Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

29 Novembre 2024 - 5:48PM

Edgar (US Regulatory)

RENN Fund, Inc.

Consolidated Schedule of Investments

As of September 30, 2024 (Unaudited)

Shares or

Principal

Amount | | |

Company | |

Cost | | |

Value | |

| | | | |

MONEY MARKET FUNDS – 26.74% | |

| | | |

| | |

| | 92,578 | | |

Fidelity Government Cash Reserves Portfolio - Institutional Class, 4.63% | |

$ | 92,578 | | |

$ | 92,578 | |

| | 4,488,793 | | |

Fidelity Investment Money Market Funds Government Portfolio - Institutional Class, 4.83% | |

| 4,488,793 | | |

| 4,488,793 | |

| | | | |

Total Money Market Funds | |

| 4,581,371 | | |

| 4,581,371 | |

| | | | |

| |

| | | |

| | |

| | | | |

CONVERTIBLE BONDS – 0.00% | |

| | | |

| | |

| | | | |

Oil and Gas – 0.00% | |

| | | |

| | |

| | 1,000,000 | | |

PetroHunter Energy Corporation 8.50% Maturity 12/31/2014(1)(2)(5) | |

| 540,225 | | |

| - | |

| | | | |

Total Convertible Bonds | |

| 540,225 | | |

| - | |

| | | | |

| |

| | | |

| | |

| | | | |

COMMON EQUITIES – 72.24% | |

| | | |

| | |

| | | | |

Accomodations – 0.32% | |

| | | |

| | |

| | 2,000 | | |

Civeo Corp. | |

| 54,150 | | |

| 54,800 | |

| | | | |

| |

| | | |

| | |

| | | | |

Asset Management – 0.20% | |

| | | |

| | |

| | 973 | | |

Associated Capital Group, Inc. - Class A | |

| 40,594 | | |

| 34,464 | |

| | | | |

| |

| | | |

| | |

| | | | |

Communication Services – 0.01% | |

| | | |

| | |

| | 100 | | |

IG Port, Inc.(4) | |

| 1,229 | | |

| 1,441 | |

| | | | |

| |

| | | |

| | |

| | | | |

Financial Services – 0.04% | |

| | | |

| | |

| | 500 | | |

DigitalBridge Group, Inc. | |

| 7,250 | | |

| 7,065 | |

| | 2 | | |

White Mountains Insurance Group, Inc. | |

| 3,456 | | |

| 3,392 | |

| | | | |

| |

| 10,706 | | |

| 10,457 | |

| | | | |

| |

| | | |

| | |

| | | | |

Hospitality – 0.84% | |

| | | |

| | |

| | 7,300 | | |

Carnival Corp.(2) | |

| 104,635 | | |

| 134,904 | |

| | 50 | | |

Royal Caribbean Ltd. | |

| 2,940 | | |

| 8,868 | |

| | | | |

| |

| 107,575 | | |

| 143,772 | |

| | | | |

| |

| | | |

| | |

| | | | |

Metal Mining – 3.50% | |

| | | |

| | |

| | 580 | | |

Franco-Nevada Corp. | |

| 83,192 | | |

| 72,065 | |

| | 18,858 | | |

Mesabi Trust | |

| 517,197 | | |

| 427,134 | |

| | 1,640 | | |

Wheaton Precious Metals Corp. | |

| 68,954 | | |

| 100,171 | |

| | | | |

| |

| 669,343 | | |

| 599,370 | |

| | | | |

| |

| | | |

| | |

| | | | |

Medicinal Chemicals and Botanical Products – 14.77% | |

| | | |

| | |

| | 77,228 | | |

FitLife Brands, Inc.(2) | |

| 9,131,688 | | |

| 2,528,445 | |

| | | | |

| |

| | | |

| | |

| | | | |

Oil and Gas – 37.92% | |

| | | |

| | |

| | 1,400 | | |

Liberty Energy, Inc. | |

| 27,247 | | |

| 26,726 | |

| | 21,448 | | |

Landbridge Company LLC(2) | |

| 368,273 | | |

| 839,046 | |

| | 19,315 | | |

Permian Basin Royalty Trust | |

| 299,138 | | |

| 229,655 | |

| | 808,445 | | |

PetroHunter Energy Corporation(1)(2)(5) | |

| 101,056 | | |

| - | |

| | 16,302 | | |

PrairieSky Royalty Ltd.(4) | |

| 207,008 | | |

| 331,343 | |

| | 100 | | |

Sabine Royalty Trust | |

| 8,002 | | |

| 6,177 | |

| | 5,724 | | |

Texas Pacific Land Corp. | |

| 1,079,738 | | |

| 5,064,252 | |

| | | | |

| |

| 2,090,462 | | |

| 6,497,199 | |

| | | |

Other Financial Investment Activities – 1.93% | |

| | |

| |

| | 76,000 | | |

Urbana Corp.(4) | |

| 271,870 | | |

| 304,000 | |

| | 6,700 | | |

Urbana Corp. Class A(4) | |

| 22,434 | | |

| 26,354 | |

| | | | |

| |

| 294,304 | | |

| 330,354 | |

| | | | |

| |

| | | |

| | |

| | | | |

Securities and Commodity Exchanges – 1.13% | |

| | | |

| | |

| | 720 | | |

Bakkt Holdings, Inc.(2) | |

| 16,978 | | |

| 6,890 | |

| | 0 | | |

CNSX Markets, Inc.(2)(3)(4) | |

| 13,502 | | |

| 13,619 | |

| | 240 | | |

Intercontinental Exchange, Inc.(4) | |

| 30,806 | | |

| 38,554 | |

| | 14,000 | | |

Miami International Holdings, Inc.(1)(2)(3) | |

| 105,000 | | |

| 134,260 | |

| | | | |

| |

| 166,286 | | |

| 193,323 | |

| | | | |

| |

| | | |

| | |

| | | | |

Securities, Commodity Contracts, and Other Financial Investments and Related Activities – 2.41% | |

| | | |

| | |

| | 7,290 | | |

Grayscale Bitcoin Mini Trust(2) | |

| 30,362 | | |

| 41,043 | |

| | 4 | | |

Grayscale Ethereum Classic Trust(2) | |

| 46 | | |

| 32 | |

| | 7,282 | | |

Grayscale Bitcoin Trust(2) | |

| 249,806 | | |

| 367,741 | |

| | 114 | | |

iShares Bitcoin Trust(2) | |

| 4,037 | | |

| 4,119 | |

| | 4 | | |

iShares Silver Trust ETF(2) | |

| 111 | | |

| 114 | |

| | | | |

| |

| 284,362 | | |

| 413,049 | |

| | | | |

| |

| | | |

| | |

| | | | |

Live Sports (Spectator Sports) – 1.63% | |

| | | |

| | |

| | 5,091 | | |

Big League Advance, LLC.(1)(2)(3) | |

| 280,000 | | |

| 280,005 | |

| | | | |

| |

| | | |

| | |

| | | | |

Surgical & Medical Instruments & Apparatus – 4.45% | |

| | | |

| | |

| | 615,000 | | |

Apyx Medical Corp.(2) | |

| 1,470,958 | | |

| 762,600 | |

| | | | |

| |

| | | |

| | |

| | | | |

Technology Services – 3.09% | |

| | | |

| | |

| | 1,048 | | |

CACI International, Inc. – Class A. (2) | |

| 296,486 | | |

| 528,779 | |

| | | | |

| |

| | | |

| | |

| | | | |

Total Common Equities | |

| 14,898,143 | | |

| 12,378,058 | |

| | | | |

| |

| | | |

| | |

| | | | |

OPEN ENDED MUTUAL FUNDS – 0.14% | |

| | | |

| | |

| | 824 | | |

Kinetics Spin-Off and Corporate Restructuring Fund(6) | |

| 13,168 | | |

| 23,723 | |

| | | | |

Total Open Ended Mutual Funds | |

| 13,168 | | |

| 23,723 | |

| | | | |

| |

| | | |

| | |

| | | | |

PREFERRED STOCKS – 1.08% | |

| | | |

| | |

| | 30,966 | | |

Diamond Standard, Inc.(1)(2)(3) | |

| 185,798 | | |

| 185,798 | |

| | | | |

Total Preferred Stocks | |

| 185,798 | | |

| 185,798 | |

| | | | |

| |

| | | |

| | |

| | | | |

WARRANTS – 0.03% | |

| | | |

| | |

| | | | |

Diamond Standard, Inc., Exercise Price: $9.00, | |

| | | |

| | |

| | 837 | | |

Expiration Date: January 15, 2026(1)(2)(3) | |

| - | | |

| - | |

| | | | |

Miami International Holdings, Inc., Exercise Price: $7.50, | |

| | | |

| | |

| | 2,132 | | |

Expiration Date: March 31, 2026(1)(2)(3) | |

| - | | |

| 5,287 | |

| | | | |

Total Warrants | |

| - | | |

| 5,287 | |

| | | | |

| |

| | | |

| | |

| | | | |

TOTAL INVESTMENTS – 100.23% | |

$ | 20,218,705 | | |

$ | 17,174,237 | |

| | | | |

LIABILITIES LESS OTHER ASSETS – -0.23% | |

| | | |

| (40,089 | ) |

| | | | |

NET ASSETS - 100.00% | |

| | | |

$ | 17,134,148 | |

Shares or

Principal

Amount | | |

Company | |

Proceeds | | |

Value | |

| | | | |

SECURITIES SOLD SHORT – 0.05% | |

| | | |

| | |

| | | | |

EXCHANGE TRADED FUNDS – 0.05% | |

| | | |

| | |

| | (473 | ) | |

Direxion Daily Gold Miners Index Bear 2X Shares ETF | |

| (4,520 | ) | |

| (2,526 | ) |

| | (101 | ) | |

Direxion Daily Junior Gold Miners Index Bear 2X Shares ETF | |

| (4,266 | ) | |

| (2,666 | ) |

| | (311 | ) | |

Direxion Daily S&P Biotech Bear 3X Shares ETF | |

| (2,287 | ) | |

| (1,816 | ) |

| | (13 | ) | |

ProShares Ultra VIX Short-Term Futures ETF(2) | |

| (981 | ) | |

| (324 | ) |

| | (2 | ) | |

ProShares Ultra Silver Class ETF(2) | |

| (83 | ) | |

| (81 | ) |

| | (11 | ) | |

ProShares UltraShort ETF(2) | |

| (113 | ) | |

| (105 | ) |

| | (6 | ) | |

ProShares UltraShort Bloomberg Natural Gas ETF(2) | |

| (241 | ) | |

| (331 | ) |

| | (19 | ) | |

ProShares VIX Short-Term Futures ETF(2) | |

| (498 | ) | |

| (233 | ) |

| | | | |

Total Exchange Traded Funds | |

| (12,989 | ) | |

| (8,082 | ) |

| | | | |

| |

| | | |

| | |

| | | | |

EXCHANGE TRADED NOTES – 0.00% | |

| | | |

| | |

| | (15 | ) | |

iPath Series B S&P VIX Short-Term Futures ETN(2) | |

$ | (1,296 | ) | |

$ | (744 | ) |

| | | | |

Total Exchange Traded Notes | |

| (1,296 | ) | |

| (744 | ) |

| | | | |

| |

| | | |

| | |

| | | | |

TOTAL SECURITIES SOLD SHORT – 0.05% | |

$ | (14,285 | ) | |

$ | (8,826 | ) |

| (1) | See Annual Report Note 5 - Fair Value Measurements. |

| (3) | Big League Advance, LLC., CNSX Markets, Inc., Diamond Standard,

Inc. and Miami International Holdings, Inc. are each currently a private company. These securities are illiquid and valued at fair value. |

| (4) | Foreign security denominated in U.S. Dollars. |

| (5) | The PetroHunter Energy Corporation (“PetroHunter”)

securities are in bankruptcy. The securities are valued at fair value. |

| (6) | Affiliated security, given that the security is managed by the

same Investment Advisor as the Fund. |

See accompanying Consolidated Notes to Financial Statements.

RENN Fund, Inc.

CONSOLIDATED NOTES TO FINANCIAL STATEMENTS

As of September 30, 2024 (Unaudited)

Investments in Affiliated Issuers

An affiliated issuer is an entity in which the Fund

has ownership of at least 5% of the voting securities, or any investment which is advised or sponsored by the advisor. In this instance,

affiliation is based on the fact that the Kinetics Spin-off and Corporate Restructuring Fund is advised by Horizon, the same Investment

Advisor to the Fund. Issuers that are affiliates of the Fund at period-end are noted in the Fund’s Schedule of Investments. Additional

security purchases and the reduction of certain securities shares outstanding of existing portfolio holdings that were not considered

affiliated in prior years may result in the Fund owning in excess of 5% of the outstanding shares at period-end. The table below reflects

transactions during the period with entities that are affiliates as of September 30, 2024, and may include acquisitions of new investments,

prior year holdings that became affiliated during the period and prior period affiliated holdings that are no longer affiliated as of

period-end.

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Dividends and Distributions | |

Name of Issuer

and Title of Issue | |

Value

Beginning

of Period | | |

Purchases | | |

Sales

Proceeds | | |

Net

Realized

Gain (Loss) | | |

Change in

Unrealized

Appreciation

(Depreciation) | | |

Value

End of

Period | | |

Capital

Gains | | |

Income | |

| Kinetics Spin-off and Corporate | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Restructuring Fund | |

$ | 15,293 | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | 8,430 | | |

$ | 23,723 | | |

$ | - | | |

$ | - | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total | |

$ | 15,293 | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | 8,430 | | |

$ | 23,723 | | |

$ | - | | |

$ | - | |

| Name of Issuer and Title of Issue | |

Shares

Beginning

of Period | | |

Purchases | | |

Sales

Proceeds | | |

Stock

Split | | |

Shares End of

Period | |

| Kinetics Spin-off and Corporate | |

| | | |

| | | |

| | | |

| | | |

| | |

| Restructuring Fund | |

| 824 | | |

| - | | |

| - | | |

| - | | |

| 824 | |

| Total | |

| 824 | | |

| - | | |

| - | | |

| - | | |

| 824 | |

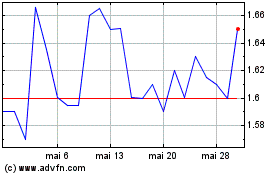

RENN (AMEX:RCG)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

RENN (AMEX:RCG)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024