ETH Price Gets Punishment As Miners Sold Over 17,000 Ethereum

21 Septembre 2022 - 10:34PM

NEWSBTC

Ethereum’s recent upgrade has pushed miners out of its network. Now

Ethereum 2.0 support validators who staked 32ETH and above in the

network. The community expected the merge to push the price of ETH

and other cryptos up. But the reverse became the case afterward.

Related Reading: Ethereum: Can The Top Altcoin End Bitcoin’s

Dominance Post Merge? A few minutes after the event on September

15, Bitcoin lost $1K. Ethereum also lost more than $200, plummeting

from $1,635 to $1471 same merge day. The next few days, on

September 18, ETH price shaded off more and landed on

$1335.33. Currently, on September 21, Ethereum is trading at

$1344.45. This price shows a 0.17% price decrease in 24 hours. Its

hourly gain shows 0.17%, but the 7 days price movement indicates a

15.91% loss. Ethereum Miners Dump ETH Holding Increasing

Pressure Recall that Ethereum is no longer operating with a

proof of work consensus mechanism. The combination of its Beacon

Chain and mainnet has rendered miners useless on the network,

replacing them with validators. Even though the miners hard-forked

the network creating the ETHPOW, the new network has suffered

attacks and is not yet as strong and promising. The crypto market

expected a price reversal from bearish to bullish after the

Ethereum upgrade. But after the event, the ETH price dropped, and

the supply of ETH increased. This is not surprising because miners

started disposing of their ETH coins before the merge. Ethereum

miners initially gained 13,000 ETH every day on the PoW network.

But on the new PoS, validators get only 1600 ETH. Miners’ rewards

dropped by 90% after the merge, which could have lowered ETH supply

advantageously, pushing the price upward. Unfortunately,

Ethereum miners have dumped up to 30K ETH holding due to the price

movement and the upgrade effect. This was the reason behind Ether’s

price plunge from Merge day. The continuous selling added pressure

on investors causing more price losses. The current state of

crypto assets is not promising. Many enthusiasts are also dumping

their holdings as prices continue to plummet. What is the

Implication for Ethereum? As miners continue dumping their

ETH on the market, the price of Ether will keep falling. Even

though the other factors that could have boosted the price remain

positive, miners’ exit from the Ethereum market has worsened

everything for ETH. Currently, many analysts are predicting

that Ethereum might drop to $750. If the miners continue selling

spree coupled with the macroeconomic factors, that price level will

likely occur soon. Related Reading: Post-Merge Profit-Taking

Cuts 13% Off Ethereum Ratio Against BTC Moreover, the upcoming Feds

rate hike is causing panic already. Many investors dread the

announcement as it might make the market bullish or bearish. If the

rate stays 75 bps, there’s no problem. But the market is in trouble

if it goes high to 100 bps. Featured image from Pixabay and

chart from TradingView.com

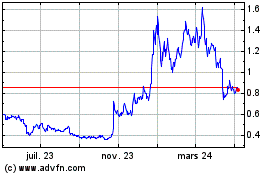

Mina (COIN:MINAUSD)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Mina (COIN:MINAUSD)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024