Current Report Filing (8-k)

03 Novembre 2022 - 9:04PM

Edgar (US Regulatory)

0000843006false00008430062022-11-012022-11-01iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________

FORM 8-K

______________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 1, 2022

______________

Issuer Direct Corporation |

(Exact name of registrant as specified in its charter) |

______________

Delaware | | 1-10185 | | 26-1331503 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

One Glenwood Drive, Suite 1001, Raleigh, NC 27603

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code (919) 481-4000

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, par value $0.001 | ISDR | NYSE American |

Item 1.01 Entry into a Material Definitive Agreement.

On November 1, 2022 (the “Closing Date”), Issuer Direct Corporation, a Delaware corporation (the “Company”) entered into a Membership Interest Purchase Agreement (the “Purchase Agreement”) with Lead Capital, LLC, a Delaware limited liability company (the “Seller”), whereby the Company purchased all of the issued and outstanding membership interests of iNewsWire.com LLC, a Delaware limited liability company (“Newswire”). Newswire is a leading media and marketing communications technology company that provides press release distribution, media databases, media monitoring, and newsrooms through its Media Advantage Platform.

Under the terms of the Purchase Agreement and on the Closing Date, the Company paid to the Seller aggregate consideration of approximately $43.9 million, consisting of the following: (i) a cash payment of $18.0 million subject to a 60-day escrow to secure the payment of any working capital adjustments or any employee bonus obligations of Newswire; (ii) the issuance of a Secured Promissory Note in the principal amount of $22.0 million (the “Secured Note”); and (iii) the issuance of 180,181 shares of the Company’s common stock, par value $0.001 (the “Equity Payment”).

The Secured Note is due and payable on November 8, 2023 (the “Maturity Date”) and bears an annual interest rate of 6%. The Secured Note is secured by the intellectual property (with certain exceptions) and the domain names acquired by the Company as part of the acquisition. The Secured Note may be prepaid, however, the 6% interest payment is guaranteed through the Maturity Date even if prepayments are made.

The Equity Payment is valued at approximately $3.9 million based on the Company’s closing stock price of $21.60 on the Closing Date.

The Purchase Agreement and the transaction contemplated thereby were not subject to approval by the shareholders of the Company. The Purchase Agreement contains certain representations and warranties regarding the Seller and the Newswire business and certain more limited representations and warranties regarding the Company. Except for fraud and certain tax liabilities, the Company’s recovery right under the indemnification provisions of the Purchase Agreement are limited solely to a representation and warranty insurance policy with an aggregate coverage amount of $12.9 million and a retention amount of $0.4 million. The Seller and its managing member agreed to 4-year non-compete provisions as part of the Purchase Agreement.

This summary of certain terms of the Purchase Agreement and Secured Note do not purport to be complete and are subject to, and qualified in its entirety by, the full text of the Purchase Agreement and Secured Note, copies of which are attached hereto as Exhibit 10.1 and 10.2, respectively, and are hereby incorporated into this Current Report on Form 8-K (this “Form 8-K”) by reference.

The Purchase Agreement has been included solely to provide investors and security holders with information regarding its terms. It is not intended to be a source of financial, business or operational information, or to provide any other factual information, about Newswire, the Seller or their respective subsidiaries or affiliates. The representations, warranties and covenants contained in the Purchase Agreement are made only for purposes of the Purchase Agreement and are made as of specific dates; are solely for the benefit of the parties (except as specifically set forth therein); may be subject to qualifications and limitations agreed upon by the parties in connection with negotiating the terms of the Purchase Agreement; and may be subject to standards of materiality and knowledge applicable to the contracting parties that differ from those applicable to investors or security holders. Investors and security holders should not rely on the representations, warranties and covenants or any description thereof as characterizations of the actual state of facts or condition of Newswire, the Seller or any of their respective subsidiaries or affiliates. Moreover, information concerning the subject matter of the representations, warranties and covenants may change after the date of the Purchase Agreement, as applicable, which subsequent information may or may not be fully reflected in public disclosures.

Item 2.01. Completion of Acquisition or Disposition of Assets.

The information set forth in Item 1.01of this Form 8-K is incorporated herein by reference in its entirety.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of the Registrant.

The information set forth in Item 1.01of this Form 8-K regarding the Secured Note is incorporated herein by reference in its entirety.

Item 3.02 Unregistered Sales of Equity Securities.

The information set forth in Item 1.01of this Form 8-K regarding the Equity Payment is incorporated herein by reference in its entirety. The Equity Payment was issued in reliance upon the exemption from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”), provided by Section 4(a)(2) of the Securities Act as sales by an issuer not involving any public offering.

Item 8.01. Other Events.

On November 3, 2022, the Company issued a press release announcing the acquisition of Newswire. A copy of the press release is filed as Exhibit 99.1 hereto and incorporated herein by reference in its entirety. This information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(a) Financial statements of business acquired.

(b) Pro forma financial information.

Any financial statements and pro forma financial information required by this Item will be filed by amendment to this Form 8-K not later than 71 calendar days after the date that this Form 8-K is required to be file.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| Issuer Direct Corporation |

| | |

Date: November 3, 2022 | By: | /s/ Brian R. Balbirnie | |

| | Brian R. Balbirnie Chief Executive Officer | |

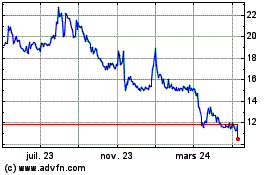

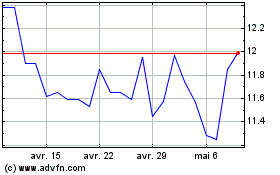

Issuer Direct (AMEX:ISDR)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Issuer Direct (AMEX:ISDR)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024