UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. ___)*

Servotronics, Inc.

(Name of Issuer)

Common Stock, $0.20 value per share

(Title of Class of Securities)

817732100

(CUSIP Number)

ESTATE OF NICHOLAS D. TRBOVICH, SR.

C/O KENNETH D. TRBOVICH AND MICHAEL D. TRBOVICH, CO-EXECUTORS OF THE ESTATE

960 PORTERVILLE ROAD

EAST AURORA, NEW YORK 14052

(716) 634-4646

(Name, Address and Telephone Number of Person Authorized to

Receive Notices and Communications)

December 6, 2022

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to

report the acquisition that is the subject of this Schedule 13D, and is

filing this schedule because of Sections 240.13d-1(e),

240.13d-1(f) or 240.13d-1(g),

check the following box. _

Note: Schedules filed in paper format shall include a signed original and five

copies of the schedule, including all exhibits. See Section 240.13d-7 for other

parties to whom copies are to be sent.

* The remainder of this cover page shall be filled out for a reporting

person's initial filing on this form with respect to the subject class

of securities, and for any subsequent amendment containing information which

would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall

not be deemed to be "filed" for the purpose of Section 18 of the Securities

Exchange Act of 1934 ("Act") or otherwise subject to the liabilities of that

section of the Act but shall be subject to all other provisions of the Act

(however, see the Notes).

1 NAMES OF REPORTING PERSONS:

Estate of Nicholas D. Trbovich, Sr.

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY):

30-6590360

2 CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS):

(a) X

(b) _

3 SEC USE ONLY:

4 SOURCE OF FUNDS (SEE INSTRUCTIONS):

Not Applicable

5 CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEMS 2(d) OR 2(e):

_

6 CITIZENSHIP OR PLACE OF ORGANIZATION:

United States of America

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

7 SOLE VOTING POWER:

99,175 shares

8 SHARED VOTING POWER:

294,643 shares

9 SOLE DISPOSITIVE POWER:

99,175 shares 99,175 shares

10 SHARED DISPOSITIVE POWER:

294,643 shares

11 AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON:

393,818 shares (1)

12 CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

(SEE INSTRUCTIONS):

_

13 PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11):

15.7% (2)

14 TYPE OF REPORTING PERSON (SEE INSTRUCTIONS):

IN

|

(1) Includes: (a) 99,175 shares of Common Stock (defined below) owned by the

Estate, for which Kenneth D. Trbovich and Michael D. Trbovich serve as the

co-executors. (b) The Estate jointly controls 294,643 shares of Common Stock

owned by Beaver Hollow Wellness, LLC through that certain Voting Agreement

dated as of December 6, 2022, as more fully described below.

(2) Calculated based on 2,510,042 shares of common stock ("Common Stock") of

the Issuer outstanding as of November 7, 2022, as reported in the Issuer's

Quarterly Report on Form 10-Q for the quarter ended September 30, 2022.

1 NAMES OF REPORTING PERSONS:

Kenneth D. Trbovich

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY):

2 CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(SEE INSTRUCTIONS):

(a) X

(b) _

3 SEC USE ONLY:

4 SOURCE OF FUNDS (SEE INSTRUCTIONS):

OO

5 CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT TO ITEMS 2(d) OR 2(e):

_

6 CITIZENSHIP OR PLACE OF ORGANIZATION:

United States of America

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

7 SOLE VOTING POWER:

108,780 shares

8 SHARED VOTING POWER:

393,818 shares

9 SOLE DISPOSITIVE POWER:

108,780 shares

10 SHARED DISPOSITIVE POWER:

393,818 shares

11 AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH

REPORTING PERSON:

502,598 shares (1)

12 CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

(SEE INSTRUCTIONS):

_

13 PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11):

20.0% (2)

14 TYPE OF REPORTING PERSON (SEE INSTRUCTIONS):

IN

|

(1) Includes: (a) 91,171 shares of Common Stock owned by Kenneth D. Trbovich.

(b) Kenneth D. Trbovich, serves as the Trustee of and controls

17,609 shares of Common Stock which are held by the Trbovich

Family Foundation (the "Foundation"). (c) Kenneth D. Trbovich serves

as the Co-Executor of the Estate and jointly controls 99,175 shares

of Common Stock owned by the Estate. (d) The Estate jointly controls

294,643 shares of Common Stock owned by Beaver Hollow Wellness, LLC

through that certain Voting Agreement dated as of December 6, 2022,

as more fully described below.

(2) Calculated based on 2,510,042 shares of Common Stock outstanding as of

November 7, 2022, as reported in the Issuer's Quarterly Report on Form

10-Q for the quarter ended September 30, 2022.

1 NAMES OF REPORTING PERSONS:

Michael D. Trbovich

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY):

2 CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS):

(a) X

(b) _

3 SEC USE ONLY:

4 SOURCE OF FUNDS (SEE INSTRUCTIONS):

OO

5 CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEMS 2(d) OR 2(e):

_

6 CITIZENSHIP OR PLACE OF ORGANIZATION:

United States of America

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

7 SOLE VOTING POWER:

35,559

8 SHARED VOTING POWER:

393,818 shares

9 SOLE DISPOSITIVE POWER:

35,559 shares

10 SHARED DISPOSITIVE POWER:

393,818 shares

11 AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON:

429,377 shares (1)

12 CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

(SEE INSTRUCTIONS):

_

13 PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11):

17.1% (2)

14 TYPE OF REPORTING PERSON (SEE INSTRUCTIONS):

IN

|

(1) Includes: (a) 35,559 shares of Common Stock owned by Michael D. Trbovich.

(b) Michael D. Trbovich serves as the Co-Executor of the Estate and jointly

controls 99,175 shares of Common Stock owned by the Estate. (c) The Estate

jointly controls 294,643 shares of Common Stock owned by Beaver Hollow

Wellness, LLC through that certain Voting Agreement dated as of December 6,

2022, as more fully described below.

(2) Calculated based on 2,510,042 shares of Common Stock outstanding as

of November 7, 2022, as reported in the Issuer's Quarterly Report on

Form 10-Q for the quarter ended September 30, 2022.

TABLE OF CONTENTS

Item 1. Security and Issuer

Item 2. Identity and Background

Item 3. Source and Amount of Funds or Other Consideration

Item 4. Purpose of Transaction

Item 5. Interest in Securities of the Issuer

Item 6. Contracts, Arrangements, Understandings or Relationships with

Respect to Securities of the Issuer

Item 7. Material to Be Filed as Exhibits

Signature

|

Item 1. Security and Issuer

This Schedule 13D (the "Schedule 13D") relates to shares of common stock,

par value $0.20 per share ("Common Stock"), of Servotronics, Inc., a

Delaware corporation (the "Company"). The principal executive offices of

the Company are located at 1110 Maple Street, Elma, New York 14059.

Item 2. Identity and Background

(a) This Schedule 13D is being filed by:

(i) The Estate of Nicholas D. Trbovich, Sr. ("Mr. Trbovich"), an estate

created under the laws of the State of New York upon the death of Nicholas

D. Trbovich, Sr. (the "Estate");

(ii) Kenneth D. Trbovich, a United States citizen and co-executor of the

Estate ("KDT"); and

(iii) Michael D. Trbovich, a United States citizen and co-executor of the

Estate ("MDT", and together with the Estate and KDT, the "Reporting Persons")

KDT, in his capacity as co-executor of the Estate, and MDT, in his capacity

as co-executor of the Estate, are sometimes referred to herein as the

"Co-Executors", and each a "Co-Executor".

(b) The address of the principal business and principal office of

the Estate is, and of Mr. Trbovich was, 960 Porterville Road, East

Aurora, New York 14052.

(c) Mr. Trbovich was a business person involved in the aerospace

and weapons manufacturing industries. The Estate was organized upon

Mr. Trbovich's death. KDT and MDT were appointed and qualified as

co-executors of the Estate on August 8, 2017 pursuant to the terms of

Mr. Trbovich's will. The address of the Estate is c/o Kenneth D. Trbovich

and Michael D. Trbovich, as Co-Executors of the Estate of Nicholas D.

Trbovich, Sr., 960 Porterville Road, East Aurora, New York 14052. KDT

is a consultant and is acting as Co-Executor of the Estate, whose address

is the same as the above. MDT is acting as Co-Executor of the Estate,

whose address is the same as the above.

(d) During the last five years, none of the Reporting Persons have

been convicted in a criminal proceeding (excluding traffic

violations or similar misdemeanors).

(e) During the last five years, none of the Reporting Persons have

been a party to a civil proceeding of a judicial or administrative body

of competent jurisdiction and as a result of such proceeding was or is

subject to a judgment, decree or final order enjoining future violations of,

or prohibiting or mandating activities subject to, federal or state

securities laws or finding any violations with respect to such laws.

(f) Mr. Trbovich was a citizen of the United States of America.

Item 3. Source and Amount of Funds or Other Consideration

Prior to his death on August 8, 2017, Mr. Trbovich directly owned 393,818

shares of Common Stock, which became part of the Estate's assets upon his

death. KDT and MDT were appointed as the co-executors of the Estate pursuant

to the will of Mr. Nicolas D. Trbovich, Sr.

Item 4. Purpose of Transaction

Mr. Trbovich originally acquired the shares of Common Stock subject to this

Schedule 13D for investment purposes in connection with his role as Founder,

Chairman, CEO, and Company Director from 1959 until his passing in 2017,

and previously also serving as President of the Company. On December 6,

2022, the Estate exchanged 294,643 shares (the "Jointly Controlled Shares")

for a limited liability company interest in Beaver Hollow Wellness, LLC, a

New York limited liability company ("BHW") as part of a diversification of

the Estate's asset portfolio. In connection with the exchange, the Estate

entered into a Voting Agreement dated as of December 6, 2022, with the other

member of BHW, Founders Software, Inc., which governs the voting and

transfer, and disposal rights of the Jointly Controlled Shares. The

exchange was effected as a private exchange of equity interests.

The Estate is reviewing the condition of the Company and its value to

its shareholders and engaging community leaders in such discussions and

review. The Estate may also engage in dialogues and other communications

regarding the Company with other stockholders of the Company, knowledgeable

industry or market observers, or other persons. Any such discussions may

relate to, among other things, the Company's value to shareholders, its

operating strategies, performance, management succession plans, and corporate

governance matters.

The Estate may also take other steps to increase shareholder value as well

as pursue other plans or proposals that relate to, or would result in,

the matters set forth in subparagraphs (a)-(j) of Item 4 of Schedule 13D

and the Estate may seek to influence such actions through customary means

including presenting his views for consideration to the Company,

shareholders and other interested parties, privately or publicly, and,

if necessary, through the exercise of its shareholder rights and may

seek to engage other Company shareholders and community leaders in such plans.

The Estate intends to review its investment in the Company's shares of

Common Stock on a continuing basis. Depending on various factors including,

without limitation, the Company's financial position and investment strategy,

the price levels of the shares, conditions in the securities markets and

general economic and industry conditions, the Estate may in the future

take such actions with respect to its investment in the Company as it

deems appropriate including, without limitation, purchasing additional

shares of Common Stock, or selling some or all of its shares of Common Stock.

Item 5. Interest in Securities of the Issuer

(a) As of 12:00 p.m., Eastern Standard time, on the date of this Schedule 13D,

the Estate beneficially owns an aggregate of 393,818 shares of Common Stock

(the "Shares"). The Shares represent 15.7% of the Company's Common Stock

outstanding. Percentages of the Common Stock outstanding reported in this

Schedule 13D are calculated based upon the 2,510,042 shares of Common Stock

outstanding as of November 7, 2022, as reported in the Company's Quarterly

Report on Form 10-Q for the quarterly period ended September 30, 2022, filed

by the Company with the Securities and Exchange Commission on November 14,

2022.

(b) The Estate owns and has sole voting and dispositive power over 99,175

of the Shares which power is exercised by Kenneth D. Trbovich and Michael

D. Trbovich as the co-executors of the Estate. The Estate indirectly

owns and jointly controls 294,643 of the Shares owned by Beaver Hollow

Wellness, LLC through that certain Voting Agreement dated as of December

6, 2022, as more fully described below.

(c) On December 6, 2022, the Estate exchanged 294,643 of the Shares

(the "Jointly Controlled Shares") for a limited liability company

interest in Beaver Hollow Wellness, LLC, a New York limited liability

company ("BHW"). In connection with the exchange, the Estate entered

into a Voting Agreement dated as of December 6, 2022, with the other

member of BHW, Founders Software, Inc., a Nevada corporation ("FSI"),

wholly owned and controlled by Paul L. Snyder III ("PLS"), who is

also Chairman of the Board and the indirect majority shareholder of

FSI, which governs the voting and transfer, and disposal rights of

the Jointly Controlled Shares. The exchange was effected as a

private exchange of equity interests.

(d) Subject to the Voting Agreement described in Item 6 below (i)

BHW has the right to receive dividends and the proceeds from any

sale of the Jointly Controlled Shares and (ii) the Estate and FSI,

as the members of BHW, have the power to direct the receipt of dividends

and the proceeds from any sale of the Jointly Controlled Shares. The

Estate has to receive or the power to direct the receipt of dividends

from, or the proceeds from the sale of 99,175 of the Shares it owns,

such rights to be exercised by the Co-Executors.

(e) Not applicable.

Item 6. Contracts, Arrangements, Understandings and Relationships

with Respect to Securities of the Issuer

In connection with the exchange of the Jointly Controlled Shares for

a membership interest in BHW, the Estate entered into a Voting Agreement

dated as of December 6, 2022 (the "Voting Agreement") with the other

member of BHW, Founders Software, Inc., which governs the voting,

transfer, direction of dividends, and disposal rights of the Jointly

Controlled Shares.

Item 7. Material to Be Filed as Exhibits

Voting Agreement dated as of December 6, 2022.

Signature

After reasonable inquiry and to the best of my knowledge and

belief, I certify that the information set forth in this

statement is true, complete and correct.

Dated: December 9, 2022

ESTATE OF NICHOLAS D. TRBOVICH, SR.

By: /s/ Kenneth D. Trbovich

Name: Kenneth D. Trbovich

Title: Co-Executor of the Estate of Nicholas D. Trbovich , Sr.

By: /s/ Michael D. Trbovich

Name: Michael D. Trbovich

Title: Co-Executor of the Estate of Nicholas D. Trbovich , Sr.

|

KDT

/s/ Kenneth D. Trbovich

Kenneth D. Trbovich, as Co-Executor of the Estate of Nicholas D.

Trbovich , Sr.

|

MDT

/s/ Michael D. Trbovich

Michael D. Trbovich as Co-Executor of the Estate of Nicholas D.

Trbovich , Sr.

|

This regulatory filing also includes additional resources:

voting_agreement.pdf

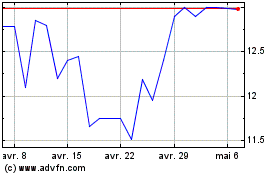

Servotronics (AMEX:SVT)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Servotronics (AMEX:SVT)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024