SEC Hands Coinbase A ‘Wells Notice;’ Coinbase Rebukes

23 Mars 2023 - 6:47AM

NEWSBTC

Flagship cryptocurrency exchange Coinbase has stood the test of

time through bear and bull markets alike. Like it or not, Coinbase

lives on a short list of exchanges that have been around for over a

decade. This week, the exchange revealed that they have been issued

a ‘Wells notice’ from the SEC, a signal of growing action from the

U.S. enforcement bureau that continues to show hesitancy in

adapting crypto-friendly policies. Historically, Wells notices

typically serve as a concluding pillar in an SEC investigation, and

often signal incoming enforcement. SEC Notice: Coinbase Expresses

Frustration The notice was made public by Coinbase through a blog

post published on Wednesday, amplified through a tweet thread from

the exchange’s Chief Legal Officer, Paul Grewal. The blog post

notes that the SEC is focused on a few of the exchange’s primary

product offerings, including staking service Earn, institutional

arm Prime, and the exchange’s consumer-facing Wallet product. The

firm goes on to explain that they are “prepared for this

disappointing development,” despite seemingly uncertain roads

ahead. Nonetheless, Coinbase emphasizes that product offerings are

unchanged, and doubles down on a sentiment that has been often

echoed by many exchanges: “we welcome a legal process to provide

the clarity we have been advocating for and to demonstrate that the

SEC simply has not been fair or reasonable when it comes to its

engagement on digital assets.” Coinbase (NASDAQ:COIN) states that

they have met with the SEC nearly three dozen times over the past

year. | Source: NASDAQ:COIN on TradingView.com Related Reading:

Quant Points Out Curious Relationship Between USDT Inflows &

Bitcoin Price The SEC’s Growing List Of Targets This news shouldn’t

surprise many. In recent days, we’ve seen the SEC also unleash

securities law violations against Tron’s Justin Sun and celebrities

like Lindsey Lohan. It’s been a long back and forth between

Coinbase and the SEC, with the exchange just sending a letter to

the commission in recent days. Earlier this year, the SEC sent a

similar Wells notice to Paxos, issuers of stablecoin BUSD, and many

believe that stablecoins are a point of emphasis for the

commission. This move led Jesse Powell, co-founder and CEO of

fellow long-time crypto exchange Kraken, to express that regulators

in the U.S. are the main hindrance to crypto’s growth. It’s

uncertain where we head from here; while historically, a sample set

from just under 1,000 cases between 2011 and 2013 reflects that

approximately 80% of issued Wells notices have resulted in tangible

charges. However, a lot has changed in the past decade, and new SEC

leadership under head Gary Gensler haven’t supplied much

inspiration to crypto advocates that effective policy is en route.

In the meantime, Coinbase maintains that they do not offer

securities to customers. Related Reading: Bitcoin Rally Driven By

Record Open Interest In Derivatives Market

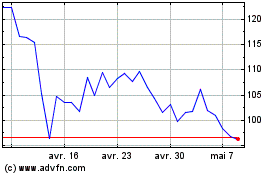

Quant (COIN:QNTUSD)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Quant (COIN:QNTUSD)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024