UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14A-101)

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No.___ )

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2))

[X] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material Pursuant to Section 240.14a-12

SIFCO Industries, Inc.

(NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

_______________________________________________________________

(NAME OF PERSON(S) FILING PROXY STATEMENT, IF OTHER THAN THE REGISTRANT)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

1.Title of each class of securities to which transaction applies: ___________

2.Aggregate number of securities to which transaction applies: __________

3.Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): _______________________

4.Proposed maximum aggregate value of transaction: __________________

5.Total fee paid: _______________________________________________

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

1.Amount Previously Paid: _________________________________________

2.Form, Schedule or Registration Statement No.: ________________________

3.Filing Party: ____________________________________________________

4.Date Filed: __________________________________________

SIFCO Industries, Inc.

970 East 64th Street, Cleveland, Ohio 44103

NOTICE OF 2023 ANNUAL MEETING OF SHAREHOLDERS

The 2023 Annual Meeting of Shareholders of SIFCO Industries, Inc. (the "Company" or "SIFCO") will be held virtually on January 31, 2023 at 9:30 a.m. local time, to consider and vote upon proposals to:

1.Elect six (6) directors, each to serve a one-year term until the 2024 Annual Meeting of Shareholders and/or their successors are duly elected;

2.Ratify the selection of Grant Thornton LLP as the independent registered public accounting firm of the Company for the 2023 fiscal year;

3.Cast a non-binding advisory vote on executive compensation (say-on-pay); and

4.Consider and take action upon such other matters as may properly come before the meeting or any adjournment thereof.

Shareholders will be able to participate in the Annual Meeting online, vote their shares electronically, and submit questions at the meeting by registering at https://www.viewproxy.com/SIFCO/2023/htype.asp.

The holders of record of the Company's shares of common stock (the "Common Shares") at the close of business on December 5, 2022 will be entitled to receive notice of and vote at the virtual meeting.

Instructions for accessing the SIFCO Industries, Inc. Annual Report for the fiscal year ended September 30, 2022 is included with this Notice of Internet Availability of Proxy Materials being sent to shareholders.

Your vote is very important. Whether you intend to attend the virtual meeting or not, you are encouraged to vote, as promptly as possible, over the Internet or by telephone, as instructed in the proxy card.

By order of the Board of Directors.

| | | | | | | | | | | | | | |

| | SIFCO Industries, Inc. | |

| | | | |

| December 22, 2022 | | Megan L. Mehalko, Corporate Secretary |

This proxy statement is dated December 22, 2022 and is being made available to shareholders via the Internet on or about December 22, 2022.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON JANUARY 31, 2023. Our proxy materials include this Proxy Statement, a proxy card, and our 2022 Annual Report, all of which are available free of charge. You may also obtain these materials at the Securities and Exchange Commission ("SEC") website at www.sec.gov.

SIFCO Industries, Inc.

970 East 64th Street, Cleveland, Ohio 44103

PROXY STATEMENT

General Information

The proxy that accompanies this statement is solicited by the Board of Directors of SIFCO Industries, Inc. (the "Company" or "SIFCO") for use at the 2023 Annual Meeting of the Shareholders of the Company (the "Annual Meeting" or the "2023 Annual Meeting"), to be held virtually on January 31, 2023, or at any adjournment thereof. The cost of solicitation of proxies in the form accompanying this statement will be borne by the Company.

Important Notice Regarding the Internet Availability of Proxy Materials for the 2023 Annual Meeting of Shareholders. As permitted by the SEC, the Company is sending a Notice of Internet Availability of Proxy Material (the "Notice") to all shareholders of record as of December 5, 2022. All shareholders will have the ability to access this Proxy Statement and the Company's Annual Report on Form 10-K for the fiscal year ended September 30, 2022 as filed with the SEC on December 22, 2022 on a website referred to in the Notice or to request a printed set of these materials at no charge. Instructions on how to access these materials over the Internet or to request a printed copy may be found in the Notice.

Proxy Material Delivery Requests. Any shareholder may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. Choosing to receive future proxy materials by email will save the Company the cost of printing and mailing documents to shareholders and will reduce the impact of annual meetings on the environment. A shareholder's election to receive proxy materials by email will remain in effect until the shareholder terminates it.

Voting Matters. Any shareholder giving a proxy for the Annual Meeting may revoke it before it is exercised by giving a later dated proxy or by giving notice of revocation to the Company in writing before or at the 2023 Annual Meeting. However, the mere attendance at the 2023 Annual Meeting of the shareholder granting a proxy will not revoke the proxy unless the shareholder votes online at the virtual 2023 Annual Meeting. Unless revoked by notice as above stated, shares represented by valid proxies will be voted on all matters to be acted upon at the 2023 Annual Meeting. On any matter or matters with respect to which the proxy contains instructions for voting, such shares will be voted in accordance with such instructions. Abstentions and broker non-votes will be deemed to be present for the purpose of determining a quorum for the 2023 Annual Meeting. Abstentions will not affect the vote on Proposal No. 1. Brokers who have not received voting instructions from beneficial owners generally may vote in their discretion with respect to the ratification of the selection of the independent registered public accounting firm (Proposal No. 2), but will not be able to vote with respect to Proposal No. 1 and 3. Broker non-votes will not affect the outcome of any proposals brought before the 2023 Annual Meeting.

If you are a shareholder of record as of the applicable record date, you may vote at the virtual Annual Meeting, vote by proxy over the telephone, vote by proxy through the internet, or vote by proxy using the enclosed proxy card (if you received paper copies of the proxy materials). Whether or not you plan to attend the virtual meeting, we urge you to vote by proxy to ensure that your vote is counted.

•To vote your shares at the virtual Annual Meeting, see the “Online Attendance and Participation at the Annual Meeting” in the following section of this Proxy Statement.

•You may vote by mail by requesting a paper copy of the proxy materials, which will include a proxy card, and then completing, signing, dating and timely returning the proxy card to the Company using the postage-paid envelope provided with the paper copy of the proxy materials.

•To vote over the telephone, dial toll-free 1-866-804-9616 using a touch-tone phone and have your proxy card available when you call and follow the instructions provided.

•To vote through the internet, go to www.AALvote.com/SIF and have your proxy card available when you access the site and follow the instructions provided.

If you hold your shares beneficially through a bank or broker you must provide a legal proxy from your bank or broker during registration and you will be assigned a virtual control number in order to vote your shares during the Annual Meeting. If a shareholder is unable to obtain a legal proxy to vote their shares, the shareholder may attend the 2023 Annual Meeting (but will not be able to vote their shares) so long as the shareholder demonstrates proof of stock ownership.

ONLINE ATTENDANCE AND PARTICIPATION AT THE ANNUAL MEETING

The Company has decided to hold the Annual Meeting virtually this year and there will not be a physical location for attending the 2023 Annual Meeting. We believe that hosting a virtual Annual Meeting will enable shareholders to attend and participate fully and equally, improve meeting efficiency and our ability to communicate effectively with our shareholders, and reduce the cost of the Annual Meeting.

The virtual 2023 Annual Meeting will be conducted via live audio webcast to enable our shareholders to participate from any location around the world that is convenient to them. We have designed the virtual 2023 Annual Meeting to provide the same rights and opportunities to participate as a shareholder would have at an in-person meeting.

Shareholders are entitled to attend and participate at the Annual Meeting if such persons were a shareholder of record as of the close of business on December 5, 2022. To attend and participate in the meeting, shareholders will need to register at https://www.viewproxy.com/SIFCO/2023/htype.asp no later than 11:59PM Eastern Standard Time on January 30, 2023. Registered shareholders will need the control number included on your proxy card in order to vote during the shareholder meeting. Shareholders may also ask questions, vote during the meeting, and examine the Company’s shareholder list during the meeting.

Shareholders holding shares beneficially through a bank or broker must provide a legal proxy from their bank or broker during registration and will be assigned a virtual control number in order to vote the shareholders' shares during the Annual Meeting. If a shareholder is unable to obtain a legal proxy to vote his or her shares, the shareholder may attend the 2023 Annual Meeting (but will not be able to vote their shares) so long as the shareholder demonstrates proof of stock ownership. Instructions on how to connect and participate via the Internet, including how to demonstrate proof of stock ownership, are posted at https://www.viewproxy.com/SIFCO/2023/htype.asp.

On the day of the Annual Meeting, beneficial shareholders may only vote during the meeting by e-mailing a copy of such shareholder’s legal proxy to virtualmeeting@viewproxy.com in advance of the meeting.

If you have registered correctly at https://www.viewproxy.com/SIFCO/2023/htype.asp, shareholders will receive a meeting invitation by e-mail with a unique join link along with a password prior to the meeting date.

For technical assistance prior to the Annual Meeting, send an email to virtualmeeting@viewproxy.com or call at 866-612-8937.

The Company believes that hosting a virtual Annual Meeting provides expanded access, improved communication and cost savings for the Company and its shareholders. Shareholders may vote during the meeting by following the instructions that will be available on the virtual meeting website during the meeting.

Your vote is very important. Whether you intend to attend the Annual Meeting or not, you are encouraged to vote, as promptly as possible prior to the 2023 Annual Meeting, over the Internet or by telephone (or by mail if you received or requested a paper proxy card), as instructed in the proxy card. Even if you plan to virtually attend the 2023 Annual Meeting, we recommend that you vote your shares in advance so that your vote will be counted if you later decide not to attend the virtual meeting.

OUTSTANDING SHARES AND VOTING RIGHTS

The record date for determining shareholders entitled to vote at the 2023 Annual Meeting is December 5, 2022. As of December 5, 2022, the outstanding voting securities of the Company consisted of 6,098,217 common shares, $1.00 par value per share (“Common Shares”). Each Common Share, exclusive of treasury shares, has one vote. The Company held no Common Shares in its treasury on December 5, 2022. The holders of a majority of the Common Shares of the Company issued and outstanding, present in person or by proxy, shall constitute a quorum for the purposes of the 2023 Annual Meeting.

STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

The number of our Common Shares beneficially owned and percent of class set forth in the table below is based on the number of shares outstanding as of December 5, 2022 (unless otherwise indicated) by each person who, to our knowledge, beneficially owns more than 5% of our common stock.

| | | | | | | | |

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class |

| | |

| Ms. Janice Carlson and Mr. Charles H. Smith, III, | 1,775,498 (1) | 29.12% (1) |

| Trustees, Voting Trust Agreement | | |

| c/o SIFCO Industries, Inc. | | |

970 E. 64th Street | | |

| Cleveland, OH 44103 | | |

| | |

| M. and S. Silk Revocable Trust | 781,969 (2) | 12.82% (2) |

| 4946 Azusa Canyon Road | | |

| Irwindale, CA 91706 | | |

| | |

| Minerva Advisors, LLC | 385,708 (3) | 6.32% (3) |

| 50 Monument Road, Suite 201 | | |

| Bala Cynwyd, PA 19004 | | |

(1) Based on the Schedule 13D/A filed with the SEC on January 28, 2021, Janice Carlson and Charles H. Smith, III beneficially owned, as Trustees (the "Trustees"), 1,775,498 Common Shares of the Company and such Common Shares have been deposited with them or their predecessors, as Trustees, under a Voting Trust Agreement, dated January 31, 2017 (the "Voting Trust Agreement") and the Voting Trust Extension Agreement, dated January 27, 2021, which extends the Voting Trust Agreement until January 31, 2023. The Trustees under the Voting Trust Agreement share voting control with respect to all such Common Shares. Although the Trustees do not have the power to dispose of the shares subject to the Voting Trust Agreement, they share the power to terminate the voting trust or to return shares subject to the Voting Trust Agreement to holders of voting trust certificates.

(2) Based on the Schedule 13D/A filed with the SEC on May 22, 2009, M. and S. Silk Revocable Trust, Mark J. Silk and Sarah C. Silk, Co-Trustees, share both voting and dispositive power over 700,600 Common Shares of the Company as of May 21, 2009 and, in September 2018, Mr. Silk gifted 300,000 of the Common Shares to his children. As a director of the Company, Mr. Silk has been awarded various awards in the amount of 43,163 restricted shares that have vested. In fiscal 2022, Mr. Silk was issued 6,402 restricted shares in his capacity as a director of the Company.

(3) Based on the Schedule 13G/A filed with the SEC on February 14, 2022, Minerva Advisors LLC (“Advisors”), Minerva Group, LP (“Group”), Minerva GP, LP (“GP LP”), Minerva GP, Inc. (“GP Inc.”) and David P. Cohen (“Cohen”) reports: (a) 385,708 Common Shares beneficially owned by Advisors and Cohen and (b) 309,100 Common Shares beneficially owned by Group, GP LP, and GP Inc. The Schedule 13G/A reports that Advisors, Group, GP LP, GP Inc. and Cohen have the sole voting and dispositive power over 309,100 Common Shares and Advisors and Cohen have the shared power to vote and dispositive power over 76,608 Common Shares.

PROPOSAL 1 - TO ELECT SIX (6) DIRECTORS

Six (6) directors are to be elected at the 2023 Annual Meeting to hold office until the next annual meeting of shareholders and/or until their respective successors are elected and qualified. Shares represented by validly given proxies will be voted in favor of the persons set forth below to serve as directors unless the shareholder indicates to the contrary on the proxy or in person at the 2023 Annual Meeting. The six (6) nominees receiving the most votes will be elected as directors at the 2023 Annual Meeting. Proxies cannot be voted for a greater number of nominees than the number named in this Proxy Statement.

Norman E. Wells, has elected to retire at the end of his term and the Board determined not to fill his seat at this time, reducing the number of directors of the Company from seven to six.

Each of the below nominees has consented (i) to serve as a nominee, (ii) to being named as a nominee in this Proxy Statement and (iii) to serve as a director, if elected. Although the Company does not contemplate that any of the nominees will be unavailable for election, if a vacancy in the slate of nominees is occasioned by death or other unexpected occurrence, it is currently intended that the remaining directors will (but will not be bound to), by the vote of a majority of their number, designate a different nominee for election to the Board at the 2023 Annual Meeting.

Board Recommendation - The Board of Directors (the "Board") recommends that you vote FOR the election of all nominees. Unless you instruct otherwise on your proxy card or in person, your proxy will be voted in accordance with the Board’s recommendation.

Nominees for Election to the Board of Directors

Set forth below for each nominee for election as a director is a brief statement, including the age, principal occupation and business experience, and any public company directorships held. The members of the Nominating and Governance Committee have recommended the persons listed below as nominees for the Board of Directors, all of whom presently are directors of the Company.

The Nominating and Governance Committee of the Board reviews and evaluates individuals for nomination to stand for election as a director who are recommended to the Nominating and Governance Committee in writing by any of our shareholders pursuant to the procedure outlined below in the section titled “Process for Selecting and Nominating Directors” on the same basis as candidates who are suggested by our current or past directors, executive officers, or other sources. In considering individuals for nomination to stand for election, the Nominating and Governance Committee will consider: (i) the current composition of directors and how they function as a group; (ii) the skills, experiences or background, and the personalities, strengths, and weaknesses of current directors; (iii) the value of contributions made by individual directors; (iv) the need for a person with specific skills, experiences or background to be added to the Board; (v) any anticipated vacancies due to retirement or other reasons; and (vi) other factors that may enter into the nomination decision. The Nominating and Governance Committee endeavors to select nominees that contribute the requisite skills and professional experiences in order to advance the performance of the Board and establish a well rounded Board with diverse views that reflect the interests of our shareholders. The Nominating and Governance Committee considers diversity as one of a number of factors in identifying nominees for directors, however, there is no formal policy in

this regard. The Nominating and Governance Committee views diversity broadly to include diversity of experience, skills and viewpoint, in addition to traditional concepts of diversity, such as race and gender.

When considering an individual candidate’s suitability for the Board, the Nominating and Governance Committee does not prescribe minimum qualifications or standards for directors, however, the Nominating and Governance Committee looks for directors who have personal characteristics, educational backgrounds and relevant experiences that would be expected to help further the goals of both the Board and the Company. The Nominating and Governance Committee will review the extent of the candidate’s demonstrated success in his or her chosen business, profession, or other career, and the skills that the candidate would be expected to add to the Board. The Nominating and Governance Committee may, in certain cases, conduct interviews with the candidate and/or contact references, business associates, other members of boards on which the candidate serves or other appropriate persons to obtain additional information. The Nominating and Governance Committee will make its determinations on whether to nominate an individual candidate based on the Board’s then-current needs, the merits of that candidate and the qualifications of other available candidates. The types of key attributes and/or experience that the Nominating and Governance Committee believes the composite board membership needs to possess to ensure the existence of a functionally effective board include, but are not limited to, and are subject to variation in connection with the Company's and Board's needs: (i) proven leadership capabilities; (ii) familiarity with the organizational and operational requirements of medium and large-sized manufacturing organizations; (iii) strategic planning; (iv) experience in mergers and acquisitions and an understanding of financial markets; (v) experience in finance and accounting; (vi) familiarity with the aerospace, defense, energy and related industries and markets; (vii) experience with public company compensation matters and structure; and (viii) prior service on the boards of directors of other companies – both public and private. The Nominating and Governance Committee believes that each of the nominees possesses certain of the key attributes that such Committee believes to be important for an effective board.

Jeffrey P. Gotschall, 74, director of the Company since 1986, Chairman of the Board from 2001 to 2015 and Chairman Emeritus since 2015. Mr. Gotschall previously served as the Company's Chief Executive Officer from 1990 until his retirement in 2009 and served from 1989 to 2002 as President, from 1986 to 1990 as Chief Operating Officer, from 1986 through 1989 as Executive Vice President and from 1985 through 1989 as President of SIFCO Turbine Component Services, a former operating subsidiary of the Company. Mr. Gotschall’s long history with the Company, coupled with his management expertise, enables him to bring valuable perspective to the Board and its discussion of industry issues.

Peter W. Knapper, 61, President and Chief Executive and director of the Company since June 2016. Prior to joining the Company, Mr. Knapper worked for the TECT Corporation from 2007 to 2016, and was the Director of Strategy and Site Development. TECT offers the aerospace, power-generation, transportation, marine, and medical industries a combination of capabilities unique among metal component manufacturers. Prior to this role, Mr. Knapper served as President of TECT Aerospace and Vice President of Operations of TECT Power. In addition, Mr. Knapper spent five (5) years at Rolls Royce Energy Systems, Inc., a subsidiary of Rolls-Royce Holdings plc, as the Director of Component Manufacturing and Assembly. Mr. Knapper brings his strategic and industry experience to his role in management and to the Board of the Company.

Donald C. Molten, Jr., 65, director of the Company since 2010. Mr. Molten, Jr. currently serves on the board of First Choice Packaging, a privately held company. He is the former Managing Partner of Dimensional Analytics, LLC, a strategic consulting firm based in Hudson, Ohio. Prior to the formation of Dimensional Analytics, LLC, Mr. Molten, Jr. served as the Associate Headmaster at University School, a K-12 boys' college preparatory school in Hunting Valley, Ohio, where he currently serves as trustee. Prior to joining University School in 2004, Mr. Molten, Jr. was a Managing Director and Partner of Linsalata Capital Partners, a private equity firm that specializes in acquiring middle market companies. Mr. Molten, Jr. is the former chairman and director of the Tranzonic Companies, Inc. and a former director of U-Line Corporation, Inc. Mr. Molten, Jr. formerly served as director of America’s Body Company, CMS / Hartzell, Neff Motivation, Transpac, Teleco, Degree Communications and Wellborn Forest Company. Prior to joining Linsalata Capital Partners, Mr. Molten, Jr. was a vice president of Key Equity Capital and its predecessor, Society Venture Capital, entities that made equity investments in closely held businesses. His experience in equity and debt transactions and leveraged buyouts also includes seven (7) years with The Northwestern Mutual Life Insurance Company. Mr. Molten, Jr. provides significant experience in implementation of growth strategies, execution of strategic acquisitions and divestitures and meaningfully contributes to the Board’s discussion of strategic considerations.

Alayne L. Reitman, 58, director of the Company since 2002. Ms. Reitman currently serves as Chair of the Audit Committee for Ideastream Public Media, serves as Vice Chair for the Cleveland Museum of Natural History and is a member of the Audit Committee of Hawken School. Ms. Reitman serves on the board of Embedded Planet LLC, a high-tech start-up company, where she previously served from 1999 to 2001 as President. Ms. Reitman previously served from 1993 to 1998 as Vice President and Chief Financial Officer of the Tranzonic Companies, Inc., a manufacturer and distributor of a variety of cleaning, maintenance and personal protection products, and from 1991 to 1993 as Senior Financial Analyst for American Airlines. Ms. Reitman's leadership skills and her financial acumen and management experience allow her to be a significant resource to the Board.

Mark J. Silk, 56, director of the Company since 2014. Mr. Silk was previously involved with the Company as both a customer and former director. Mr. Silk is President and CEO of ThinKom Solutions, Inc., a designer and manufacturer of high performance antenna systems for the aeronautical and ground mobile satellite communications industry. Mr. Silk is also an operating partner in Blue Sea Capital, a middle-market private equity firm focused on investments in aerospace and defense, healthcare and industrial growth. Mr. Silk is also the owner and Chairman of Arrow Engineering, Inc., which manufactures machined parts for the military and commercial aerospace industry. Mr. Silk was previously the President and CEO and a shareholder of Integrated Aerospace, Inc., a supplier of landing gear and external fuel tanks to the military and commercial aerospace industry and of Tri-Star Electronics International, Inc., a manufacturer of high reliability electrical contacts and specialty connectors for the military and commercial aerospace industry. Mr. Silk’s broad industry knowledge and diverse investment expertise provides the Board with an expanded view of opportunities to grow the existing business and factors for consideration regarding acquisition opportunities.

Hudson D. Smith, 71, director of the Company since 1988. Mr. Smith is currently the President of Forged Aerospace Sales, LLC. Mr. Smith previously served the Company as Executive Vice President from 2003 through 2005; as Treasurer from 1983 through 2005; as President of SIFCO Forge Group, the Company's Cleveland forging operation from 1998 through 2003; as Vice President and General Manager of SIFCO Forge Group, from 1995 through 1997; as General Manager of SIFCO Forge Group from 1989 through 1995; and as General Sales Manager of SIFCO Forge Group from 1985 through 1989. Mr. Smith served as a board member of the Forging Industry Association from 2004 through 2008. Refer to “Director Compensation” below for a discussion of certain transactions between Mr. Smith and the Company. Mr. Smith’s historic and current involvement in the industry make him an invaluable contributor to considerations of industry trends and major customer matters.

Each of the foregoing nominees is recommended by the Nominating and Governance Committee. There are, and during the past ten (10) years there have been, no legal proceedings material in an evaluation of the ability of any director or executive officer of the Company to act in such capacity or concerning his or her integrity. There are no family relationships among any of the directors and executive officers except that Mr. Gotschall and Mr. Smith are cousins.

STOCK OWNERSHIP OF EXECUTIVE OFFICERS, DIRECTORS AND NOMINEES

The following table sets forth, as of November 30, 2022, the number of Common Shares of the Company beneficially owned and percent of class by each director, nominee for director and named executive officer and all directors and executive officers as a group, according to information furnished to the Company by such persons:

| | | | | | | | | | | | | | | | | | | | |

| | Amount and Nature of | | |

Name of Beneficial Owner (1) | | Beneficial Ownership | | Percent of Class |

| | | | | | |

Mark J. Silk (2) | | | 781,969 | | | | 12.82% |

Hudson D. Smith (2)(3)(4) | | | 287,430 | | | | 4.71% |

| Jeffrey P. Gotschall (2)(3)(4) | | | 274,223 | | | | 4.50% |

| Peter W. Knapper | | | 168,921 | | | 2.77% |

| Donald C. Molten, Jr. | | | 71,049 | | | 1.17% |

| Norman E. Wells, Jr. (5) | | | 65,263 | | | 1.07% |

| Alayne L. Reitman (2) | | | 56,261 | | | * |

| Thomas R. Kubera | | | 39,051 | | | * |

| All Directors and Executive Officers as a Group (8 persons) | | 1,744,167 | | | | 28.60% |

*Common Shares owned are less than one percent of class.

(1) Unless otherwise stated below, the named person owns all of such shares of record and has sole voting and investment power as to those shares.

(2) In the cases of Mr. Gotschall, Ms. Reitman, Mr. Smith, and Mr. Silk, the amount in the table includes 400 shares, 30 shares, 10,655 shares, and 300,000 shares, respectively, owned by their spouses and any children or in trust for any of them, their spouses, and their lineal descendants.

(3) Includes Voting Trust Certificates issued by the aforementioned (see page 5) Voting Trust representing an equivalent number of Common Shares held by such Trust as follows: Mr. Gotschall – 219,723 and Mr. Smith – 228,021.

(4) Mr. Gotschall and Mr. Smith are cousins.

(5) Mr. Wells, Jr. is retiring upon the expiration of his term effective January 31, 2023.

CORPORATE GOVERNANCE AND BOARD OF DIRECTORS MATTERS

Board of Directors - The Company's Board of Directors held eight (8) scheduled meetings during fiscal 2022. The Board of Directors' standing committees are the Audit, Compensation, and Nominating and Governance Committees. From time-to-time, the Board may determine that it is appropriate to form a special committee of its independent directors to address a particular matter(s) not specific to one of its standing committees. Directors are expected to attend Board meetings, the annual shareholders’ meeting, and meetings of the committees on which he or she serves. During fiscal 2022, each director attended at least 75% of the total number of meetings of the Board and the committees on which he or she served. SIFCO’s independent directors meet in executive session at each regularly scheduled Board meeting, which are presided over by the Chairman of the Board. All directors attended the Company’s 2022 Annual Meeting of Shareholders, which was held virtually.

Director Independence - The members of the Board of Directors' standing committees are all independent directors as defined in Section 803 of the NYSE American Company Guide. The Board has affirmatively determined that Mr. Gotschall, Mr. Molten, Jr., Ms. Reitman, Mr. Wells, Jr. and Mr. Silk meet these standards of independence. There are no undisclosed transactions, relationships, or arrangements between the Company and any of such directors. The Board has affirmatively determined that Mr. Knapper, current employee of the Company and Mr. Smith, due to his relationship as described in the Director Compensation section included herein, do not meet these standards of independence, are therefore not independent and, accordingly, are not members of any of the Board’s standing committees.

Board Committees

Audit Committee - The functions of the Audit Committee are to select, subject to shareholder ratification, the Company’s independent registered public accounting firm; to approve all non-audit related services performed by the Company’s independent registered public accounting firm; to determine the scope of the audit; to discuss any special considerations that may arise during the course of the audit; and to review the audit and its findings for the purpose of reporting to the Board of Directors. Further, the Audit Committee receives a written statement delineating the relationship between the independent registered public accounting firm and the Company. None of the members of the Audit Committee participated in the preparation of the Company’s financial statements at any time during the past three (3) years. The members of the Audit Committee are all independent directors as defined in Section 803 of the NYSE American Company Guide and SEC Rule 10A-3. Each member of the Audit Committee is financially literate, and Ms. Reitman is designated as the Audit Committee financial expert. None of the Audit Committee members serve on more than one (1) other public company audit committee. The Audit Committee, currently composed of Ms. Reitman (Chairperson), Mr. Gotschall, Mr. Molten, Jr., Mr. Wells, Jr., and Mr. Silk. The Audit Committee held four (4) meetings during fiscal 2022. The Audit Committee operates under a written charter that is available on the Company’s website at www.sifco.com.

Compensation Committee - The functions of the Compensation Committee are to review and make recommendations to the Board to ensure that the Company's executive compensation and benefit programs are consistent with its compensation philosophy and corporate governance guidelines and, subject to the approval of the Board, to establish the executive compensation packages offered to directors and officers. Officers’ base salary, target annual incentive compensation awards and granting of long-term equity-based incentive compensation, and

the number of shares that should be subject to each equity instrument so granted, are set at competitive levels with the opportunity to earn competitive pay for targeted performance as measured against the performance of a peer group of companies. The Compensation Committee is appointed by the Board, and consists entirely of directors who are independent directors as defined in Section 803 of the NYSE American Company Guide. The Compensation Committee is currently composed of Mr. Wells, Jr. (Chairperson), Mr. Gotschall, Mr. Molten, Jr., Ms. Reitman, and Mr. Silk. The Compensation Committee held four (4) meetings during fiscal 2022 and certain discussions were, where appropriate, conducted by the full Board or all of the non-management directors. The Compensation Committee operates under a written charter that is available on the Company’s website at www.sifco.com. If re-elected as a director, Mr. Molten, Jr. will take over as the Chairperson of the Compensation Committee following Mr. Wells, Jr's. retirement.

Nominating and Governance Committee - The functions of the Nominating and Governance Committee are to recommend candidates for the Board of Directors and address issues relating to (i) senior management performance and Board succession and (ii) the composition and procedures of the Board. The Nominating and Governance Committee is currently composed of Mr. Molten, Jr. (Chairperson), Mr. Gotschall, Ms. Reitman, Mr. Silk and Mr. Wells, Jr. The members of the Nominating and Governance Committee are all independent directors as defined in Section 803 of the NYSE American Company Guide. The Nominating and Governance Committee held four (4) meetings during fiscal 2022. Certain functions, where appropriate were conducted by the full Board or independent directors, as applicable. The Nominating and Governance Committee operates under a written charter that is available on the Company’s website at www.sifco.com.

Board Role in Risk Oversight - The Board reviews the Company’s annual plan and strategic plan, which address, among other things, the risks and opportunities facing the Company. The Board also has overall responsibility for executive officer succession planning, and discusses and reviews succession planning on a regular basis. Certain areas of oversight may be delegated to the relevant committees of the Board and the committees report back to the full Board on their deliberations. This oversight is enabled by reporting processes that are designed to provide visibility to the Board about the identification, assessment, monitoring and management of enterprise-wide risks. Management incorporates enterprise risk assessments of the Company as part of its annual planning process, including each of its business segments, and presents it to the Board for review as part of senior management’s annual planning process. The Board monitors enterprise-wide risk management with management periodically throughout the year and more frequently where needed. The Board has remained actively engaged with management in monitoring and responding to the residual impacts of the COVID-19 pandemic and its impact on the commercial aerospace industry. Management remains in regular communication with the Board regarding the impact of recovery efforts, and the management of risks and strategy decisions. The principal areas of this risk assessment include a review of strategic business, financial, operational, compliance and technology objectives and the potential risk for the Company. In addition, on an ongoing basis: (a) the Audit Committee maintains primary responsibility for oversight of risks and exposures pertaining to the accounting, auditing and financial reporting processes of the Company; (b) the Compensation Committee maintains primary responsibility for risks and exposures associated with oversight of the administration and implementation of our compensation policies; and (c) the Nominating and Governance Committee maintains primary responsibility for risks and exposures associated with corporate governance and succession planning.

Separation of Role of Chairman of the Board and CEO - Mr. Wells, Jr., an independent director, serves as Chairman of the Board, a position he has held since July 1, 2016 and is retiring at the end of his term on January 31, 2023. If re-elected as a director, Ms. Reitman will become Chair of the Board following Mr. Wells, Jr's.' retirement. The Company has determined its current structure to be most effective as the Chairperson serves as a liaison between its directors and management and helps to maintain communication and discussion among the Board and management, while allowing the CEO to focus on the execution of business strategy, growth and development. The Chairperson serves in a presiding capacity at Board meetings and has such other duties as are determined by the Board from time to time.

Process for Selecting and Nominating Directors - In its role as the nominating body for the Board, the Nominating and Governance Committee reviews the credentials of potential director candidates (including any potential candidates recommended by shareholders), conducts interviews and makes formal recommendations to the Board for the annual and any interim election of directors. The Nominating and Governance Committee will consider shareholder nominations for directors at any time. Any shareholder desiring to have a nominee considered by the Nominating and Governance Committee should submit such recommendation in writing to a member of the Nominating and Governance Committee or the Corporate Secretary of the Company at its principal executive offices, c/o SIFCO Industries, Inc., 970 East 64th Street, Cleveland, Ohio 44103. The recommendation letter should include the shareholder’s own name, address and the number of shares owned and the candidate’s name, age, business address, residence address, and principal occupation, as well as the number of shares the candidate owns. The letter should provide all the information that would need to be disclosed in the solicitation of proxies for the election of directors under federal securities laws. Finally, the shareholder should also submit the recommended candidate’s written consent to be elected and commitment to serve if elected. The Company may also require a candidate to furnish additional information regarding his or her eligibility and qualifications.

Communications with the Board of Directors - Shareholders and other interested parties may communicate their concerns directly to the entire Board of Directors or specifically to non-management directors of the Board. Such communication can be confidential or anonymous, if so designated, and may be submitted in writing to the following address: Board of Directors, SIFCO Industries, Inc., c/o Ms. Megan L. Mehalko, Corporate Secretary, 970 E. 64th Street, Cleveland, Ohio 44103, who will forward the communication to the specified director(s) as necessary.

Corporate Governance Guidelines and Code of Ethics - We are committed to high standards of business integrity and corporate governance. The Company’s Code of Ethics applies to all of its Directors and its employees, including its Chief Executive Officer and its Chief Financial Officer. The Code of Ethics (including any amendments to, or related waivers from, the Code of Ethics), the Company's Corporate Governance Guidelines and Policies and all committee charters are posted in the Investor Relations portion of the Company's website at www.sifco.com.

Anti-Hedging and Anti-Pledging Practices - Our insider trading policy prohibits our directors, officers and employees from (a) engaging in any transactions (e.g., puts, calls, options, other derivative securities, collars, forward sales contracts, or selling short) with respect to Company stock, the purpose of which is to hedge or offset any decrease in market value of such stock and (b) purchasing Company stock on margin, borrowing against Company stock on margin, or pledging Company stock as collateral for any loan.

Certain Relationships and Related Transactions - There were no transactions between the Company and its officers, directors or any person related to its officers or directors, or with any holder of more than 5% of the Company’s Common Shares, either during fiscal 2022 or up to the date of this proxy statement, except for the continued sales representative agreement between the Company and Mr. Smith that is discussed below under the heading “Director Compensation.”

The Company reviews all transactions between the Company and any of its officers and directors. The Company’s Code of Ethics emphasizes the importance of avoiding situations or transactions in which personal interests may interfere with the best interests of the Company or its shareholders. In addition, the Company’s general corporate governance practice includes board-level discussion and assessment of procedures for discussing and assessing relationships, including business, financial, familial and nonprofit, among the Company and its officers and directors, to the extent that they may arise. The Board reviews any transaction with an officer or director to determine, on a case-by-case basis, whether a conflict of interest exists. The Board ensures that all directors voting on such a matter have no interest in the matter and discusses the transaction with legal counsel as the Board deems necessary. The Board will generally delegate the task of discussing, reviewing and approving transactions between the Company and any of its related persons to the Audit Committee.

EXECUTIVE COMPENSATION

The Company is a “smaller reporting company” under the rules promulgated by the SEC and complies with the disclosure requirements specifically applicable to smaller reporting companies. This section and summary compensation table are not intended to meet the “Compensation Disclosure and Analysis” disclosure that is required to be made by larger reporting companies.

Executive Summary:

This section contains information about the compensation paid to the Company's Named Executive Officers ("NEOs") during its fiscal years ended September 30, 2022 and 2021. The following should be read in conjunction with the information presented in the compensation tables, the footnotes to those tables and the related disclosures appearing later in this section. The tables and related disclosures contain specific information about the compensation earned or paid during the fiscal years ending September 30, 2022 and 2021 to the following individuals, who were determined to be the Company's NEOs:

•Peter W. Knapper, President and Chief Executive Officer

•Thomas R. Kubera, Chief Financial Officer

Pay Philosophy and Practices

Role of Compensation Committee:

Five (5) independent directors comprised the Company’s Compensation Committee in 2022, which is responsible for establishing and administering the Company’s compensation policies, programs, and procedures. In performing its duties, the Compensation Committee may request information from senior management regarding the Company’s performance, pay and programs to assist it in its actions. Moreover, the Compensation Committee has the authority to retain outside advisors as needed to assist it in reviewing the Company’s programs, revising them and providing analysis regarding competitive pay information. The Compensation Committee annually reviews and establishes the goals used for the Company's incentive compensation plans. In addition, it annually assesses the performance of the Company and the Chief Executive Officer. Based on this evaluation, the Compensation Committee then recommends the Chief Executive Officer’s compensation for the next year to the Board for its consideration and approval. In addition, the Compensation Committee reviews the Chief Executive Officer’s compensation recommendations for the remaining NEOs, providing appropriate input and approving final actions. Finally, the Compensation Committee provides approval for the Chief Executive Officer's recommendations of the compensation of other key executives.

Role of Senior Management:

The Company’s management serves in an advisory or support capacity as the Compensation Committee carries out its charter. Typically, the Company’s Chief Executive Officer participates in meetings of the Compensation Committee, but does not participate in discussion regarding compensation of the Chief Executive Officer. The Company’s other NEOs and senior management may participate as necessary or at the Compensation Committee’s request. The NEOs and senior management normally provide the Compensation Committee with information regarding the Company’s performance, as well as information regarding executives who participate in the Company’s various plans. Such data is usually focused on the executives’ historical pay and benefit levels, plan costs, context for how programs have changed over time and input regarding particular management issues that need to be addressed. In addition, management may furnish similar information to independent compensation advisors engaged from time to time by the Compensation Committee. Management provides input regarding the recommendations made by outside advisors or the Compensation Committee. Management implements, communicates and administers the programs approved by the Compensation Committee. The Chief Executive Officer annually evaluates the performance of the Company and its other NEOs. Based on his evaluation, he provides the Compensation Committee with his recommendations regarding the pay for the other NEOs and senior executives for its consideration, input and approval. The Compensation Committee, in turn, authorizes the Chief Executive Officer to establish the pay for the Company’s other executives based on terms consistent with those used to establish the pay of the NEOs. Members of management present at meetings when pay is discussed are recused from such discussions when the Compensation Committee focuses on their individual pay.

Use of Market Pay Study and Independent Compensation Consultant

In establishing and evaluating fiscal 2022 compensation for our NEOs, the Company used market data from the Economic Research Institute's Executive Compensation Assessor. The Economic Research Institute data reflected compensation levels at companies of similar size engaged in aircraft parts manufacturing and applied geographic pay differentials to reflect the location of our operations. The Compensation Committee did not engage an outside compensation consultant during the 2022 fiscal year.

Summary Compensation Table

The following table sets forth information regarding the compensation of the Company’s President and Chief Executive Officer and the Chief Financial Officer, who are the only named executive officers of the Company, for the fiscal years ended September 30, 2022 and 2021, respectively:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Summary Compensation Table |

| Name and Principal Position | Year | Salary ($) | Bonus ($) | Stock Awards ($) (1) | Option Awards ($) | Non- Equity Incentive Plan Compensation ($) (2) | Non qualified Deferred Compensation Earnings ($) | All Other

Compensation

($) (3) | Total ($) |

| Peter W. Knapper | 2022 | $ | 423,877 | | $ | — | | $ | 201,728 | | $ | — | | $ | 140,479 | | $ | — | | $ | 15,250 | | $ | 781,334 | |

| President and CEO | 2021 | $ | 408,470 | | $ | — | | $ | 187,000 | | $ | — | | $ | 260,010 | | $ | — | | $ | 14,500 | | $ | 869,980 | |

| | | | | | | | | |

| Thomas R. Kubera | 2022 | $ | 253,805 | | $ | — | | $ | 72,120 | | $ | — | | $ | 51,056 | | $ | — | | $ | 10,782 | | $ | 387,763 | |

| CFO | 2021 | $ | 235,040 | | $ | — | | $ | 52,360 | | $ | — | | $ | 90,200 | | $ | — | | $ | 10,885 | | $ | 388,485 | |

| | | | | | | | | |

(1)Amounts shown do not reflect compensation actually received by the executive officer. The awards for which amounts are shown in this column include the stock awards granted under the Company's 2007 Long-Term Incentive Plan (amended and restated as of November 16, 2016) (referred to as the "Plan"). The above amounts represent the grant date fair values of the stock awards granted in fiscal 2022 and 2021, as measured in accordance with Financial Accounting Standards Board ("FASB") Accounting Standard Codification Topic 718, Compensation – Stock Compensation. Such fair value is based on the target number of restricted and performance-based stock awards granted in each of the two (2) fiscal years noted multiplied by the closing market price of the Company’s Common Shares on the NYSE American Exchange on the date of grant.

(2)Reflects the value of annual incentive compensation earnings for named executive officers.

(3)All other compensation for Messrs. Knapper and Kubera consists of amounts contributed by the Company as matching contributions pursuant to the SIFCO Industries, Inc. Employees' 401(k) Plan, a defined contribution plan.

Compensation Updates Following the 2022 Fiscal Year End

During and following the conclusion of the Company’s fiscal 2022 year-end, the Compensation Committee considered the Company’s existing practices for setting performance targets for payout under the annual cash incentive compensation plan. The Compensation Committee determined that incentive compensation will only be paid if cash availability is maintained above a certain threshold and if performance exceeds the consolidated adjusted EBITDA plan for fiscal 2023 (representing more challenging performance targets when compared to prior year’s targets).

The Compensation Committee also decided to continue the Company’s practice of executive long-term incentive plan grants to the Company's NEOs. Following the initial determination regarding the equity award grants to which the CEO was entitled to under the Company's long-term incentive plan, the CEO requested and the Compensation Committee agreed that 29,000 of the time-based and performance share equity awards that otherwise have been awarded to Mr. Knapper under the LTIP would be allocated to other personnel. Following this, the CEO was awarded a grant of 15,000 shares (comprised of a mix of time-based restricted stock and performance shares) and the CFO a grant of 12,000 shares (comprised of a mix of time-based restricted stock and

performance shares). The remaining shares under the LTIP were allocated among eligible participants, taking into account the CEO’s recommendations for such allocations. The performance metrics and vesting schedule remain unchanged from prior years’ practice.

Outstanding Equity Awards

For each individual named in the Summary Compensation Table, set forth below is information relating to such person’s ownership of unearned restricted shares and performance-based shares at September 30, 2022, except for performance shares that would have vested at September 30, 2022. The performance goals for these shares were not met and, accordingly, no shares were paid out. There were no outstanding stock options at September 30, 2022.

| | | | | | | | | | | | | | | | | | |

| Outstanding Equity Awards at Fiscal Year-End |

| Name | | Stock Awards |

| | | | Number of Shares or Units of Stock That Have Not Vested (#) | Market Value of Shares or Units of Stock That Have Not Vested ($) (1) | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) | Equity Incentive Plan Award: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($) (1) |

|

| Peter W. Knapper | | | | | | | | |

| | | | | | | | |

| Restricted Shares | | | | | — | | $ | — | | 59,886 | | $ | 183,850 | |

| Performance Shares | | | | | — | | $ | — | | 49,630 | | $ | 152,364 | |

| Thomas R. Kubera | | | | | | | | |

| Restricted Shares | | | | | — | | $ | — | | 23,206 | | $ | 71,242 | |

| Performance Shares | | | | | — | | $ | — | | 13,809 | | $ | 42,394 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

(1)Based upon the closing market price of the Company’s Common Shares on the NYSE American Exchange on September 30, 2022, which was $3.07

Defined Benefit Pension Plan

None of the NEOs participate in the Company's defined benefit pension plan for salaried employees, which was frozen to new entrants and ceased future benefit accruals as of March 1, 2003.

Supplemental Executive Retirement Plan

None of the NEOs participate in the Company's non-qualified Supplemental Executive Retirement Plan ("SERP"), which was frozen to new entrants and ceased future benefit accruals as of March 1, 2003.

Potential Payments Upon Termination or Change-in-Control

The Company is party to a Change in Control and Severance Agreement with Mr. Knapper, which provides severance benefits in the event of his involuntary termination with or without a change in control. The Company is also a party to a Change in Control Agreement with Mr. Kubera which provides severance benefits in the event of his involuntary termination with a change in control. The purpose of these agreements is to reinforce

and encourage the continued dedication of these executives and diminish any potential distraction in the face of (i) solicitations by other employers and (ii) the potentially disruptive circumstances arising from the possibility of a change in control of the Company. These agreements provide the following benefits:

•In the case of Mr. Knapper, if Mr. Knapper is terminated involuntarily without a change in control prior to June 29, 2025, or if Mr. Knapper is terminated other than for cause or if he terminates his employment for good reason within the two (2) year period following a change in control, the Change in Control and Severance Agreement provides for a lump sum severance payment equal to 200% of his annual base salary in effect at the time of termination, continuation of health and welfare insurance coverage for up to 24 months following termination, and pro-rata vesting of any outstanding equity awards under the Plan. Beginning with the 2021-2023 grants under the Plan, Mr. Knapper's Equity Award Agreements provide partial vesting of outstanding performance awards and full vesting of restricted stock awards if Mr. Knapper is terminated involuntarily following a Change in Control.

•In the case of Mr. Kubera, if, within the two year period following a change of control, Mr. Kubera is terminated other than for cause or if he terminates with good reason, the Change In Control Agreement provides for a lump sum severance payment equal to 150% of his annual base salary in effect at the time of termination and continuation of health and welfare insurance coverage for up to 24 months following termination. Beginning with the 2021-2023 grants under the Plan, Mr. Kubera's Equity Award Agreements provide partial vesting of outstanding performance awards and full vesting of restricted stock awards if Mr. Kubera is terminated involuntarily following a Change in Control.

The following table describes the potential payments upon termination of employment of Messrs. Knapper and Kubera. The table assumes the executive's employment was terminated on September 30, 2022, the last business day of the Company’s 2022 fiscal year.

| | | | | | | | | | | |

| Potential Payments Upon Termination of Employment |

Name and

Principal Position |

Voluntary Termination | Involuntary Not For Cause (or For Good Reason) Termination – without a Change in Control ($) | Involuntary Not For Cause (or For Good Reason) Termination –

with a Change in

Control ($) (1) |

Peter W. Knapper Severance Accelerated Vested Performance and Restricted Stock awards Health & Welfare Insurance |

-0-

-0-

-0- | $856,800

$183,850

$ 52,032 | $856,800

$183,850

$ 52,032 |

Thomas R. Kubera Severance Accelerated Vested Performance and Restricted Stock awards Health & Welfare Insurance |

-0-

-0-

-0- |

-0-

-0-

-0- |

$390,780

$ 71,242

$ 52,032 |

(1)The value of the accelerated vested restricted stock and performance stock awards is determined based on the closing price of the Company's stock as of September 30, 2022, which was $3.07.

DIRECTOR COMPENSATION

Board compensation was evaluated in November 2022 for fiscal 2023. The annual cash retainer for the Board Chairman was set at $60,000. The annual cash retainer for all other non-employee directors was set at $40,000. In addition, Committee members continue to receive a $4,000 cash retainer per year with respect to the committee(s) on which he or she serves. The Chair of the Audit Committee receives an additional $14,000 cash retainer per year; the Chair of the Compensation Committee receives an additional $9,000 cash retainer per year; and each Chair of the Nominating and Governance Committee and Special Committee, if any, receive an additional $7,000 cash retainer per year. Directors who are employees of the Company do not receive the annual retainer or other consideration with respect to their service on the Board. In light of the potential dilutive effect of the Company's granting of equity awards, a fixed-share equity grant was approved for 2023. The Board Chair will receive 8,000 shares and all other non-employee directors will receive 6,000 shares.

Under the Director Compensation Policy in fiscal 2022, each non-employee director had a target annual equity award equal to a grant date value of $50,000. The Chairman of the Board had a target annual equity award value of $75,000. Each non-employee director who held such position on the date of the annual meeting of the shareholders was awarded 6,402 shares of our Common Stock and the Chairman of the Board was awarded 9,603 shares of our Common Stock.

The Company's Amended and Restated Code of Regulations provides that it will indemnify any director or former directors who was or is a party or is threatened to be made a party to any matter, whether civil, criminal, administrative or investigative, by reason of the fact that the individual is or was a director of the Company. The Company also currently has in effect director and officer insurance coverage.

The following table shows the compensation paid to each of the non-employee directors during fiscal 2022. Mr. Knapper did not receive any additional compensation for his services as a director; see the Summary Compensation Table for information regarding our CEO's compensation.

| | | | | | | | | | | | | | | | | | | | | | | |

| Director Compensation Table |

| Director Compensation for Fiscal 2022 |

Name |

Fees Earned or Paid

in Cash ($) |

Stock Awards ($) (1) | Option Awards ($) | Non-Equity Incentive Plan Compensation ($) | Change in Pension Value and Nonqualified Deferred Compensation Earnings |

All Other

Compensation ($) (2) |

Total ($) |

| Jeffrey P. Gotschall | $ | 34,000 | | $ | 42,189 | | $ | — | | $ | — | | $ | — | | $ | — | | $ | 76,189 | |

Donald C. Molten, Jr. | $ | 41,000 | | $ | 42,189 | | $ | — | | $ | — | | $ | — | | $ | — | | $ | 83,189 | |

Alayne L. Reitman | $ | 48,000 | | $ | 42,189 | | $ | — | | $ | — | | $ | — | | $ | — | | $ | 90,189 | |

| Mark J. Silk | $ | 34,000 | | $ | 42,189 | | $ | — | | $ | — | | $ | — | | $ | — | | $ | 76,189 | |

Hudson D. Smith | $ | 30,000 | | $ | 42,189 | | $ | — | | $ | — | | $ | — | | $ | 206,438 | | $ | 278,627 | |

Norman E. Wells, Jr. | $ | 58,000 | | $ | 63,284 | | $ | — | | $ | — | | $ | — | | $ | — | | $ | 121,284 | |

(1)Each non-employee Director except Mr. Wells, Jr. was awarded 6,402 restricted shares of the Company’s common stock. Mr. Wells, Jr., as Chairman, was awarded 9,603 restricted shares of the Company's common stock. Fair value is based on (i) the number of restricted stock awards granted in fiscal 2022 multiplied by (ii) the closing market price of the Company’s Common Shares on the NYSE American Exchange on the date of grant, which was $6.59.

(2)With respect to Mr. Smith, all other compensation consists of payments made to Forged Aerospace Sales, LLC, an entity affiliated to Mr. Smith, during fiscal 2022 under the Sales Representative Agreement, further described below, for services other than as director.

Mr. Smith previously held several executive level positions with the Company and, in connection with his resignation from such executive position with the Company, Mr. Smith, through his affiliated entity, Forged Aerospace Sales, LLC, continues to maintain a Sales Representative Agreement with the Company, the terms of which are substantially the same as the terms of other agreements the Company maintains with its third-party sales representatives and which Mr. Smith did not participate in negotiating. Compensation under the Sales Representative Agreement, which resulted in payments of $206,438 in fiscal 2022, is based strictly upon earned sales commissions with no guaranteed minimum obligation to Mr. Smith and/or to Forged Aerospace Sales, LLC.

PRINCIPAL ACCOUNTING FEES AND SERVICES

Audit Fees

Fees paid or payable to Grant Thornton LLP for the audits of the annual financial statements included in the Company’s Form 10-K and for the reviews of the interim financial statements included in the Company's Forms 10-Q for the years ended September 30, 2022 and 2021 were $604,678 and $511,072, respectively. The Audit Committee has sole responsibility for determining whether and under what circumstances an independent registered public accounting firm may be engaged to perform audit-related services and must pre-approve any non-audit related service performed by such firm. In fiscal 2022, audit and non-audit related fees, to the extent they were incurred, were pre-approved by the Audit Committee.

Non-Audit Related Fees

There were no Fees paid or payable to Grant Thornton LLP for non-audit related services for the years ended September 30, 2022 and 2021.

Tax Fees

There were no fees paid or payable during fiscal 2022 or 2021 to Grant Thornton LLP for tax compliance or consulting services.

All Other Fees

There were no fees paid or payable during fiscal 2022 or 2021 to Grant Thornton LLP for products or services other than the professional services described above.

AUDIT COMMITTEE REPORT

The Audit Committee reviewed and discussed the audited financial statements of the Company for the fiscal year ended September 30, 2022, with the Company's management and with the Company's independent registered public accounting firm, Grant Thornton LLP. The Audit Committee also has (i) discussed with Grant Thornton LLP the matters required to be discussed by the applicable requirements of the Public Company Accounting Board ("PCAOB"), including Auditing Standard No. 1301, Communications with Audit Committees, as adopted by the PCAOB and SEC, (ii) received the written communications from Grant Thornton LLP pursuant to the applicable requirements of the PCAOB certifying the firm’s independence and (iii) the Audit Committee discussed the independence of Grant Thornton LLP with that firm. Grant Thornton LLP has confirmed to the Company that it is in compliance with all rules, standards and policies of the Independence Standards board and the SEC governing auditor independence.

The Audit Committee operates under a written charter as last amended in May 2020.

Based upon the Audit Committee's review and discussions noted above, the Audit Committee recommended to the Board of Directors that the Company's audited financial statements be included in the Company's Annual Report on Form 10-K for the fiscal year ended September 30, 2022 to be filed with the SEC.

| | | | | |

| Audit Committee |

| Alayne L. Reitman; Chairperson |

| Jeffrey P. Gotschall |

| Donald C. Molten, Jr. |

Mark J. Silk |

Norman E. Wells, Jr. |

PROPOSAL 2 – TO RATIFY THE SELECTION OF AUDITORS

The firm of Grant Thornton LLP has been the Company's independent registered public accounting firm since 2002. The Board of Directors has chosen that firm to audit the accounts of the Company and its consolidated subsidiaries for the fiscal year ending September 30, 2023. Ratification of the retention of our independent registered public accounting firm is considered approved with the affirmative vote of a majority of the Common Shares present and voting at the 2023 Annual Meeting (in person or by proxy). Proposal No. 2 is a non-binding proposal. Although shareholder ratification is not required under the laws of the State of Ohio, the appointment of Grant Thornton LLP is being submitted to the Company’s shareholders for ratification at the 2023 Annual Meeting in order to provide a means by which our shareholders may communicate their opinion to the Audit Committee. If our shareholders do not ratify the appointment of Grant Thornton LLP, the Audit Committee will reconsider the appointment, but is not obligated to change the appointment, and may for other reasons be unable to make another appointment. Grant Thornton LLP has advised the Company that neither the firm nor any of its members or associates has any direct or indirect financial interest in the Company or any of its affiliates other than as auditors.

Board Recommendation - the Board of Directors recommends that you vote FOR the ratification of the selection of Grant Thornton LLP as the independent registered public accounting firm of the Company for the year ending September 30, 2023. Unless you instruct otherwise on your proxy card or in person, your proxy will be voted in accordance with the Board’s recommendation.

Representatives of Grant Thornton LLP are expected to be present at the 2023 Annual Meeting and will be provided with the opportunity to make a statement if they desire to do so and to be available to respond to appropriate questions.

PROPOSAL 3 – TO CAST A NON-BINDING ADVISORY VOTE ON EXECUTIVE COMPENSATION

As required by Section 14A of the Security Exchange Act of 1934, this proposal, commonly known as a "say-on-pay" proposal, gives you, as a shareholder the opportunity to endorse or not to endorse our executive compensation program through the following resolution:

"RESOLVED, that the shareholders approve the compensation paid to our NEOs, as disclosed pursuant to the compensation disclosure rules of the SEC, including the compensation tables and accompanying narrative disclosure under the Executive Compensation section in this proxy statement."

The Compensation Committee's compensation objectives are to attract and retain highly qualified individuals with a demonstrated record of achievement; reward past performance, provide incentives for future performance, and align the interests of the NEOs with the interests of the shareholders. To do this, we currently offer a competitive total compensation package. The Compensation Committee has determined that the compensation structure for our NEOs is effective and appropriate.

The vote on this Proposal 3 is non-binding and advisory in nature, which means that the vote is not binding the Company, our Board of Directors or any of the committees of our Board of Directors. This "say-on-pay" proposal will be held every three (3) years; the next non-binding advisory vote on "say-on-pay" will be held

at the 2026 Annual Meeting. The next vote on the frequency of the "say-on-pay" vote will also be held at the 2026 Annual Meeting.

Board Recommendation - The Board of Directors recommends that you vote FOR Proposal 3 relating to the approval of the Company's executive compensation.

SHAREHOLDER PROPOSALS FOR THE 2024 ANNUAL MEETING OF SHAREHOLDERS

A shareholder who intends to present a proposal at the 2024 Annual Meeting, and who wishes to have the proposal included in the Company's proxy statement and form of proxy for that meeting, must deliver the proposal to the Company no later than August 21, 2023. Any shareholder proposal submitted other than for inclusion in the Company's proxy materials for the 2024 Annual Meeting must be delivered to the Company no later than October 30, 2023 or such proposal will be considered untimely. If a shareholder proposal is received after October 30, 2023, the Company may vote, in its discretion as to the proposal, all of the Common Shares for which it has received proxies for the 2024 Annual Meeting.

OTHER MATTERS

The Company does not know of any other matters that will come before the meeting. In case any other matter should properly come before the 2023 Annual Meeting, it is the intention of the persons named in the enclosed proxy or their substitutions to vote in accordance with their best judgment in accordance with the recommendation of the Board of Directors or, in the absence of such a recommendation, in accordance with their judgment pursuant to the discretionary authority conferred by the enclosed proxy.

NO INCORPORATION BY REFERENCE

The Audit Committee Report (including reference to the independence of the Audit Committee members) is not deemed filed with the SEC or subject to the liabilities of Section 18 of the Securities Act of 1933, as amended ("Securities Act"), and shall not be deemed incorporated by reference into any prior or future filings made by us under the Securities Act, or the Exchange Act, except to the extent that we specifically incorporate such information by reference. The section of the Proxy Statement entitled "Proposal to Elect Six (6) Directors," "Corporate Governance and Board of Director Matters," "Executive Compensation," "Director Compensation," and "Principal Accounting Fees and Services" are specifically incorporated by reference in the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2022.

NOTICE REGARDING DELIVERY OF SECURITY HOLDER DOCUMENTS

The SEC permits companies to send a single set of annual disclosure documents to any household at which two (2) or more stockholders reside, unless contrary instructions have been received, but only if the Company provides advance notice and follows certain procedures. In such cases, such stockholders continue to receive a separate notice of the meeting and proxy card. This “householding” process reduces the volume of duplicate information and reduces printing and mailing expenses. The Company has not instituted householding for shareholders of record; however, a number of brokerage firms may have instituted householding for beneficial owners of the Company’s Common Shares held through such brokerage firms. If your family has multiple accounts holding shares of Common Shares of the Company, you already may have received householding notification from your broker. Please contact your broker directly if you have any questions or require additional copies of the annual disclosure documents. The broker will arrange for delivery of a separate copy of this Proxy

Statement or our Annual Report promptly upon your written or oral request. You may decide at any time to revoke your decision to household, and thereby receive multiple copies.

EXECUTIVE OFFICERS OF THE COMPANY

Disclosure regarding the executive officers of the Company is set forth in the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2022 filed with the SEC under the heading “Directors, Executive Officers and Corporate Governance”, which is incorporated into this Proxy Statement by reference. This Annual Report will be delivered to our shareholders with the Proxy Statement. Copies of the Company’s filings with the SEC, including the Annual Report, are available to any shareholder through the SEC’s internet website at http://www.sec.gov or in person at the SEC’s Public Reference Room at 100 F Street, N.E., Room 1580, Washington, DC 20549. Information regarding operations of the Public Reference Room may also be obtained by calling the SEC at 1-800-SEC-0330. Shareholders may also access our SEC filings free of charge on the Company’s own internet website at http://www.sifco.com/proxy_materials. The content of the Company’s website is available for informational purposes only, and is not incorporated by reference into this Proxy Statement.

| | | | | | | | |

| | |

| By order of the Board of Directors. | | SIFCO Industries, Inc. |

| | |

| | |

| December 22, 2022 | | Megan L. Mehalko, Corporate Secretary |

| | |

| | |

| | |

| | |

| | |

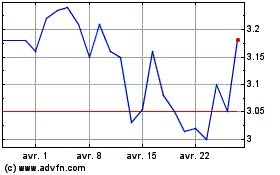

Sifco Industries (AMEX:SIF)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Sifco Industries (AMEX:SIF)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024