Post-effective Amendment to an S-8 Filing (s-8 Pos)

04 Août 2022 - 11:11PM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission

on August 4, 2022

Registration No. 333-32516

Registration No. 333-106411

Registration No. 333-128445

Registration No. 333-146330

Registration No. 333-153369

Registration No. 333-155668

Registration No. 333-168428

Registration No. 333-170801

Registration No. 333-182899

Registration No. 333-209772

Registration No. 333-229914

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________________________________________________________________________

POST-EFFECTIVE AMENDMENT TO

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

______________________________________________________________________________________________

Howmet Aerospace

Inc.

(Exact name of registrant as specified in its

charter)

______________________________________________________________________________________________

Delaware

(State or other jurisdiction of incorporation

or organization)

25-0317820

(IRS Employer Identification No.)

201 Isabella Street, Suite 200

Pittsburgh, Pennsylvania 15212-5872

United States of America

(Address of principal executive offices)

______________________________________________________________________________________________

HOWMET AEROSPACE HOURLY RETIREMENT SAVINGS PLAN

HOWMET AEROSPACE SALARIED RETIREMENT SAVINGS PLAN

(Full Title of the Plan)

______________________________________________________________________________________________

Lola F. Lin

Executive Vice President, Chief Legal Officer

and Secretary

Howmet Aerospace Inc.

201 Isabella Street, Suite 200

Pittsburgh, Pennsylvania 15212-5872

United States of America

+1 (412) 553-1940

(Name and Address, Including Zip

Code, and Telephone Number, Including Area Code, of Agent for Service)

______________________________________________________________________________________________

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of

“large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth

company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer |

x |

|

Accelerated filer |

¨ |

| Non-accelerated filer |

¨ |

(Do not check if a smaller reporting company) |

Smaller reporting company |

¨ |

| |

|

|

Emerging growth company |

¨ |

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

EXPLANATORY NOTE

This Post-Effective Amendment (the “Amendment”) incorporates

by reference the contents of the Registration Statements on Form S-8 filed by Howmet Aerospace Inc. (formerly known as Arconic Inc. and

Alcoa Inc.) (the “Company”) with the U.S. Securities and Exchange Commission on the following dates:

· March 15,

2000 (File No. 333-32516)

· June 24,

2003 (File No. 333-106411)

· September 20,

2005 (File No. 333-128445)

· September 26,

2007 (File No. 333-146330)

· September 8,

2008 (File No. 333-153369)

· November 25,

2008 (File No. 333-155668)

· July 30,

2010 (File No. 333-168428)

· November

23, 2010 (File No. 333-170801)

· July 27,

2012 (File No. 333-182899)

· February 26, 2016 (File No. 333-209772)

· February 27, 2019 (File No. 333-229914)

each as amended from time to time (collectively, the “Registration

Statements”).

This Amendment constitutes Post-Effective Amendment No. 12 to

Registration Statement Nos. 333-32516 and 333-106411; Post-Effective Amendment No. 7 to Registration Statement Nos. 333-128445, 333-146330,

333-153369, 333-155668 and 333-168428; Post-Effective Amendment No. 6 to Registration Statement Nos. 333-170801, 333-182899, and

333-209772; and Post-Effective Amendment No. 2 to Registration Statement No. 333-229914.

This Amendment to the Registration Statements is being filed for the

purpose of (i) reallocating shares to the Arconic Corp. Hourly 401(k) Plan and the Arconic Corp. Salaried 401(k) Plan, all of which have

been offered and sold, and deleting such plans from the Registration Statements, (ii) reallocating shares into the Howmet Aerospace

Hourly Retirement Savings Plan from the plan merger of the Howmet Aerospace Niles Bargaining Retirement Savings Plan on December 31, 2021,

and (iii) reallocating shares to the Howmet Aerospace Hourly Retirement Savings Plan and the Howmet Aerospace Salaried Retirement Savings

Plan that were, in each case, previously allocated among certain other legacy retirement savings plans previously covered by the Registration

Statements.

With this filing, the aggregate amount of shares of the Company's

common stock, par value $1.00 per share (the “Common Stock”) originally registered on the Registration Statements, as adjusted for

the 2-for-1 stock split effective June 9, 2000, and the 1-for-3 reverse stock split effective on October 5, 2016, are hereby

allocated among the plans as shown:

| Plan Name | |

Shares | |

| Howmet Aerospace Hourly Retirement Savings Plan | |

| 17,938,401 | |

| Howmet Aerospace Salaried Retirement Savings Plan | |

| 31,120,709 | |

PART II

INFORMATION

REQUIRED IN THE REGISTRATION STATEMENT

| Item 3. | Incorporation of Documents by Reference. |

The Securities and Exchange Commission (“SEC”) allows the

Company to “incorporate by reference” in the Registration Statements the information in the documents that it files with the

SEC, which means that the Company can disclose important information to you by referring you to those documents. The information incorporated

by reference in the Registration Statements is considered to be a part of the Registration Statements, and information in documents that

the Company files later with the SEC will automatically update and supersede information contained in documents filed earlier with the

SEC or contained in the Registration Statements. The Company incorporates by reference in the Registration Statements the documents listed

below and any future filings that it may make with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of

1934 (the “Exchange Act”) after the date of this Amendment and prior to the filing of a post-effective amendment to the Registration

Statements that indicates that all securities offered thereby have been sold or that deregisters all securities then remaining unsold,

except that the Company is not incorporating by reference any information that is deemed to have been furnished and not filed in accordance

with SEC rules:

| · | The Company’s Quarterly Reports on Form 10-Q for the quarters ended March 31, 2022 and June 30,

2022, filed with the SEC on May 3, 2022 and August 4, 2022, respectively; |

| | | |

The Company will furnish without

charge to you, upon written or oral request, a copy of any or all of the documents described above, except for exhibits to those documents,

unless the exhibits are specifically incorporated by reference into those documents. Requests for copies should be addressed to:

Howmet Aerospace Inc.

201 Isabella Street, Suite 200

Pittsburgh, Pennsylvania 15212-5872

Attention: Investor Relations

Telephone: +1 (412) 553-1950

| Item 4. | Description of Securities. |

Not applicable.

| Item 5. | Interests of Named Experts and Counsel. |

Not applicable.

| Item 6. | Indemnification of Directors and Officers. |

The Company is governed by the provisions of the General Corporation

Law of the State of Delaware (as amended, the “DGCL”) permitting the Company to purchase director’s and officer’s

insurance to protect itself and any director, officer, employee or agent of the Company. The Company has an insurance policy which insures

the directors and officers of the Company and its subsidiaries against certain liabilities which might be incurred in connection with

the performance of their duties.

Section 145 of the DGCL grants a corporation the power to indemnify

its officers and directors, under certain circumstances and subject to certain conditions and limitations as stated therein, against expenses,

including attorneys’ fees, judgments, fines and amounts paid in settlement, actually and reasonably incurred by them as a result

of threatened, pending or completed actions, suits or proceedings brought against them by reason of the fact that they are or were an

officer or director of the corporation or served at the request of the corporation if they acted in good faith and in a manner they reasonably

believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had

no reasonable cause to believe their conduct was unlawful.

Article VI of the Company’s Bylaws (the “Bylaws”)

provides that the Company shall indemnify and hold harmless each person who was or is a party to, or is otherwise threatened to be made

a party to, any threatened, pending or completed action, suit or proceeding (a “Proceeding”), by reason of the fact that he

or she (or a person of whom he or she is the legal representative), is or was a director or officer of the Company or, while serving as

a director or officer of the Company, is or was serving at the request of the Company as a director, officer, trustee, employee or agent

of another entity (a “Covered Person”), to the fullest extent permitted by the DGCL, against all expenses, liability and loss

reasonably incurred or suffered by such Covered Person in connection therewith; provided, however, that the Company shall indemnify any

such Covered Person seeking indemnification in connection with a Proceeding (or part thereof) initiated by such Covered Person only if

such Proceeding (or part thereof) was authorized by the Board of Directors of the Company. The Company has entered into indemnity agreements

with its directors and officers consistent with the foregoing.

The Bylaws also provide that, to the fullest extent permitted by the

DGCL, each Covered Person shall have the right to be paid by the Company the expenses (including reasonable attorneys’ fees) incurred

in connection with any Proceeding in advance of its final disposition; provided, that if the DGCL requires, the payment of such expenses

incurred by a director or officer in his or her capacity as a director or officer shall be made only upon delivery to the Company of an

undertaking by or on behalf of such director or officer, to repay all amounts so advanced if it shall ultimately be determined by final

judicial decision from which there is no further right of appeal that such director or officer is not entitled to be indemnified for such

expenses.

Section 145 of the DGCL and the Bylaws also provide that the indemnification

provided for therein shall not be deemed exclusive of any other rights to which those seeking indemnification may otherwise be entitled.

Section 102(b)(7) of the DGCL provides that a Delaware corporation’s

certificate of incorporation may contain a provision eliminating or limiting the personal liability of a director to the corporation or

its stockholders for monetary damages for breach of fiduciary duty as a director, provided that such provision shall not eliminate or

limit the liability of a director: (i) for any breach of the director’s duty of loyalty to the corporation or its stockholders;

(ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law; (iii) certain unlawful

share purchases, redemptions, or dividends; or (iv) for any transaction from which the director derived an improper personal benefit.

The Company’s Certificate of Incorporation (the “Certificate of Incorporation”) provides that a director of the Company

shall not be personally liable either to the Company or to any of its stockholders for monetary damages for breach of fiduciary duty as

a director, to the fullest extent permitted by the DGCL. Any amendment, modification or repeal of the foregoing provision in the Certificate

of Incorporation shall not adversely affect any right or protection of a director of the Company in respect of any act or omission occurring

prior to the time of such amendment, modification or repeal. The Certificate of Incorporation provides that if the DGCL is amended to

further eliminate or limit the liability of a director, then a director of the Company, in addition to the circumstances in which a director

is not personally liable as set forth in the foregoing provision, shall not be liable to the fullest extent permitted by the amended DGCL.

The foregoing description does not purport to be complete, and is

subject to, and qualified in its entirety by, the DGCL, the Certificate of Incorporation and the Bylaws.

| Item 7. | Exemption from Registration Claimed. |

Not applicable.

The following exhibits are filed with or incorporated

by reference into this Amendment:

| 10.1# |

Howmet Aerospace Hourly Retirement Savings Plan, as Amended and Restated, effective January 1, 2021, incorporated by reference to Exhibit 10(g) to the Company's Annual Report on Form 10-K for the year ended December 31, 2021. |

| |

|

| 10.2# |

First Amendment, effective January 1, 2022, to the Howmet Aerospace Hourly Retirement Savings Plan, as Amended and Restated, incorporated by reference to Exhibit 10(g)(1) to the Company's Annual Report on Form 10-K for the year ended December 31, 2021. |

| |

|

| 10.3# |

Howmet Aerospace Salaried Retirement Savings Plan, as Amended and Restated effective January 1, 2021, incorporated by reference to Exhibit 10(g)(2) to the Company’s Annual Report on Form 10-K for the year ended December 31, 2021. |

| |

|

| 23.1* |

Consent of PricewaterhouseCoopers LLP. |

| |

|

| 24 |

Power of Attorney of certain directors of the Company (incorporated by reference to Exhibit 24 to the Company’s Annual Report on Form 10-K for the year ended December 31, 2021, filed with the SEC on February 14, 2022). |

| # | Indicates

management contract or compensatory plan, contract or agreement. |

Incorporated by reference to the Registration

Statements.

SIGNATURES

In accordance with the requirements of the Securities

Act of 1933, Howmet Aerospace Inc. certifies that it has reasonable grounds to believe that it meets all of the requirements for filing

on Form S-8 and has duly caused and authorized the officers whose signatures appear below to sign this Amendment on its behalf, in the

City of Pittsburgh, Commonwealth of Pennsylvania on August 4, 2022.

| |

|

HOWMET AEROSPACE INC. |

| |

|

|

| |

By: |

/s/ Barbara L. Shultz |

| |

|

Barbara L. Shultz

Vice President and Controller |

In accordance with the requirements of the Securities

Act of 1933, this Amendment has been signed by the following persons in the capacities indicated as of August 4, 2022.

| Signature |

|

Title |

| |

|

|

| /s/ John C. Plant |

|

Executive Chairman and Chief Executive Officer |

| John C. Plant |

|

(Principal Executive Officer and Director) |

| |

|

|

| /s/ Ken Giacobbe |

|

Executive Vice President and Chief Financial Officer |

| Ken Giacobbe |

|

(Principal Financial Officer) |

| |

|

|

| /s/ Barbara L. Shultz |

|

Vice President and Controller |

| Barbara L. Shultz |

|

(Principal Accounting Officer) |

James F. Albaugh, Amy E. Alving, Sharon R. Barner, Joseph

S. Cantie, Robert F. Leduc, David J. Miller, Jody G. Miller, Nicole W. Piasecki and Ulrich R. Schmidt, each as a Director, on August 4,

2022, by Barbara L. Shultz, their Attorney-in-Fact.*

| *By: |

/s/ Barbara L. Shultz |

|

| |

Barbara L. Shultz |

|

| |

Attorney-in-Fact |

|

In accordance with the requirements of the Securities

Act of 1933, the trustees (or other persons who administer the Howmet Aerospace Hourly Retirement Savings Plan and the Howmet Aerospace Salaried Retirement Savings Plan) have duly caused

this Amendment to be signed on their behalf by the undersigned, thereunto duly authorized, in the City of Pittsburgh, Commonwealth

of Pennsylvania, on August 4, 2022.

| |

|

HOWMET AEROSPACE HOURLY RETIREMENT SAVINGS PLAN

HOWMET AEROSPACE SALARIED RETIREMENT SAVINGS PLAN |

| |

|

|

| |

By: |

/s/ Neil E. Marchuk |

| |

|

Neil E. Marchuk, Member,

Howmet Aerospace Inc. Benefits Management Committee |

| |

|

|

| |

By: |

/s/ Barbara L. Shultz |

| |

|

Barbara L. Shultz, Member,

Howmet Aerospace Inc. Benefits Management Committee |

| |

|

|

| |

By: |

/s/ Brian Redmond |

| |

|

Brian Redmond, Member,

Howmet Aerospace Inc. Benefits Management Committee |

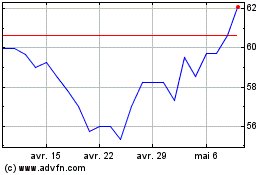

Howmet Aerospace (AMEX:HWM-)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Howmet Aerospace (AMEX:HWM-)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024