Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

21 Novembre 2022 - 8:29PM

Edgar (US Regulatory)

Issuer

Free Writing Prospectus dated November 18, 2022

Filed

Pursuant to Rule 433

Registration

No. 333-255424

How

to Advise Clients on the First and Only Publicly Traded Opportunity Zone Fund

Investing

For 2022/23

Tax

Sheltering, Growth and Income Potential in the Face of Widespread Uncertainty

Want

to simplify the opportunity zone investment process for accredited and non- accredited investors alike?

Instead

of trying to decide which of the 8,700 Opportunity Zones might be the best investment … Brandon Lacoff, CEO and Founder of Belpointe

PREP, LLC (“Belpointe OZ”) simplifies the entire process.

He

will explain why he believes the optimal structure for investing in Opportunity Zones is a public real estate partnership structure.

You’ll

learn how a public real estate partnership structure, like Belpointe OZ, can offer several advantages over traditional real estate investments

when it comes to investing in Opportunity Zones, such as:

| |

● |

Providing

for pass-through income, thereby avoiding double taxation for investors; |

| |

● |

Providing

for pass-through depreciation, with no depreciation recapture if an investment is held for 10 years up to December 31, 2047; |

| |

● |

Low

minimums for investor access; |

| |

● |

Required

annual distributions of at least 90% of taxable income; |

| |

● |

Up

to a 20% reduction on taxable distributions via Internal Revenue Code Section 199A; and |

| |

● |

Providing

investors with greater control over their exit timing and amount. |

In

addition, you’ll learn how a publicly traded real estate partnership structure can further enhance the above stated benefits, as

follows:

| |

● |

Clients

will not be asked to add additional capital for any type of improvements or problems with investment properties; |

| |

● |

Providing

investors with better reporting, transparency, and oversight; Providing investors with the opportunity for daily liquidity; |

| |

● |

Allowing

both accredited and non-accredited investors to access the investment class; and |

| |

● |

Simplifying

the investment purchase process. |

Simply

put: you may be able to keep more money invested in your and your clients’ accounts and out of the hands of the IRS with an investment

opportunity with growth and income potential and a possible inflation and recession hedging side effect.

CIMA®,

CPWA®, CIMC®, RMA®, and AEP® CE Credits have been applied for and are pending approval.

Important

Information and Qualifications

Belpointe

PREP, LLC (“Belpointe OZ”) has filed a registration statement (including a prospectus) with the U.S. Securities and Exchange

Commission (SEC) for the offer and sale of up to $750,000,000 of Class A units representing limited liability interests in Belpointe

OZ. You should read Belpointe OZ’s most recent prospectus and the other documents that it has filed with the SEC for more complete

information about Belpointe OZ and the offering.

Investing

in Belpointe OZ’s Class A units involves a high degree of risk, including a complete loss of investment. Prior to making an investment

decision, you should carefully consider Belpointe OZ’s investment objectives and strategy, risk factors, fees and expenses and

any tax consequences that may results from an investment in Belpointe OZ’s Class A units. To view Belpointe OZ’s most recent

prospectus containing this and other important information visit sec.gov or belpointeoz.com. Alternatively, you may request Belpointe

OZ send you the prospectus by calling (203) 883-1944 or emailing claidlaw@belpointe.com. Read the prospectus in its entirety before making

an investment decision.

Neither

Belpointe OZ nor any of its affiliates provide investment or tax advice and do not represent in any manner that the outcomes described

herein will result in any particular tax consequence. You should consult with your own investment and tax advisers concerning the U.S.

federal, state and local income tax consequences, as well as any tax consequences under the laws of any other taxing jurisdiction, in

relation to your personal tax circumstances. Past performance is not an indicator or a guarantee of future performance. The price of

Belpointe OZ’s Class A will fluctuate in market value and may trade above or below its net asset value. Brokerage commissions and

expenses will reduce returns.

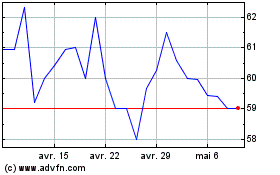

Belpointe PREP (AMEX:OZ)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Belpointe PREP (AMEX:OZ)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024