ETC Price And Social Dominance Figures Down In Last 7 Days – What’s Next?

10 Novembre 2022 - 2:16PM

NEWSBTC

Similarly to Bitcoin and other altcoins, ETC (Ethereum Classic) has

been severely impacted by the FTX liquidity crisis. CoinGecko data

show that the historical performance of the coin on the daily,

weekly, biweekly, and monthly time frames is not promising for the

ETH fork. The most noticeable depreciation among these was recorded

for the bi-weekly time scale, at a rate of 16.7 percent. If other

measures continue to lag, what does the future hold for ETC?

Related Reading: These Solana Numbers May Scare Off SOL Investors –

Here’s Why ETC Stepping On Green The token has gained 19.35% so far

today. While $18.255 provides temporary support for bulls, the

regression channel indicates a much stronger slump and so the bulls

should not bank on it. At the moment, the highest the price of the

coin may go is $22.595, the level where buyers and sellers met

during the decline from October 29 to November 3. This ceiling will

begin to give way in the coming days as the coin’s relative

strength index (RSI) rebounds. Since the price of ETC is highly

correlated with the price of ETH, traders and investors in the

former should keep an eye on the price of ETH as well. Image:

Coinmash This indicates that the price of ETC will closely track

that of ETH. There is an indication of a surge in the price of

Ether from the $1,099.17 area, where it had been trading at the

time of writing, although at the rate the broader crypto market is

going, any decent spike may not come soon. In addition to relying

on the rising RSI readings, bulls should also consider the positive

CMF figures, which signal a change in sentiment. This could

counteract the recent decline in ETC’s social influence caused by

the FTX insolvency situation. Moreover, social engagements and

mentions are increasing, drawing more attention to the coin. Bulls

In Charge… For Now Despite the obvious negative decline, the market

is partly under the grip of bulls, according to the available

technical indicators. As technicals improve, investors and traders

should continue to hold ETC for the time being. The EMA ribbon, on

the other hand, is bearish and suggests that the coin may be

shorted rather than held for the long term. Nonetheless, once the

market rebounds from the severe decrease caused by panic, we may

expect ETC’s price to closely track that of tETH’s. However,

investors can continue to hold ETC for the foreseeable future.

Traders and investors should also exercise caution. As much as

possible, ETC bulls should defend the $18.225 support zone. Related

Reading: Polygon Soars 13% In Last 7 Days As MATIC Bulls Work To

Hit New Highs ETC total market cap at $2.9 billion on the daily

chart | Featured image from The Market Periodical, Chart:

TradingView.com

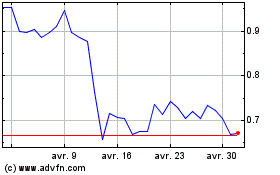

Polygon (COIN:MATICUSD)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Polygon (COIN:MATICUSD)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024