Star Equity Fund Issues Statement on Inaction of Servotronics Board

14 Novembre 2022 - 10:30PM

Star Equity Fund, LP (“Star Equity Fund”, “we”, “our”), a 5.2%

shareholder of Servotronics, Inc. (NYSE American: SVT)

(“Servotronics” or “the Company”), seeks to unlock shareholder

value and improve corporate governance at its portfolio companies.

On October 20th, we privately presented

Servotronics’ CEO and board of directors (the “Board”) with a

preliminary, non-binding indication of interest (the “Proposal”) to

explore a potential combination of Star Equity Holdings, Inc.

(Nasdaq: STRR) (“Star Equity”) and Servotronics, subject to

executing an NDA and further due diligence.

Star Equity’s Proposal Would Benefit SVT

ShareholdersWe believe Star Equity would be an excellent

merger partner for Servotronics because the combination of the two

companies would create significant value for both SVT and STRR

shareholders through:

- the reduction of public company and

corporate overhead costs,

- increased operational focus and

efficiency, and

- ample opportunities for

collaboration with Star Equity’s experienced business leaders.

We also indicated we would be willing to pay a

premium to SVT’s October 19th closing stock price, subject to

further due diligence.

Entrenched SVT Board Dismisses Star

Equity’s Proposal in Neglect of its Fiduciary DutyAlthough

the Board acknowledged receipt of the Proposal, they did not

respond for over ten days and would not return multiple phone calls

placed to the Company. Then, on November 1st, Servotronics’ CEO,

William Farrell, issued a public letter to stakeholders vaguely

describing his optimism for the future of Servotronics under his

leadership. On November 2nd, the Board finally responded to our

proposal after declining to engage in conversations with

us, citing “significant risks” and the need to “safeguard

shareholders’ best interests” – code for “we’re not even going to

talk with you to learn more about your proposal.”

We strongly believe William Farrell’s November

1st letter to stakeholders was in direct response to our Proposal

and an attempt by him and the incumbent Board to garner support for

themselves while denying SVT shareholders a potential value

creating opportunity. We are appalled at the Board’s rejection of

our Proposal without genuinely engaging or even having a phone call

with us, and we strongly question the incumbent directors’

commitment to their fiduciary duty to shareholders.

Although we are pleased the Board made some

changes earlier this year, we believe those changes were only made

because of our activist campaign and resulting pressure, and it is

now obvious that further change needs to occur to the Board’s

composition. It is clear to us the incumbent Board is still not

properly aligned with shareholders and remains entrenched, placing

their own self-interest above that of shareholders. We strongly

urge the Board to reconsider their response to our Proposal – a

proposal we believe would create significant value for SVT

shareholders – and we remain ready to act in the best interest of

all SVT shareholders in the future.

About Star Equity Fund, LPStar

Equity Fund, LP is an investment fund managed by Star Equity

Holdings, Inc. Star Equity Fund seeks to unlock shareholder value

and improve corporate governance at its portfolio companies.

About Star Equity Holdings,

Inc.Star Equity Holdings, Inc. (Nasdaq: STRR) is a

diversified holding company with three divisions: Healthcare,

Construction, and Investments.

|

For more information contact: |

|

|

Star Equity Fund, LP |

The Equity

Group |

|

Jeffrey E. Eberwein |

Lena Cati |

|

Portfolio Manager |

Senior Vice President |

|

203-489-9501 |

212-836-9611 |

|

jeff.eberwein@starequity.com |

lcati@equityny.com |

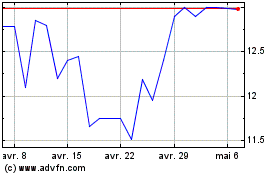

Servotronics (AMEX:SVT)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Servotronics (AMEX:SVT)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024