Ethereum ETF Race Gets Hotter As SEC Receives 11 Filings In One Week

05 Août 2023 - 5:00PM

NEWSBTC

The United States Securities and Exchange Commission (SEC) has been

flooded with many applications for Ethereum (ETH) Exchange-Traded

Funds (ETFs) in just one week. The applications currently stand at

12, with the latest addition coming from ProShares, a popular fund

manager. The platform filed four applications for Ether-based

ETFs, including a dual Ether and Bitcoin futures strategy ETF, an

Ether Strategy ETF, and a short Ether Strategy ETF. Will The

SEC Approve An Ethereum Futures ETF? The recent surge in

applications started on the 28th of July this year after Volatility

Shares filed its application. Ever since, other asset management

companies, including ProShares, Roundhill Financial, Bitwise,

Van Eck, and Grayscale Investment, have filled submissions, with

some bringing multiple applications. Related Reading: These

Are The Factors That Could Lead To Another Bitcoin Rally: ARK

Invest The most recent application, filed on August 3 by ProShares,

proposes an equal-weight Bitcoin and Ether ETF to measure the

performance of holding long positions in the nearest maturing

monthly Ether and Bitcoin contracts. According to renowned

Financial Expert at Bloomberg Intelligence, James Seyffart,

ProShare filed four separate applications with the SEC. Bitwise

also submitted three applications, while Grayscale Investments

filed two applications. However, despite the growing

optimism, it remains to be seen if the Securities and Exchange

Commission will approve these filings. The SEC has never approved

an ETF that tracks Ether Futures contracts, unlike Bitcoin Futures

ETFs that have been around since October 2021. Many market experts

have argued that these applications are a mere gamble by these

asset management companies, who do not want to miss out on being

the first Ethereum ETF in the United States. ETH price holds

steady above $1,830 amid ETF race | Source: ETHUSD on

Tradingview.com The likelihood of receiving the SEC’s approval

remains slim as the regulatory body has never approved an Ethereum

futures ETF filing. Add to the mix the consistent refusal of SEC’s

Chair, Gary Gensler, consistent refusal to answer if the agency

considers ETH a security. This has further compounded regulatory

uncertainty around the network. If none of the applications before

the SEC get denied, the Ether ETFs will launch 75 days from their

respective filing dates. Analysts expect the Volatility Shares ETF

to lead the charge on 12th October. Understanding The

Difference Between Futures And Spot ETF Products The primary

difference between futures and spot ETF products lies in the fact

that while the former tracks the price of futures contracts, the

latter requires the issuers to purchase the underlying assets. Spot

ETFs are generally considered more valid since they require the

fund manager to purchase and hold underlying assets. Related

Reading: Bank Of Canada Study Shows Crypto Ownership In The Country

Fell In The Last 2 Years The current spike in Ether-based

applications comes amidst a wave of filings from leading asset

management companies, including BlackRock, the world’s largest

asset manager, among others. These companies are looking to offer

the first spot in Bitcoin ETF in the US. Investors and

members of the crypto community remain expectant of the outcome of

the SEC’s consideration of the applications lying before it.

Whatever decision the agency takes is likely to affect the

attractiveness and accessibility of crypto investments, especially

for larger institutional investors. Featured image from

iStock, chart from Tradingview.com

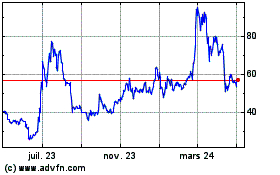

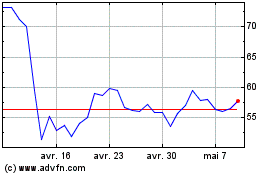

Compound (COIN:COMPUSD)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Compound (COIN:COMPUSD)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024