Public Bitcoin Mining Firms Are Nearly Out Of Coins To Sell

07 Septembre 2022 - 7:00PM

NEWSBTC

Public bitcoin mining firms have been caught between a rock and a

hard place with the decline in bitcoin prices. As their cash flow

had declined significantly, they had turned to sell BTC to be able

to keep up with the costs of their operations. The massive stash of

BTC that these public miners had stacked up during the incredible

year of 2021 is now making its way to the market. But they are

quickly running out of coins to sell. Bitcoin Miners Dump Coins

Over the last three months, there have been reports of Bitcoin

miners dumping thousands of BTC. The volume of BTC being sold was

alarming because they were more than the miners were producing in a

month. Related Reading: CAKE Sets Sights For $5 After More Than 7

Million Tokens Are Sent To A Fiery Death On September 2nd,

blockchain data aggregation firm CryptoQuant revealed that bitcoin

miners had sold about 4,586 BTC in 3 days. At the time, bitcoin’s

price was trending just above $20,000, bringing the dollar value of

the sale to more than $93 million at the time. In the month of

July, public bitcoin miners had sold off a collective 5,700 BTC.

The trend would continue into the month of August as miners

continued to offload more questions. By the third week of August,

they had dumped more than 6,000 BTC. By selling their stash of BTC,

public bitcoin miners have been able to keep bankruptcy at bay.

However, their stash of BTC is not bottomless, and they are running

out of coins to sell. Miners’ Balances Run Low Public bitcoin

miners have now sold a healthy part of their balance sheets at this

point. The sales have been understandable given the state of the

market, but miners are now facing another problem, and that is the

fact that they are running out of BTC to sell. Since they have been

selling more BTC than they have been producing, their balances have

taken a hit. The companies which have suffered the most have been

Marathon Digital and Hut 8. At the end of March 31st, before they

started selling BTC, both of these miners had massive balances. In

the last three months, Marathon Digital has sold over 60% of its

BTC holdings, along with Stronghold. Hut 8 has sold around 40% of

its holdings, while Core Scientific has sold around 33%. Miners

running out of BTC to sell | Source: Arcane Research However, not

all miners have followed this trend. In fact, some miners have

taken this time to increase their holdings. Riot Blockchain is an

example of a public bitcoin miner that grew its holding in the last

3 months by almost 100%. Cleanspark also recorded about a 15%

increase in its BTC balances. Related Reading: Top Exchanges Mark

Readiness For Vasil, Can Cardano Rally To $1? Despite these miners

having to sell large quantities of BTC, the majority continue to do

well financially. The only one on the list seeing deep financial

struggles is Stronghold, and this has to do with the fact that the

company did not have much in the way of a large BTC balance, to

begin with. Featured image from Vecteezy, charts from Arcane

Research and TradingView.com Follow Best Owie on Twitter for market

insights, updates, and the occasional funny tweet…

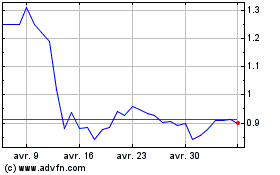

Flow (COIN:FLOWUSD)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Flow (COIN:FLOWUSD)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024