Chainlink Price Rises Above The $7 Mark, Will This Support Level Hold?

28 Février 2023 - 9:00PM

NEWSBTC

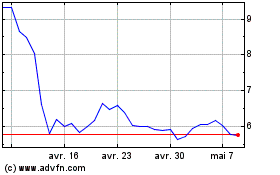

The Chainlink price has moved above the $7 mark, below which LINK

had traded for multiple weeks. Over the last week, LINK lost close

to 8% of its value. On the daily chart, the altcoin was

consolidating with a loss of 0.4%. Most altcoins have managed to

move away from their local support lines as Bitcoin found support

at the $23,000 level. The technical outlook for Chainlink remained

bearish at the time of writing. Despite LINK breaching the $7 mark,

demand for the altcoin was low. Related Reading: Bears Dominate

Filecoin Price But Traders Should Short At This Level Buying

strength was also low as accumulation for LINK declined. Once

Chainlink moves above its immediate resistance level, buyers will

note a recovery. With increased buying strength, LINK will start

its bullish recovery. The market capitalization of Chainlink fell

over the last 24 hours, indicating that sellers were in control of

the asset’s price. For Chainlink to move up on its chart, broader

market strength remains imperative. Chainlink Price Analysis:

One-Day Chart LINK was trading at $7.41 at the time of writing.

Overhead resistance for the altcoin stood at $7.80. Even if LINK

trades above the resistance above the mark, the bearish pressure

would only be invalidated if the altcoin moved above the $8 mark.

The coin’s immediate support was at $7.20, after which it fell to

$7 and then to $6.90. The $6.90 level will strengthen the bears to

retake the charge of the price. If Chainlink surpasses the $7.80

mark, then chances are that the $7 support will hold for the

altcoin. The amount of Chainlink traded in the last session was

low, indicating that buying strength was still quiet on the chart.

Technical Analysis The altcoin could not secure buying strength

despite breaking above the $7 mark. The Relative Strength Index

stood at 50, indicating low buying power. The indicator noted a

slight uptick, but buyers needed help to get hold of the asset’s

price at press time. Similarly, the LINK price traveled below the

20-Simple Moving Average (SMA), which indicated bearishness as

sellers were still driving the price momentum in the market. A move

above the immediate price ceiling will put LINK above the 20-SMA

line. Following the other indicators, LINK also depicts sell

signals on the chart. The Moving Average Convergence Divergence

indicated price momentum and reversals too. The indicator formed

red signal bars that were tied to sell signals; this often means an

upcoming fall in price. Related Reading: Ethereum Bears Keep

Pushing, Why This Resistance Could Turn Barrier The Directional

Movement Index still needs to reflect the bearishness, as the +DI

line (blue) was above the -DI line (orange). The Average

Directional Index (red) was dipping close to the 20-mark, which

meant that the current price trend was losing strength. The

subsequent trading sessions are crucial for Chainlink. Featured

Image From UnSplash, Charts From TradingView.com

Filecoin (COIN:FILUSD)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Filecoin (COIN:FILUSD)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024