Binance Coin (BNB) Sees Slight Recovery After Brief Fall Amid CFTC Lawsuit

29 Mars 2023 - 8:18AM

NEWSBTC

Binance Coin (BNB) has weathered a brief dip in the wake of

regulatory action against the crypto exchange and CEO, bouncing

back to trade near a key resistance level. Despite news of a

civil enforcement action from the CFTC causing a 5% drop to $310,

BNB has since climbed back up to $314.62, up 1.56% in the last 24

hours, according to CoinMarketCap. With the relative strength

index pointing toward further gains, buyers may be poised to break

through resistance at $312.6 and push toward $315. Related Reading:

Dogecoin (DOGE) Breaks Out Of Resistance Line – Will It Hit $1?

Binance Coin Could Fall Further Down According to BNB’s chart

analysis, there may be more potential for the coin to decrease

before becoming oversold. This idea is further supported by the

fact that the token’s 30-day moving average is set to dip below its

200-day average. The recent drop in BNB’s price was fueled by the

CFTC’s allegations against Binance, accusing the exchange of

facilitating unauthorized derivatives trading for U.S. customers

and neglecting customer identity verification protocols. Image:

Cryptopolitan If the CFTC’s accusations are proven true, Binance

and BNB could face even more roadblocks ahead. This decline falls

within a well-known chart pattern called a symmetrical triangle,

which traders often use to predict potential price breakouts. This

pattern typically indicates that buyers and sellers are locked in a

tight battle, with neither side gaining the upper hand. As the

price bounces back and forth within the triangle, it creates a

tightening range, as if the pressure is building up like a coiled

spring. Eventually, the price is forced to break out of the

triangle, with traders watching closely to see which direction it

will move. If the breakout is to the upside, it’s a bullish sign

that buyers have taken control and the price is likely to rise.

Conversely, a downside breakout signals that sellers have seized

the initiative and the price is likely to fall. What Traders Should

Expect At present, the BNB price has taken a downward turn after

hitting the overhead trendline, leading to a bearish cycle within

the pattern. This bearish cycle may potentially cause a significant

drop of 16-18% in the coin price, as it heads toward the pattern’s

lower support trendline. BNB total market cap currently at $49

billion on the daily chart at TradingView.com Related Reading:

Bitcoin Price Surge Threatened By Liquidity Crunch – What To Expect

Looking at the daily timeframe, Binance Coin (BNB) is seen trading

within a broad range, with support located at $302 and resistance

at $346.3. As the coin battles to find its footing, traders are

keeping a close eye on whether it will break through the resistance

or succumb to the downward pressure and drop to the lower support

level. Ultimately, only time will tell which direction BNB

will head next. -Featured image from CoinBrain

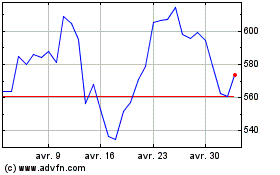

Binance Coin (COIN:BNBUSD)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Binance Coin (COIN:BNBUSD)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024