false0001095052FY

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 40-F

☐ Registration statement pursuant to Section 12 of the Securities Exchange Act of 1934

or

☒ Annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934

| For the fiscal year ended August 31, 2024 |

Commission File Number 001-33562 |

PLATINUM GROUP METALS LTD.

(Exact name of registrant as specified in its charter)

British Columbia

(Province or Other Jurisdiction of Incorporation or Organization)

1099

(Primary Standard Industrial Classification Code Number)

Not Applicable

(I.R.S. Employer Identification Number)

1100 Melville Street, Suite 838

Vancouver, BC

Canada V6E 4A6

(604) 899-5450

(Address and telephone number of Registrant's principal executive offices)

DL Services Inc.

Columbia Center, 701 Fifth Avenue, Suite 6100

Seattle, WA 98104-7043

(206) 903-8800

(Name, address (including zip code) and telephone number (including area code)

of agent for service in the United States)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

Title of Each Class:

|

Trading Symbol

|

Name of Each Exchange on Which Registered:

|

|

Common Shares, no par value

|

PLG

|

NYSE American

|

Securities registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

For annual reports, indicate by check mark the information filed with this form:

Annual information form ☒ Audited annual financial statements ☒

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report:

102,480,148 Common Shares outstanding as of August 31, 2024

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging growth company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term "new or revised financial accounting standard" refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

DOCUMENTS INCORPORATED BY REFERENCE

The following documents, filed as Exhibits 99.1, 99.2, 99.3, 99.13 and 99.14 to this Annual Report on Form 40-F of Platinum Group Metals Ltd. (the "Registrant" or the "Company"), are hereby incorporated by reference into this Annual Report:

(a) Annual Information Form for the fiscal year ended August 31, 2024 ("AIF");

(b) Audited Consolidated Financial Statements as at August 31, 2024 and 2023, and for the two years in the period ended August 31, 2024 and the related notes, Management’s Annual Report on Internal Control over Financial Reporting and the Report of Independent Registered Public Accounting Firm, with respect thereto;

(c) Management's Discussion and Analysis for the fiscal year ended August 31, 2024 ("MD&A");

(d) Code of Business Conduct and Ethics; and

(e) Waterberg Definitive Feasibility Study Update, Bushveld Igneous Complex, Republic of South Africa" dated October 9, 2024, and with an effective date of August 31, 2024

EXPLANATORY NOTE

The Company is a Canadian issuer eligible to file its annual report pursuant to Section 13 of the Exchange Act on Form 40-F. The Company is a "foreign private issuer" as defined in Rule 3b-4 under the Exchange Act. Accordingly, the Company's equity securities are exempt from Sections 14(a), 14(b), 14(c), 14(f) and 16 of the Exchange Act pursuant to Rule 3a12-3.

The Company is permitted, under a multi-jurisdictional disclosure system adopted by the United States, to prepare this Annual Report in accordance with Canadian disclosure requirements, which are different from those of the United States.

FORWARD LOOKING STATEMENTS

This Annual Report and the Exhibits incorporated by reference herein contain "forward-looking information" and "forward-looking statements" within the meaning of applicable Canadian and U.S. securities laws, respectively, which may include, but are not limited to, statements with respect to possible events, conditions, acquisitions, or results of operations that are based on assumptions about future conditions and courses of action and include future oriented financial information with respect to prospective results of operations, financial position or cash flows that is presented either as a forecast or a projection, and also include, but are not limited to, statements with respect to our future financial and operating performance and estimates of reserves and resources. Often, but not always, forward-looking statements can be identified by the use of words such as "plans", "proposes", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "projects", "intends", "targets", "aims", "anticipates", or "believes" or variations (including negative variations) of such words or phrases, or statements that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. As a result, actual actions, events or results may differ materially from those described in the forward-looking statements, and there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended including, without limitation, those referred to in our AIF (incorporated by reference as Exhibit 99.1 to this Annual Report) under the heading "Risk Factors" and elsewhere.

Although forward-looking statements contained in the Exhibits incorporated by reference into this Annual Report are based upon what our management believes are reasonable assumptions, we cannot assure investors that actual results will be consistent with the forward-looking statements. Our forward-looking statements contained in the Exhibits incorporated by reference into this Annual Report are made as of the respective dates set forth in such Exhibits. In preparing this Annual Report, we have not updated such forward-looking statements to reflect any change in circumstances or in management's beliefs, expectations or opinions that may have occurred prior to the date hereof, and we disclaim any obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise, except as required by law. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated. Accordingly, investors should not place undue reliance on forward-looking statements due to the inherent uncertainty therein.

RESOURCE AND RESERVE ESTIMATES

The information provided under the heading "Cautionary Note to U.S. Investors" contained in the Company's AIF is incorporated by reference herein.

CONTROLS AND PROCEDURES

The information provided under the heading "Disclosure Controls and Internal Control Over Financial Reporting" contained in the Company's MD&A is incorporated by reference herein.

The Company's independent registered public accounting firm, PricewaterhouseCoopers LLP (Vancouver, British Columbia, PCAOB ID No 271) has audited our management's assessment of our internal control over financial reporting. PricewaterhouseCoopers LLP's report is located with our Audited Consolidated Financial Statements, which are incorporated herein by reference to Exhibit 99.2.

NOTICES PURSUANT TO REGULATION BTR

The Company did not send any notices required by Rule 104 of Regulation BTR during the year ended August 31, 2024 concerning any equity security subject to a blackout period under Rule 101 of Regulation BTR.

AUDIT COMMITTEE AND AUDITOR INFORMATION

The Company has a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended. The information provided under the headings "Audit Committee - Audit Committee Composition and Background", "Audit Committee - External Auditor Service Fees (By Category)" and "Audit Committee - Pre-Approval Policies and Procedures" contained in the Company's AIF is incorporated by reference herein.

CODE OF ETHICS

The information provided under the heading "Social and Environmental Policies - Governance and Nomination Committee - Governance Matters - Code of Conduct and Business Ethics" contained in the Company's AIF is incorporated by reference herein.

The Company's current Code of Business Conduct and Ethics is incorporated by reference herein.

OFF-BALANCE SHEET ARRANGEMENTS

The information provided under the heading "Discussion of Operations and Financial Condition - Off-Balance Sheet Arrangements" contained in the Company's MD&A is incorporated by reference herein.

MATERIAL CASH REQUIREMENTS FROM KNOWN CONTRACTUAL AND OTHER OBLIGATIONS

The information provided under the heading "Discussion of Operations and Financial Condition - Contractual Obligations" contained in the Company's MD&A is incorporated by reference herein.

MINE SAFETY DISCLOSURE

The Company was not an operator, and did not have a subsidiary that was an operator, of a coal or other mine, as defined in Section 3 of the Federal Mine Safety and Health Act of 1977, in the United States during the year ended August 31, 2024.

DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS

Not applicable.

NYSE AMERICAN STATEMENT OF CORPORATE GOVERNANCE DIFFERENCES

The Company's common shares are listed for trading on the NYSE American LLC ("NYSE American"). Section 110 of the NYSE American Company Guide permits the NYSE American to consider the laws, customs and practices of foreign issuers in relaxing certain NYSE American listing criteria, and to grant exemptions from NYSE American listing criteria based on these considerations. A company seeking relief under these provisions is required to provide written certification from independent local counsel that the non-complying practice is not prohibited by home country law. A description of the significant ways in which the Company's governance practices differ from those followed by domestic companies pursuant to NYSE American standards is provided on the Company's website at platinumgroupmetals.net.

UNDERTAKINGS

The Company undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the Commission staff, and to furnish promptly, when requested to do so by the Commission staff, information relating to: the securities registered pursuant to Form 40-F; the securities in relation to which the obligation to file an annual report on Form 40-F arises; or to transactions in said securities.

CONSENT TO SERVICE OF PROCESS

The Company has previously filed with the Commission a written consent to service of process and power of attorney on Form F-X. Any change to the name or address of the Company's agent for service shall be communicated promptly to the Commission by amendment to the Form F-X referencing the file number of the Company.

SIGNATURES

Pursuant to the requirements of the Exchange Act, the Registrant certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this Annual Report to be signed on its behalf by the undersigned, thereunto duly authorized.

PLATINUM GROUP METALS LTD.

/s/ Frank Hallam

Frank R. Hallam

President, Chief Executive Officer and Director

Date: November 27, 2024

EXHIBIT INDEX

The following documents are being filed with the Commission as exhibits to this annual report on Form 40-F.

| Exhibit Number |

Description |

| 97 |

Clawback Policy |

| 99.1 |

Annual Information Form for the year ended August 31, 2024 |

| 99.2 |

Audited Consolidated Financial Statements for the year ended August 31, 2024, including the Report of Independent Registered Public Accounting Firm with respect thereto |

| 99.3 |

Management's Discussion and Analysis for the year ended August 31, 2024 |

| 99.4 |

Certification of Chief Executive Officer as Required by Rule 13a-14(a) under the Exchange Act |

| 99.5 |

Certification of Chief Financial Officer as Required by Rule 13a-14(a) under the Exchange Act |

| 99.6 |

Certification of Chief Executive Officer Pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

| 99.7 |

Certification of Chief Financial Officer Pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

| 99.8 |

Consent of PricewaterhouseCoopers LLP |

| 99.9 |

Consent of Charles J. Muller |

| 99.10 |

Consent of Gordon I. Cunningham |

| 99.11 |

Consent of Michael Murphy |

| 99.12 |

Consent of Robert van Egmond |

| 99.13 |

Code of Business Conduct and Ethics (incorporated by reference to Exhibit 99.13 to the Form 40-F filed by the Company on November 23, 2022) |

| 99.14 |

Waterberg Project Definitive Feasibility Study and Mineral Resource Update, Bushveld Igneous Complex, Republic of South Africa dated October 9, 2024, with an effective date of August 31, 2024 (incorporated by reference to Exhibit 99.1 to the Company's Current Report on Form 6-K furnished to the Commission on October 9, 2024) |

| 101.INS |

Inline XBRL Instance Document - the instance document does not appear in the Interactive Data File as its XBRL tags are embedded within the Inline XBRL document |

| 101.SCH |

Inline XBRL Taxonomy Extension Schema |

| 101.CAL |

Inline XBRL Taxonomy Extension Calculation Linkbase |

| 101.DEF |

Inline XBRL Taxonomy Extension Definition Linkbase |

| 101.LAB |

Inline XBRL Taxonomy Extension Label Linkbase |

| 101.PRE |

Inline XBRL Taxonomy Extension Presentation Linkbase |

| 104 |

Cover Page for Company's Annual Report on Form 40-F for the year ended August 31, 2024, formatted in Inline XBRL |

PLATINUM GROUP METALS LTD.

CLAWBACK POLICY

(the "Policy")

This Policy is designed to comply with Section 10D of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), related rules and the listing standards of NYSE American LLC or any other stock exchange on which the shares of Platinum Group Metals Ltd. (the "Company") are listed in the future.

This Policy will apply if the Company is required to prepare an accounting restatement due to its material noncompliance with any financial reporting requirement under the U.S. federal securities laws (including any required accounting restatement to correct an error in previously issued financial statements that is material to the previously issued financial statements, or that would result in a material misstatement if the error were corrected in the current period or left uncorrected in the current period) (a "Financial Restatement"), and the result of such Financial Restatement is that any incentive-based compensation received by any executive officer of the Company during the recovery period would have been lower had it been calculated based on such restated results. If a Financial Restatement occurs, the Board of Directors of the Company (the "Board") or such other persons as may be designated by the Board (the Board or such other persons being referred to in this Policy as the "Administrators") shall make the determinations and take the steps contemplated in accordance with this Policy.

A Financial Restatement does not include situations in which financial statement changes did not result from material non-compliance with financial reporting requirements, such as, but not limited to retrospective: (i) application of a change in accounting principles; (ii) revision to reportable segment information due to a change in the structure of the Company's internal organization; (iii) reclassification due to a discontinued operation; (iv) application of a change in reporting entity, such as from a reorganization of entities under common control; (v) adjustment to provision amounts in connection with a prior business combination; and (vi) revision for stock splits, stock dividends, reverse stock splits or other changes in authorized share structure.

COMPENSATION RECOVERY

If a Financial Restatement is required, and if the Administrators determine that the amount of any incentive-based compensation received by any executive officer of the Company during the recovery period (the "Awarded Compensation") would have been a lower amount had it been calculated based on such restated financial results (the "Actual Compensation"), then the Administrators shall, except as provided below, cancel, rescind, or otherwise seek to recover reasonably promptly from such executive officer for the benefit of the Company, and such executive officer will be required to forfeit or repay to the Company, the difference between the Awarded Compensation and the Actual Compensation without regard to any taxes paid (the "Excess Compensation"). Where the amount of Excess Compensation is not subject to mathematical recalculation directly from the information in a Financial Restatement, such as when the amount of Excess Compensation is based on stock price or total shareholder return, the amount must be based on a reasonable estimate of the effect of the Financial Restatement upon which the incentive-based compensation was received; and the Company must maintain documentation of the determination of that reasonable estimate and provide such documentation to the applicable stock exchange.

IMPRACTICABILITY

The Administrators shall not seek such cancelation, rescission, forfeiture, or recovery from an executive officer to the extent the Administrators determine that it is impracticable to do so, in accordance with Rule 10D-1 of the Exchange Act, and the rules of the applicable stock exchange.

NOTICE AND OPPORTUNITY TO BE HEARD

Before the Administrators determine to seek cancelation, rescission, forfeiture, or recovery pursuant to this Policy, the Administrators shall provide to the applicable executive officer written notice and the opportunity to be heard at a meeting of the Administrators (which may be in-person or telephonic, as determined by the Administrators) held after a reasonable period of time.

METHOD OF RECOVERY

If the Administrators determine to seek cancelation, rescission, forfeiture or recovery pursuant to this Policy, the Administrators shall make a written demand for repayment from the applicable executive officer and, if such executive officer does not, within a reasonable period, forfeit or tender repayment in response to such demand, as may be required, and the Administrators determine that such executive officer is unlikely to do so, the Administrators may seek a court order against such executive officer for any such cancelation, rescission, forfeiture or repayment or determine, in their sole discretion, other method(s) for recovering reasonably promptly Excess Compensation hereunder. Such methods may include, without limitation:

-

requiring reimbursement of incentive-based compensation previously paid;

-

forfeiting any compensation contribution made under the Company's deferred compensation plans;

-

offsetting the amount of Excess Compensation from any compensation that the executive officer may earn or be awarded in the future;

-

taking any other remedial and recovery action permitted by law, as determined by the Administrators; or

-

some combination of the foregoing.

OTHER RECOVERY RIGHTS

The Board intends that this Policy will be applied to the fullest extent of the law. The Board may require that any employment agreement or similar agreement relating to incentive-based compensation received on or after the Effective Date shall, as a condition to the grant of any benefit thereunder, require an executive officer to agree to abide by the terms of this Policy. Any right of recovery under this Policy is in addition to, and not in lieu of, any other: (i) remedies or rights of compensation recovery that may be available to the Company pursuant to the terms of any similar policy in any employment agreement, or similar agreement relating to incentive-based compensation, unless any such agreement expressly prohibits such right of recovery, and (ii) legal remedies available to the Company. The provisions of this Policy are in addition to (and not in lieu of) any rights to repayment the Company may have under Section 304 of the Sarbanes-Oxley Act of 2002 and other applicable laws.

NO INDEMNIFICATION OR ADVANCE

Subject to applicable law, the Company shall not indemnify, including by paying or reimbursing for premiums for any insurance policy covering any potential losses, any executive officer against the loss of any Excess Compensation, nor shall the Company advance any costs or expenses to any executive officers in connection with any action to recover Excess Compensation.

OTHER DEFINITIONS

For the purposes of this Policy:

The term "executive officer" shall refer to the Company's president, principal financial officer, principal accounting officer (or if there is no such accounting officer, the controller), any vice-president of the Company in charge of a principal business unit, division, or function (such as sales, administration, or finance), any other officer who performs a policy-making function, or any other person who performs similar policymaking functions for the Company. Executive officers of the Company's parent(s) or subsidiaries are deemed executive officers of the Company if they perform such policy-making functions for the Company. "Policy-making function" excludes policy-making functions that are not significant.

The policy applies to all incentive-based compensation received by a person after beginning service as an executive officer, and who served as an executive officer at any time during the performance period for that incentive-based compensation.

The term "financial reporting measure" means measures (including non-GAAP financial measures) that are determined and presented in accordance with the accounting principles used in preparing the Company's financial statements, and any measures that are derived wholly or in part from such measures. A measure need not be presented within the financial statements or included in a filing with the Securities and Exchange Commission (the "SEC") to constitute a financial reporting measure for purposes of this Policy.

The term "incentive-based compensation" means all compensation that is granted, earned or vested based wholly or in part upon the attainment of a financial reporting measure, including, for example, bonuses or awards under the Company's short and long-term incentive plans, grants and awards under the Company's equity incentive plans, and contributions of such bonuses or awards to the Company's deferred compensation plans or other employee benefit plans. For avoidance of doubt, incentive-based compensation that is deferred (either mandatorily or voluntarily) under the Company's non-qualified deferred compensation plans, as well as any matching amounts and earnings thereon, are subject to recovery under this Policy. Incentive-based compensation does not include awards that are granted, earned and vested without regard to attainment of financial reporting measures, such as time-vesting awards, discretionary awards and awards based wholly on subjective standards, strategic measures or operational measures.

Incentive-based compensation is deemed "received" in the Company's fiscal period during which the financial reporting measure specified in the incentive-based compensation award is attained, even if the payment or grant of the incentive-based compensation occurs after the end of that period.

"Recovery period" means the three completed fiscal years immediately preceding the date that the Company is required to prepare a Financial Restatement, as well as any transition period as defined by Rule 10D-1 of the Exchange Act and the applicable stock exchange rule.

The date that the Company is "required" to prepare a Financial Restatement shall be determined in accordance with Rule 10D-1 of the Exchange Act and the applicable stock exchange rule.

INTERPRETATION OF THE POLICY

Any determination, modification, interpretation, or other action by the Administrators pursuant to this Policy shall be made and taken by a vote of a majority of its members. The Administrators have the sole authority to construe, interpret, and implement this Policy, make any determination necessary or advisable in administering this Policy, and modify, supplement, rescind, or replace all or any portion of this Policy. It is intended that this Policy be interpreted in a manner that is consistent with the requirements of Section 10D of the Exchange Act and any applicable rules or standards adopted by the SEC or applicable stock exchange.

SUCCESSORS

This Policy shall be binding upon and enforceable against all executive officers and their beneficiaries, heirs, executors, administrators or other legal representatives.

EFFECTIVE DATE

The effective date of this Policy is October 2, 2023 (the "Effective Date"). This Policy applies to incentive-based compensation received by executive officers on or after the Effective Date that results from attainment of a financial reporting measure based on or derived from financial information for any fiscal period ending on or after the Effective Date. Without limiting the scope or effectiveness of this policy, compensation granted or received by executive officers prior to the Effective Date remains subject to the Company's prior Clawback Policy approved by the Board on March 20, 2017. In addition, this Policy is intended to be and will be incorporated as an essential term and condition of any incentive-based compensation agreement, plan or program that the Company establishes or maintains on or after the Effective Date.

AMENDMENT AND TERMINATION

The Board may amend this Policy from time to time in its discretion, and shall amend this Policy as it deems necessary to reflect changes in regulations adopted by the SEC under Section 10D of the Exchange Act and to comply with any rules or standards adopted by the applicable stock exchange.

Adopted by the Board on October 2, 2023

Last Approved by the Board on January 11, 2024

TABLE OF CONTENTS

ITEM 1 DEFINITIONS

In this Annual Information Form all units are presented in accordance with the International System of Units (i.e., metric) unless otherwise noted. Capitalized terms and abbreviations used in the AIF but not otherwise defined have the meanings set out below unless the context otherwise indicates:

1.1 GENERAL

"2015 FP Regulations" refers to the Financial Provision Regulations in regard to rehabilitation published under the Constitution and National Environmental Management Act, No. 107 of 1998 on November 20, 2015, South Africa.

"2020 Work Program" refers to R 24.7 million of project work aimed at increasing confidence in specific areas of the Waterberg DFS which was funded by Implats in 2020 in consideration for the Waterberg JV Co. entering into the Amended Call Option Agreement.

"2022 ATM" refers to the at-the-market equity program to sell from time to time common shares of the Company for up to $50.0 million in aggregate sales proceeds pursuant to an Equity Distribution Agreement entered with the BMO U.S. and BMO Canada. on July 27, 2022.

"2022 Registration Statement" means the Company's registration statement on Form F-10 filed on June 15, 2022 and amended on June 21, 2022, with the SEC under the Multijurisdictional Disclosure System established between Canada and the United States.

"2022 Shelf Prospectus" refers to the Company's short form base shelf prospectus filed on June 21, 2022, with the securities regulatory authorities in each of the provinces and territories of Canada.

"2023 Draft EIA Regulations" means the draft regulations to further amend the 2014 EIA Regulations, that were published for public comment by the DFFE in August 2023.

"2024 Management Information Circular" means the management information circular of the Company dated January 17, 2024.

"2024 Registration Statement" means the Company's registration statement on Form F-10 filed on October 31, 2024 and amended on November 13, 2024, with the SEC under the Multijurisdictional Disclosure System established between Canada and the United States.

"2024 Shelf Prospectus" refers to the Company's short form base shelf prospectus filed on November 13, 2024, with the securities regulatory authorities in each of the provinces and territories of Canada.

"Accounting Concerns" means, under the Whistleblower Policy, compliance with applicable government laws, rules and regulations, corporate reporting and disclosure, accounting practices, accounting controls, auditing practices and other matters relating to fraud against shareholders which the Company must comply with that may be the subject of a submission by a Covered Person.

"AEL" means atmospheric emission license.

"Africa Wide" refers to Africa Wide Mineral Exploration and Prospecting (Pty) Ltd.

"Agents" refer to BMO Canada and BMO U.S.

"AIF" means this Annual Information Form dated November 27, 2024.

"Ajlan" refers to Ajlan & Bros Mining and Metals Co.

"Amended Call Option Agreement" means the amended and restated Purchase and Development Option with Implats dated March 31, 2020.

"Amplats" refers to Anglo American Platinum Limited.

"AMR" refers to Alta Mesa Resources, Inc.

"ANC" refers to the African National Congress of South Africa.

"Anti-Bribery Conduct Policy" means the Company's Commitment to anti-bribery conduct adopted in December 2021 to complement and expand on the existing Code of Business Conduct and Ethics.

"AQA" refers to the National Environmental Management Air Quality Act, No. 39 of 2004 of South Africa.

"AQA Listed Activities" refers to the list of activities, including certain mining related and processing activities, that are prohibited to be undertaken under the AQA.

"ASC" refers to the Alberta Securities Commission.

"BCEA" means the Basic Conditions of Employment Act, South Africa.

"BCSC" refers to the British Columbia Securities Commission.

"BEE" refers to Broad-Based Black Economic Empowerment.

"BEE Act" means the Broad-Based Black Economic Empowerment Act, No. 53 of 2003, South Africa.

"BEE Amendment Act" means the Broad-Based Black Economic Empowerment Amendment Act, No. 46 of 2013 which came into operation on October 24, 2014.

"BIC" refers to The Battery Innovation Center.

"BMO Canada" refers to BMO Nesbit Burns Inc.

"BMO U.S." refers to BMO Capital Markets Corp.

"BMR" means base metal refinery.

"Board" refers to the board of directors of Platinum Group.

"Bushveld Complex" means the Bushveld Igneous Complex located in South Africa and contains the world's largest reserves of PGMs or PGEs.

"CAPEX" means capital expenditures.

"Carbon Bill" means the South African Second Draft Carbon Tax Bill 2017 published in December 2017.

"Carbon Tax Act" means the South African Carbon Tax Act, No. 15 of 2019.

"CCIAs" means climate change impact assessments.

"CCMA" refers to the Commission for Conciliation, Mediation and Arbitration, South Africa.

"CDM" means the clean development mechanism projects issued under national registries to be eligible for listing as eligible South African carbon offsets.

"CIPC" means the Companies and Intellectual Property Commission, an agency of the Department of Trade, Industry and Competition in South Africa.

"Clawback Policy" means the policy adopted by the Company, as revised with an effective date of October 2, 2023, for the cancelation or recovery of excess payment of performance-based compensation issued or paid to an executive officer of the Company in the event of a restatement of the financial results of the Company and the performance-based compensation issued or paid would have been less had it been calculated based on such restated results.

"Climate Bill" means the South African Climate Change Bill first published for comment in June 2018.

"Climate Change Act" means the South African Climate Change Act, No. 22 of 2024.

"CMA" means the Common Monetary Area of South Africa, Namibia, Lesotho and Eswatini (formerly Swaziland).

"Code" means the U.S. Internal Revenue Code of 1986, as amended.

"Code of Conduct" refers to the Company's Code of Business Conduct and Ethics.

"Common Shares" means the common shares of the Company listed for trading on the TSX under the symbol "PTM" and on the NYSE American under the symbol "PLG".

"Company" or "Platinum Group" refers to Platinum Group Metals Ltd., a corporation organized under the laws of British Columbia, Canada, formed by way of an amalgamation on February 18, 2002, under the Company Act (British Columbia) and transitioned under the Business Corporations Act (British Columbia) on January 25, 2005.

"Companies Act" refers to the South African Companies Act, No. 71 of 2008, which came into force on May 1, 2011.

"Constitution" means the Constitution of the Republic of South Africa, 1996.

"Convertible Notes" means the $19.99 million 6 7/8% Convertible Senior Subordinated Notes repaid and cancelled by the Company on January 20, 2022.

"Covered Persons" means directors, officers, employees, consultants and, as appropriate, certain third parties of the Company who make submissions under the Whistleblower Policy regarding Accounting Concerns.

"COVID-19 Pandemic" means the global outbreak of coronavirus, an infectious disease caused by the severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2) virus, as declared by the World Health Organization on March 11, 2020.

"CTC" means Contributed Tax Capital.

"CTOs" means Cease Trade Orders.

"Deepkloof" means Deepkloof Limited, a wholly owned subsidiary of HCI.

"Defendants" means the defendants Platinum Group Metals (RSA) Proprietary Limited, Royal Bafokeng Platinum Limited, Royal Bafokeng Resources (Proprietary) Limited and Maseve Investments 11 (Proprietary) Limited in relation to the Maseve Sale Transaction.

"Deferred Share Unit Plan" means the Company's deferred share unit plan that permits directors who are not salaried officers or employees of the Company or a related corporation to convert into deferred share units the fees that would otherwise be payable by the Company to them relating to future services for their participation on the Board and on committees of the Board.

"DFFE" means the South African Department of Forestry, Fisheries and the Environment.

"Digbee" means Digbee Ltd., provider of the Digbee ESG.

"Digbee ESG" means the Digbee free-to-access online ESG disclosure and ratings tool and communications platform designed specifically for the mining sector.

"DMR" means the South African Department of Mineral and Petroleum Resources.

"Draft Guideline" means the South African Draft National Guideline for Consideration of Climate Change Implications.

"Draft NWA Regulations" means the draft regulations published by the DWS for comment in May 2023.

"DTC" means the Davis Tax Committee, consisting of the members of the South Africa Tax Review Committee as well as the Committee's Terms of Reference.

"DWS" means the South African Department of Water and Sanitation.

"EA" means Environmental Authorization.

"EBIT" means a royalty rate in respect of refined minerals calculated by dividing earnings before interest and taxes by the product of 12.5 times gross revenue, calculated as a percentage, plus an additional 0.5%.

"EEA" means the South African Employment Equity Act, No. 55 of 1998.

"EHSSR Policies" refers to the Company's Environmental, Health, Safety, and Social Responsibility Policies.

"EHST Committee" means the Company's Environmental, Health, Safety and Technical Advisory Committee.

"EIA" means Environmental Impact Assessment.

“EIA Listing Notices” refers to the South African government assessment notices under NEMA’s EIA Regulations that identify activities that require an environmental authorisation prior to the commencement of those activities.

"EMP" means Environmental Management Plan.

"EMPs" means the EMP and Environmental Management Programs.

"Environmental Minister" means the Minister of the DFFE.

"ESG" means Environmental, Social and Governance.

"ESKOM" refers to ESKOM Holdings SOC Limited, South Africa's state electricity utility company.

"Explanatory Memorandum" means the Carbon Bill, together with an Explanatory Memorandum in respect of the Carbon Bill.

"Financial Statements" refers to the Consolidated audited financial statements of Platinum Group for the year ended August 31, 2024.

"FinSurv" refers to the South African Reserve Bank, more specifically the Financial Surveillance Department.

"FIU" refers to Florida International University.

"Forward-Looking Statements" means the "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and the "forward-looking information" within the meaning of applicable Canadian securities legislation.

"Fraser McGill" refers to Fraser McGill (Pty) Ltd.

"Future Rehabilitation" means the remediation of latent or residual environmental impacts which may become known in the future including the pumping and treatment of polluted or extraneous water.

"Generic BEE Codes" means the Broad-Based Black Economic Empowerment Codes of Good Practice published under the BEE Act, as amended from time to time.

"GHG emissions" means greenhouse gas emissions.

"GNU" refers to a government of national unity formed by a broad coalition government consisting of a number of political parties in order to promote national unity and political stability.

"Good Practice Code" means the South Africa Code of Good Practice on the Prevention and Elimination of Harassment in the Workplace published in March 2022.

"Hanwa" refers to Hanwa Co. Ltd.

"HCI" refers to Hosken Consolidated Investments Limited, a black empowerment investment holding company which is listed in the financial sector on the JSE Securities Exchange South Africa.

"HCI Agreement" means the amended and restated subscription agreement dated May 10, 2018, between the Company and HCI.

"HDPs" means historically disadvantaged South Africans.

"High Court Ruling" refers to the High Court of South Africa ruling dated June 14, 2022, dismissing the challenge brought by Africa Wide to set aside the Maseve Sale Transaction.

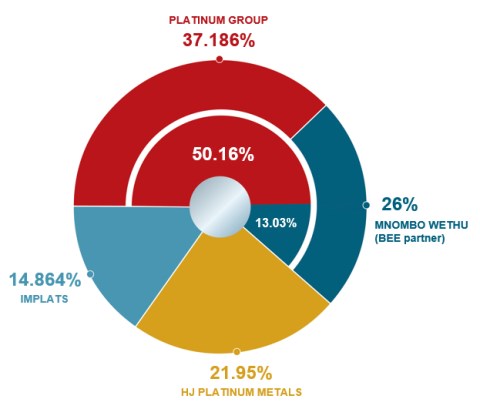

"HJM" refers to HJ Platinum Metals Company Ltd., a special purpose company established in June 2023, and owned by JOGMEC and Hanwa, to hold an aggregate 21.95% interest in Waterberg JV Co. and fund their future equity investments in the Waterberg Project on a 75% / 25% funding basis.

"Human Rights Policy" refers to the Company's human rights policy.

"IFRS Accounting Standards" means International Financial Reporting Standards as issued by the International Accounting Standards Board.

"Implats" refers to Impala Platinum Holdings Ltd.

"Implats Transaction" refers to the transaction dated November 6, 2017, whereby the Company sold Implats an 8.6% interest in Waterberg JV Co. for $17.2 million, JOGMEC sold Implats a 6.4% interest for $12.8 million, Implats acquired an option to acquire a controlling interest in the Waterberg Project, which was later terminated in June 2020, and Implats acquired the Offtake ROFR.

"Initial Budget" refers to the Waterberg Project initial budget of approx. $2.49 million that was scheduled to be spent by March 31, 2023, as approved by the directors of Waterberg JV Co. on September 1, 2022.

"Investment Company Act" means the U.S. Investment Company Act of 1940, as amended.

"IT" means information technology.

"ITA" means Income Tax Act No 58 of 1962.

"JOGMEC" refers to Japan Organization for Metals and Energy Security (formerly Japan, Oil, Gas and Metals National Corporation).

"Labour Court" refers to the court that adjudicates labour law cases in South Africa.

"Land Claims Commissioner" means the Regional Land Claims Commissioner of South Africa.

"Land Reform Minister" means the Minister of Land Reform and Rural Development of South Africa.

"LED" means Local Economic Development.

"LEDS" means South Africa's first Low Emission Development Strategy 2050.

"Limpopo Provincial Government" refers the Limpopo Province of South Africa's provincial government, established in accordance with the Constitution and responsible for social services; economic functions; and provincial governance and administration.

"Lion Battery" means Lion Battery Technologies Inc., a company founded by Platinum Group in partnership with Amplats to research the use of palladium and platinum in lithium battery applications.

"Listed Activities" refers to certain activities that are incidental to mining, listed in a series of EIA Regulations published under the Constitution and National Environmental Management Act, No. 107 of 1998, South Africa.

"LRA" means the Labour Relations Act, No. 66 of 1995, South Africa.

"Mark-to-Market Election" refers to the mark-to-market election for marketable stock under Section 1296 of the Code.

"Maseve" refers to Maseve Investments 11 (Proprietary) Limited.

"Maseve Sale Transaction" refers to the closing transaction for the sale of the Maseve Mine to RBPlat.

"MEC" means Member of the Executive Committee for the Limpopo Department of Economic Development, Environment and Tourism.

"MHSA" means the Mine Health and Safety Act, No. 29 of 1996, South Africa.

"MHSA Bill" means the Mine Health and Safety Amendment Bill, which was published for comment in June 2022, as amended and republished on October 14, 2024.

"Minerals Council Judgment" means the judgment handed down by the High Court of South Africa on September 21, 2021, in the matter between Minerals Council South Africa vs Minister of Mineral Resources and Energy and thirteen others [Case No.20341/19], in relation to the challenge to the Mining Charter 2018.

"Mining Charter" refers to the South African Broad-Based Socio-Economic Empowerment Charter for the Mining and Minerals Industry.

"Mining Charter 2018" refers to the amended South African Broad-Based Socio Economic Empowerment Charter for the Mining and Minerals Industry, 2018.

"Mining Codes" refers to the Codes of Good Practice for the South African Minerals Industry, 2009.

"Minister" means the Minister of the Department of Mineral and Petroleum Resources of South Africa.

"Minister of Finance" means the Minister of Finance of South Africa.

"Mnombo" refers to Mnombo Wethu Consultants Proprietary Limited, a South African BEE company.

"MPRDA" means the Mineral and Petroleum Resources Development Act, No. 28 of 2002 of South Africa.

"MPRDA Amendment Act, 2008" means the Mineral and Petroleum Resources Development Amendment Act, No. 49 of 2008, sections of which became effective in 2013.

"MTBPS" means Medium-Term Budget Policy Statement.

"MTRA" means the Mining Titles Registration Act, No. 16 of 1967, South Africa.

"NCOP" means the National Council of Provinces, the upper house of the Parliament of South Africa under the (post-apartheid) Constitution which came into full effect in 1997.

"NEMA" means the Constitution and National Environmental Management Act, No. 107 of 1998 of South Africa.

"NEMA Bill" means the National Environmental Laws Amendment Bill B14D-2017.

"NEMLAA3" means the National Environmental Management Laws Amendment Act, No. 25 of 2014.

"NEMLAA4" means the National Environmental Management Laws Amendment Act, No. 2 of 2022, published on June 24, 2022.

"NEMWA" means the National Environmental Management: Waste Act, No. 59 of 2008 of South Africa.

"Nextraction" refers to Nextraction Energy Corp.

"NI 43-101" refers to National Instrument 43-101 - Standards of Disclosure for Mineral Projects, effective as of June 9, 2023, as adopted by the Canadian Securities Administrators.

"NI 51-102" refers to National Instrument 51-102 - Continuous Disclosure Obligations, effective as of June 9, 2023, as adopted by the Canadian Securities Administrators.

"NI 52-110" refers to National Instrument 52-110 - Audit Committees, effective as of November 17, 2015, as adopted by the Canadian Securities Administrators.

"NWA" means the National Water Act, No. 36 of 1998 of South Africa.

"NYSE American" refers to the NYSE American LLC, an American stock exchange located in New York City, where the Common Shares are traded under the symbol "PLG".

"OECD" refers to the Organisation for Economic Cooperation and Development.

"Offtake ROFR" means Implats' Right of First Refusal to enter into an offtake agreement, matching third party commercial arms-length terms offered to Waterberg JV Co., for the smelting and refining of mineral products from the Waterberg Project.

"Options" means the options to purchase Common Shares of the Company granted to certain eligible persons under the Share Compensation Plan.

"PAJA" refers to the Promotion of Administrative Justice Act, No. 3 of 2000, South Africa.

"Paris Agreement" means the legally binding international treaty on climate change adopted by 196 Parties at the United Nations Climate Change Conference (COP21) in Paris, France on December 12, 2015, and entered into force on November 4, 2016.

"PCC" refers to the Presidential Climate Commission of South Africa.

"Plans" means the Share Compensation Plan and the Deferred Share Unit Plan.

"Precious Metals Act" means the Precious Metals Act, No. 37 of 2005 of South Africa.

"Pre-Construction Work Program" refers to the in principle pre-construction work program approved for the Waterberg Project by the directors and shareholders of Waterberg JV Co. on October 18, 2022, amounting to approximately $21.0 million.

"Pre-MPRDA Amendment Act Environmental Provisions" means the majority of the MPRDA's environmental regulation provisions which were deleted from the environmental mining legislation as a result of the transition of the primary environmental regulation of mining from the MPRDA to NEMA.

"PTM RSA" refers to Platinum Group Metals (RSA) Proprietary Limited, a wholly owned South African subsidiary of Platinum Group.

"QEF Election" refers to a qualified electing fund election that may be done by a U.S. taxpayer to mitigate certain tax consequences under the Internal Revenue Code of 1986, as amended.

"RBPlat" refers to Royal Bafokeng Platinum Limited.

"Rehabilitation and Closure Liability" means the MPRDA provision pursuant to which a mineral right holder remains liable for any environmental liability, pollution, ecological degradation, the pumping and treatment of extraneous water, compliance to the conditions of the EA and the management and sustainable closure of a mine, until the Minister has issued a closure certificate.

"Restitution Act" means the Restitution of Land Rights Act, No. 22 of 1994, South Africa.

"Restitution Amendment Act" refers to the Restitution of Land Rights Amendment Act, No. 15 of 2014, South Africa.

"Restoration" means the return of dispossessed land in South Africa that may be granted to a successful claimant pursuant to the Restitution Act.

"Royalty Act" collectively means the Mineral and Petroleum Resources Royalty Act, No. 28 of 2008 and Mineral and Petroleum Resources Royalty (Administration) Act, No. 29 of 2008 of South Africa.

"RSUs" means Restricted Share Units, rights awarded to certain eligible persons to receive Common Shares that become vested in accordance with the Share Compensation Plan.

"SARB" refers to the South African Reserve Bank.

"SEC" refers to the Securities and Exchange Commission, a U.S. government oversight agency responsible for regulating the securities markets and protecting investors.

"SETs" refers to the sectoral emission targets under the Paris Agreement

"Share Compensation Plan" means the Company's Share Compensation Plan (as amended) to provide for the award of RSUs and grant of Options to the directors, executive officers, key employees and consultants of the Company and its subsidiaries.

"Shelf Prospectus" means the Company's final short form base shelf prospectus dated November 13, 2024, filed with the securities regulatory authorities in each of the provinces and territories of Canada.

"S-K 1300" means Subpart 229.1300 of Regulation S-K, Disclosure by Registrants Engaged in Mining Operations, and Item 601(b)(96) Technical Report Summary, of Regulation S-K.

"SLP" refers to Social and Labour Plan, a document which South Africa's DMR requires and approves when a company wishes to apply for and maintain a right to mine in any given area within South Africa.

"Smelter DFS" refers to the definitive feasibility study for the construction and operation of a PGE smelter and BMR in Saudi Arabia as set out in the Cooperation Agreement.

"SPLUMA" refers to the Spatial Planning and Land Use Management Act, No. 16 of 2013, South Africa.

"Sprott Facility" means the $20 million senior secured credit facility dated August 15, 2019, with Sprott Private Resource Lending II (Collector), LP and other lenders party thereto which was to mature on August 14, 2022, but was fully repaid in February 2022.

"SRA" refers to the Sponsored Research Agreement between Lion Battery and the FIU Board of Trustees dated July 12, 2019 (as amended).

"Stage Four Budget" means the stage four budget of $1.35 million for continued work on the Waterberg Project as approved by the directors, and shareholders of Waterberg JV Co. on April 3, 2024.

"Stage Three Budget" refers to the stage three budget of approximately $1.65 million for continued work on the Waterberg Project as approved by the directors, and shareholders (with Implats abstaining) of Waterberg JV Co. on December 11, 2023.

"Stage Two Budget" means the stage two budget of $3.6 million for continued work on the Waterberg Project as approved by the directors, and shareholders of Waterberg JV Co. on March 24, 2023.

"Stantec" refers to Stantec Consulting International Ltd.

"Stipulated Distribution" means, for purposes of the Mining Charter 2018:

(i) a minimum of 5% non-transferable carried interest to qualifying employees from the effective date of a mining right. The definition of qualifying employees excludes employees who already own shares in the Company as a condition of their employment, except where such is a "Mining Charter" requirement;

(ii) a minimum of 5% non-transferable carried interest from the effective date of a mining right, or a minimum 5% equity equivalent benefit; and

(iii) a minimum of 20% shareholding to a BEE entrepreneur, of which 5% must preferably be for women.

"Tax Act" refers to the Income Tax Act (Canada).

"Trumping Provision" means the provisions in section 3(2) set out in the BEE Amendment Act.

"TSX" refers to the Toronto Stock Exchange, a Canadian stock exchange located in Toronto, Ontario, where the Common Shares are traded under the symbol "PTM".

"Updated NDC" means Updated Nationally Determined Contributions.

"Waterberg DFS" means the NI 43-101 technical report entitled "Independent Technical Report, Waterberg Project Definitive Feasibility Study and Mineral Resource Update, Bushveld Complex, South Africa" dated October 4, 2019, with an effective date of resources and reserves of September 4, 2019.

"Waterberg DFS Update" means the NI 43-101 and S-K 1300 technical report entitled "Waterberg Definitive Feasibility Study Update, Bushveld Igneous Complex, Republic of South Africa" dated October 9, 2024, with an effective date of resources and reserves of August 31, 2024.

"Waterberg JV Co." refers to Waterberg JV Resources Proprietary Limited, a subsidiary of PTM RSA.

"Waterberg Mining Right" refers to the mining right for the Waterberg Project granted by the DMR on January 28, 2021.

"Waterberg Project" refers to the deposit area discovered by the Company on the Waterberg property located on the Northern Limb of the Bushveld Complex, approximately 85 km north of the town of Mokopane, South Africa.

"Waterberg Shareholders Agreement" refers to the Shareholder Agreement in respect to Waterberg JV Co. concluded on or about October 16, 2017, between Implats, Platinum Group, PTM RSA, Mnombo, JOGMEC, Tiger Gate Platinum (RF) Proprietary Limited and acceded to by Hanwa on December 19, 2018, and by HJM on July 7, 2023.

"Waterberg SLP" refers to the Waterberg Social and Labour Plan granted on January 28, 2021, and registered on July 6, 2021.

"Wesizwe" refers to Wesizwe Platinum Ltd., Africa Wide's parent company.

"Whistleblower Policy" means the policy which outlines procedures for the confidential, anonymous submissions by Covered Persons regarding Accounting Concerns, without fear of retaliation of any kind.

"WML" means waste management licence.

"WUL" means water use licence.

"WVM" refers to West Vault Mining Inc.

1.2 ABBREVIATIONS AND GLOSSARY OF MINING TERMS

The following is a list of abbreviations and a glossary of certain mining terms used in this AIF:

"3E" refers to platinum, palladium and gold, collectively.

"4E" refers platinum, palladium, rhodium and gold, collectively.

"anorthosite" is an intrusive igneous rock characterized by a predominance of plagioclase feldspar (90-100%), and a minimal mafic component (0-10%). Pyroxene, ilmenite, magnetite, and olivine are the mafic minerals most commonly present.

"assay" is an analysis to determine the quantity of one or more elemental components.

"Au" refers to gold.

"cm" is an abbreviation for centimetres.

"CO2-eq" is an abbreviation for carbon dioxide equivalent.

"Cu" refers to copper.

"deposit" is a mineralized body, which has been physically delineated by sufficient drilling, trenching, and/or underground work, and found to contain a sufficient average grade of metal or metals to warrant further exploration and/or development expenditures. Such a deposit does not qualify as a commercially mineable ore body or as containing ore reserves, until final legal, technical, and economic factors have been resolved.

"diamond drill" is a type of rotary drill in which the cutting is done by abrasion rather than percussion. The cutting bit is set with diamonds and is attached to the end of the long hollow rods through which water is pumped to the cutting face. The drill cuts a core of rock that is covered in long cylindrical sections, an inch or more in diameter.

"fault" is a fracture in a rock across which there has been displacement.

"felsites" refers to an igneous rock that contains a group of light-colored silicate minerals, including feldspar, feldspathoid, quartz, and muscovite.

"fracture" is a break in a rock, usually along flat surfaces.

"g/t" refers to grams per tonne.

"gabbro" is an intrusive rock comprised of a mixture of mafic minerals and feldspars.

"grade" is the concentration of an ore metal in a rock sample, given either as weight percent for base metals (i.e., Cu, Zn, Pb) or in grams per tonne (g/t) or ounces per short ton (oz/t) for precious or platinum group metals.

"ha" is an abbreviation for hectare.

"harzburgite" is a variety of peridotite consisting mostly of the two minerals, olivine and low-calcium (Ca) pyroxene (enstatite). It commonly contains a few percent chromium-rich spinel as an accessory mineral.

"hectare" is an area totaling 10,000 square metres or 100 metres by 100 metres.

"intrusive" is a rock mass formed below earth's surface from molten magma, which was intruded into a pre-existing rock mass and cooled to solid.

"km" refers to kilometres.

"kriging" is the numerical modeling by applying statistics to resource calculations (or other earth sciences problems). The method recognizes that samples are not independent and that spatial continuity between samples exists.

"m" refers to metres.

"mafic" is a rock type consisting of predominantly iron and magnesium silicate minerals with little quartz or feldspar minerals.

"magmatic" means pertaining to magma, a naturally occurring silicate melt, which may contain suspended silicate crystals, dissolved gases, or both; magmatic processes are at work under the earth's crust.

"Merensky" means the Merensky Reef, a distinct layer or reef comprising the Bushveld Complex which occurs around the Western Limb of the Bushveld Complex.

"mineralization" refers to minerals of value occurring in rocks.

"ML/day" refers to megalitre/day.

"MVA" refers to megavolt ampere.

"MWR" refers to megawatts refrigeration.

"Ni" is an abbreviation for nickel.

"olivine" is a mineral silicate of iron and magnesium, principally (Mg, Fe)2SiO4, found in igneous and metamorphic rocks and used as a structural material in refractories and in cements.

"ounce" or "oz" refers to a troy ounce having a weight of 31.103 grams.

"outcrop" refers to an exposure of rock at the earth's surface.

"Pd" refers to palladium.

"pegmatoid" is an igneous rock that has the coarse-grained texture of a pegmatite but that lacks graphic intergrowths or typically granitic composition.

"PGE" refers to mineralization containing platinum group elements, i.e., platinum, palladium, rhodium and gold.

"PGM" refers to platinum group metals, i.e., platinum, palladium, rhodium and gold.

"plagioclase" is a form of feldspar consisting of aluminosilicates of sodium and/or calcium, common in igneous rocks and typically white.

"Platreef" means the Platreef, a distinct layer or reef comprising the Bushveld Complex found within the Northern Limb of the Bushveld Complex.

"Pt" refers to platinum.

"pyroxenite" refers to a relatively uncommon dark-coloured rock consisting chiefly of pyroxene; pyroxene is a type of rock containing sodium, calcium, magnesium, iron, titanium and aluminum combined with oxygen.

"Qualified Person" or "QP" as used in this AIF means a Qualified Person as that term is defined in NI 43-101 and S-K 1300.

"quartz" is a common rock-forming mineral (SiO2).

"quartzite" is an extremely compact, hard, granular rock consisting essentially of quartz. It often occurs as silicified sandstone, as in sarsen stones.

"Rh" refers to rhodium.

"stope" is an underground excavation from which ore has been extracted.

"tailings" is the material that remains after all metals considered economic have been removed from ore during milling.

"tonne" refers to a metric tonne having a weight of 1,000 kilograms or 2,205 pounds.

"troctolite" is a gabbro made up mainly of olivine and calcic plagioclase, often having a spotted appearance likened to a trout's back.

"UG2" refers to Upper Group 2 Chromitite Layer or Reef, a distinct layer or reef comprising the Bushveld Complex which occurs around the Eastern Limb of the Bushveld Complex.

"ultramafic" refers to types of rock containing relatively high proportions of the heavier elements such as magnesium, iron, calcium and sodium; these rocks are usually dark in colour and have relatively high specific gravities.

ITEM 2 PRELIMINARY NOTES

2.1 DATE OF INFORMATION

All information in this AIF is as of August 31, 2024, unless otherwise indicated.

2.2 FINANCIAL INFORMATION

All financial information in this AIF is derived from the Financial Statements which have been prepared in accordance with IFRS Accounting Standards. A copy of the Financial Statements may be obtained online at www.sedarplus.ca.

2.3 CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This AIF and the documents incorporated by reference herein contain Forward-Looking Statements. All statements, other than statements of historical fact, that address activities, events or developments that the Company believes, expects or anticipates will, may, could or might occur in the future are Forward-Looking Statements. The words "expect", "anticipate", "estimate", "forecast", "may", "could", "might", "will", "would", "should", "intend", "believe", "target", "budget", "plan", "strategy", "goals", "objectives", "projection" or the negative of any of these words and similar expressions are intended to identify Forward-Looking Statements, although these words may not be present in all Forward-Looking Statements. Forward-Looking Statements included or incorporated by reference in this AIF include, without limitation, statements with respect to:

• the timely completion of additional required financings and potential terms thereof;

• the completion of appropriate contractual smelting and/or refining arrangements with Implats or another third party smelter/refiner;

• the projections set forth or incorporated into, or derived from, the Waterberg DFS Update, including, without limitation, estimates of mineral resources and mineral reserves, and projections relating to future prices of metals, commodities and supplies, currency rates, capital and operating expenses, production rate, grade, recovery and return, and other technical, operational and financial forecasts;

• the approval of a WUL and environmental permits for, and other developments related to, a deposit area discovered by the Company on the Waterberg Project;

• the Company's expectations with respect to the outcome of a review application in the High Court to set aside a decision by the Environmental Minister of the DFFE to refuse condonation for the late filing of the appeal by individuals from a community group against the grant of an EA for the Waterberg Project;

• the Company's expectations with respect to the outcome of the March 7, 2024 application in the High Court seeking to declare invalid the grant of the Waterberg Mining Right by the DMR on January 28, 2021;

• the negotiation and execution of long term access agreements, on reasonable terms, with communities recognized as titled landowners of three farms where surface and underground mine infrastructure is planned, and rezoning for mining use;

• the development of performance indicators to measure and monitor key environmental, social sustainability and governance activities at the Waterberg Project;

• the ability of state electricity utility ESKOM to supply sufficient power to the Waterberg Project;

• risks related to geopolitical events and other uncertainties, such as Russia's invasion in Ukraine and conflict in the Middle East;

• the adequacy of capital, financing needs and the availability of and potential for obtaining further capital;

• the ability or willingness of the shareholders of Waterberg JV Co. to fund their pro rata portion of the funding obligations for the Waterberg Project;

• revenue, cash flow and cost estimates and assumptions;

• future events or future performance;

• development of next generation battery technology by Lion Battery, the Company's battery technology joint venture (described below);

• potential benefits of Lion Battery engaging BIC;

• governmental and securities exchange laws, rules, regulations, orders, consents, decrees, provisions, charters, frameworks, schemes and regimes, including interpretations of and compliance with the same;

• developments in South African politics and laws relating to the mining industry;

• anticipated exploration, development, construction, production, permitting and other activities on the Company's properties;

• project economics;

• future metal prices and currency exchange rates;

• the identification of several large-scale water basins that could provide mine process and potable water for the Waterberg Project and local communities;

• the Company's expectations with respect to the outcomes of litigation;

• mineral reserve and mineral resource estimates;

• potential changes in the ownership structures of the Company's projects;

• the Company's ability to license certain intellectual property;

• the potential use of alternative renewable energy sources for the Waterberg Project; and

• future assistance from the MEC in regard to the Company's engagements with local communities.

Forward-Looking Statements reflect the current expectations or beliefs of the Company based on information currently available to the Company. Forward-Looking Statements in respect of capital costs, operating costs, production rate, grade per tonne and concentrator and smelter recovery are based upon the estimates in the technical report referred to in this AIF and in the documents incorporated by reference herein and ongoing cost estimation work, and the Forward-Looking Statements in respect of metal prices and exchange rates are based upon the three year trailing average prices and the assumptions contained in such technical report and ongoing estimates.

Forward-Looking Statements are subject to a number of risks and uncertainties that may cause the actual events or results to differ materially from those discussed in the Forward-Looking Statements, and even if events or results discussed in the Forward-Looking Statements are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on, the Company. Factors that could cause actual results or events to differ materially from current expectations include, among other things:

• the Company’s ability to continue as a going concern;

• the Company's additional financing requirements;

• the effect of future debt financing on the Company and its financial condition;

• the Company's history of losses and expectations that will continue to incur losses until the Waterberg Project reaches commercial production on a profitable basis, which may never occur;

• the Company's negative operating cash flow;

• uncertainty of estimated mineral reserve and mineral resource estimates, production, development plans and cost estimates for the Waterberg Project;

• the Company's ability to bring properties into a state of commercial production;

• the potential impact of international conflict, geopolitical tensions and events, and international operations on the Company;

• discrepancies between actual and estimated mineral reserves and mineral resources, between actual and estimated development and operating costs, between actual and estimated metallurgical recoveries and between estimated and actual production;

• the potential impact of international conflict and geopolitical tensions and events on the Company;

• fluctuations in the relative values of the U.S. Dollar, the Rand and the Canadian Dollar;

• volatility in metals prices;

• the possibility that the Company may become subject to the Investment Company Act;

• Implats or another third party may not enter into appropriate contractual smelting and/or refining arrangements with Waterberg JV Co.;

• the ability of the Company to acquire the necessary surface access rights on commercially acceptable terms or at all;

• the ability of South Africa's state-owned electricity utility ESKOM to supply sufficient power to the Waterberg Project;

• the failure of the Company or the other shareholders of Waterberg JV Co. to fund their pro rata share of funding obligations for the Waterberg Project;

• any disputes or disagreements with the Company's other shareholders of Waterberg JV Co. or Mnombo;

• the Company is subject to assessment by various taxation authorities, who may interpret tax legislation in a manner different from the Company, which may negatively affect the final amount or the timing of the payment or refund of taxes;

• the Company's ability to attract and retain its key management employees;

• contractor performance and delivery of services, changes in contractors or their scope of work or any disputes with contractors;

• conflicts of interest among the Company's officers and directors;

• any designation of the Company as a "passive foreign investment company" for its current and future tax years and potential adverse U.S. federal income tax consequences for U.S. shareholders;

• litigation or other legal or administrative proceedings brought against or relating to the Company, including the review application in the High Court to set aside a decision by the Environmental Minister of the DFFE to refuse condonation for the late filing of the appeal by individuals from a community group against the grant of an EA for the Waterberg Project and the March 7, 2024 application in the High Court seeking to declare invalid the grant of the Waterberg Mining Right by the DMR;

• information systems and cyber security risks;

• actual or alleged breaches of governance processes or instances of fraud, bribery or corruption;

• exploration, development and mining risks and the inherently dangerous nature of the mining industry, including environmental hazards, industrial accidents, unusual or unexpected formations, safety stoppages (whether voluntary or regulatory), pressures, mine collapses, cave ins or flooding and the risk of inadequate insurance or inability to obtain insurance to cover these risks and other risks and uncertainties;

• property zoning and mineral title risks including defective title to mineral claims or property;

• changes in national, provincial and local government legislation, taxation, controls, regulations and political or economic developments in Canada, South Africa or other countries in which the Company does or may carry out business in the future;

• equipment shortages and the ability of the Company to acquire the necessary infrastructure for its mineral properties;

• environmental regulations and the ability to obtain and maintain necessary permits, including EAs and WULs;

• extreme competition in the mineral exploration industry;

• delays in obtaining, or a failure to obtain, permits necessary for current or future operations or failures to comply with the terms of such permits;

• any adverse decision in respect of the Company's mineral rights and projects in South Africa under the MPRDA;

• risks of doing business in South Africa, including but not limited to, labour, economic and political instability and potential changes to and failures to comply with legislation;

• the failure to maintain or increase equity participation by historically disadvantaged South Africans in the Company's prospecting and mining operations and to otherwise comply with relevant BEE laws and the Mining Charter 2018;

• certain potential adverse Canadian tax consequences for foreign-controlled Canadian companies that acquire Common Shares of the Company;

• socio economic instability in South Africa or regionally, including risks of resource nationalism;

• labour disruptions and increased labour costs;

• interruptions, shortages or cuts in the supply of electricity or water;

• characteristics of and changes in the tax and royalties systems in South Africa;

• a change in community relations;

• opposition from local and international groups, and/or the media;

• South African foreign exchange controls impacting repatriation of profits;

• land restitution claims or land expropriation;

• restriction on dividend payments;

• the risk that the Common Shares may be delisted;

• volatility in the price of the Common Shares;

• the exercise or settlement of Options, RSUs or warrants resulting in dilution to the holders of Common Shares;

• future sales of equity securities decreasing the value of the Common Shares, diluting investors' voting power, and reducing our earnings per share;

• enforcing judgments based on the civil liability provisions of United States federal securities laws;

• pandemics and other public health crises;

• global financial conditions;

• that the Company may be a "passive foreign investment company" for its current and future tax years;

• government imposed shutdowns or expense increases;

• water licence risks; and

• other risks disclosed under Item 5.5 Risk Factors in this AIF.

These factors should be considered carefully, and investors should not place undue reliance on the Company's Forward-Looking Statements. In addition, although the Company has attempted to identify important factors that could cause actual actions or results to differ materially from those described in Forward-Looking Statements, there may be other factors that cause actions or results not to be as anticipated, estimated or intended.

The mineral resource and mineral reserve figures referred to in this AIF and the documents incorporated herein by reference are estimates and no assurances can be given that the indicated levels of Pt, Pd, Rh and Au will be produced. Such estimates are expressions of judgment based on knowledge, mining experience, analysis of drilling results and industry practices. Valid estimates made at a given time may significantly change when new information becomes available. By their nature, mineral resource and mineral reserve estimates are imprecise and depend, to a certain extent, upon statistical inferences which may ultimately prove unreliable. Any inaccuracy or future reduction in such estimates could have a material adverse impact on the Company.

Any Forward-Looking Statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any Forward-Looking Statement, whether as a result of new information, future events or results or otherwise.

2.4 RESERVE AND MINERAL RESOURCE DISCLOSURE

Mineral resources that are not mineral reserves do not have demonstrated economic viability. Confidence in an inferred mineral resource estimate is insufficient to allow meaningful application of the technical and economic parameters to enable an evaluation of economic viability sufficient for public disclosure, except in certain limited circumstances set out in NI 43-101. The mineral resource and mineral reserve figures referred to in this AIF and the documents incorporated herein by reference are estimates and no assurances can be given that the indicated levels of platinum, palladium, rhodium and gold will be produced. Such estimates are expressions of judgment based on knowledge, mining experience, analysis of drilling results and industry practices. Valid estimates made at a given time may significantly change when new information becomes available. By their nature, mineral resource and mineral reserve estimates are imprecise and depend, to a certain extent, upon statistical inferences which may ultimately prove unreliable. Any inaccuracy or future reduction in such estimates could have a material adverse impact on the Company.

Units of Conversion

The following table sets forth certain standard conversions from the International System of Units (metric units) to the Standard Imperial Units:

|

Conversion Table

|

|

Metric

|

|

Imperial

|

|

1.0 millimetre (mm)

|

=

|

0.039 inches (in)

|

|

1.0 metre (m)

|

=

|

3.28 feet (ft)

|

|

1.0 kilometre (km)

|

=

|

0.621 miles (mi)

|

|

1.0 hectare (ha)

|

=

|

2.471 acres (ac)

|

|

Conversion Table

|

|

1.0 gram (g)

|

=

|

0.032 troy ounces (oz)

|

|

1.0 metric tonne (t)

|

=

|

1.102 short tons (ton)

|

|

1.0 g/t

|

=

|

0.029 oz/ton

|