Bitcoin Won’t Hit $400,000 This Cycle, VanEck CEO Reveals Realistic Price Target

28 Novembre 2024 - 12:30PM

NEWSBTC

In an interview with Mario Nawfal, Jan van Eck, CEO of $118 billion

global asset manager VanEck, offered an analysis of Bitcoin’s

potential trajectory, the US fiscal deficit, and the broader

financial markets. Contrary to some hyper-bullish forecasts, van

Eck provided a more conservative price target for Bitcoin for this

bull run. Van Eck stated, “Our thesis is effectively that Bitcoin

will keep to the halving cycle, so we’re looking at sort of

$150,000 to $180,000 this cycle as a price target.” He dismissed

the notion that Bitcoin could reach $400,000 in the current cycle,

suggesting that such a milestone might be achieved in the next

cycle. “In the next cycle, it reaches my target of half the value

of gold, so $400,000 plus depending on the price of gold,” he

added. Discussing the US fiscal deficit, van Eck identified it as

“the elephant in the room” and a significant concern for the

markets. “We are spending money that’s just completely

unsustainable, and for any other country, they’d be headed towards

bankruptcy,” he remarked. Related Reading: Will Bitcoin See Another

‘Thanksgiving Day Massacre’? Experts Weigh In He outlined two

prevailing schools of thought in Washington regarding fiscal

policy. The first is the lobbyist perspective, which asserts that

it’s impossible to cut spending significantly, resulting in minimal

slowing of growth in the budget deficit. The second is the “extreme

disruptors” approach, advocating for a $500 billion cut in

government spending. Van Eck credited this figure to Vivek

Ramaswamy, co-head of the Department of Government Efficiency

(DOGE), stating, “They can effectuate that because there are 1,200

programs that are no longer authorized but still spending money,

which means that they can terminate them with an executive order.”

He described this target as “healthy” and “realistic,” although

acknowledging it would not close the entire deficit, which was $1.8

trillion last year. Addressing the market’s reaction to the

election of President Trump, van Eck found it peculiar that despite

a clear electoral outcome, there remains uncertainty about fiscal

policy. “We had a sweep by one political party, yet we don’t really

know what their fiscal policy is gonna be,” he observed. He noted

that the initial market reaction was negative for gold because of

the possibility of government restructuring. “The initial reaction

was negative gold because the idea was, wow, maybe they will be

able to restructure government. Never bet against Elon, right?” he

said. Related Reading: Bitcoin Adoption Grows As Rumble Unveils $20

Million BTC Treasury Strategy Van Eck also commented on

geopolitical tensions, particularly the situation in Ukraine and

the approval of long-range missiles striking deep into Russian

territory. While acknowledging that such events can impact markets,

he cautioned, “The problem is geopolitical stuff is completely

uninvestable. We never know what next headline is coming, and we

don’t know if it’s going to be bullish or bearish.” He advised that

professional investors often choose to “do absolutely nothing” in

response to geopolitical uncertainties. Catalysts For Bitcoin Price

On the subject of institutional interest in Bitcoin and regulatory

shifts, van Eck emphasized that the regulatory environment plays a

crucial role. “It really depends on the regulatory environment,” he

said. He pointed out that while regions like Asia have seen

regulators giving the green light, the US has been relatively

quiet. However, he noted a recent uptick in interest: “Now, with

the new regime, suddenly the phone is ringing.” Van Eck revealed

his personal investment stance, stating, “That’s why I have a huge

personal investment in Bitcoin and gold.” He expressed optimism

about Bitcoin’s maturation process, likening it to a child growing

up: “I would say it’s sort of like a teenager, and what gets it to

mature is new investor sets coming in.” He noted that while

individual investors have embraced Bitcoin ETFs, the wealth

management industry has yet to fully engage. Addressing the

correlation between Bitcoin and traditional markets, particularly

the NASDAQ, van Eck admitted concern: “The thing that worried me

the most […] Bitcoin’s correlation to the NASDAQ was high.” He

explained that this high correlation made Bitcoin less attractive

to professional investors who were already overexposed to mega-cap

tech stocks. However, he remains hopeful that Bitcoin’s correlation

will diminish: “Rooting for and expecting that its correlation will

go back to zero, which it has been for the long term.” At press

time, BTC traded at $95,350. Featured image created with DALL.E,

chart from TradingView.com

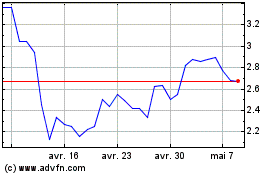

Optimism (COIN:OPUSD)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

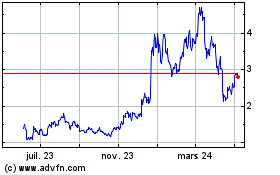

Optimism (COIN:OPUSD)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024