock as of the Record Date.

ACTIONS APPROVED BY MAJORITY STOCKHOLDERS

This Information Statement contains a brief summary of the material aspects of the actions approved by our Board and the consenting Majority Stockholders.

ISSUANCE OF SHARES OF COMMON STOCK IN CONNECTION WITH THE ACQUISITION OF BUCKSHOT

Information About the Parties

Enservco Corporation is a diversified national provider of specialized well-site services to the domestic onshore conventional and unconventional oil and gas industries. Enservco provides a range of oilfield services through its various operating subsidiaries, including hot oiling, acidizing, frac water heating, and related services. The Company has a broad geographic footprint covering major domestic oil and gas basins across the United States. Additional information is available at www.enservco.com.

Buckshot Trucking, LLC is a Wyoming limited liability company (“Buckshot”) that was founded in 2017. It’s headquartered in Fort Lupton, Colorado, with an additional leased facility located in Casper, Wyoming. Buckshot focuses on hot shot trucking (i.e., expedited transportation in the oil, gas and broader energy sector), dedicated freight services, and less-than-truckload (LTL) services within the oil, gas and broader energy sector. The company maintains master service agreements with several large energy companies. Buckshot has approximately 26 employees, comprised of 16 drivers and others supporting the logistics coordination, management, and compliance functions. As of the date of this Information Statement, Buckshot’s fleet is comprised of approximately 8 truck-trailers; 11 trucks and 23 trailers, all of which are owned by Buckshot and utilized in its logistics/transportation business. Buckshot’s current focus in the greater-Rocky Mountain area is complemented by an extensive operational presence in Wyoming, Utah, North Dakota, and Texas.

Summary Terms

On March 19, 2024, the Company entered into a Membership Interest Purchase Agreement (the “Purchase Agreement”) with Tony Sims, an individual resident of Colorado; Jim Fate, an individual resident of Colorado (together, the “Sellers”), and Buckshot, pursuant to which the Company agreed to acquire from the Sellers all of the issued and outstanding membership interests of Buckshot (the “Acquisition”) for $5.0 million (the “Base Amount”), subject to a net working capital adjustment, plus up to $500,000, in the form of the Company’s Common Stock, contingent upon satisfaction of certain conditions set forth in the Purchase Agreement. The Base Amount consists of $3.75 million in cash and $1.25 million in shares of Common Stock based on the volume-weighted average of the Common Stock for the 10-day period immediately preceding the closing date. The exact number of Transaction Shares to be issued will be determined in accordance with the terms of the Purchase Agreement. Under applicable NYSE American Rules (as defined below), the issuance of the Common Stock pursuant to the Purchase Agreement is subject to the prior approval or consent of the holders of a majority of the outstanding Common Stock.

Background of the Acquisition

On November 22, 2023, the Company and Buckshot entered into a confidential non-binding Letter of Intent (the “Proposal”), pursuant to which the Company proposed to acquire 100% of the membership interests of Buckshot for $5.0 million. The Proposal included standard conditions to closing, such as:

| |

●

|

Completion of financial, operational and legal due diligence.

|

| |

●

|

Audited financial statements of Buckshot for the prior two years.

|

| |

●

|

Approval by the board of directors and shareholders of the Company and Buckshot.

|

| |

●

|

Execution of a definition purchase agreement with standard representations, warranties and indemnities.

|

| |

●

|

Execution of an employment agreement with Tony Sims.

|

| |

●

|

Receipt of all required consents.

|

| |

●

|

No material adverse changes, litigation or developments in Buckshot’s business.

|

On March 15, 2024, a meeting was convened by the Company's Board. During this meeting, management presented an extensive overview of the Acquisition, including Buckshot's business and financial profile, the transaction structure, integration plans and material terms. The Board engaged in a detailed discussion, with directors inquiring about various aspects of the Acquisition, including the principal terms of the Purchase Agreement, the net working capital, compliance with NYSE American Rules, the projected timeline for closing, transaction fees, and financing arrangements, among other topics. After a thorough review and deliberation of the Acquisition, the Board authorized management to proceed with execution and delivery of the Purchase Agreement.

Rationale for the Acquisition

As previously explained in the press release issued on March 20, 2024, the Company’s Chairman and CEO noted the following potentially positive factors of the Acquisition (which are not intended to be exhaustive and are not in any relative order of importance):

| |

●

|

The Acquisition will strategically transform the Company by entering the logistics business with Buckshot’s immediately accretive logistics business. In this regard, management considered that the Acquisition will:

|

| |

o

|

add a higher margin business that has historically generated strong growth and cash generation without substantial new overhead;

|

| |

o

|

provide year-round prospective growth with operational and financial visibility;

|

| |

o

|

provide incremental services for the Company’s existing and expanded customer base while providing a pathway for earnings, cash flow growth and improved predictability; and

|

| |

o

|

establish a new operating division that complements and expands current strong market position in hot oiling and acidizing services and frac water heating services, in addition to non-oil & natural gas customers.

|

| |

●

|

The founders of Buckshot, Tony Sims and Jim Fate, will continue to lead the Buckshot business.

|

| |

●

|

Buckshot’s 2023 unaudited EBITDA (earnings before interest, tax and depreciation) is approximately $2.3 million on revenue of approximately $8.2 million, a near doubling of Buckshot’s revenue since 2021.

|

The Company expects to close on the Acquisition approximately 20 days following the mailing date of this Information Statement. The Acquisition, once complete, will provide Enservco with a growing business that is not weather dependent, empower the Company to enter steady year-round logistics, expand its operating footprint, and improve cash flow visibility. In addition to offering year-round cash flow and earnings visibility, the Acquisition will expand our service offering into energy logistics and the opportunity for growth in new markets and an expanded customer base.

Terms of the Purchase Agreement

The issuance of the Common Stock pursuant to the Purchase Agreement is subject to the prior approval or consent of the holders of a majority of the outstanding Common Stock. Under the Purchase Agreement, the Company agreed to use its reasonable best efforts to obtain from specified stockholders a written consent approving the issuance of the Common Stock as promptly as reasonably practicable following the effective date of the Purchase Agreement. Such written consent was obtained June 25, 2024. In addition, the Company agreed to prepare and file an information statement with respect to the issuance of Common Stock with the U.S. Securities and Exchange Commission (“SEC”) in accordance with Rule 14c-2 of the Exchange Act of 1934, as amended (the “Information Statement”) and/or a proxy statement should Enservco proceed with a stockholder meeting in lieu of a written consent seeking approval.

Under the Purchase Agreement, the Company agreed to file a registration statement with the SEC for the purpose of registering for resale the shares issued pursuant to the Purchase Agreement. The Company is required to file such registration statement with the SEC within 60 days following the Acquisition closing date.

The Purchase Agreement contains customary representations, warranties, and covenants. In addition, the Purchase Agreement contains post-closing indemnification rights, subject to certain specified limitations, for breaches of representations and warranties, covenants, and certain other matters.

Each party’s obligation to consummate the Acquisition is subject to satisfaction of the closing conditions, including without limitation: (i) Buckshot having a trailing twelve (12) month adjusted EBITDA of at least $2.0 million as of the closing date; (ii) Buckshot delivering a closing working capital amount of at least $1.23 million as of the closing date; (iii) the Company mailing this Information Statement to its stockholders and the passage of at least 20 calendar days from the date of such mailing; (iv) performance by the other party of its obligations and covenants under the Purchase Agreement; (v) absence of any decree prohibiting consummation of the Acquisition; and (vi) delivery of the closing deliverables by the other party. Current expectations are that the Acquisition will close approximately 20 days following the mailing date of this Information Statement.

The foregoing description of the Purchase Agreement is not exhaustive and is qualified in its entirety by reference to the Purchase Agreement, a copy of which is attached as Exhibit 10.1 to the Company’s Current Report on Form 8-K/A filed with the SEC on June 28, 2024, which is incorporated by reference herein.

Interests of Certain Persons

None of the Company’s directors or executive officers have any interest in the action approved by the Majority Stockholders and described in this Information Statement except in their capacity as holders of Common Stock, which interest is the same as that of all other holders of our Common Stock.

In connection with the Acquisition, the Company will enter into an employment agreement with Tony Sims, one of the founders and former owners of Buckshot, to serve as President of Buckshot. Upon closing of the Acquisition, Buckshot will become a new, wholly owned subsidiary of the Company. As inducement for his employment, the Company agreed to issue Mr. Sims an option to acquire 250,000 shares of Common Stock at an exercise price equal to the fair market value of such shares on the grant date, with 50% of such options vesting on the grant date and the remaining 50% becoming fully vested on July 1, 2025.

Regulatory Approval

No regulatory approvals are required to consummate the Acquisition.

Financial Information

Historical financial Information. The financial statements of Buckshot as of and for the three months ended March 31, 2024 and March 31, 2023 (unaudited) and as of and for the years ended December 31, 2023 and 2022 (audited) are filed as Exhibit 99.2 and Exhibit 99.3, respectively, to the Company’s Current Report on Form 8-K/A filed with the SEC on June 28, 2024, and are incorporated herein by reference.

Pro forma financial information. The unaudited pro forma condensed combined balance sheet as of March 31, 2024, the unaudited pro forma condensed combined statement of operations for the three months ended March 31, 2024, the unaudited pro forma combined statement of operations for the year ended December 31, 2023, and notes to the unaudited pro forma condensed combined financial information of the Company, all giving effect to the Acquisition, are filed as Exhibit 99.4 to the Company’s Current Report on Form 8-K/A filed with the SEC on June 28, 2024, and are incorporated herein by reference.

Risk Factors

The Acquisition is subject to risks and uncertainties, including the anticipated closing date of the Acquisition, the ability of the Company to raise sufficient capital to fund the cash portion of the purchase price, and the ability of the Company to successfully integrate Buckshot’s market opportunities, personnel and operations, transition to a logistics business and achieve expected benefits.

Reason for Stockholder Approval

Our Common Stock is listed on the NYSE American and, as such, we are subject to the rules of that exchange (the “NYSE American Rules”). NYSE American Rule 712(b) requires stockholder approval prior to the issuance of securities in connection with an acquisition of stock or assets of another company where the issuance or potential issuance by the issuer of common stock (or securities convertible into common stock) could result in an increase in outstanding common shares of 20% or more.

The issuance of the Transaction Shares in connection with the Acquisition could result in an increase of the Company’s outstanding Common Stock by 20% or more. To ensure compliance with NYSE American Rule 712(b), the Majority Stockholders, on June 25, 2024, approved the issuance of Transaction Shares.

Stockholder Approval of the Issuance of the Transaction Shares

For purposes of NYSE American Rule 712(b), written consent of the holders of a majority of the outstanding Common Stock entitled to vote will constitute stockholder approval. Under Section 228 of the DGCL, our Certificate of Incorporation and our Bylaws, any action that can be taken at an annual or special meeting of stockholders may be taken without a meeting, without prior notice and without a vote, if the holders of outstanding stock having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present, consent to such action in writing. Section 228(e) of the DGCL requires that prompt notice of any action so taken by written consent be provided to all holders of Common Stock as of the Record Date.

As of the Record Date, the Company had 37,281,938 shares of Common Stock issued and outstanding. Each share of Common Stock is entitled to one vote. The Majority Stockholders collectively held 19,033,279 shares of Common Stock as of the Record Date, representing approximately 51.1% of the voting power of all outstanding Common Stock. Accordingly, the written consent executed by the Majority Stockholders is sufficient to approve the action and no further stockholder action is required to approve the issuance of the Transaction Shares.

This Information Statement is first being mailed on or about July 12, 2024 to the Company’s stockholders of record as of the Record Date. The approval of the action by written consent of the Majority Stockholders shall become effective on or about August 1, 2024, or approximately 20 days after we mail this Information Statement.

Notice Pursuant to Section 228(e) of the Delaware General Corporation Law

Section 228(e) of the DGCL requires that prompt notice of any action so taken by written consent be provided to all holders of our Common Stock as of the Record Date. This Information Statement serves as the notice required by Section 228(e) of the DGCL.

Accounting Treatment

The Company expects that the Acquisition will be accounted for as a business combination using the acquisition method of accounting under the provisions of Accounting Standards Codification (ASC) Topic 805, “Business Combinations” (“ASC 805”). Under ASC 805, all assets acquired and liabilities assumed are recorded at their acquisition date fair value.

No Appraisal Rights

No appraisal or dissenters’ rights are available to our stockholders under Delaware law, our Certificate of Incorporation or Bylaws with respect to the issuance of Transaction Shares.

Effect on Current Stockholders

The issuance of the Transaction Shares in connection with the Acquisition will result in an increase in the number of shares of Common Stock outstanding, and our existing stockholders will incur dilution of their ownership percentage. Because the number of shares that may be issued pursuant to the Purchase Agreement is determined based on the volume-weighted average price of the Common Stock for the 10-day period immediately preceding the closing date, the exact magnitude of the dilutive effect cannot be conclusively determined at this time.

We have agreed to file a registration statement to permit the public resale of the shares of Common Stock issued under the Purchase Agreement. The influx of those shares into the public market could potentially have a negative effect on the trading price of our Common Stock.

Other Material Information

The Company will seek to raise a portion or all of the $3.75 million in cash consideration for the Acquisition pursuant to the sale of ELOC Shares. See “Issuance of Common Stock In Excess of the Exchange Cap Pursuant to the Common Stock Purchase Agreement.”

ISSUANCE OF COMMON STOCK IN EXCESS OF THE EXCHANGE CAP

PURSUANT TO THE COMMON STOCK PURCHASE AGREEMENT

Background

On June 11, 2024, the Company entered into a Common Stock Purchase Agreement (the “ELOC Purchase Agreement”) between the Company and Keystone Capital Partners, LLC (“Investor”), establishing an equity line of credit (“ELOC”). Under the ELOC Purchase Agreement, the Company has the right, but not the obligation, to sell to Investor, and Investor is obligated to purchase, up to the lesser of $10.0 million of newly issued shares of the Company’s Common Stock, and 7,310,000 shares of Common Stock, representing 19.99% of the total number of shares of Common Stock outstanding immediately prior to the execution of the Purchase Agreement (the “Exchange Cap”); provided, however, that such limitations will not apply if we obtain stockholder approval to issue additional shares of Common Stock.

We may receive gross proceeds of up to $10.0 million from the sale of ELOC Shares under the ELOC Purchase Agreement. We intend to use any net proceeds from any sale of ELOC Shares to Investor under the ELOC Purchase Agreement for working capital, strategic and other general corporate purposes, including to fund a portion of the Acquisition. However, we cannot predict whether the net proceeds invested will yield a favorable return. We will have broad discretion in the way we use these proceeds. This arrangement enhances the Company's liquidity and financial stability by providing access to additional capital as needed.

Terms of the Keystone Committed Equity Financing

Pursuant to the ELOC Purchase Agreement, the Company has the right, but not the obligation, to sell to Investor, and Investor is obligated to purchase, up to the lesser of (i) $10.0 million of newly issued shares of the Company’s Common Stock and (ii) the Exchange Cap.

The Company does not have a right to commence any sales of Common Stock to Investor under the ELOC Purchase Agreement until the time when all of the conditions to the Company’s right to commence sales of Common Stock set forth in the ELOC Purchase Agreement have been satisfied, including that a registration statement covering the resale of such shares is declared effective by the SEC and the final form of prospectus is filed with the SEC (the “Commencement Date”). Over the 36-month period from and after the Commencement Date, the Company will control the timing and amount of any sales of Common Stock to Investor. Actual sales of shares of Common Stock to Investor under the ELOC Purchase Agreement will depend on a variety of factors to be determined by the Company from time to time, including, among others, market conditions, the trading price of the Common Stock and determinations by us as to the appropriate sources of funding and the Company’s operations.

At any time from and after the Commencement Date, on any business day on which the closing sale price of the Common Stock is equal to or greater than $0.10 (the “Purchase Date”), the Company may direct Investor to purchase a specified number of shares of Common Stock (a “Fixed Purchase”) not to exceed 100,000 shares at a purchase price equal to the lesser of 92.5% of (i) the daily volume weighted average price (the “VWAP”) of the Common Stock for the five trading days immediately preceding the applicable Purchase Date for such Fixed Purchase and (ii) the lowest sale price of a share of Common Stock on the applicable Purchase Date for such Fixed Purchase during the full trading day on such applicable Purchase Date.

In addition, at any time from and after the Commencement Date, on any business day on which the closing sale price of the Common Stock is equal to or greater than $0.10 and such business day is also the Purchase Date for a Fixed Purchase of an amount of shares of Common Stock not less than the applicable Fixed Purchase Maximum Amount (as defined in the ELOC Purchase Agreement) (the “VWAP Purchase Date”), the Company may also direct Investor to purchase, on the immediately following business day, an additional number of shares of Common Stock in an amount up to the Maximum VWAP Purchase Amount (as defined in the ELOC Purchase Agreement) (a “VWAP Purchase”) at a purchase price equal to the lesser of 92.5% of (i) the closing sale price of the Common Stock on the applicable VWAP Purchase Date and (ii) the VWAP during the period on the applicable VWAP Purchase Date beginning at the opening of trading and ending at the VWAP Purchase Termination Time (as defined in the ELOC Purchase Agreement). At any time from and after the Commencement Date, on any business day that is also the VWAP Purchase Date for a VWAP Purchase, the Company may also direct Investor to purchase, on such same business day, an additional number of shares of Common Stock in an amount up to the Maximum Additional VWAP Purchase Amount (as defined in the ELOC Purchase Agreement) (an “Additional VWAP Purchase”) at a purchase price equal to the lesser of 92.5% of (i) the closing sale price of the Common Stock on the applicable Additional VWAP Purchase Date and (ii) the VWAP during the Additional VWAP Purchase Period (as defined in the ELOC Purchase Agreement).

As consideration for Investor’s irrevocable commitment to purchase shares of Common Stock pursuant to the ELOC Purchase Agreement, the Company issued 545,554 shares of Common Stock to Investor (the “Initial Commitment Shares”). In addition, the Company agreed to issue an additional $100,000 of shares of Common Stock to Investor on the 90th calendar day following the Commencement Date, with the number of such shares determined based upon the VWAP Purchase Price as of such date (the “Back End Commitment Shares”).

Concurrent with the execution of the ELOC Purchase Agreement, the Company entered into a registration rights agreement with Investor (the “Registration Rights Agreement”), pursuant to which the Company agreed to file a registration statement covering the resale of the Initial Commitment Shares, the Back End Commitment Shares, and the maximum number of shares issuable under the Purchase Agreement as may be permitted under applicable rules. The Company agreed to use its commercially reasonable efforts to cause the registration statement to be declared effective within the earlier of 75 calendar days from the date of the Registration Rights Agreement if such registration statement is subject to review by the SEC and the 5th business day from the date the Company is notified by the SEC that such registration statement will not be reviewed.

The foregoing description of the ELOC Purchase Agreement and the Registration Rights Agreement is not exhaustive and is qualified in its entirety by reference to the ELOC Purchase Agreement and Registration Rights Agreement, copies of which are filed as Exhibit 10.1 and Exhibit 10.2, respectively, to the Company’s Current Report on Form 8-K filed with the SEC on June 13, 2024, and are incorporated by reference herein.

Interests of Certain Persons

None of the Company’s directors or executive officers have any interest in the action approved by the Majority Stockholders and described in this Information Statement except in their capacity as holders of Common Stock, which interest is the same as that of all other holders of our Common Stock.

Reasons for Stockholder Approval

Our Common Stock is currently listed on the NYSE American and, as such, we are subject to the NYSE American Rules. NYSE American Rule 713, in relevant part, requires stockholder approval prior to (i) the sale, issuance, or potential issuance by the issuer of common stock (or securities convertible into common stock) at a price less than the greater of book or market value which together with sales by officers, directors or principal shareholders of the issuer equals 20% or more of presently outstanding common stock; or (ii) the sale, issuance, or potential issuance by the issuer of common stock (or securities convertible into common stock) equal to 20% or more of presently outstanding stock for less than the greater of book or market value of the stock. Therefore, under the ELOC Purchase Agreement, the parties agreed not to issue and sell shares in excess of the Exchange Cap, unless (i) we sought and obtained the approval of our stockholders to issue and sell shares in excess of such Exchange Cap or (ii) sales of Common Stock are made at a price equal to or in excess of the lower of (A) the closing price immediately preceding the delivery of the applicable notice to Investor and (B) the average of the closing prices of the Common Stock on the NYSE American for the five business days immediately preceding the delivery of such notice (in each case plus an incremental amount to take into account the Commitment Shares), such that the sales of such Common Stock to Investor would not count toward the Exchange Cap because they are “at market” under applicable NYSE American rules.

Our Board has determined that the ELOC Purchase Agreement and our ability to issue the ELOC Shares thereunder in excess of the Exchange Cap up to the maximum amount (as set forth under the ELOC Purchase Agreement) is in the best interests of the Company and its stockholders. The ability to sell the ELOC Shares to Investor provides us with a reliable source of capital for working capital and general corporate purposes.

We cannot predict the market price of our Common Stock at any future date, and therefore cannot predict the number of ELOC Shares to be issued under the ELOC Purchase Agreement or whether the market price for any issuance will be “at market” or greater. Under certain circumstances, it is possible that we may need to sell shares of Common Stock in excess of the Exchange Cap at a price that is less than “at market” under applicable NYSE American Rules, which require stockholder approval pursuant to NYSE American Rule 713.

Therefore, to ensure compliance with NYSE American Rule 713, the Majority Stockholders, on June 25, 2024, approved the issuance of shares of Common Stock to Investor in excess of the Exchange Cap under the terms of the ELOC Purchase Agreement.

Stockholder Approval of the Issuance of the ELOC Shares

NYSE American Rule 713(a) requires stockholder approval for the issuance of common stock if the issuance will result in the issuance of 20% or more of the Company’s Common Stock outstanding before the issuance. For purposes of NYSE American Rule 713(a), written consent of the holders of a majority of the shares of Common Stock entitled to vote constitutes stockholder approval. Under Section 228 of the DGCL, our Certificate of Incorporation and our Bylaws, any action that can be taken at an annual or special meeting of stockholders may be taken without a meeting, without prior notice and without a vote, if the holders of outstanding stock having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present, consent to such action in writing.

As of the Record Date, the Company had 37,281,938 shares of Common Stock issued and outstanding. Each share of Common Stock is entitled to one vote. The Majority Stockholders collectively held 19,033,279 shares of Common Stock as of the Record Date, representing approximately 51.1% of the voting power of all outstanding shares of Common Stock. Accordingly, the written consent executed by the Majority Stockholders is sufficient to approve the action and no further stockholder action is required to approve the issuance of the ELOC Shares under the ELOC Purchase Agreement.

This Information Statement is first being mailed on or about July 12, 2024 to the Company’s stockholders of record as of the Record Date. The approval of the action by written consent of the Majority Stockholders shall become effective on or about August 1, 2024, or approximately 20 days after we mail this Information Statement.

Notice Pursuant to Section 228(e) of the Delaware General Corporation Law

Section 228(e) of the DGCL requires that prompt notice of any action so taken by written consent be provided to all holders of our Common Stock as of the Record Date. This Information Statement serves as the notice required by Section 228(e) of the DGCL.

Effect on Current Stockholders

The issuance of ELOC Shares under the ELOC Purchase Agreement, including any shares that may be issued in excess of the Exchange Cap, will increase the number of shares of Common Stock outstanding, and our existing stockholders will incur dilution of their ownership percentage. Because the number of ELOC Shares that may be issued to Investor pursuant to the ELOC Purchase Agreement is determined based on a volume weighted average price at the time we elect to sell, the exact magnitude of the dilutive effect cannot be conclusively determined, provided that we may not deliver a purchase notice requiring Investor to purchase our shares if our closing price at the time is less than a threshold price of $0.10, appropriately adjusted for any reorganization, recapitalization, non-cash dividend, stock split or other similar transaction.

The Company has filed a registration statement to permit the public resale of the ELOC Shares issued to Investor under the ELOC Purchase Agreement. Investor may resell some or all of the ELOC Shares we issue to it under the ELOC Purchase Agreement and such sales could cause the market price of our Common Stock to decline.

Risk Factors

The issuance of the ELOC Shares under the ELOC Purchase Agreement is subject to risks and uncertainties, which are described in our filings with the SEC.

No Appraisal Rights

No appraisal or dissenters’ rights are available to our stockholders under Delaware law, our Certificate of Incorporation or Bylaws with respect to the issuance of the ELOC Shares.

OUTSTANDING VOTING SECURITIES

As of the Record Date, the Company had 37,281,938 shares of Common Stock shares outstanding and entitled to vote. Each share of Common Stock is entitled to one vote. On June 25, 2024, the Majority Stockholders, constituting 51.1% of the voting power of our outstanding Common Stock on the Record Date, executed a written consent to approve, for purposes of complying with applicable NYSE American Rules, the issuance of Transaction Shares in connection with the Acquisition and the issuance of ELOC Shares in excess of the Exchange Cap under the ELOC Purchase Agreement. Since these actions have been approved by the Majority Stockholders, no consents are being solicited by this Information Statement and no further stockholder action is required.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

This table presents information about our Common Stock’s beneficial ownership as of June 25, 2024, for (i) each named executive officer and director; (ii) all named executive officers and directors as a group; and (iii) each other stockholder known to us owning more than 5% of our outstanding Common Stock.

Beneficial ownership complies with SEC rules, generally including voting or investment power over securities. A person or group is deemed to have “beneficial ownership” of any shares they can acquire within sixty (60) days. For percentage calculations, any shares that a person can acquire within sixty days are considered issued and outstanding for that person but not for others. This table does not imply beneficial ownership admission by anyone listed.

|

Name of Beneficial Owner(1)

|

|

Amount and Nature

of Beneficial Ownership(2)

|

|

|

Percent of Common Stock

|

|

|

Named Executive Officers and Nominees

|

|

|

|

|

|

|

|

|

Richard A. Murphy

|

|

|

17,002,294

|

(3)

|

|

45.22

|

%

|

|

Mark Patterson

|

|

|

470,000

|

(4)

|

|

1.69

|

%

|

|

Robert S. Herlin

|

|

|

445,637

|

|

|

*

|

|

|

William A. Jolly

|

|

|

445,303

|

|

|

*

|

|

|

Kevin Chesser

|

|

|

496,847

|

(5)

|

|

*

|

|

|

Marc A. Kramer

|

|

|

|

|

|

|

|

|

All current executive officers and nominees as a group (5 persons)

|

|

|

18,184,406

|

|

|

48.08

|

%

|

|

5% Stockholders

|

|

|

|

|

|

|

|

|

Ionic Ventures, LLC

|

|

|

2,862,314

|

(6)

|

|

10.36

|

%

|

|

Corsair Capital Partners, LP

|

|

|

1,571,657

|

(7)

|

|

5.69

|

%

|

* The percentage of Common Stock beneficially owned is less than 1%.

Notes to table:

| |

(1)

|

The address of the beneficial owners in each case is c/o Enservco Corporation, 14133 County Road 9 ½, Longmont, CO 80504 except as indicated below.

|

| |

(2)

|

Calculated in accordance with Rule 13d-3 under the Exchange Act.

|

| |

(3)

|

Consists of the following: (i) 50,383 shares of Common Stock owned directly by Mr. Murphy; (ii) warrants to acquire 3,160,805 shares of Common Stock held by Cross River Partners, L.P. (“Cross River”), (iii) 6,991,106 shares of common stock held by Cross River, (iv) 4,400,000 Common Stock shares issuable upon conversion of certain promissory notes by Cross River, and (v) 2,400,000 warrants issuable to Cross River upon conversion of certain promissory notes held by Cross River. Mr. Murphy is the managing partner of Cross River Partners, L.P. The address of Cross River Partners, L.P. is 31 Bailey Ave, Suite D, Ridgefield, CT 06877.

|

| |

(4)

|

Consists of 345,000 shares of Common Stock owned by Mr. Patterson that are currently vested and options to acquire 125,000 shares of Common Stock that vested on January 1, 2024. Excludes 125,000 options to acquire share of Common Stock that vest on January 1, 2025.

|

| |

(5)

|

Consists of 171,622 shares of Common Stock owned by Mr. Chesser and 100,000 Common Stock shares issuable upon conversion of certain promissory notes.

|

| |

(6)

|

Based upon Schedule 13G/A filed with the Securities and Exchange Commission on February 14, 2024 reporting beneficial ownership of Ionic Ventures, LLC (Ionic), Ionic Management, LLC (Ionic Management), Brendan O’Neil and Keith Coulston. Ionic holds (i) 1,090,162 shares of Common Stock and (ii) warrants exercisable for up to 4,000,000 shares of Common Stock, of which 2,227,848 shares are not deemed beneficially owned by Ionic as a result of the triggering of a 9.99% beneficial ownership blocker, which prohibits Ionic from exercising the warrants if, as a result of such exercise, the holder, together with its affiliates and any persons acting as a group together with such holder or any of such affiliates, would beneficially own more than 9.99% of the outstanding shares of Common Stock immediately after the exercise. Ionic has the power to dispose of and the power to vote the shares beneficially owned by it, which power may be exercised by its manager, Ionic Management. Each of the managers of Ionic Management, Mr. O’Neil and Mr. Coulston, has shared power to vote and/or dispose of the shares beneficially owned by Ionic and Ionic Management. Neither Mr. O’Neil nor Mr. Coulston directly owns the shares. By reason of the provisions of Rule 13d-3 of the Act, each of Mr. O’Neil and Mr. Coulston may be deemed to beneficially own the Shares which are beneficially owned by each of Ionic and Ionic Management, and Ionic Management may be deemed to beneficially own the Shares which are beneficially owned by Ionic. The principal business address of each of the reporting persons is 3053 Fillmore St., Suite 256, San Francisco, CA 94123.

|

| |

(7)

|

Based upon Schedule 13G filed with the Securities and Exchange Commission on February 14, 2024 reporting beneficial ownership of Corsair Capital Partners, L.P. (“Corsair Capital”), Corsair Capital Partners 100, L.P. (“Corsair 100”), Corsair Capital Investors, Ltd (“Corsair Investors”), Corsair Capital Management, L.P. (“Corsair Management”), Jay R. Petschek (“Mr. Petschek”) and Steven Major (“Mr. Major”). Corsair Capital individually owns 1,571,657 shares of Common Stock, including 1,160,000 shares of Common Stock underlying currently exercisable warrants. Corsair 100 individually owns 228,974 shares of Common Stock, including 169,000 shares of Common Stock underlying currently exercisable warrants. Corsair Investors individually owns 95,233 shares of Common Stock, including 71,000 shares of Common Stock underlying currently exercisable warrants. Corsair Management, as the investment manager of each of Corsair Capital, Corsair 100 and Corsair Investors is deemed to beneficially own 1,895,864 shares of Common Stock. Mr. Petschek, as a controlling person of Corsair Management, is deemed to individually beneficially own 1,895,864 shares of Common Stock. Mr. Major, as a controlling person of Corsair Management, is deemed to individually beneficially own 1,895,864 shares of Common Stock. Corsair Capital, Corsair Management, Mr. Petschek and Mr. Major have shared voting and investment power over the 1,571,657 shares owned by Corsair Capital. Corsair 100, Corsair Management, Mr. Petschek and Mr. Major have shared voting and investment power over the 228,974 shares owned by Corsair 100. Capital Investors, Corsair Management, Mr. Petschek and Mr. Major have shared voting and investment power over the 95,233 shares owned by Corsair Investors. The principal business address for each of Corsair Capital, Corsair 100, Corsair Management, Mr. Petschek and Mr. Major is 366 Madison Ave, 12th floor, New York, NY 10017. The principal business address for Corsair Investors is M&C Corporate Services Ltd, Box 309, George Town, Cayman Islands KY1-1104.

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Information Statement contains forward-looking statements in addition to historical information. When used in this Information Statement, the words “can,” “will,” “intends,” “expects,” “believes,” similar expressions and any other statements that are not historical facts are intended to identify those assertions as forward-looking statements. All statements that address activities, events or developments that the Company intends, expects or believes may occur in the future are forward-looking statements. These forward-looking statements are just predictions and involve significant risks and uncertainties, many of which are beyond our control, and actual results may differ materially from these statements. Factors that could cause actual outcomes or results to differ materially from those reflected in forward-looking statements include, but are not limited to, those discussed in our filings with the SEC. The Company does not undertake any obligation to update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by any applicable securities laws.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly, and current reports, proxy statements, and other information with the SEC, to satisfy our compliance and disclosure requirements under the Exchange Act. You may read and copy materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The Company’s SEC filings are made available electronically to the public at the SEC’s website located at http://www.sec.gov.

The SEC allows the Company to “incorporate by reference” information that it files with the SEC in other documents into this Information Statement. This means that the Company may disclose important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference is considered to be part of this Information Statement. The Company is incorporating by reference the Company’s Current Report on Form 8-K filed with the SEC on June 13, 2024 and Current Report on Form 8-K/A filed with the SEC on June 28, 2024.

The Company undertakes to provide without charge to each person to whom a copy of this Information Statement has been delivered, upon request, by first class mail or other equally prompt means, a copy of any or all of the documents incorporated by reference in this Information Statement, other than the exhibits to these documents, unless the exhibits are specifically incorporated by reference into the information that this Information Statement incorporates. You may obtain documents incorporated by reference by requesting them in writing at Enservco Corporation, 14133 County Rd 9 ½, Longmont, CO 80504, Attn: Secretary, or by telephoning the Company at 303-333-3678.

DOCUMENT DELIVERY FOR SHARED ADDRESSES

We appreciate your cooperation with our effort to send fewer mailings to households that share an address. If we are sending one copy of our documents to a shared address but you would prefer your own copy, just let us know. You can request this by writing or calling us at the contact details provided. If you are currently receiving multiple copies at a shared address and would prefer just one copy for the household, please inform us in the same way.

OTHER MATTERS

The Company has not authorized anyone to provide information on behalf of the Company that is different from that contained in this Information Statement. This Information Statement is dated July 12, 2024. No assumption should be made that the information contained in this Information Statement is accurate as of any date other than that date, and the mailing of this Information Statement will not create any implication to the contrary.

| |

By Order of the Board of Directors,

|

| |

/s/ Richard A. Murphy

|

| |

Chief Executive Officer and Chairman of the Board

|

| |

July 12, 2024

|

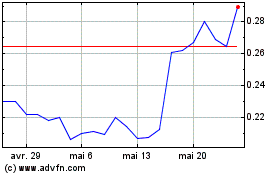

ENSERVCO (AMEX:ENSV)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

ENSERVCO (AMEX:ENSV)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024