Current Report Filing (8-k)

01 Juillet 2022 - 10:32PM

Edgar (US Regulatory)

0001807046

false

0001807046

2022-06-28

2022-06-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): June 28,

2022

Belpointe

PREP, LLC

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-40911 |

|

84-4412083 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

255

Glenville Road

Greenwich,

Connecticut |

|

06831 |

| (Address

or principal executive offices) |

|

(Zip

Code) |

(203)

883-1944

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former

name or former address, if changes since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Class |

|

Trading

Symbol |

|

Name

of Exchange on which registered |

| Class

A units |

|

OZ |

|

NYSE

American |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| Emerging growth company |

☒ |

| If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 7(a)(2)(B) of the Securities Act. |

|

Item

1.01 Entry into a Material Definitive Agreement.

As

previously disclosed, on January 3, 2022, Belpointe PREP, LLC (“we,” “us,” “our,” or the “Company”),

through an indirect wholly owned subsidiary, provided a commercial mortgage loan in the principal amount of $30.0 million (the “Loan”)

to Norpointe, LLC (“Norpointe”), an affiliate of our Chief Executive Officer. Norpointe is the owner of certain real property

located at 41 Wolfpit Avenue, Norwalk, Connecticut 06851 (the “Property”). The Loan was evidenced by a promissory note bearing

interest at a rate of 5.0% per annum, due and payable on December 31, 2022, and was secured by a first mortgage lien on the Property.

Given our excess cash on hand as of the year ended December 31, 2021, management viewed the Norpointe transaction as an opportunity to

earn a strong rate of return on that cash by making a low risk—due to the low loan-to-value ratio and first priority mortgage interest—short-term

loan rather than depositing the funds in a lower yielding account pending investment in future developments.

On

June 28, 2022, for purposes of complying with the qualified opportunity fund requirements, we restructured the Loan through BPOZ 1000

First QOZB, LLC (“BPOZ 1000”), an indirect majority-owned subsidiary of the Company, whereby BPOZ 1000 provided a commercial

mortgage loan in the principal amount of $30.0 million (the “QOZB Loan”) to Norpointe. Thereafter, on June 29, 2022, Norpointe

repaid the original Loan in full. The QOZB Loan is evidenced by a promissory note bearing interest at a rate of 5.0% per annum, due and

payable on June 28, 2023 (the “Note”) and is secured by a first mortgage lien on the Norpointe Property pursuant to the terms

of a Mortgage Deed and Security Agreement (the “Mortgage”).

The

foregoing description of the Note and Mortgage does not purport to be complete and is qualified in its entirety by reference to the full

text of the Note and Mortgage, which are filed as Exhibits 10.1 and 10.2 hereto and are incorporated herein by reference.

Item

8.01 Other Event

On

June 28, 2022, our indirect wholly owned subsidiary originated a $3.8 million equity investment, representing a majority ownership interest,

in CMC Storrs SPV, LLC (“CMC”), the holding company for 497-501 Middle Turnpike, Mansfield, Connecticut (“497-501 Middle”),

and, pursuant to the terms of CMC’s Amended and Restated Limited Liability Company Agreement, committed to contributing up to an

additional $58.5 million in equity capital for development of 497-501 Middle.

497-501

Middle is an approximately 60-acre site, consisting of an approximately 30-acre former golf course and approximately 30 acres of undeveloped

hiking and biking trails surrounding wetlands. We currently anticipate that 497-501 Middle will be developed into an approximately 250-apartment

home community and that amenities will include a leasing office, clubhouse with a demonstration kitchen, fitness center, game room, study/lounge

area, meeting rooms, and an outside AstroTurf meadow.

497-501

Middle is located roughly five minutes from the University of Connecticut’s (“UConn’s”) main college campus in

Storrs, Connecticut (“Storrs”), approximately 30 minutes from Hartford, Connecticut, and 90 minutes from Boston, Massachusetts.

UConn ranked 23rd among “top public schools” nationally in the 2021 U.S. New & World Report (“U.S. News”)

collegiate rankings, and, based on a fact sheet published by UConn, over 18,000 undergraduate students attended college at the Storrs

campus in 2021, with 75% of those students living off campus, according to U.S. News, one of the worst housing units to student ratios

of major universities in the U.S.

Item

9.01 Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Dated:

July 1, 2022

| |

BELPOINTE PREP, LLC |

| |

|

|

| |

By: |

/s/

Brandon E. Lacoff |

| |

|

Brandon

E. Lacoff |

| |

|

Chairman

of the Board and Chief Executive Officer |

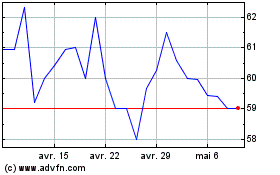

Belpointe PREP (AMEX:OZ)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Belpointe PREP (AMEX:OZ)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024