European Big Oil's Renewables Earnings -- At a Glance

23 Février 2023 - 3:47PM

Dow Jones News

Italy's Eni SpA on Thursday wrapped up the earnings season for

Europe's largest oil companies, in which some of them began jamming

the brakes on climate initiatives as they reported bumper profits

for 2022. Here is a look at the financial performance of their

renewables operations in the fourth quarter. The companies that

include gas in their renewables and low-carbon businesses have been

excluded.

--Shell PLC reported adjusted earnings of $293 million for its

renewables and energy solutions segment in the fourth quarter,

which compares with $43 million a year earlier. This means

renewables and energy solutions represented 3% of the U.K. energy

giant's adjusted earnings--which strip out certain commodity price

adjustments and one-time charges--in the fourth quarter.

At the end of 2022, renewables generation capacity--which

includes projects in operation, under construction and committed

for sale--stood at 6.4 gigawatt, Shell said.

---Eni's retail and renewable business Plenitude & Power

recorded a fourth-quarter adjusted operating profit of 118 million

euros ($125.2 million), below consensus expectations of EUR140

million, with the miss mainly driven by the Plenitude segment. The

Plenitude & Power business represented 3% of the Italian

oil-and-gas major adjusted operating profit, at EUR3.58

billion.

The Italian oil-and-gas major said Plenitude grew its renewable

capacity substantially in 2022, reaching an installed capacity of

2.2 GW at the end of the quarter, up from 1.14 GW.

--Galp Energia SGPS SA's Renewables & New Businesses

recorded a replacement cost-adjusted Ebitda of EUR17 million in the

fourth quarter. The figure represented roughly 1.8% of the

Portuguese energy company's overall replacement cost-adjusted

Ebitda, which rose 48% on year to EUR951 million.

Galp said renewables installed capacity reached 1.4 GW by the

end of the quarter, following the commercial startup of roughly 100

megawatt of solar projects in Spain and Portugal.

Renewable-energy generation rose 44% on year to 307

gigawatt-hours in the fourth quarter, driven by the new capacity

online and an overall improvement in operational performance, the

company said. Full-year renewable-energy generation also rose to

1,930 GWh, it said.

--Spanish energy company Repsol SA reported an adjusted net

income of EUR167 million for its commercial-and-renewables division

in the fourth quarter, beating company-compiled consensus by 10%.

Repsol said the rise was mainly due to higher results in Retail

Electricity & Gas, Liquefied Petroleum Gas and Lubricants,

Aviation, Asphalts and Specialties.

Commercial & renewables represented 8% of the company's

overall adjusted net income of EUR2.01 billion.

--Norwegian energy major Equinor ASA's renewables division

recorded an adjusted loss of $86 million in 2022's fourth quarter

compared with a loss of $38 million in the prior year. The

division's net operating loss was $63 million compared with a loss

of $38 million.

Equinor's quarterly adjusted earnings were $15.06 billion, up

from $14.99 billion and ahead of the $14.41 billion analysts were

expecting, according to a company-compiled consensus. Net profit

rose to $7.9 billion from $3.37 billion a year earlier.

In the fourth quarter, production from renewable-energy sources

was 517 GWh, down 2% from the same quarter in 2021.

Write to Barcelona editors at barcelonaeditors@dowjones.com

(END) Dow Jones Newswires

February 23, 2023 09:32 ET (14:32 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

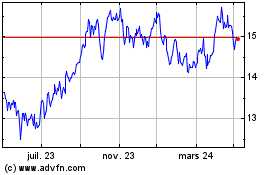

Eni (BIT:ENI)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

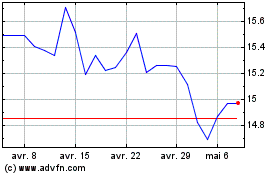

Eni (BIT:ENI)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024