Issuer

Free Writing Prospectus dated March 18, 2022

Filed

Pursuant To Rule 433

Registration

No. 333-255424

[Transcript

of Opportunity Zone Investing: A Tax, Growth and Income Strategy in the Face of Widespread Uncertainty from March 15, 2022]

Cody

Laidlaw: Perfect, so it looks like we live, so everybody that can hear me now, good afternoon and thanks for attending. We’re

going to give it about another two to three minutes just to allow other people to join, so just bear with us.

Brandon

Lacoff: Alright, let’s get started. What do you think?

Cody

Laidlaw: Alright. Yeah, now is a good time. So in order to make this as efficient as possible, I’m just going to read a quick

disclaimer before I pass it over to our presenter, Brandon, who you can see there on the screen. So today’s presentation may include

statements that are forward-looking statements within the meaning of the federal securities laws. Any forward-looking statements expressed

in this webinar are made in good faith, and we believe there is a reasonable basis for them. However, there are a number of risks, uncertainties,

and other important factors, many of which are difficult or impossible to predict, that could cause actual results to vary materially

from the forward-looking statements expressed in this webinar. Except as otherwise required by law, we will not update or revise any

forward-looking statements to reflect subsequent events.

Belpointe

PREP has filed a registration statement with the SEC for the offer and sale of up to $750 million worth of its Class A units. Investing

in Belpointe PREP’s Class A units involves a high degree of risk, including a complete loss of your investment. You should read

Belpointe PREP’s most recent prospectus and the other documents that it has filed with the SEC for more complete information about

Belpointe PREP and it’s offering. Prior to making an investment decision, you should carefully consider Belpointe PREP’s

investment objectives and strategy, risk factors, fees and expenses, and any tax consequences that may result from an investment in Belpointe

PREP’s Class A units. You can obtain a copy of Belpointe PREP’s prospectus and other filings on the SEC’s website,

on our website at BelpointeOz.com, or by contacting me at the phone number or email address included in today’s presentation materials.

So with that, I will hand it over to our CEO, Brandon Lacoff.

Brandon

Lacoff: Thank you, Cody. Welcome everybody. Our program today, what we want to spend time is give a little bit of the basics about

what an opportunity zone is, give a little information about ourselves as well, and then go into the details of what makes Belpointe

OZ different and what kind of projects we’re working on today.

So

a little background on Belpointe. We’re a fully integrated real estate company out of a Greenwich, Connecticut, with offices around

the country. We have both development and construction expertise, and we’re going to talk about how that’s important in opportunity

zone investing, because most opportunity zone investing is ground-up or substantial improvement of real estate, which means a lot of

heavy construction. So having that in-house expertise, and that expertise comes from the AvalonBay professionals that we have in-house,

they’ve been with us since 2010, and we’ve mostly invested in the northeast, with our history, but over the last couple of

years we’ve been investing around the country, areas like Florida and Nashville, Tennessee, are areas that we’re investing

in now and we’re going to talk about those projects later in the presentation.

A

little background on us as well. Our last funds, we put out over $160 million of equity into 11 projects, 10 of those 11 projects, or

91% of those projects, were actually in opportunity zones. We did not get the tax benefits because we invested and continued those projects

before 2018. So that just gives you a little bit of flavor of our history, and investing in these zones is something that’s not

new for us.

So

background on the opportunity zone. The regulation, came out in 2017, actually December of 2017, in the Tax Cuts and Jobs Act, and in

that, there was a bunch of things in that statute but opportunity zones was one of the big tax benefits that came out of that regulation,

which allowed. In June of 2018, there was over 8,700 census tracts that were designated as opportunity zone census tracts, and those,

let me give you a little map, that’s a map of, if you can see your screen, that is the map of all 8,700, actually 8,761 census

tracts around the country that are designated opportunity zones. Every city, every major city, and every city has multiple opportunity

zones, so it’s approximately about 10.5% of all census tracts are opportunity zone-designated.

So

to qualify for a, as an investor, to qualify for a valid opportunity zone investment you have to invest within 180 days of receiving

a capital gain and investing into an opportunity zone fund. Once the opportunity zone fund has that capital, the opportunity zone fund

has to distribute, or invest, I should say, has to invest into these census tracts, into these over 8,700 census tracts, at least 90%

of their capital into these zones. So that’s an important factor for the fund itself. For the investor, they simply have to invest

within 180 days of receiving their capital gain. So if an investor receives their capital gain, they have 180 days to reinvest that capital

gain into an opportunity zone fund like ourselves, and we’re going to talk about how our structure is different than the other

structures, but the basic rules of opportunity zones, you have 180 days to reinvest that capital. However, there are extensions for the

180 days and we’ll go into that in a little bit more detail, but the basic extension is if you receive that capital gain through

an entity, through a partnership or an LLC entity, you can get on it, you can get two choices on your extension, you can get, you have

the original 180 days, or the two extensions that you can get is 180 days from the last day of the year that you received that capital

gain through that entity, or 180 days from when the tax return is due. So for example, today, just happened to be today, today is the

last day, assuming that you don’t have an extension, which obviously you can file an extension, but for opportunity zones, you

have 180 days from March 15th, because the LLC or partnership entity, tax return without extensions are due today, and you would have

180 days from today. The reason why I bring that up as an important factor, because if a client had a capital gain sometime last year,

and it’s through a partnership or some kind of pass through entity, they would actually have 180 days from today to re-invest that

capital gain. So that’s an important factor. Obviously, today being March 15th, it was a prudent day to mention that.

So

capital gains, people ask all the time, “what kind of capital gains can I invest; is it just real estate, like a 1031?” And

the answer is no, it’s any type of capital gain. It could be from stocks, bonds, commodities, cryptocurrencies, artwork, classic

cars, jewelry, and obviously real estate as well, any type of capital gain, you can reinvest that capital gain within that 180 day window,

there are extensions if you received that capital gain through an entity, but you have 180 days to re-invest that capital gain and receive

the tax benefits of opportunity zones. And just to be detailed, it’s both short-term capital gains and long-term capital gains.

We get that question all the time, “what happens if it’s a short term capital gain that gets taxed at ordinary income rates?”

It’s still a capital gain, even though it’s a short-term capital gain and the rate is different, you still get the same benefits

for opportunity zone by investing within 180 days and getting the benefits as long as you re-invest within that qualified period of time.

Again,

it’s only the capital gain portion, so different than a 1031 where you’re investing both basis and the gain here, or I should

say the principle and the gain, you’re investing just the gain portion to get the tax benefits opportunity zone. You do not receive

the tax benefits, if it’s not a capital gain, you can make the investment, but you will not get the tax benefits of opportunity

zone if you re-invest the principle that you’re re-investing.

So

what are the tax benefits of opportunity zone? And I’m not going to spend too much time, because I think most people at this point

know what they are, but I just want to remind everybody. So you get the benefit of deferring your capital gain, so again, you’re

re-investing your capital gain within 180 days and then you get to defer that capital gain until the end of 2026. So a little less than

five years from today, you would have a deferral. Now, again, if you had a capital gain last year, you potentially depending how you

received that capital gain, you potentially can re-invest that capital gain now or later this year, and receive that deferral that you

would have to pay tax on maybe this April 15th, you get to defer that last year capital gain going forward until the end of 2026. So

that is the first benefit, and that’s obviously a big benefit, not having to pay your capital gains now or in the near future.

The

second benefit, which is obviously one of the biggest benefits, is elimination of capital gains. The elimination of capital gains derived

from the appreciation of their investment in our stock.

So

if they buy or if they invest in our company today, and let’s say they buy it for $100 a share and the stock goes up to $300 a

share, that $200 a share, as long as they hold the stock for at least 10 years or greater, that of $200 appreciation that they received

and that they are going to realize on the sale, as long as they hold it for at least 10 years, would be tax-free. There’d be no

tax on the appreciation of our units, as long as they hold our stock for at least 10 years or greater, so that is the second benefit

of opportunity zone.

The

third benefit is very similar to the first and second benefit, but it’s also at the state income level. So, if you’re, I’m

going to go to the map real quick here on the next slide, so if you reside in, there’s 45 states, taking out the five states that

are red, which do not conform with opportunity zone regulations, if you reside or your client resides in any of those states that are

the dark blue or the light gray, the tax benefit would apply to, the opportunity zone tax benefit, would apply to those investors that

reside in those states, except for obviously California, Mississippi, North Carolina, New York and Massachusetts. So you would receive

the same tax benefits of both deferral and the elimination of capital gains if you reside in one of those 45 states.

The

fourth benefit, which really is an important benefit, almost equally or maybe more important than the second benefit, which is the elimination

of capital gains, is no depreciation recapture of tax. If our shareholders hold their stock for 10 years or greater, they would get the

benefit of the appreciation and have no depreciation recaptured, as long as they hold that stock for 10 years or greater. So that is

a huge benefit that investors don’t always think about or don’t even know about, and it’s important. And the reason

why they receive that tax benefit, because they’re receiving a K-1, they’re getting depreciation to offset income that they’re

receiving, and there’s no recapture as long as they hold that stock for 10 years or greater.

So

let’s talk about our structural advantages, and this is by far the most important slide. Really, this slide, this slide really

encompasses the whole benefit of OZ and what our stock is doing and what our company is doing.

From

the left column here, which is talking about the advantages of our structure, our PREP structure, which is obviously actively managed

by professional real estate professionals, and, again, it’s the expertise on the fully integrated both on the developments, property

management, construction, having that ability in-house really separates us from everybody else.

Obviously,

having greater diversification, and diversifying not just in one region or in one state, having that diversification throughout the country,

that’s something that we’ve done already and we’re going to continue to do across the country in markets that we believe

are high growth, high growth markets.

Again,

we talked about this, pass-through depreciation. Most structures out there do not have pass-through depreciation, there are structures

like REIT structures that, at one time we were REIT structure that did not have pass-through depreciation, again, it’s important

because when we’re making distributions to our shareholders, those shareholders are able to receive the depreciation of the offset

some or all of that income, even though they’re receiving the cash, they will not have or have very little tax exposure because

of the depreciation offset, so that is a huge advantage of our structure.

The

ability to make quarterly distributions. Again, that’s something that we’re going to be doing because we’re a publicly

traded partnership, we’re actually required to distribute at least 90% or greater of our operating income that we earn, so the

income that we receive from the real estate we’ll be distributing to our shareholders, and we’re required by law to keep

our publicly traded partnership status, at least 90% of that income will be distributed to our shareholders on a quarterly basis once

we start making distributions.

So

low investment minimum, right now our stock is in the mid-90s, and so the minimum is very simple, you just have to buy one share, which

is approximately $94 a share right now. And so, that is the minimum. It’s almost, I would say it’s almost no restrictions,

no minimum, but you do have to buy one share, which like I said, is $94 a share right now.

The

next column is kind of what we talked about before, just to go real quick under this one slide that has everything. Obviously, you get

the benefit, you reinvest your capital gain within 180 days, you get to defer your capital gain until the end of 2026 which means you

don’t, you and your client would not pay taxes on that deferred capital gain until April of 2027. The second benefit, which we

talked about is elimination of capital gains on the appreciation of our stock, again, that’s only if you hold for at least 10 years,

or 10 years or greater, you have no tax on the appreciation of our stock.

Again,

the tax benefit also applies for state income tax level, and that is for the 45 states that conform with the federal opportunity zone

regulations, and again, that’s if you reside in those states, except for California, Mississippi, New York, Massachusetts and North

Carolina, all the other states conform, so you get the benefit of opportunity zone both the deferral and the exclusions.

There’s

also an additional tax benefit under 199A where you can receive up to 20% tax deduction on any income that is not covered by depreciation,

so if depreciation doesn’t cover 100% of the income that we’re distributing, then you would receive another 20% tax benefit

on that portion that is exposed for tax, for income tax purposes. So again, you’d only pay 80% of whatever wasn’t covered

by depreciation, so that’s another big tax benefit of our structure, which is pretty unique for our structure, and again, really

important factor is no depreciation recapture tax if you hold our stock for at least 10 years or greater. So again, you’re getting

the benefit of depreciation and it’s offsetting income, and you do not have to recapture that tax as long as you hold the stock

for at least 10 years or greater, so that’s a big, big benefit that no one, like I said before, no one talks about.

So

let’s get to the advantages of being listed on the NYSE, so probably one of our biggest advantages of our structure is being publicly

traded. We are the first and only publicly traded opportunity zone structure. And what does that do for our shareholders? Well, number

one, it gives our shareholders better reporting and transparency to our unit holders. A big benefit because people want to know what’s

going on, they want to have transparency, and the best transparency that our, an investor’s going to have is having an SEC reporting

company. We just filed on Friday after the market closed, our 10-K, and again, that’s a pretty detailed document that goes into

the different things that we’re doing, obviously, it gives you the final numbers for 2021, it also gives you the projects that

we own and the status update on that, it also gives you just overall disclosure on what the company is doing to date. So that’s

an important factor of being publicly traded and obviously, SEC regulated.

Other

important factors obviously are liquidity on the entering the stock and also exiting. So let’s talk about entering the stock. Obviously

being a publicly traded company, you’re able to buy the stock on the stock exchange. Our symbol is “OZ,” so you simply

have to log in to your brokerage account, or call your broker or your advisor, and to be able to buy the stock. There’s no subscription

agreements or with that paperwork, which is typically 5 to 10 pages, there’s no authorizations, there’s no wiring a check

or mailing a check in, you simply just have to log on to your brokerage account and one click and buy the security. So that’s the

easy side of easy access to be able to just buy the stock to be able to make a qualified opportunity zone investment. On the other side,

on the exit, being a listed NYSE company allows for liquidity, and that liquidity can be as quickly as the investor wants or as long

as the investor level wants. So one of the benefits is, because we’re a publicly traded company, there is no limitation on the

exit. So what I mean by that is a typical private equity fund structure would have a 10 to 12 year exit or end life, I should call it,

the fund has to close by a certain time period. Our structure doesn’t have that because our shareholders have control of their

exit, they’re able to exit whenever they choose to exit. If they want to exit before 10 years and forgo some of the opportunity

zone on tax benefits. They can do that. If they want to hold for more than 10 years and want to hold it for 15-20 years, because they

like the benefits they’re getting on the distributions, and they like the appreciation of the stock that’s going to be tax

free, they like those benefits, they can hold the stock for as long as they choose to. So giving the control, the exit control into our

investors’ hands, they can choose when they want to exit, if it’s less than 10 years, or longer than 10 years, they have

that ability, just logging on to the brokerage account or calling their advisor and exiting when they choose to exit.

Because

we’re a publicly traded company, it also allows for non-accredited investors in addition to accredited investors to have access

to these tax benefits where typically would only be accessed to accredited investors. This is the one structure that allows both accredited

and non- accredited investors to have access to these tax benefits.

So

the Belpointe OZ advantages. Things that we’re doing, in addition to our overall structure, we are also, we’ve reduced, from

day one, we’ve reduced our management fee to 75 basis points, so three quarters of 1%, where our competitors are charging anywhere

from 1.5 to a 2.5, call it 2%, maybe a little, I’ve seen a couple that are over 2%, but I guess on the average it’s around

1.5 to 2%, so we’re less than half than our competitors. Carried interest, we are charging, which is really a performance fee,

which is a share in the profits, we’re charging only, our carrier interest is only 5% when our competitors are anywhere from 15

to 25%, so again, we’re about a quarter of what our competitors are charging. We charge no investor servicing fee, which is a,

which is typical on the brokerage side, which is charging an additional management fee to the brokers for, almost like an oversight fee,

as investor servicing fee. We have no capital calls, where you see most structures that charge, they can have the ability to call capital.

We saw a little bit of this in the beginning of the pandemic, but a lot of funds will have some kind of mechanism, which is typical for

private equity funds to call for additional capital when needed, and our structure does not call capital no matter what. If, once the

investor invests, there’s no risk of having additional capital called by our funds.

The

next category, which was something that really separates us from everybody else, which is unique, is our ability to acquire other opportunity

zone funds. By doing an acquisition or that merger, it allows us to acquire their stabilized assets, so assets that are already built

as qualified opportunity zone investments, if we acquire their parent company, it allows us to acquire their assets and reduce or eliminate

our construction risk and lease-up risk. So obviously that’s a big factor for our structure, and that’s something that we’re

going to be focusing on this year, next year, and actually probably for the next five years. So acquiring stabilized opportunity zone

deals through mergers.

Cody

Laidlaw: Hey, Brandon, before you get to this slide.

Brandon

Lacoff: Yeah.

Cody

Laidlaw: There’s a lot of questions about having somebody from Belpointe reach out to people after the conclusion of this webinar.

You guys will notice on the right side of your screen, it says “offers,” and there’s a red dot, if you click that,

and click “schedule now,” it’ll take you to our website where you can fill out a registration form that goes to all

of our representatives and they’ll reach out to you at the conclusion of this webinar. And then one other question I want to address

real quick. People keep asking about this presentation that Brandon is presenting, this is going to go to everybody at the conclusion

of the webinar. I’m going to send it out personally, so as soon as this is over, you will all have a copy of this investment deck.

Brandon

Lacoff: Okay, and Cody, are people emailing you questions as well, or it’s just both email and in the chat?

Cody

Laidlaw: It’s a combination. It’s email, and just to be clear, guys, the chat box is on private, but there is a lot of

people asking questions. So if you do have a question, it’s probably easier to do the chat box, but feel free to do email or the

chat box.

Brandon

Lacoff: Great. So we’re going to make sure we have enough time at the end to answer some questions, so I know this is probably

a bunch. So I just want to go into a little bit more detail and we’ll talk about our deals and we’ll get to questions, so.

So,

this is an important factor and part of our business plan, and again, it really separates us from everybody else, the ability to acquire,

stabilized opportunity zone assets and people say, “why is that a big deal?” So in the regulation, typically, or not typically,

what the regulations call for a typical structure, I should say, would either acquire a piece of property and either build on that property

as a ground-up construction, which qualifies. Obviously, you’d have to be in the zone, so you got to be first in the zone, then

you buy the, a piece of, you acquire a piece of property and then you build something from ground up, so from scratch, or you can meet

the substantial improvement test. The substantial improvement test is when you buy an existing building, and let’s say the building

is worth $30 million, the building itself, you can renovate that building and put in at least, you have to put in at least another $30

million or greater, so you have to equal the value of their acquisition of that building or greater to qualify for an opportunity zone,

to be a valid qualified opportunity zone investment.

Well,

there’s a third category which is what I just talked about, which is our ability to acquire stabilized opportunity zone deals.

So most other funds or all the other funds can either only acquire or make a valid opportunity zone investment if it’s ground-up

or meet the substantial improvement test. Well, there’s a third category which is in the regulations which allows us because of

our structure, because we are a publicly traded partnership structure, we are a publicly traded REIT which we were, before October of

last year, we were able to make this structure happen, and this is one of the main reasons why we converted from a publicly traded REIT

into a publicly-traded partnership structure, which we call a PREP, it’s for this very reason and which allows us to acquire the

QOF, which is the parent company and receive the assets below, which are generating positive cash flow and reduce the construction and

lease up risk, which you normally see in a normal qualified opportunity zone investment.

So

people ask well, how is this even possible? How does it benefit everybody? Real quick, the win number one is the sponsor, so these other

funds out there have developers, have sponsors who are the developers, and they typically take about two years to build their projects,

and then they’re forced, under the regulation, if they want to get the full tax benefit to hold that asset for eight additional

more years. So it’s a total of 10 years, the two plus the eight gives you the 10 minimum in order to get the full tax benefit.

In our structure, because we’re making this merger and we’re acquiring the parent company and getting all their assets, we’re

able to allow their investors to get the tax benefits and not lose their qualified opportunity zone election. So the sponsors themselves,

they’re getting just cash, they’re happy because they’re getting their money eight years faster than they had expected,

so they’re thrilled because if they’re going to get $10 million of profit in their investment that they put together, their

program, they’re happy because they’re getting their profit, their portion of the profit eight years faster and they’re

getting cash and they’re thrilled, so that’s easy.

Their

investors, like I said, are happy because they’re getting the continuation of their tax benefits, so they don’t lose a day

in their investment, they get to recognize their gain from the appreciation of whatever they built, so they’re happy, but in the

same time, they’ll get the diversification, liquidity, the lower fees, all the other benefits that the Belpointe OZ provides to

its shareholders, all those shareholders will also receive the tax benefits, so they’re happy, so their sponsor is happy because

they’re getting their money faster, their investors are happy because they get to recognize their appreciation in their property

plus keep the tax benefits of opportunity zone, so they’re thrilled. And our investors, which is the third win, it allows our shareholders

to get the cash flow of these assets that we’re acquiring at the same time eliminating construction, development and lease up risk,

so it greatly reduces our risk, but also allows us to increase our cash flow and make distributions to our shareholders immediately.

So that is an important factor in why we converted from the Belpointe REIT to Belpointe PREP, which is now on the NYSE under stock symbol

“OZ.”

So

real quick on the investment strategy, I think we’ve talk about it before, but for anybody new, we’re really focused on metropolitan

areas within 75 miles and metropolitan areas that are seeing a significant employment and population growth, and that’s growth

from 2010, 2011 census tracts, so we’re able to look at data that’s over 10 years in time. So that’s something that

is important for us when we’re looking at new markets, obviously, stabilizes asset acquisitions, which we just talked about, our

ability to acquire stabilized cash flowing assets, really separates us from everybody else. Asset classes, we’re really focused

on multi-family, we think it has the best return for its risk, and again, low risk because when there is times that are not great and

people can’t get mortgage or can’t buy a home, obviously people need to rent, but people nowadays are choosing to even though

the real estate market is hot and people are buying homes, people are also choosing to live in buildings like our buildings which is

a lifestyle choice.

Investment

platforms, we have a franchise and programmatic platform which really allows us to buy off-market opportunities throughout the country.

Franchise is bringing in a developer and opening up an office around that developer, where the programmatics we’re partnering up

with an established company that’s a development company in a certain market like we have in, for example, Nashville, Tennessee,

and we do a programmatic platform relationship where we co-invest with them on multiple deals, and we’ll talk about some of the

deals we’re working on in Nashville with that partner, but the programmatic platform is something that’s very successful

for us for a while, because it allows us to find deals that we normally wouldn’t be able to find without that local partner in

that region that has closer ties into that market.

Strategic

locations, obviously, we’re looking to build infill developments in urban areas close to employment and transportation, obviously,

is a big driver for us. And obviously, an investment strategy, having the proper underwriting is obviously an important factor and those

are the list of location and demographics and employment. And some of the analytics that we look at in our underwriting.

Risk

mitigation. People ask me how do you mitigate risk? And again, real quick, I won’t spend too much time in this. We want to leave

some question, time for question and answers, but we have in house, like I said before, the AvalonBay developers and construction professionals,

again, really separates ourselves, having that expertise and Avalon being one of the largest multifamily development company on the New

York Stock Exchange. So a lot of pedigree there. Avalon has been around for almost 30 years.

The

diversification, obviously geographic diversification, having that diversification is obviously important. You don’t want to just

invest in one asset. We want to invest over multiple assets. And currently, we have, I believe 10 assets, we have now, and we’re

continuing to grow the portfolio over the next five plus years, maybe obviously longer, but also, we’re focused on the next five

years and in the next five years is the time period that we can continue to take opportunity zone investment. Approximately 85% of our

investments will be in multifamily. That’s a target that we have. To reduce risk, we also make sure we have a proper amount of

leverage. We typically talk about somewhere between 50 and 70%, which here, we’re talking 60% loan-to-value for our stabilized

portfolio. Obviously reducing risk, having lower fees obviously is a big factor, especially when investors are going to be investing

for at least 10 years, a longer time period with less fees obviously is good for our investors.

Again,

reducing risk, being able to acquire stabilized opportunity zone deals, obviously eliminates development and construction risk and also

lease up risk. So that’s another huge factor in our structure compared to our competitors, is being able to acquire stabilize cash

flowing assets is a big benefit for us because we’re eliminating that construction risk, which is probably the biggest risk in

opportunity zone investing. Obviously, asset diversification, not just based on geographic, but making sure we have a diversification

of portfolio, if it’s maybe student housing or senior housing or class A multifamily or even workforce housing.

Here’s

an example, real quick, of a project that we built in our old funds. This is a private equity fund that we completed the project before

2018. We built it for approximately $39 million and we sold it for $50 million June of 2019. But this is an example of an opportunity

zone deal. Again, we did not get the tax benefit because we built it before 2018, but it’s an example that is an opportunity zone

on the waterfront in Stanford, Connecticut, and something that we’ve built A-to-Z ourselves in house, both the construction and

then development, and just wanted to highlight this investment that, that is something that we did.

We’re

going to get the questions answered real quick, but real quick in the next 10 minutes, just wanted to talk what we were invested in.

And obviously, having our unique structure be able to acquire stabilized opportunity zone deals is great. Also being able to have it

being publicly traded has a lot of benefits like we talked about, but it still comes down to what are we investing in? We still have

to make quality investments, and in the past, our old structure, we made some investments, and obviously, that’s all in new structure

now, and we’re going to go through some of those investments and these investments are mostly new ground up development. There

are some deals that are renovation. And then obviously going forward, we look forward to acquiring stabilized opportunity zone deals

that once we have a definitive agreement on one of those deals, we’ll obviously announce it and make that public to the world.

So

this is a project was our first project, this was originally in our REIT structure, now, obviously, is in our PREP structure, it’s

418 units in downtown, right on Main Street, 1991 Main Street, it used to be a mall, right on the Main Street, it’s about six or

seven blocks away from the waterfront, which is directly west of us, which is where the Ritz Carlton is, if anybody knows Sarasota, so

phenomenal street. Main Street is where all their entertainment is, it’s kind of like their mini Rodeo Drive with all the restaurants,

entertainment life, shops, phenomenal location, and this will be a class A multifamily building with 55,000 square foot of retail on

the ground floor. This came with a parking structure next door, which I believe had, I think had 500 or 600 parking spaces, I think 600

parking spaces, and then we’ll have additional parking underneath our building. So phenomenal location. We’re excited about

this project and this is a class A location, class A building, class A amenities. It’s going to do really, really well.

Our

next project is actually a block and half away across the street, 1700 Main Street. Again, obviously, we’re excited about Sarasota.

This is going to be project of 160 units. This project, again, similar to 1991 Main, class A, ground floor retail facing Main Street,

plenty of parking and obviously, class A amenities for the residents.

Right

behind that building is a building that we bought about the same time we bought 1700 Main Street. This is 1701 Ringling. This building

we bought partly because we needed the development rights for the last building, which is 1700. So we were able to take the residential

development rights off the office building at 1701 Ringling and move it over to 1700 Main. That really also helped us reduce the basis

in this asset. We paid about $6.8 million, about two and a half million, maybe a little bit more value moved over to the other building,

which left us with $4 million and change on the value here, which the land alone is probably worth around that value. So the way we looked

at it is we were able to get this office building, which was an 80,000 square foot office building, 40,000 square feet, approximately

half of this space is leased to Frontier, which is a sale lease back, and, or maybe it’s a less than half, but about a third to

half is a sale lease back to Frontier, which came out of bankruptcy, and that’s why we’re able to buy the building for the

great price, and we’ll renovate this building. This will be a qualified opportunity zone deal, because we’ll meet the substantial

improvement test on this property and we’ll be able to renovate this building, get it cash flow positive, and then be able to meet

the substantial improvement test and then obviously, have a stabilized asset with cash flow on it.

Our

next project is a 260 plus unit. I forget the exact number. It’s still in progress, but it’s a little over 260 units. It’s

right in downtown St. Pete at the Edge district. Related just built a project right next door and sold that project. And again, class

A, over 260 units, ground floor retail, about 17,000 square for the retail on the ground floor, phenomenal location, and we’re

excited about this project as well, because of its location and because of its finishes and really phenomenal location. Both the Sarasota

market and the St Pete market, the last 12 months, rents increase, has increased over 20%. I think it’s around over 23% in each

of these markets. So just to show you how much demand and how much growth is in these markets. It’s been a busy increase in rent

increases the last 12 months, and we’re excited about what’s going on in these two markets.

Next

market is Nashville, Tennessee. We’re going to be building 265 units right on the edge of the Gulch, which if anybody knows Nashville,

Tennessee, the Gulch is one of the hottest areas of Nashville. This is something that’s, we’re still in pre-development.

We hope to be breaking ground soon on this project. And again, this is 265 units with a little over 10,000 square foot of retail in a

phenomenal location in Nashville, Tennessee, just outside of the Gulch. And this is with our local partner that we have down there, and

we also have additional properties in the Gulch, sorry, in Nashville, Tennessee. This is on the east side, that is a waterfront property

on the east side of Nashville, if you’re familiar with Nashville between the downtown and the stadium, you have that river, this

is on the river fronts overlooking Nashville, downtown Nashville, and we’re excited about this development as well. This will be

more of a master plan development with over 400 units, and so we’re excited about this acquisition of quality real estate, and

obviously, being able to develop with this side of Nashville and having the views of Nashville. And, we’re also excited about,

one of the thing I want to add about Nashville, you have new employers, like Oracle, who are building huge campuses that will house thousands

of new employees, that’s only three miles from our site, and again, this is going to, Nashville is a growing city, and we’re

excited about what’s happening there.

Here’s

a site that we acquired at Mansfield, Connecticut, which is right near university of Connecticut Storrs, which is their main campus.

We’re excited about obviously this location. University of Connecticut having one of the lowest off campus to student ratio of

any university, any public university out there. I think they’re second lowest, which means there’s a lot of demand, there’s

just not a lot of supply. So we’re excited about this market solely because of there’s so much demand in this market and

there’s not enough supply. Haven Communities is one other competitor that is going through approval process right now and there’s

one other property that’s been built in the last 10 years, but besides that, there hasn’t been anything built in the last

45 to 50 plus years. So the product is very old in that market and really needs some new product, and we’re excited to be one of

the two new projects that are being built right now.

So,

Cody, we have another 10 minutes left for questions. I hope that’s highlighted some of the projects we’re working on, highlighted

what makes our structure different and how we’re going to be focusing on stabilized acquisitions, and then I know there’s

probably hundreds if not more questions about what I just went over. So Cody you want to hit some of the questions that you’ve

been bombarded with?

Cody

Laidlaw: Yeah. Perfect. So just to let everybody know, there’s a ton of questions here, so we’re definitely not going

to get to them all, and there’s a lot of individual situation questions as well. So I’d remind you there’s the offer

tab on your right side, click that, click “schedule now” and fill out the form so somebody can reach out to you. Just because

there’s a lot of individual questions. If you do have questions, you could do that, or you can email me or call me, both the email

and the number is up on the screen right now.

So

first question, let’s see. So this is a recap, you answered this but can you explain how you can still defer capital gains that

were recognized in 2021 by purchasing your OZ stock in 2022? Second part to that question, and can you talk about the caveat available

for pass-through entities?

Brandon

Lacoff: Yeah. So if, they’re kind of, great question, but they’re kind of very short that’s why you asked it together.

So if you have a capital gain last year and you’re an individual, you have 180 days from that capital gain, so potentially, if

you had a gain in November or December, you still have time now, not a lot of time, but you still have time now to invest, reinvest that

capital gain into our OZ structure, and still defer that gain from last year. So if you already paid that capital gain, you would get

a refund, or if you didn’t pay it, you can invest it, make the election and not have to pay that capital gain for 2021. The second

part of the question is, you can also, if you had a capital gain that was more than 180 days ago, but you received it through a pass-through

entity, you get two, you have two choices for extensions. You have 180 days from December of, December 31st of last year, you have 180

days. Or you get another 180 days from when the tax return will be due. So a pass-through entity tax return without extension would be

due today. So you would have 180 days from today to reinvest that capital gain. Even though the capital gain was derived in 2021, you

still have time to defer that capital gain from last year, as long as you make that investment within one of the 180 days. Depending

if you received it through an entity or you received it personally. So you just you have to look at the situation. And again if you have

questions, you can reach out to Cody or myself, and we have in-house tax experts that will help you decipher if you qualify or don’t

qualify for the extensions or not. So you can always reach out to us.

Cody

Laidlaw: Perfect. Next question is besides just purchasing publicly traded OZ stock with capital gains, is there anything else we

need to do? Also, do we have to form our own qualified opportunity fund to invest?

Brandon

Lacoff: Yeah, so you simply have to just buy the stock, and by buying the stock within that 180 day window that we talked about,

and obviously you have the extensions, amount extensions depending on how you received your capital gain, but if you invested in one

of those windows, you made a valid opportunity zone investment, simple as that, you made that investment. However, the second step that

you’re going to have to do, is you’re going to have to at the end of that year, you’re going to have to fill out an

8949, which is what you’d have to do anyway on your tax return. Which is recognizing that capital gain, but on that tax return

you would make the election you made it in opportunities zone investment to offset that gain, and you have to fill out an 8997, that

goes into the detail of what you invested in. Obviously you invested in OZ, Belpointe OZ, you would put our tax ID number in, and say

when you made that investment and those are the additional forms that you would have to fill out later which is part of your tax return.

So you simply have to just make the investment, and then when you fill out your tax returns you fill out the 8949 and the 8997, which

you can do yourself or your tax preparer would do for you.

Cody

Laidlaw: Perfect. Here’s a good one. So it’s common knowledge to not let the tax tail wag the dog. So of course the underlying

investments performance is of utmost importance. Can you talk, and I don’t know how much we can get into, but can you talk about

any recent sales or the overall outlook in the markets that you’re currently invest into?

Brandon

Lacoff: Yeah, I can’t obviously get into stuff that’s nonpublic, but overall the market has done very, very well, both

on the land and developments themselves. So especially in the multifamily space, industrial space has done very well. So in the last

even 12 to 24 months real estate has been, has done very, very well, and we’ve seen a lot of appreciation in value of real estate.

And obviously, investing in good locations and in good assets are key to what we’re doing, and we’re excited and we think

our locations are A+, especially in the opportunity zone realm, we think our locations are phenomenal, both in Nashville, in Florida

and UConn and other areas that we’re looking around the country. So we’re excited about the locations that we picked.

Cody

Laidlaw: Perfect. If a unit holder sells a portion of their OZ stock, does that trigger an inclusion event for the whole investment?

Brandon

Lacoff: It does not. Only, for the only the portion that you sell would be an inclusion event, if you obviously sold, in a period

less than 10 years, you would still get the partial benefit of deferral for whatever period that you held it for, but yes, you would

not lose the tax, the whole tax benefits of all the investments. If you invested a million dollars and you sold $200,000, you would have

a partial inclusion of that on the portion that you sold it, that was probably before, prior to 10 year holding period.

Cody

Laidlaw: Okay. Next question. Is there a lock, I guess this is coming from people that are used to private investments. Is there

a lock-up period or a penalty for selling early out of your structure?

Brandon

Lacoff: There is no lock up period, investors can buy and sell as they please. The only negative is if you made a qualified opportunity

zone investment and you sold before the 10-year benefit, the 10-year time period, you would lose part of your opportunities zone tax

benefit because you didn’t hold it for the full 10 years. So, but there is no penalty when it comes to the stock itself. You may

lose some of the tax benefits of the opportunity zone.

Cody

Laidlaw: Perfect. How is your investment strategy and different than that of private structures?

Brandon

Lacoff: Sure, our strategy is probably similar to a lot of our competitors when it comes to ground-up development or renovation of

existing buildings. I think our projects are better locations because I’m excited about what we’re building in the cities

we’re building. So from ground up, it’s a similar strategy. I think the thing that really separates us is our ability to

acquire stabilized opportunity zone deals and get that cash flow much quicker than having to build it and obviously reducing that construction

risk and the lease-up risk and development risk. So being able to buy something that’s going to be cash flowing and still keep

the tax benefits for the target company that we’re acquiring, I think it’s a huge benefit, it really separates us from everybody

else. So I would say, to answer that question, I would say the ability to acquire stabilized opportunity zones deals, really separates

us from everybody else.

Cody

Laidlaw: Got it. Along the same lines, so the ultimate liquidity for LPs in a private structure is for the sponsor of that entity

to dispose of all the assets, return capital plus profit. What’s the ultimate exit liquidity in publicly traded structures like

ours?

Brandon

Lacoff: Everybody has their own individual clock. So we’re looking to continue to build and acquire quality opportunities zone

deals. So when someone wants the exit, they’re going to exit. So with a closed end fund, everybody is relying on the manager to

decide when they’re going to exit. Our structure allows each individual shareholder to make the decision when they want to exit.

So our strategy is a long-term hold strategy and our profit doesn’t, it’s not tied to any time period like a private structure

would be. So we’re really aligned with our shareholders, I should say, our unit holders, and when a shareholder decides to exit,

they can just simply log on through their brokerage account and sell the security and be able to exit their investment on the exchange.

So it’s really up to each individual shareholder to hold the investment as long as they want to hold it for. If it’s less

than 10 years or greater than 20 years whatever they, or something in between, it’s totally up to them.

Cody

Laidlaw: Okay, I think we have time for one more question. Commonly asked question. Do you need to use a qualified intermediary to

invest into an opportunity zone?

Brandon

Lacoff: You don’t, you don’t. That’s one of the benefits of opportunity zone. You don’t need a qualified

intermediary. You actually get more time to invest. Where in a 1031, you have to use a third-party intermediary, like you said, but in

addition to that, you have to invest both your basis and your gain into the new real estate structure, and so only real estate to real

estate. This is any capital gain, and it could be cars, it can be jewelry, it could be art work, cryptocurrency, bonds, stocks, whatever,

and you only want to reinvest your capital gain portion because only the capital gain portion gets the opportunity zone tax benefit.

So you’re only rolling over that, the gain portion. The basis that you have on your sale, the basis that you have, that’s

your original investment. You’re going to take that out, tax free, put that in your pocket and invest it somewhere else. You’re

only rolling your portion, that is the capital gain portion, and you get a full 180 days, where in a 1031, you have 45 days to identify

what you’re reinvesting in, and, again, if you have to put all the money in, the whole A-to-Z in that you took out, so that is,

yeah, that is a big difference between our structure and opportunity zones and 1031s.

Cody

Laidlaw: Perfect. So before we sign off, I probably missed 50 plus questions. So just know I see those, I’m going to download

them, and at the end of this webinar, I mean, they’re going to follow up with each one of you individually, either by email or

phone. But just know you’re going to get a response to your question. So thank you, Brandon, and thank you everybody else for attending.

Brandon

Lacoff: Appreciate it. Thanks everybody.

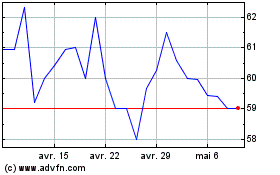

Belpointe PREP (AMEX:OZ)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Belpointe PREP (AMEX:OZ)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024