TIDMAEP

RNS Number : 8817J

Anglo-Eastern Plantations PLC

26 August 2021

Anglo-Eastern Plantations Plc

("AEP", "Group" or "Company")

Announcement of interim results for the six months ended 30 June

2021

The group, comprising Anglo-Eastern Plantations Plc and its

subsidiaries (the "Group"), is a major producer of palm oil and

rubber with plantations across Indonesia and Malaysia, amounting to

some 128,000 hectares, has today released its results for the six

months ended 30 June 2021.

Financial Highlights

2021 2020 2020

6 months 6 months 12 months

to 30 June to 30 to 31 December

June

$m $m $m

(unaudited) (unaudited) (audited)

Revenue 201.1 123.1 269.1

Profit / (Loss) before tax

- before biological assets

("BA") movement 54.2 17.1 50.4

- after BA movement 58.2 16.8 51.7

Basic Earnings per ordinary

share ("EPS")

- before BA movement 90.27cts 26.83cts 77.67cts

- after BA movement 96.79cts 26.35cts 80.32cts

Total net assets 558.2 493.2 528.6

Enquiries:

Anglo-Eastern Plantations Plc

Dato' John Lim Ewe Chuan +44 (0)20 7216 4621

Panmure Gordon (UK) Limited

Dominic Morley +44 (0)20 7886 2954

Chairman's Interim Statement

As of today, the world continues to struggle with the fallout

from the Covid-19 pandemic with worldwide infections exceeding two

hundred and twelve million and more than four million reported

deaths. While vaccination efforts are picking up in many parts of

the world, several countries are battling fresh Covid-19

infections. The emergence of a deadly Delta variant which is more

contagious and transmissible has accelerated the pandemic

especially in places where the vaccination of the mass population

is making slow progress. The resurgence of infection brought

renewed and expanded lockdowns in both Malaysia and Indonesia where

the Group operates. The Indonesian government recently imposed

large-scale movement restrictions to curb a spike in new infections

as healthcare services are overwhelmed by increasing number of

patients. In Malaysia despite a surge in the number of Covid

infections, the lockdown was relaxed to allow interstate travel in

certain circumstances and some social and commercial

activities.

Our operations in Indonesia located mainly in remote

plantations, away from main cities are generally spared from the

lockdowns which are concentrated in populated cities and towns

where infection rates are high. However, we are certainly not

spared as our Indonesian operations recently recorded a spike and

doubling of employees who have tested positive for the virus in

Bengkulu and Kalimantan regions. We continue to reiterate to our

employees to observe established safety protocols. We also

encourage our employees to register promptly for the government

vaccination programs. There are no reported Covid cases in the

Malaysian operation probably due to the small number of employees

and its remote location.

The interim results for the Group for the six months to 30 June

2021 are as follows:

Revenue for the six months to 30 June was $201.1 million, 63%

higher than $123.1 million reported for the same period of 2020.

The Group's gross profit was $59.8 million compared to $21.8

million for the first six months of 2020. Overall profit before tax

after biological assets ("BA") movement for the first half of 2021

increased more than three fold to $58.2 million against $16.8

million for the corresponding period in 2020. The overall profit

includes a reversal of impairment loss of $0.1 million for the

first half of 2021 compared to an impairment loss of $2.5 million

for the first half of 2020. The BA movement adjustment for the

first half of 2021 was a credit of $4.0 million against a debit of

$0.3 million in the last period. The higher profit was attributed

to the higher Crude Palm Oil ("CPO") prices and increased

production.

Fresh Fruit Bunches ("FFB") production for the first half of

2021 was 15% higher at 586,500mt compared to 511,700mt for the same

period last year due to better weather conditions and an increased

matured area. Our young palms in North Sumatera and Kalimantan

performed exceptionally well contributing to the higher production

numbers. Bought-in crops for the first half of 2021 also increased

by 37% to 583,400mt from 425,400mt mainly due to the increase of

crop purchases in the Bengkulu region.

Operational and financial performance

For the six months ended 30 June 2021, gross profit margin

increased to 29.8% from 17.7% as the Group experienced higher CPO

and palm kernel prices.

CPO price ex-Rotterdam averaged $1,122/mt for the first six

months to 30 June 2021, 73% higher than $648/mt over the same

period in 2020. Our Group's average ex-mill price for CPO was

higher at $706/mt for the same period (H1 2020: $551/mt). The

ex-mill prices are normally at a discount to ex-Rotterdam prices as

buyers are required to pay logistic charges and Indonesian CPO tax

and levy.

Profit after tax for the six months ended 30 June 2021 was $45.9

million, compared to a profit after tax of $12.5 million for the

first six months of 2020.

The resulting basic earnings per share for the period was

96.79cts (H1 2020: 26.35cts).

The Group's balance sheet remains strong. Net assets as at 30

June 2021 were $558.2 million compared to $493.2 million as at 30

June 2020 and $528.6 million as at 31 December 2020. The increase

in net assets from the last interim report was attributed to higher

profit and lower capital expenditure. The Indonesian Rupiah has

depreciated by 3% against the US dollar in the first half of

2021.

As at 30 June 2021, the Group had cash and cash equivalents, net

of loans and borrowings, of $159.1 million (H1 2020: $88.7 million,

31 December 2020: $115.2 million). The external bank borrowings as

at 30 June 2020 of $2.7 million which was part of the first half of

$88.7 million as mentioned above were fully repaid in 2020. The

Group has no bank borrowing in 2021.

Operating costs

Operating costs for the Indonesian operations were higher in the

first half of 2021 compared to the same period in 2020 mainly due

to the increase in bought-in crops from third parties, higher

upkeep of plantations and mills and higher harvesting cost related

to the increase in production and the increase in matured area.

Production and Sales

2021 2020 2020

6 months 6 months Year

to 30 June to 30 June to 31 December

mt mt mt

Oil palm production

FFB

- all estates 586,500 511,700 1,103,100

- bought-in from third parties 583,400 425,400 913,200

Saleable CPO 238,700 189,900 406,100

Saleable palm kernels 57,100 45,300 97,100

Oil palm sales

CPO 237,900 195,900 400,400

Palm kernels 55,400 45,200 94,700

FFB sold outside 13,400 19,000 44,300

Rubber production 206 215 465

The Group's six mills processed a total of 1,156,500mt in FFB

for the first half of 2021, a 26% increase compared to 918,100mt

for the same period last year. The higher throughput was due to the

higher FFB supplied from both our own estates and bought-in crops

from third parties as explained earlier.

Overall CPO produced for the first half of 2021 was 26% higher

at 238,700mt from 189,900mt. The oil extraction rate for the first

half of 2021 was 20.6% compared to 20.7% in the same period last

year. External crops made up 50% of the crop processed compared to

46% in the first half of 2020, which have historically always had a

lower oil content.

Commodity prices

The CPO price ex-Rotterdam for the first half of 2021 averaged

$1,122/mt, 73% higher than last year (H1 2020: $648/mt). The price

was volatile for the first half of 2021. It started the year at

$1,014/mt, gradually trended upwards to peak in May at $1,345/mt

before dropping to a low of $975/mt towards the middle of June,

before recovering and closing at $1,050/mt on 30 June 2021. The

rally in the first half of 2021 was built upon speculation of

unfavourable weather conditions in prime soybean-producing

countries which may adversely affect the supply of soybean oil.

This has resulted in a positive spill-over effect in the demand for

CPO which is the closest substitute for soybean oil.

Rubber price averaged $1,734/mt, 48% higher than H1 2020 at

$1,174/mt.

Development

The Group's planted areas at 30 June 2021 comprised:

Total Mature Immature

Ha ha Ha

North Sumatera 19,113 18,310 803

Bengkulu 16,750 15,725 1,025

Riau 4,873 4,873 -

South Sumatera 6,468 5,742 726

Kalimantan 16,764 14,208 2,556

Bangka 2,519 816 1,703

Plasma 4,191 3,077 1,114

------- ------- ---------

Indonesia 70,678 62,751 7,927

Malaysia 3,453 3,453 -

------- ------- ---------

Total: 30 June 2021 74,131 66,204 7,927

------- ------- ---------

Total: 31 December 2020 73,600 63,414 10,186

------- ------- ---------

Total: 30 June 2020 72,441 64,040 8,401

------- ------- ---------

The Group's new planting and replanting for the first six months

of 2021 totalled 1,025ha compared to 971ha for the same period last

year . In addition, Plasma planting for the period was 187ha (H1

2020: 216ha).

The Group remains optimistic that it will meet substantially its

total planting target of 3,800ha in 2021. The Group's total

landholding comprises some 128,000ha, of which the planted area

stands at around 74,131ha (H1 2020: 72,441ha) with the balance of

estimated plantable land at 17,900ha.

The construction of the seventh mill in North Sumatera has been

delayed by the frequent lockdowns caused by the pandemic in the

country, affecting the deployment of manpower at construction site,

as well as fabrication of mechanical works, interruption of supply

chain and the transport of building materials. The mill is now

likely to be completed at the end of Q2, 2022.

Dividend

As in previous years, no interim dividend has been declared. A

final dividend of 1.0 cents per share in respect of the year ended

31 December 2020 was paid on 16 July 2021.

Outlook

India, the world's largest edible oil importer in its effort to

tame its domestic inflation has at the end of June 2021 cut its

taxes on CPO and other palm oil products for three months while

maintaining the existing tax rates on other vegetable oils. This is

likely to lead to a bigger import and improved demand at the

expense of other vegetable oils.

The industry also welcomed the Indonesian government decision to

reduce the CPO export levy at the start of the second half of 2021.

Export levy is payable on a gradual basis starting at $55/mt when

CPO price reaches $670/mt. The previous maximum export levy was

$255/mt when CPO price exceeds $995/mt. The revised maximum export

levy is $175/mt when CPO price exceeds $1000/mt.

On the whole CPO prices are expected to moderate in the second

half of 2021 as the industry enters into the high production season

and palm oil inventory inches higher over the next few months.

Prices nevertheless are expected to remain volatile depending on

how production levels unfold amidst a change in global weather

pattern.

Despite the increase in the vaccination rate, there are rising

concerns over the emergence of a new virus variant which has

already spread to Indonesia and could interrupt our operations or

in a worst case scenario shutdown our estates and mill operations.

A prolonged pandemic in our main export markets may also hurt

demand in the short term. The Group has policies in place and would

be in a good position to mitigate these risks should they arise to

limit the impact to the Group.

Principal risks and uncertainties

The principal risks and uncertainties, including the risks due

to the Coronavirus pandemic, have broadly remained the same since

the publication of the annual report for the year ended 31 December

2020.

A more detailed explanation of the risks relevant to the Group

is on pages 34 to 39 and from pages 114 to 119 of the 2020 annual

report which is available at https:// www.angloeastern.co.uk /.

Madam Lim Siew Kim

Chairman

26 August 2021

Responsibility Statements

We confirm that to the best of our knowledge:

a) The unaudited interim financial statements have been prepared

in accordance with International Accounting Standards ("IAS") 34:

Interim Financial Reporting as adopted by the European Union;

b) The Chairman's interim statement includes a fair review of

the information required by Disclosure and Transparency Rule

("DTR") 4.2.7R (an indication of important events during the first

six months and a description of the principal risks and

uncertainties for the remaining six months of the year); and

c) The interim financial statements include a fair review of the

information required by DTR 4.2.8R (material related party

transactions in the six months ended 30 June 2021 and any material

changes in the related party transactions described in the last

Annual Report) of the DTR of the United Kingdom Financial Conduct

Authority.

By order of the Board

Dato' John Lim Ewe Chuan

Executive Director, Corporate Finance and Corporate Affairs

26 August 2021

Condensed Consolidated Income Statement

2021 2020 2020

6 months to 30 June 6 months to 30 June Year to 31 December

(unaudited) (unaudited) (audited)

--------------------------------- --------------------------------- ------------------------ ----------

Notes Result Result Result

Continuing before before before

operations BA BA BA BA BA BA

movement* movement Total movement movement Total movement movement Total

$000 $000 $000 $000 $000 $000 $000 $000 $000

--------------------- ------ ---------- --------- ---------- --------- ---------- ----------- ----------- ----------

Revenue 3 201,105 - 201,105 123,098 - 123,098 269,060 - 269,060

Cost of sales (145,214) 3,951 (141,263) (100,989) (298) (101,287) (213,370) 1,274 (212,096)

--------------------- ------ ---------- --------- ---------- ---------- --------- ---------- ----------- ----------- ----------

Gross profit 55,891 3,951 59,842 22,109 (298) 21,811 55,690 1,274 56,964

Administration

expenses (3,334) - (3,334) (3,336) - (3,336) (8,134) - (8,134)

Reversal of

impairment

/ (Impairment

losses) 54 - 54 (2,491) - (2,491) 2,008 - 2,008

Provision for

expected

credit loss - - - (313) - (313) (1,485) - (1,485)

--------------------- ------ ---------- --------- ---------- ---------- --------- ---------- ----------- ----------- ----------

Operating profit /

(loss) 52,611 3,951 56,562 15,969 (298) 15,671 48,079 1,274 49,353

Exchange (losses)

/ gains 300 - 300 (11) - (11) (268) - (268)

Finance income 4 1,333 - 1,333 1,376 - 1,376 2,876 - 2,876

Finance expense 4 (12) - (12) (236) - (236) (292) - (292)

--------------------- ------ ---------- --------- ---------- ---------- --------- ---------- ----------- ----------- ----------

Profit / (Loss)

before

tax 5 54,232 3,951 58,183 17,098 (298) 16,800 50,395 1,274 51,669

Tax expense 6 (11,441) (873) (12,314) (4,415) 75 (4,340) (13,660) (66) (13,726)

--------------------- ------ ---------- --------- ---------- ---------- --------- ---------- ----------- ----------- ----------

Profit / (Loss) for

the period 42,791 3,078 45,869 12,683 (223) 12,460 36,735 1,208 37,943

--------------------- ------ ---------- --------- ---------- ---------- --------- ---------- ----------- ----------- ----------

Attributable to:

- Owners of the

parent 35,781 2,581 38,362 10,633 (190) 10,443 30,784 1,051 31,835

- Non-controlling

interests 7,010 497 7,507 2,050 (33) 2,017 5,951 157 6,108

--------------------- ------ ---------- --------- ---------- ---------- --------- ---------- ----------- ----------- ----------

42,791 3,078 45,869 12,683 (223) 12,460 36,735 1,208, 37,943

--------------------- ------ ---------- --------- ---------- ---------- --------- ---------- ----------- ----------- ----------

Earnings per share

for profit

attributable

to the owners of

the

parent during the

period

- basic 8 96.79cts 26.35cts 80.32cts

- diluted 8 96.79cts 26.35cts 80.32cts

* The total column represents the IFRS figures and the result

before BA movement is an Alternative Performance Measure ("APM").

We have opted to additionally disclose this APM as the BA movement

is considered to be a fair value calculation which does not

appropriately represent the Group's result for the year.

Condensed Consolidated Statement of Comprehensive Income

2021 2020 2020

6 months 6 months Year

to 30 June to 30 June to 31 December

(unaudited) (unaudited) (audited)

$000 $000 $000

--------------------------------------------------------------- ------------ ------------ ---------------

Profit for the period 45,869 12,460 37,943

--------------------------------------------------------------- ------------ ------------ ---------------

Other comprehensive expenses:

Items may be reclassified to profit or loss:

Loss on exchange translation of foreign operations (14,879) (13,973) (5,490)

--------------------------------------------------------------- ------------ ------------ ---------------

Net other comprehensive expenses may be reclassified

to profit or loss (14,879) (13,973) (5,490)

--------------------------------------------------------------- ------------ ------------ ---------------

Items not to be reclassified to profit or loss:

Unrealised (loss) / gain on revaluation of leasehold

land, net of tax (1,014) (932) 1,309

Remeasurement of retirement benefits plan, net

of tax - - (649)

--------------------------------------------------------------- ------------ ------------ ---------------

Net other comprehensive (expenses) / income not

being reclassified to profit or loss (1,014) (932) 660

--------------------------------------------------------------- ------------ ------------ ---------------

Total other comprehensive expenses for the period,

net of tax (15,893) (14,905) (4,830)

Total comprehensive income / (expenses) for the

period 29,976 (2,445) 33,113

Attributable to:

- Owners of the parent 25,492 (1,560) 27,722

- Non-controlling interests 4,484 (885) 5,391

--------------------------------------------------------------- ------------ ------------ ---------------

29,976 (2,445) 33,113

--------------------------------------------------------------- ------------ ------------ ---------------

Condensed Consolidated Statement of Financial Position

2021 2020 2020

as at 30 June as at 30 June as at 31 December

(unaudited) (unaudited) (audited)

$000 $000 $000

------------------------------------------ -------------- -------------- ------------------

Non-current assets

Property, plant and equipment 356,170 355,006 365,353

Receivables 24,153 17,895 22,236

Deferred tax assets 9,317 12,470 8,817

------------------------------------------- -------------- -------------- ------------------

389,640 385,371 396,406

------------------------------------------ -------------- -------------- ------------------

Current assets

Inventories 15,038 6,297 12,541

Income tax receivables 10,034 14,225 10,071

Other tax receivables 34,717 35,803 41,618

Biological assets 12,443 7,054 8,783

Trade and other receivables 5,492 6,108 4,693

Short-term investments 1,539 - 1,957

Cash and cash equivalents 159,140 91,442 115,211

------------------------------------------- -------------- -------------- ------------------

238,403 160,929 194,874

------------------------------------------ -------------- -------------- ------------------

Current liabilities

Loans and borrowings - (2,734) -

Trade and other payables (27,223) (17,178) (26,310)

Income tax liabilities (11,863) (3,409) (5,981)

Other tax liabilities (1,171) (1,258) (1,089)

Dividend payables (420) (221) (24)

Lease liabilities (244) (221) (236)

------------------------------------------- -------------- -------------- ------------------

(40,921) (25,021) (33,640)

------------------------------------------ -------------- -------------- ------------------

Net current assets 197,482 135,908 161,234

------------------------------------------- -------------- -------------- ------------------

Non-current liabilities

Deferred tax liabilities (14,659) (15,984) (15,467)

Retirement benefits - net liabilities (14,220) (11,792) (13,383)

Lease liabilities (90) (328) (217)

------------------------------------------- -------------- -------------- ------------------

(28,969) (28,104) (29,067)

------------------------------------------ -------------- -------------- ------------------

Net assets 558,153 493,175 528,573

------------------------------------------- -------------- -------------- ------------------

Issued capital and reserves attributable

to owners of the parent

Share capital 15,504 15,504 15,504

Treasury shares (1,171) (1,171) (1,171)

Share premium 23,935 23,935 23,935

Capital redemption reserve 1,087 1,087 1,087

Revaluation reserves 48,465 47,530 49,367

Exchange reserves (245,502) (240,146) (233,534)

Retained earnings 611,459 552,660 573,493

------------------------------------------- -------------- -------------- ------------------

453,777 399,399 428,681

Non-controlling interests 104,376 93,776 99,892

------------------------------------------- -------------- -------------- ------------------

Total equity 558,153 493,175 528,573

------------------------------------------- -------------- -------------- ------------------

Condensed Consolidated Statement of Changes in Equity

Attributable to owners of the parent

-----------------------------------------------------------------------------------------------

Capital Non-controlling

Share Treasury Share redemption Revaluation Exchange Retained interests Total

capital shares premium reserve reserves Reserves earnings Total equity

$000 $000 $000 $000 $000 $000 $000 $000 $000 $000

---------------------------------------------------------- --------- ---------- --------- ----------- ------------- ---------- ---------- --------- ---------------- ---------

Balance at 31 December

2019 15,504 (1,171) 23,935 1,087 48,413 (229,026) 542,415 401,157 94,661 495,818

Items of other comprehensive

income:

* Unrealised gain on revaluation of leasehold land,

net

of tax - - - - 954 - - 954 355 1,309

* Remeasurement of retirement benefits plan, net of

tax - - - - - - (559) (559) (90) (649)

* Loss on exchange translation of foreign operations - - - - - (4,508) - (4,508) (982) (5,490)

---------------------------------------------------------- --------- ---------- --------- ----------- ------------- ---------- ---------- --------- ---------------- -----------

Total other comprehensive

income / (expenses) - - - - 954 (4,508) (559) (4,113) (717) (4,830)

Profit for the year - - - - - - 31,835 31,835 6,108 37,943

---------------------------------------------------------- --------- ---------- --------- ----------- ------------- ---------- ---------- --------- ---------------- -----------

Total comprehensive income

/ (expenses) for the year - - - - 954 (4,508) 31,276 27,722 5,391 33,113

Dividends paid - - - - - - (198) (198) (160) (358)

---------------------------------------------------------- ---------

Balance at 31 December

2020 15,504 (1,171) 23,935 1,087 49,367 (233,534) 573,493 428,681 99,892 528,573

---------------------------------------------------------- --------- ---------- --------- ----------- ------------- ---------- ---------- --------- ---------------- -----------

Items of other comprehensive

income:

* Unrealised loss on revaluation of leasehold land,

net

of tax - - - - (902) - - (902) (112) (1,014)

* Loss on exchange translation of foreign operations - - - - - (11,968) - (11,968) (2,911) (14,879)

---------------------------------------------------------- --------- ---------- --------- ----------- ------------- ---------- ---------- --------- ---------------- -----------

Total other comprehensive

expenses - - - - (902) (11,968) - (12,870) (3,023) (15,893)

Profit for the period - - - - - - 38,362 38,362 7,507 45,869

---------------------------------------------------------- --------- ---------- --------- ----------- ------------- ---------- ---------- --------- ---------------- -----------

Total comprehensive (expenses)

/ income for the period - - - (902) (11,968) 38,362 25,492 4,484 29,976

Dividends payable - - - - - - (396) (396) - (396)

Balance at 30 June 2021 15,504 (1,171) 23,935 1,087 48,465 (245,502) 611,459 453,777 104,376 558,153

---------------------------------------------------------- --------- ---------- --------- ----------- ------------- ---------- ---------- --------- ---------------- -----------

Attributable to owners of the parent

---------------------------------------------------------------------------------------------------

Capital Non-controlling

Share Treasury Share redemption Revaluation Exchange Retained interests Total

capital shares premium reserve reserves reserves earnings Total Equity

$000 $000 $000 $000 $000 $000 $000 $000 $000 $000

---------------------------------------------------------- --------- ---------- --------- ----------- ------------- ---------- ---------- ------------- ---------------- -----------

Balance at 31 December

2019 15,504 (1,171) 23,935 1,087 48,413 (229,026) 542,415 401,157 94,661 495,818

Items of other comprehensive

income:

* Unrealised loss on revaluation of leasehold land,

net

of tax - - - - (883) - - (883) (49) (932)

* Loss on exchange translation of foreign operations - - - - - (11,120) - (11,120) (2,853) (13,973)

---------------------------------------------------------- --------- ---------- --------- ----------- ------------- ---------- ---------- ------------- ---------------- -----------

Total other comprehensive

expenses - - - - (883) (11,120) - (12,003) (2,902) (14,905)

Profit for the period - - - - - - 10,443 10,443 2,017 12,460

---------------------------------------------------------- --------- ---------- --------- ----------- ------------- ---------- ---------- ------------- ---------------- -----------

Total comprehensive expenses

for the period - - - - (883) (11,120) 10,443 (1,560) (885) (2,445)

Dividends payable - - - - - - (198) (198) - (198)

Balance at 30 June 2020 15,504 (1,171) 23,935 1,087 47,530 (240,146) 552,660 399,399 93,776 493,175

---------------------------------------------------------- --------- ---------- --------- ----------- ------------- ---------- ---------- ------------- ---------------- -----------

Condensed Consolidated Statement of Cash Flows

2021 2020 2020

6 months 6 months Year

to 30 June to 30 June to 31 December

(unaudited) (unaudited) (audited)

$000 $000 $000

-------------------------------------- ------------ ------------ ---------------

Cash flows from operating

activities

Profit before tax 58,183 16,800 51,669

Adjustments for:

Biological assets movement (3,951) 298 (1,274)

(Gain) / Loss on disposal

of property, plant and equipment (1) 26 (2)

Depreciation 9,379 8,993 18,143

Retirement benefit provisions 1,357 932 1,793

Net finance income (1,321) (1,140) (2,584)

Unrealised (gain) / loss

in foreign exchange (300) 11 268

Property, plant and equipment

written off 139 263 587

(Reversal of impairment)

/ Impairment losses (54) 2,491 (2,008)

(Reversal) / Provision for

expected credit loss (1) 313 1,485

Operating cash flows before

changes in working capital 63,430 28,987 68,077

(Increase) / Decrease in

inventories (2,835) 2,209 (3,915)

Decrease / (Increase) in

non-current, trade and other

receivables 1,789 (372) (12)

Increase in trade and other

payables 1,737 1,786 10,554

-------------------------------------- ------------ ------------ ---------------

Cash inflows from operations 64,121 32,610 74,704

Interest paid - (217) (258)

Retirement benefits paid (141) (175) (434)

Overseas tax paid (1,351) (6,147) (8,917)

-------------------------------------- ------------ ------------ ---------------

Net cash flows from operating

activities 62,629 26,071 65,095

-------------------------------------- ------------ ------------ ---------------

Investing activities

Property, plant and equipment

- purchases (12,031) (11,141) (21,277)

- sales 1 50 83

Interest received 1,333 1,376 2,876

Increase in receivables

from cooperatives under

plasma scheme (5,197) (1,792) (4,563)

Placement of fixed deposits

with original maturity of

more than three months 418 - (1,957)

Net cash used in investing

activities (15,476) (11,507) (24,838)

-------------------------------------- ------------ ------------ ---------------

Financing activities

Dividends paid to the holders

of the parent - - (197)

Dividends paid to non-controlling

interests - - (160)

Repayment of existing long-term

loans - (5,425) (8,167)

Repayment of lease liabilities

- principal (106) (106) (223)

Repayment of lease liabilities

- interest (12) (19) (34)

Net cash used in financing

activities (118) (5,550) (8,781)

----------------------------------- -------- -------- --------

Net increase in cash and

cash equivalents 47,035 9,014 31,476

Cash and cash equivalents

At beginning of period 115,211 84,846 84,846

Exchange losses (3,106) (2,418) (1,111)

----------------------------------- -------- -------- --------

At end of period 159,140 91,442 115,211

----------------------------------- -------- -------- --------

Comprising:

Cash at end of period 159,140 91,442 115,211

----------------------------------- -------- -------- --------

Notes to the interim statements

1. Basis of preparation of interim financial statements

These interim consolidated financial statements have been

prepared in accordance with IAS 34, "Interim Financial Reporting",

as adopted by the European Union. They do not include all

disclosures that would otherwise be required in a complete set of

financial statements and should be read in conjunction with the

2020 Annual Report. The financial information for the half years

ended 30 June 2021 and 30 June 2020 does not constitute statutory

accounts within the meaning of Section 434(3) of the Companies Act

2006 and has been neither audited nor reviewed pursuant to guidance

issued by the Auditing Practices Board.

Basis of preparation

The annual financial statements of Anglo-Eastern Plantations Plc

are prepared in accordance with International Financial Reporting

Standards ("IFRSs") as adopted by the European Union. The

comparative financial information for the year ended 31 December

2020 included within this report does not constitute the full

statutory accounts for that period. The statutory Annual Report and

Financial Statements for 2020 have been filed with the Registrar of

Companies. The Independent Auditors' Report on the Annual Report

and Financial Statements for 2020 was unqualified, did not draw

attention to any matters by way of emphasis, and did not contain a

statement under 498(2) or 498(3) of the Companies Act 2006.

The Directors have a reasonable expectation, having made the

appropriate enquiries, that the Group has control of the monthly

cashflows and that the Group has sufficient cash resources to cover

the fixed cashflows for a period of at least 12 months from the

date of approval of this interim report. For these reasons, the

Directors adopted a going concern basis in the preparation of the

interim report. The Directors have made this assessment after

consideration of the Group's budgeted cash flows and related

assumptions including appropriate stress testing of identified

uncertainties, specifically on the potential shut down of the

entire operations if all the plantations are infected with

Coronavirus as well as the impact on the demand for palm oil due to

the Coronavirus pandemic. Stress testing of other identified

uncertainties was undertaken on primarily commodity prices and

currency exchange rates.

Changes in accounting standards

The same accounting policies, presentation and methods of

computation are followed in these condensed consolidated financial

statements as were applied in the Group's latest annual audited

financial statements.

In November 2020, the President of Republic of Indonesia enacted

a Job Creation Law that will have an impact on employee benefit

obligations. As at 31 December 2020, the Group has calculated the

employee benefit obligation based on the law that was in effect

prior to this Job Creation Law, namely UU No. 13/2003, due to the

fact that the basis of the calculation for employee benefit

obligations is further regulated in an implementing regulation

which was only enacted on 16 February 2021. Until the completion

date of this report, the Group is still calculating the impact of

the implementation of this regulation, and its effect on the

Group's financial statements.

2. Foreign exchange

2021 2020 2020

6 months 6 months Year

to 30 June to 30 June to 31 December

(unaudited) (unaudited) (audited)

Closing exchange rates

Rp : $ 14,496 14,302 14,105

$ : GBP 1.38 1.24 1.36

RM : $ 4.15 4.28 4.02

Average exchange rates

Rp : $ 14,298 14,600 14,572

$ : GBP 1.39 1.26 1.28

RM : $ 4.10 4.25 4.20

3. Revenue

Disaggregation of Revenue

The Group has disaggregated revenue into various categories in

the following table which is intended to:

-- Depict how the nature, amount and uncertainty of revenue and

cash flows are affected by timing of revenue recognition; and

-- Enable users to understand the relationship with revenue

segment information provided in note 5.

There is no right of return and warranty provided to the

customers on the sale of products and services rendered.

CPO, palm

6 months to 30 June kernel Rubber Shell Biomass Biogas Others

2021 and FFB nut products products Total

$000 $000 $000 $000 $000 $000 $000

Contract counterparties

Government - - - - 423 - 423

Non-government

- Wholesalers 197,552 356 2,187 218 - 369 200,682

---------- --------- -------- ---------- ---------- --------- ----------

197,552 356 2,187 218 423 369 201,105

---------- --------- -------- ---------- ---------- --------- ----------

Timing of transfer

of goods

Delivery to customer

premises 2,502 356 - - - - 2,858

Delivery to port of

departure - - - 218 - - 218

Customer collect from

our mills / estates 195,050 - 2,187 - - - 197,237

Upon generation / others - - - - 423 369 792

---------- --------- -------- ---------- ---------- --------- ----------

197,552 356 2,187 218 423 369 201,105

---------- --------- -------- ---------- ---------- --------- ----------

CPO, palm

6 months to 30 June kernel Rubber Shell Biomass Biogas Others

2020 and FFB nut products products Total

$000 $000 $000 $000 $000 $000 $000

Contract counterparties

Government - - - - 551 - 551

Non-government

- Wholesalers 120,002 252 1,649 213 - 431 122,547

120,002 252 1,649 213 551 431 123,098

---------- --------- -------- ---------- ---------- --------- ----------

Timing of transfer

of goods

Delivery to customer

premises 2,073 252 - - - - 2,325

Delivery to port of

departure - - - 213 - - 213

Customer collect from

our mills / estates 117,929 - 1,649 - - - 119,578

Upon generation / others - - - - 551 431 982

120,002 252 1,649 213 551 431 123,098

---------- --------- -------- ---------- ---------- --------- ----------

CPO, palm

Year to 31 December kernel Rubber Shell Biomass Biogas Others

2020 and FFB nut products products Total

$000 $000 $000 $000 $000 $000 $000

Contract counterparties

Government - - - - 970 - 970

Non-government

- Wholesalers 262,348 631 3,959 427 - 725 268,090

---------- --------- -------- ---------- ---------- --------- ----------

262,348 631 3,959 427 970 725 269,060

---------- --------- -------- ---------- ---------- --------- ----------

Timing of transfer

of goods

Delivery to customer

premises 5,613 631 - - - - 6,244

Delivery to port of

departure - - - 427 - - 427

Customer collect from

our mills / estates 256,735 - 3,959 - - - 260,694

Upon generation / others - - - - 970 725 1,695

---------- --------- -------- ---------- ---------- --------- ----------

262,348 631 3,959 427 970 725 269,060

---------- --------- -------- ---------- ---------- --------- ----------

4. Finance income and expense

2021 2020 2020

6 months 6 months Year

to 30 June to 30 June to 31 December

(unaudited) (unaudited) (audited)

$000 $000 $000

Finance income

Interest receivable on:

Credit bank balances and time

deposits 1,333 1,376 2,876

Finance expense

Interest payable on:

Development loans - (217) (257)

Interest expense on lease liabilities (12) (19) (35)

------------ ------------ ---------------

(12) (236) (292)

------------ ------------ ---------------

Net finance income recognized

in income statement 1,321 1,140 2,584

------------ ------------ ---------------

5. Segment information

North South Total

Sumatera Bengkulu Sumatera Riau Bangka Kalimantan Indonesia Malaysia UK Total

$000 $000 $000 $000 $000 $000 $000 $000 $000 $000

6 months to 30 June 2021

(unaudited)

Total sales revenue

(all

external)

* CPO, palm kernel

and FFB 57,451 70,051 198 31,239 925 36,442 196,306 1,246 - 197,552

* Rubber 356 - - - - - 356 - - 356

* Shell nut 663 648 - 746 - 130 2,187 - - 2,187

* Biomass products 218 - - - - - 218 - - 218

* Biogas products - 220 - - - 203 423 - - 423

* Others 45 48 88 21 11 143 356 13 - 369

Total revenue 58,733 70,967 286 32,006 936 36,918 199,846 1,259 - 201,105

--------- --------- --------- -------- ------- ----------- ---------- --------- ------ ---------

Profit / (loss)

before

tax 16,480 16,640 (2,198) 8,441 131 15,503 54,997 (169) (596) 54,232

BA movement 1,550 770 86 206 54 1,132 3,798 153 - 3,951

--------- --------- --------- -------- ------- ----------- ---------- --------- ------ ---------

Profit / (loss) for

the

period before tax

per consolidated

income statement 18,030 17,410 (2,112) 8,647 185 16,635 58,795 (16) (596) 58,183

--------- --------- --------- -------- ------- ----------- ---------- --------- ------ ---------

Interest income 969 297 2 52 - 10 1,330 3 - 1,333

Interest expense (9) - - - - - (9) (3) - (12)

Depreciation (2,601) (2,075) (982) (452) (172) (2,829) (9,111) (268) - (9,379)

Reversal of

impairment - - - - - 133 133 - - 133

Impairment losses - - (79) - - - (79) - - (79)

(Provision) /

Reversal

of expected credit

loss - (1) 1 - - (1) (1) - 1 -

Inter-segment

transactions 2,549 (1,002) (378) (288) (141) (968) (228) 218 10 -

Inter-segmental

revenue 18,561 637 3,140 - - 4,075 26,413 - - 26,413

Tax expense (4,484) (3,402) 670 (1,800) (17) (3,153) (12,186) (127) (1) (12,314)

Total assets 245,486 124,423 40,142 36,003 16,630 137,654 600,338 20,859 6,846 628,043

Non-current assets 108,443 68,525 29,375 17,008 14,761 101,808 339,920 16,250 - 356,170

Non-current assets

- additions 2,638 2,285 1,308 391 930 3,949 11,501 370 - 11,871

North South Total

Sumatera Bengkulu Sumatera Riau Bangka Kalimantan Indonesia Malaysia UK Total

$000 $000 $000 $000 $000 $000 $000 $000 $000 $000

6 months to 30 June 2020

(unaudited)

Total sales revenue

(all

external)

* CPO, palm kernel

and FFB 36,438 42,582 53 20,307 466 19,014 118,860 1,142 - 120,002

* Rubber 252 - - - - - 252 - - 252

* Shell nut 513 335 - 692 - 109 1,649 - - 1,649

* Biomass products 213 - - - - - 213 - - 213

* Biogas products 151 219 - - - 181 551 - - 551

* Others 46 62 91 21 7 204 431 - - 431

Total revenue 37,613 43,198 144 21,020 473 19,508 121,956 1,142 - 123,098

--------- --------- --------- -------- ------- ----------- ---------- --------- ------ --------

Profit / (loss)

before

tax 6,244 9,000 (3,592) 5,466 (113) 1,098 18,103 (155) (850) 17,098

BA movement 302 (123) (64) (144) 12 (337) (354) 56 - (298)

--------- --------- --------- -------- ------- ----------- ---------- --------- ------ --------

Profit / (loss) for

the

period before tax

per consolidated

income statement 6,546 8,877 (3,656) 5,322 (101) 761 17,749 (99) (850) 16,800

--------- --------- --------- -------- ------- ----------- ---------- --------- ------ --------

Interest income 1,028 300 2 14 - 16 1,360 15 1 1,376

Interest expense (13) - - - - (217) (230) (6) - (236)

Depreciation (2,279) (2,102) (1,048) (436) (180) (2,679) (8,724) (269) - (8,993)

Impairment losses - - (23) - - (2,468) (2,491) - - (2,491)

(Provision) /

Reversal

of expected credit

loss (58) - (255) - - (1) (314) - 1 (313)

Inter-segment

transactions 2,546 (981) (370) (282) (97) (975) (159) 71 88 -

Inter-segmental

revenue 12,402 653 1,661 - - 1,394 16,110 - - 16,110

Tax expense (2,501) (1,887) 1,105 (1,257) 43 184 (4,313) (29) 2 (4,340)

Total assets 208,010 104,609 38,880 30,438 15,069 123,131 520,137 20,077 6,086 546,300

Non-current assets 110,228 69,317 30,649 17,481 13,529 97,807 339,011 15,995 - 355,006

Non-current assets

- additions 2,610 621 1,173 267 2,048 4,025 10,744 85 - 10,829

North South Total

Sumatera Bengkulu Sumatera Riau Bangka Kalimantan Indonesia Malaysia UK Total

$000 $000 $000 $000 $000 $000 $000 $000 $000 $000

Year to 31 December 2020 (audited)

Total sales revenue

(all

external)

* CPO, palm kernel

and FFB 81,764 85,699 1,561 46,865 1,026 43,103 260,018 2,330 - 262,348

* Rubber 631 - - - - - 631 - - 631

* Shell nut 1,232 956 - 1,586 - 185 3,959 - - 3,959

* Biomass products 427 - - - - - 427 - - 427

* Biogas products 152 444 - - - 374 970 - - 970

* Others 60 105 176 - 16 355 712 6 7 725

--------- --------- ---------- --------- ------- ----------- ---------- --------- ---------- ---------

Total revenue 84,266 87,204 1,737 48,451 1,042 44,017 266,717 2,336 7 269,060

--------- --------- ---------- --------- ------- ----------- ---------- --------- ---------- ---------

Profit / (loss)

before

tax 18,915 16,809 (6,639) 12,341 (76) 11,174 52,524 (682) (1,447) 50,395

BA movement 550 130 71 126 36 344 1,257 17 - 1,274

--------- --------- ---------- --------- ------- ----------- ---------- --------- ---------- ---------

Profit / (loss) for

the

year before tax

per consolidated

income statement 19,465 16,939 (6,568) 12,467 (40) 11,518 53,781 (665) (1,447) 51,669

--------- --------- ---------- --------- ------- ----------- ---------- --------- ---------- ---------

Interest income 2,121 670 3 34 - 25 2,853 22 1 2,876

Interest expense (25) - - - - (257) (282) (10) - (292)

Depreciation (4,741) (4,253) (2,090) (886) (308) (5,387) (17,665) (478) - (18,143)

Reversal of

impairment - - 31 - - 2,165 2,196 - - 2,196

Impairment losses - - - - - - - (188) - (188)

Reversal /

(Provision)

for expected

credit loss 65 (1) (1,383) - (1) (167) (1,487) 1 1 (1,485)

Inter-segment

transactions 4,744 (1,966) (741) (564) (195) (1,913) (635) 467 168 -

Inter-segmental

revenue 27,668 3,293 3,505 - - 4,167 38,633 - - 38,633

Tax expense (6,734) (3,218) 1,361 (2,742) 25 (1,594) (12,902) (737) (87) (13,726)

Total assets 227,471 111,470 39,554 33,572 16,580 134,973 563,620 21,682 5,978 591,280

Non-current assets 111,483 70,332 30,320 17,543 14,713 104,295 348,686 16,667 - 365,353

Non-current assets

- additions 4,582 2,413 2,319 342 4,474 6,868 20,998 127 - 21,125

In the 6 months to 30 June 2021, revenues from 4 customers of

the Indonesian segment represent approximately $112.6m (H1 2020:

$63.5m) of the Group's total revenues. In the year 2020, revenues

from 4 customers of the Indonesian segment represent approximately

$130.8m of the Group's total revenues. An analysis of this revenue

is provided below. Although Customers 1 and 2 each contribute over

10% of the Group's total revenue, there was no over reliance on

these Customers as tenders were performed on a weekly basis. Two of

the top four customers were the same as in the year to 31 December

2020.

2021 2020 2020

6 months 6 months Year

to 30 June to 30 June to 31 December

(unaudited) (unaudited) (audited)

$m % $m % $m %

Major Customers

Customer 1 53.7 26.7 19.5 15.8 53.6 20.0

Customer 2 23.5 11.7 16.0 13.0 31.6 11.7

Customer 3 18.4 9.2 15.1 12.2 25.0 9.3

Customer 4 17.0 8.5 12.9 10.4 20.6 7.6

------------------ --------- --------- ---------- -------- -------- --------

Total 112.6 56.1 63.5 51.4 130.8 48.6

------------------ --------- --------- ---------- -------- -------- --------

6. Tax expense

2021 2020 2020

6 months 6 months Year

to 30 June to 30 June to 31 December

(unaudited) (unaudited) (audited)

$000 $000 $000

Foreign corporation tax

- current year 13,194 6,036 9,920

Foreign corporation tax

- prior year - 50 287

Deferred tax adjustment

- origination and reversal

of temporary differences (880) (1,746) 2,832

Recognition of previously

unrecognized deferred tax

assets - - 687

12,314 4,340 13,726

------------ ------------ ---------------

Corporation tax rate in Indonesia is at 22% (H1 2020: 25%, 2020:

22%) whereas Malaysia is at 24% (H1 2020: 24%, 2020: 24%). The

standard rate of corporation tax in the UK for the current year is

19% (H1 2020: 19%, 2020: 19%).

7. Dividend

The final and only dividend in respect of 2020, amounting to 1.0

cents per share, or $396,364 was paid on 16 July 2021 (2019: 0.5

cents per share, or $198,182, paid on 17 July 2020). As in previous

years, no interim dividend has been declared.

8. Earnings per ordinary share ("EPS")

2021 2020 2020

6 months 6 months Year

to 30 June to 30 June to 31 December

(unaudited) (unaudited) (audited)

$000 $000 $000

Profit for the period attributable

to owners of the Company before

BA movement 35,781 10,633 30,784

BA movement 2,581 (190) 1,051

------------ ------------ ---------------

Earnings used in basic and

diluted EPS 38,362 10,443 31,835

------------ ------------ ---------------

Number Number Number

'000 '000 '000

Weighted average number of

shares in issue in the period

- used in basic EPS 39,636 39,636 39,636

- dilutive effect of outstanding

share options - - -

------------ ------------ ---------------

- used in diluted EPS 39,636 39,636 39,636

------------ ------------ ---------------

Basic and diluted EPS before

BA movement 90.27cts 26.83cts 77.67cts

Basic and diluted EPS after

BA movement 96.79cts 26.35cts 80.32cts

9. Fair value measurement of financial instruments

The carrying amounts and fair values of the financial

instruments which are not recognised at fair value in the Statement

of Financial Position are exhibited below:

2021 2020 2020

6 months 6 months Year

to 30 June to 30 June to 31 December

(unaudited) (unaudited) (audited)

Carrying Fair Carrying Fair Carrying Fair

amount value amount value amount value

$000 $000 $000 $000 $000 $000

Non-current receivables

Due from non-controlling

interests 5,413 3,032 3,487 1,974 5,493 3,050

Due from cooperatives

under Plasma

scheme 18,740 17,061 14,408 13,626 16,743 14,857

24,153 20,093 17,895 15,600 22,236 17,907

--------- ------- ------------ ------- --------- -------

Financial instruments not measured at fair value include cash

and cash equivalents, trade and other receivables, trade and other

payables, and borrowings due within one year.

Due to their short-term nature, the carrying value of cash and

cash equivalents, trade and other receivables, trade and other

payables and borrowings due within one year approximates their fair

value.

All non-current assets, non-current receivables and long-term

loan are classified as Level 3 in the fair value hierarchy.

Reconciliation - Level 3 recurring fair value measurements:

2021 2020 2020

6 months 6 months Year

to 30 June to 30 June to 31 December

(unaudited) (unaudited) (audited)

$000 $000 $000

Non-current assets - Land

Opening balance 142,276 137,936 137,936

Addition 1,567 2,581 4,858

Disposal (321) - (243)

Net unrealised loss recognised

during the period (1,300) (1,243) (1,142)

Reversal of impairment

loss / (Impairment loss) 54 (1,338) 2,196

Exchange difference (3,901) (4,131) (1,329)

Closing balance 138,375 133,805 142,276

------------ ------------ ---------------

The valuation techniques and significant unobservable inputs

used in determining the fair value measurement of non-current

receivables and borrowings due after one year, as well as the

inter-relationship between key unobservable inputs and fair value,

are set out in the table below:

Item Valuation approach Inputs used Inter-relationship

between key unobservable

inputs and fair

value

----------------- ------------------------- ------------ ---------------------------

Non-current receivables

Due from Based on cash flows Discount The higher the

non-controlling discounted using rate discount rate,

interests current lending rate the lower the

of 6% (H1 2020 and fair value.

2020: 6%).

Due from Based on cash flows Discount The higher the

cooperatives discounted using rate discount rate,

under Plasma an estimated current the lower the

scheme lending rate of 6.75% fair value.

(H1 2020: 6.78%,

2020: 6.75%).

10. Report and financial information

Copies of the interim report for the Group for the period ended

30 June 2021 are available on the AEP website at

https://www.angloeastern.co.uk/.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR VQLBLFVLZBBK

(END) Dow Jones Newswires

August 26, 2021 04:59 ET (08:59 GMT)

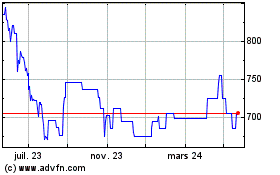

Anglo Eastern Plantations (AQSE:AEP.GB)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

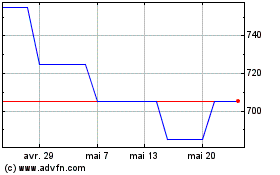

Anglo Eastern Plantations (AQSE:AEP.GB)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024