Bitcoin Climbs Above $28,500, Fed Decision Will Fuel The Rally?

22 Mars 2023 - 5:30PM

NEWSBTC

The Bitcoin price continues to record new yearly highs as the

cryptocurrency goes on a bullish rampage. There is no resistance

level capable of containing BTC bulls, while macroeconomic

uncertainty and a banking crisis fuel the fire. Related Reading:

Will QE Drive Bitcoin And Crypto To New All-Time Highs? Fidelity

Exec Is Cautious As of this writing, Bitcoin trades above the

critical level of $28,500 and is pushing upwards. Today’s U.S.

Federal Reserve (Fed) Open Market Committee (FOMC) is bound to

bring volatility. The ongoing crisis in the country has investors

sitting on the edge, and this event could provide clarity for BTC

and other assets. Bitcoin Investors’ Sentiment Shifted, But Caution

Prevails According to crypto market analyst firm Blofin, the price

of Bitcoin is rising while traders await the FOMC decision around

interest rates. As NewsBTC reported yesterday, any cute in interest

rate hike could hurt the current BTC rally. If the Fed cuts, the

institution sends a message that could be interpreted as fear. If

it rises rates, the market could translate this into confidence.

Either result seems negative for the financial institution as the

former might increase the crisis, while the latter could spike

inflation. In that sense, the Fed should operate under a “Business

as usual” and raise rates by 25 basis points (bps). If so, the

market might calm, and BTC could reclaim higher levels. In the

meantime, the number one crypto by market cap is bound to dominate

over other digital assets. Blofin wrote: BTC is now trading at

above $28.5k amid the uncertainty of the FOMC’s interest rates

decision. Due to the improvement of sentiment in the risk assets,

the performance of BTC is significantly better than ETH for the

time being, which is reflected in the ETH/BTC trading pair.

Blofin notes a decrease in Implied Volatility for at-the-money

(ATM) contracts in the crypto options sector. In other words,

investors expect BTC’s rally to slow down sometime in the coming

days. In this sector, crypto investors show a neutral bullish bias,

but Blofin noted, “risk aversion is also rising.” Today’s FOMC

decision could have a long-lasting impact on these investors’

perceptions. Related Reading: XRP, ADA Lead Market Rally With

Double-Digit Gains, More Upside To Come? However, there is a high

chance that the Fed will stay the course or come out dovish to

mitigate fear in the market. As long as this attitude does not

translate into a rate cut, BTC will likely trend upward for the

short term. 4/6. From the perspective of skewness, considering that

the Federal Reserve is likely to show a dovish attitude at the

March FOMC meeting, most investors still maintain a neutral to

bullish attitude. pic.twitter.com/SH7s5vIW9h — Blofin Academy

(@Blofin_Academy) March 22, 2023 BTC/USDT chart from

Trandingview

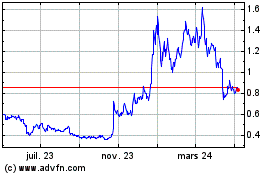

Mina (COIN:MINAUSD)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Mina (COIN:MINAUSD)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024