Meet The Company That is Avalanche’s First Unicorn at Nearly $2 Billion in TVL

02 Septembre 2021 - 2:17PM

NEWSBTC

BENQI, Avalanche’s first & only unicorn, is a very intriguing

company. With nearly $2 billion in total value locked, the DeFi

protocol is getting noticed by many people. Algorithmic liquidity

will play a crucial role in the future development of decentralized

finance solutions and products. What Is BENQI Exactly? As a company

founded by individuals involved in Ethereum and its DeFi ecosystem,

BENQI’s team acknowledged the potential of blockchain and crypto

assets early on. Although Ethereum’s blockchain has technical

limitations leading to scaling concerns and high transaction fees,

Avalanche provided a solution. The blockchain has a different

consensus algorithm, warranting a closer look. For BENQI’s team,

Avalanche could help offset some of the load from Ethereum and

provide a better transaction experience for users. Even though the

Avalanche ecosystem is still in the very early stages, several DeFi

protocols leverage its technology. As Ethereum congestion remains a

pressing issue for many – as is the centralized nature of Binance

Smart Chain – Avalanche can give BENQI a first-mover advantage.

Bringing lending and borrowing services to this ecosystem combined

with algorithmic liquidity market solutions puts a very different

spotlight on this blockchain ecosystem. It is worth noting that

BENQI can bridge to other blockchains. While it is native to

Avalanche, it connects to Ethereum through the AEB bridge. For

those users on Ethereum struggling with high gas fees – a common

problem these days due to the NFT craze – Avalanche will provide a

cheaper and faster alternative money market. BENQI will also

generate revenue from protocols collected from borrowers and the

interest spread. Those funds will be deposited into the Treasury

for future uses. BENQI Milestones To Date With a strong focus on

launching Liquidity Mining incentives for broader participation and

the top-notch relation with key Avalanche staff and communities,

BENQI plans to keep hitting milestone after milestone. Several of

those milestones have been reached already, including a

fundraising round of $6 million with the help of notable VC funds.

Strategic investors include Dragonfly Capital, GBV, Arrington XRP,

Spartan, and others. The service brought to the table by this

liquidity market protocol has not gone by unnoticed. As its

services cater to DeFi and DeFi-curious users alike, BENQI secured

$1 billion in Total Value Locked within days after its launch. That

number has now risen to nearly $2 billion as more users contribute

liquidity to the platform to facilitate decentralized lending and

borrowing. Avalanche is clearly a strong contender for DeFi

liquidity due to its more efficient nature. On the topic of seed

and private funding, BENQI noted a 3x oversubscription on both

rounds. The public sale for BENQI ended on April 29, 2021, and

raised $6 million. Investors benefit from a 21.6x return on

investment at the current price. Who Are The Team Members? The

BENQI ventures consist of multiple individuals who share a common

goal of decentralizing lending and borrowing in the most efficient

way possible. Three of its members are co-founders of Rome

Blockchain labs, Inc, an incubator and software development firm.

JD Gagnon is one of its co-founders, along with Hannu Kuusi and

Alexander Szul. Kuusi has over two decades of ICT experience and

has been a heavy crypto fan since the early days of Bitcoin. Szul

manages the development of the BENQI liquidity market

platform. With the help of crypto advocates Jason Tuang – a

DeFi specialist with financial knowledge – and Hansen Niu –

specialized in corporate strategy – the BENQI team started taking

shape. These five individuals were joined by DeFi enthusiast and

former small enterprise owner Dexter Lee and blockchain operations

management specialist Dan Mgbor. Together, they created the

liquidity market protocol the world knows as BENQI. The team will

continue to push the boundaries of what the protocol is capable of

and the services it can provide. Conclusion There are many benefits

to BENQI, both for the users and the team itself. Being the first

major liquidity market on the Avalanche blockchain creates a

competitive advantage. Moreover, this move highlights the demand

for alternative solutions to Ethereum-based decentralized finance.

Finally, lower and faster transactions are beneficial to all

parties involved. BENQI has the tools to compete with popular DeFi

platforms such as AAVE, Compound, and CREAM. Moreover, the team is

exploring options to bridge to other blockchains, including Binance

Smart Chain. That will happen through asset rails that route from

Avalanche’s C-Chain through BENQI to centralized exchanges and vice

versa. Users can rely on the existing bridge or use BENQI to

transfer assets to the Avalanche C-Chain. Having multiple options

is a significant benefit to all DeFi enthusiasts. Image:

depositphotos/grandfailure

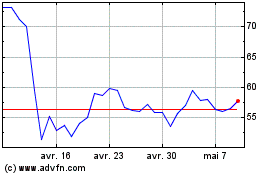

Compound (COIN:COMPUSD)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Compound (COIN:COMPUSD)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024