File pursuant to Rule 424(b)(3)

Under the Securities Act of 1933, as amended

Registration No. 333-271394

PROSPECTUS

SPLASH BEVERAGE GROUP, INC.

3,500,000 Shares of Common Stock

Pursuant to this prospectus, the

selling stockholders identified herein are offering on a resale basis an aggregate of 3,500,000 shares of common stock, par value $0.001

per share, of Splash Beverage Group, Inc., of which (i) 2,000,000 shares are issuable upon conversion of the convertible promissory note,

expiring on February 24, 2024, and (ii) 1,500,000shares of restricted common stock to be issued at the time of conversion. The outstanding

shares of common stock, on an as converted basis were issued to the selling stockholders in connection with a private placement we completed

on March 1, 2023, or the Private Placement. We will not receive any of the proceeds from the sale by the selling stockholders of the common

stock.

The selling stockholders may sell

or otherwise dispose of the common stock covered by this prospectus in a number of different ways and at varying prices. We provide more

information about how the selling stockholders may sell or otherwise dispose of the common stock covered by this prospectus in the section

entitled “Plan of Distribution” on page 6. Discounts, concessions, commissions and similar selling expenses attributable to

the sale of common stock covered by this prospectus will be borne by the selling stockholders. We will pay all expenses (other than discounts,

concessions, commissions and similar selling expenses) relating to the registration of the common stock with the Securities and Exchange

Commission, or the SEC.

You should carefully read this prospectus and any accompanying

prospectus supplement, together with the documents we incorporate by reference, before you invest in our common stock.

Our common stock is currently traded on the NYSE American

under the symbol “SBEV.” Warrants to purchase shares of our Common Stock at an exercise price of $4.60 per share are traded

on the NYSE American under the Symbol SBEV.

On April 17, 2023, the last reported

sales price for our common stock was $1.10 per share. The applicable prospectus supplement will contain information, where applicable,

as to any other listing of the securities on the NYSE American or any other securities market or exchange covered by the prospectus supplement.

Prospective purchasers of our securities are urged to obtain current information as to the market prices of our securities, where applicable.

The securities offered by this prospectus involve

a high degree of risk. See “Risk Factors” beginning on page 4, in addition to Risk Factors contained in the applicable prospectus

supplement.

Neither the Securities and Exchange Commission nor

any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

This prospectus is dated May 1, 2023

Table of Contents

You should rely only on the

information contained or incorporated by reference in this prospectus or any prospectus supplement. We have not authorized anyone to provide

you with information different from that contained or incorporated by reference into this prospectus. If any person does provide you with

information that differs from what is contained or incorporated by reference in this prospectus, you should not rely on it. No dealer,

salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus. You should

assume that the information contained in this prospectus or any prospectus supplement is accurate only as of the date on the front of

the document and that any information contained in any document we have incorporated by reference is accurate only as of the date of the

document incorporated by reference, regardless of the time of delivery of this prospectus or any prospectus supplement or any sale of

a security. These documents are not an offer to sell or a solicitation of an offer to buy these securities in any circumstances under

which the offer or solicitation is unlawful.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration

statement that we filed with the Securities and Exchange Commission, or SEC, using a “shelf” registration process. Under this

shelf registration process, the selling stockholders may sell the securities described in this prospectus in one or more offerings. A

prospectus supplement may add to, update or change the information contained in this prospectus. You should read this prospectus and any

applicable prospectus supplement, together with the information incorporated herein by reference as described under the heading “Information

Incorporated by Reference.“

You should rely only on the information

that we have provided or incorporated by reference in this prospectus and any applicable prospectus supplement. We have not authorized,

nor has any selling stockholder authorized, any dealer, salesman or other person to give any information or to make any representation

other than those contained or incorporated by reference in this prospectus or any applicable prospectus supplement. You should not rely

upon any information or representation not contained or incorporated by reference in this prospectus or any applicable prospectus supplement.

We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you.

This prospectus and any accompanying

prospectus supplement do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the registered

securities to which they relate, nor do this prospectus and any accompanying prospectus supplement constitute an offer to sell or the

solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation

in such jurisdiction. You should not assume that the information contained in this prospectus or any applicable prospectus supplement

is accurate on any date subsequent to the date set forth on the front of the document or that any information we have incorporated by

reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus or any

applicable prospectus supplement is delivered or securities are sold on a later date..

The terms “Splash Beverage

Group,” the “Company,” ”SBG,” “we,” “our,” or “us” or “Splash”

in this prospectus refer to Splash Beverage Group, Inc. and its wholly-owned subsidiaries, unless the context suggests otherwise.

SUMMARY

This summary highlights certain

information appearing elsewhere in this prospectus and in the documents we incorporate by reference into this prospectus. The summary

is not complete and does not contain all of the information that you should consider before investing in our common stock. After you read

this summary, you should read and consider carefully the entire prospectus and any prospectus supplement and the more detailed information

and financial statements and related notes that are incorporated by reference into this prospectus and any prospectus supplement. If you

invest in our shares, you are assuming a high degree of risk.

About Us – Business Overview

We are a portfolio company managing

multiple brands across several growth segments within the consumer beverage industry. Splash has built organizational capabilities and

an infrastructure enabling it to incubate and/or acquire brands with the intention of efficiently accelerating them to higher volumes.

The management team has proven capabilities in building consumer franchises and marketing and distributing multiple brands of beverages

within the non-alcoholic and alcoholic segments. Manufacturing is typically outsourced to third party co-packers and distillers, or in

select cases for a brand such as Copa Di Vino wines, performed within our own facility in Oregon.

We believe

the distribution landscape in the beverage industry is changing rapidly as tech-enabled e-commerce business models are thriving. Direct

to consumer, office or home solutions are projected to continue to gain traction in the future. To address this opportunity we continue

to shape our operating model to be vertically integrated building an e-commerce platform, Qplash, which purchases local and regional brands

for developing a direct line of sales to small retail stores.

Our wholly

owned subsidiary, Splash Beverage Group II, Inc. was originally incorporated in the State of Nevada under the name TapouT Beverages, Inc.

for the purpose of acquiring the rights under a license agreement with TapouT, LLC (Authentic Brands Group). We have license rights to

the TapouT Performance brand in North America (Including US Territories and Military Bases), United Kingdom, Brazil, South Africa, Scandinavia,

Peru, Colombia, Chile and Guatemala.

In addition,

we have a joint venture with SALT Naturally Flavored Tequila, Copa Di Vino wines and Pulpoloco, sangrias that comes in a biodegradable

can. The Company leadership understand the importance of infusing beverage brands with strong pop

culture and lifestyle elements which drives trial, belief and, most importantly, repeat purchases.

Corporate

Information

Our

principle offices are located at 1314 E. Las Olas Blvd, Suite 221, Fort Lauderdale, Florida 33301. Our main telephone number is (954)

745-5815. Our website address is www.splashbeveragegroup.com. Information on our website is not part of this prospectus.

Private Placement

On February 28, 2023, the Company

entered into a securities purchase agreement (the “Purchase Agreement”) with the selling

stockholder. Pursuant to the Purchase Agreement, the Company sold to the selling stockholder a convertible 12-month promissory note (the

“Note”) convertible for up to 2,000,000 shares of the Company’s common stock, $0.001 par value per share and received

aggregate gross proceeds of $2,000,000. The Conversion Price of the Notes is $1 per share subject to adjustments as provided in the Note.

Pursuant to the terms of the Purchase Agreement, the Company will also issue to the selling stockholder an aggregate of 1,500,000 shares

of restricted common stock, at the time of conversion.

The issuance and sale of the shares

of common stock pursuant to the Purchase Agreement were not registered under the Securities Act of 1933, as amended, or the Securities

Act, and were offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act and Regulation D promulgated thereunder.

In the Purchase Agreement, the Company granted the selling stockholders certain registration rights (“Registration Rights”).

Pursuant to the Registration Rights in the Purchase Agreement, the Company agreed to file a registration statement on Form S-3 for the

resale by the selling stockholders’ outstanding shares of common stock that were issued pursuant to the Private Placement, within

45 days from the closing of the Private Placement.

We are filing the registration

statement of which this prospectus forms a part to satisfy our obligations toward the Registration Rights granted under the Purchase Agreement.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus includes forward-looking

statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, or the Exchange

Act. Forward-looking statements give current expectations or forecasts of future events or our future financial or operating performance.

We may, in some cases, use words such as “anticipate,” “believe,” “could,” “estimate,”

“expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,”

“should,” “will,” “would” or the negative of those terms, and similar expressions that convey uncertainty

of future events or outcomes to identify these forward-looking statements.

These forward-looking statements

reflect our management’s beliefs and views with respect to future events, are based on estimates and assumptions as of the date

of this prospectus and are subject to risks and uncertainties, many of which are beyond our control, that could cause our actual results

to differ materially from those in these forward-looking statements. We discuss many of these risks in greater detail in this prospectus

under “Risk Factors” and in our Annual Report on Form 10-K filed with the SEC on March 31, 2023, as well as those described

in the other documents we file with the SEC. Moreover, new risks emerge from time to time. It is not possible for our management to predict

all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may

cause actual results to differ materially from those contained in any forward-looking statements we may make. Given these uncertainties,

you should not place undue reliance on these forward-looking statements.

We undertake no obligation to

publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may

be required by applicable laws or regulations.

RISK FACTORS

An investment in our securities

involves a high degree of risk. Before deciding whether to invest in our securities, you should consider carefully the risks and uncertainties

discussed below, as well as those under the heading “Risk Factors“ contained in our Annual Report on Form 10-K for the year

ended December 31, 2022 as filed with the SEC, and as incorporated by reference in this prospectus, as the same may be amended, supplemented

or superseded by the risks and uncertainties described under similar headings in the other documents that are filed by us after the date

hereof and incorporated by reference into this prospectus. Please also read carefully the section above titled “Cautionary Note

Regarding Forward-Looking Statements.”

The sale of a substantial

amount of our common stock, including resale of the shares of common stock held by the selling stockholders in the public market, could

adversely affect the prevailing market price of our common stock.

We are registering for resale

3,500,000shares of common stock. Sales of substantial amounts of our common stock in the public market, or the perception that such sales

might occur, could adversely affect the market price of our common stock. We cannot predict if and when selling stockholders may sell

such shares in the public market.

USE OF PROCEEDS

We will not receive any of the

proceeds from any sale or other disposition of the shares of common stock covered by this prospectus. All proceeds from the sale of the

shares will be paid directly to the selling stockholders.

SELLING STOCKHOLDERS

The shares of common stock being

offered by the selling stockholders are those issued to the selling stockholders. For additional information regarding the issuances of

those shares of common stock, see the description of the Private Placement in “Summary - Private Placement” above.

We are registering the shares of common stock in order to permit the selling stockholders to offer the shares for resale from time to

time. The selling stockholder has not had any material relationship with us within the past three years. The selling stockholder is not

a broker-dealer or an affiliate of a broker-dealer.

The table below lists the selling

stockholder and other information regarding the beneficial ownership of the shares of common stock held by the selling stockholders. The

second column lists the number of shares of common stock beneficially owned by the selling stockholder, based on its ownership of the

shares of common stock, as of the date of this prospectus, on an as converted basis.

The third column lists the shares

of common stock being offered by this prospectus by the selling stockholder.

In accordance with the terms of

the Purchase Agreement with the selling stockholders, this prospectus generally covers the resale of the sum of the number of shares of

common stock issued to the selling stockholders in the description of the Private Placement referenced above.

The fourth column assumes the

sale of all of the shares offered by the selling stockholders pursuant to this prospectus.

Under the terms of the Note issued

pursuant to the Purchase Agreement, for a period of 12 months from the issuance of the Note the selling stockholder may not sell or dispose

of Common Stock of more than 5% of the daily composite trading volume of the Common Stock as reported by Bloomberg, LP for any trading

day for the principal trading market for the Common Stock. The number of shares in the second column does not reflect this limitation.

The selling stockholders may sell all, some or none of their shares in this offering. See “Plan of Distribution.”

| Name of Selling stockholder | |

Number of Shares of Common Stock Owned Prior to Offering (1) | |

| |

Maximum Number of Shares of Common Stock to be Sold Pursuant to this Prospectus | |

Number of Shares of Common Stock Owned After Offering (2) | |

Percentage of Outstanding Common Stock Owned After the Offering |

| Target Capital 12 LLC(3) | |

| 3,500,000 | | |

| (4 | ) | |

| 3,500,000 | | |

| 0 | | |

| — | |

___________________

| |

(1) |

Under applicable SEC rules, a person is deemed to beneficially own securities which the person has the right to acquire within 60 days through the exercise of any option or warrant or through the conversion of a convertible security. Also under applicable SEC rules, a person is deemed to be the “beneficial owner” of a security with regard to which the person directly or indirectly, has or shares (a) voting power, which includes the power to vote or direct the voting of the security, or (b) investment power, which includes the power to dispose, or direct the disposition, of the security, in each case, irrespective of the person’s economic interest in the security. To our knowledge, subject to community property laws where applicable, each person named in the table has sole voting and investment power with respect to the common stock shown as beneficially owned by such selling stockholder, except as otherwise indicated in the footnotes to the table. |

| |

(2) |

Represents the amount of shares that will be held by the selling stockholder after completion of this offering based on the assumptions that (a) all common stock underlying Private Placement registered for sale by the registration statement of which this prospectus is part will be sold and (b) no other shares of common stock are acquired or sold by the selling stockholder prior to completion of this offering. However, the selling stockholder may sell all, some or none of such shares offered pursuant to this prospectus and may sell other shares of common stock that they may own pursuant to another registration statement under the Securities Act or sell some or all of their shares pursuant to an exemption from the registration provisions of the Securities Act, including under Rule 144. |

| |

(3) |

Dmitriy Shapiro is the managing member of Target Capital 12 LLC. Mr. Shapiro has voting control and investment discretion over securities held by Target Capital 12 LLC. As such, Mr. Shapiro may be deemed to be the beneficial owner (as determined under Section 13(d) of the Securities Exchange Act of 1934, as amended) of the securities held by Target Capital 12 LLC. The business address of the selling stockholder is 144 Hillside Village, Rio Grande, PR 00745. |

| |

(4) |

Ownership prior to the offering represents on an as converted basis the: (i) 2,000,000 shares of common stock issuable upon conversion of the Note, (ii) 1,500,000 shares of restricted common stock, to be issued on such conversion. |

PLAN OF DISTRIBUTION

The selling stockholder of the

securities and any of its pledgees, assignees and successors-in-interest may, from time to time, sell any or all of their securities covered

hereby on the NYSE American LLC or any other stock exchange, market or trading facility on which the securities are traded or in private

transactions. These sales may be at fixed or negotiated prices. However, in accordance with the Note issued pursuant to the Purchase Agreement

dated February 28, 2023, for a period of 12 months from such issuance the selling stockholder may not sell or dispose of Common Stock

of more than 5% of the daily composite trading volume of the Common Stock as reported by Bloomberg, LP for any trading day for the principal

trading market for the Common Stock. For example, if the daily composite trading volume for the day as reported by Bloomberg,

LP is 225,000 shares, the maximum sale by the selling stockholder may not exceed 11,250 shares, on such trading day.

The selling stockholder may use

any one or more of the following methods when selling securities:

| |

● |

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| |

|

|

| |

● |

block trades in which the broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| |

|

|

| |

● |

purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

| |

|

|

| |

● |

an exchange distribution in accordance with the rules of the applicable exchange; |

| |

|

|

| |

● |

privately negotiated transactions; |

| |

|

|

| |

● |

settlement of short sales; |

| |

|

|

| |

● |

in transactions through broker-dealers that agree with the Selling Stockholder to sell a specified number of such securities at a stipulated price per security; |

| |

|

|

| |

● |

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| |

|

|

| |

● |

a combination of any such methods of sale; or |

| |

|

|

| |

● |

any other method permitted pursuant to applicable law. |

The selling stockholder may also

sell securities under Rule 144 or any other exemption from registration under the Securities Act, if available, rather than under this

prospectus.

Broker-dealers engaged by the

selling stockholder may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts

from the selling stockholder (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser) in amounts to

be negotiated, but, except as set forth in a supplement to this Prospectus, in the case of an agency transaction not in excess of a customary

brokerage commission in compliance with FINRA Rule 2440; and in the case of a principal transaction a markup or markdown in compliance

with FINRA IM-2440.

In connection with the sale of

the securities or interests therein, the selling stockholder may enter into hedging transactions with broker-dealers or other financial

institutions, which may in turn engage in short sales of the securities in the course of hedging the positions they assume. The selling

stockholder may also sell securities short and deliver these securities to close out their short positions, or loan or pledge the securities

to broker-dealers that in turn may sell these securities. The selling stockholders may also enter into option or other transactions with

broker-dealers or other financial institutions or create one or more derivative securities which require the delivery to such broker-dealer

or other financial institution of securities offered by this prospectus, which securities such broker-dealer or other financial institution

may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The selling stockholder and any

broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters” within the meaning

of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any

profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts under the Securities

Act. The selling stockholder has informed the Company that it does not have any written or oral agreement or understanding, directly or

indirectly, with any person to distribute the securities.

The Company is required to pay

certain fees and expenses incurred by the Company incident to the registration of the securities. The Company has agreed to indemnify

the selling stockholder against certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

We agreed to keep this prospectus

effective until the earlier of (i) the date on which the securities may be resold by the Selling Stockholder without registration and

without regard to any volume or manner-of-sale limitations by reason of Rule 144, and provided the Company is in compliance with the current

public information under Rule 144 under the Securities Act or any other rule of similar effect or (ii) all of the securities have been

sold pursuant to this prospectus or Rule 144 under the Securities Act or any other rule of similar effect. The resale securities will

be sold only through registered or licensed brokers or dealers if required under applicable state securities laws. In addition, in certain

states, the resale securities covered hereby may not be sold unless they have been registered or qualified for sale in the applicable

state or an exemption from the registration or qualification requirement is available and is complied with.

Under applicable rules and regulations under the Exchange

Act, any person engaged in the distribution of the resale securities may not simultaneously engage in market making activities with respect

to the common stock for the applicable restricted period, as defined in Regulation M, prior to the commencement of the distribution. In

addition, the selling stockholders will be subject to applicable provisions of the Exchange Act and the rules and regulations thereunder,

including Regulation M, which may limit the timing of purchases and sales of the common stock by the selling stockholder or any other

person. We will make copies of this prospectus available to the selling stockholder and have informed it of the need to deliver a copy

of this prospectus to each purchaser at or prior to the time of the sale (including by compliance with Rule 172 under the Securities Act).

LEGAL MATTERS

The validity of the issuance of

the securities offered by this prospectus will be passed upon for us by Sichenzia Ross Ference LLP, New York, New York. Sichenzia Ross

Ference LLP or certain members or employees of Sichenzia Ross Ference LLP have been issued common stock of the Company.

EXPERTS

The consolidated audited financial

statements of Splash Beverage Group, Inc. at and for the years ended December 31, 2022 and 2021 have been audited by Daszkal Bolton LLP,

independent registered public accounting firm, as set forth in their report thereon appearing in our Annual Report on Form 10-K for the

year ended December 31, 2022, and incorporated herein by reference. Such financial statements are incorporated herein by reference in

reliance upon such report given on the authority of such report given on the authority of such firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and

special reports, along with other information with the SEC. Our SEC filings are available to the public over the Internet at the SEC’s

website at http://www.sec.gov. You may also read and copy any document we file at the SEC’s Public Reference Room at 100 F Street,

NE, Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the Public Reference Room.

We have filed with the SEC a registration

statement on Form S-3 under the Securities Act of 1933, as amended, that registers the shares of our common stock covered by this prospectus.

This prospectus does not contain all of the information included in the registration statement, including certain exhibits and schedules.

For further information with respect to us and our common stock, you should refer to the registration statement and the exhibits filed

as a part of the registration statement. Statements contained in or incorporated by reference into this prospectus concerning the contents

of any contract or any other document are not necessarily complete. If a contract or document has been filed as an exhibit to the registration

statement or one of our filings with the SEC that is incorporated by reference into the registration statement, we refer you to the copy

of the contract or document that has been filed. Each statement contained in or incorporated by reference into this prospectus relating

to a contract or document filed as an exhibit is qualified in all respects by the filed exhibit.

You may obtain the registration

statement and exhibits to the registration statement from the SEC at the address listed above or from the SEC’s internet site. We

make available, free of charge, on our website at www.splashbeveragegroup.com, our

Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports and statements

as soon as reasonably practicable after they are filed with the SEC. The contents of our website are not part of this prospectus, and

the reference to our website does not constitute incorporation by reference into this prospectus of the information contained on or through

that site, other than documents we file with the SEC that are specifically incorporated by reference into this prospectus.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The SEC allows us to “incorporate

by reference” into this prospectus the information in documents we file with it, which means that we can disclose important information

to you by referring you to those documents. The information incorporated by reference is considered to be a part of this prospectus, and

information that we file later with the SEC will automatically update and supersede this information. Any statement contained in any document

incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this prospectus

to the extent that a statement contained in or omitted from this prospectus or any accompanying prospectus supplement, or in any other

subsequently filed document which also is or is deemed to be incorporated by reference herein, modifies or supersedes such statement.

Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

We incorporate by reference the

documents listed below and any future documents that we file with the SEC (excluding any portion of such documents that are furnished

and not filed with the SEC) under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (i) after the date of the initial filing of the

registration statement of which this prospectus forms a part prior to the effectiveness of the registration statement and (ii) after the

date of this prospectus until the offering of the securities is terminated:

| ● |

our Annual Report on Form 10-K for the year ended December 31, 2022 filed with the SEC on March 31, 2023; |

| |

|

| ● |

our Current Reports on Form 8-K filed with the SEC on March 15, 2023, January 1, 2023, December 22, 2022, December 16, 2022, November 17, 2022, September 27, 2022, August 16, 2022, May 17, 2022, April 19,2022 and April 1, 2022; |

| |

|

| |

| ● |

the description of our common stock contained in our Registration Statement on Form 8-A filed with the SEC on June 9, 2021 (File No. 001-40471), including any amendment or report filed for the purpose of updating such description; and |

| |

|

| ● |

all reports and other documents subsequently filed by us pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act after the date of this prospectus and prior to the termination of this offering. |

We also incorporate by reference

any future filings (other than information furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits furnished on

such form that are related to such items unless such Form 8-K expressly provides to the contrary) made with the SEC pursuant to Sections 13(a),

13(c), 14 or 15(d) of the Exchange Act, including those made after the date of the initial filing of the registration statement of

which this prospectus is a part and prior to effectiveness of such registration statement, until we file a post-effective amendment that

indicates the termination of the offering of the common stock made by this prospectus and will become a part of this prospectus from the

date that such documents are filed with the SEC. Information in such future filings updates and supplements the information provided in

this prospectus. Any statements in any such future filings will automatically be deemed to modify and supersede any information in any

document we previously filed with the SEC that is incorporated or deemed to be incorporated herein by reference to the extent that statements

in the later filed document modify or replace such earlier statements.

Notwithstanding the foregoing,

information furnished under Items 2.02 and 7.01 of any Current Report on Form 8-K, including the related exhibits, is not incorporated

by reference in this prospectus.

The information about us contained

in this prospectus should be read together with the information in the documents incorporated by reference. You may request a copy of

any or all of these filings, at no cost, by writing or telephoning us at: Dean Huge, Splash Beverage Group, Inc., 1314 E Las Olas Blvd.

Suite 221, Fort Lauderdale, Florida 33301; Telephone number (954) 745-5815.

9

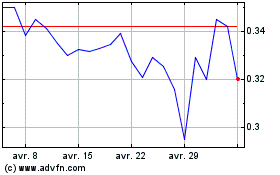

Splash Beverage (AMEX:SBEV)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Splash Beverage (AMEX:SBEV)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024