Traders Act Fast As Binance Australia Unveils Bitcoin Discount For Limited Period

30 Mai 2023 - 12:36PM

NEWSBTC

In an intriguing development for crypto traders, Binance Australia

has introduced an exclusive Bitcoin discount, offering a unique

opportunity for savvy investors. The platform’s recent announcement

comes in the midst of a countdown to a significant payment

deadline, adding a sense of urgency to the offer. While Bitcoin

(BTC) currently trades above $27,000 on several exchanges, it

traded at a price of AUD34,863 on (USD22,670) Binance

Australia lower than its current price on exchanges. The

limited period that comes with the discount has made some traders

act fast so as to take advantage of the reduced price. Bitcoin

Trading At A Discount Recent market data has revealed an intriguing

trend on Binance Australia, with Bitcoin and other digital tokens

trading at a discount compared to rival exchanges within the

country. Related Reading: No All-Time High For Bitcoin In 2023,

Former BitMEX Head Arthur Hayes Predicts CryptoCompare data shows

that Bitcoin traded at A$34,863 ($22,670) on Binance Australia,

significantly lower than the average price on platforms like

Independent Reserve and CoinJar. Notably, discounts of around 20%

were also observed for popular tokens such as Ethereum (ETH) and

Solana (SOL). The discount on Binance Australia is closely linked

to impending changes in the platform’s payment withdrawal options.

Starting from 5 p.m. on June 1, users will no longer be able to

withdraw Australian dollars to their bank accounts using the

popular PayID service. This follows the platform’s earlier loss of

access to certain Aussie dollar deposit services, creating a series

of challenges for cryptocurrency enthusiasts. Industry

experts have weighed in on the situation, shedding light on the

motivations behind the discounted Bitcoin prices. Richard Galvin,

the co-founder of fund manager Digital Asset Capital Management,

explains that Australian clients are selling Bitcoin at a discount

to ensure they can withdraw their Australian dollars before the

payment deadline. This urgency has created a unique opportunity for

investors looking to acquire Bitcoin at a reduced price.

Furthermore, to ease the withdrawal process for users, Binance

Australia has devised a solution. Following the payment deadline,

Australian dollar balances can be converted into the Tether

stablecoin, facilitating both withdrawals and trading activities.

The platform is actively seeking alternative providers to restore

AUD deposit and withdrawal services, underscoring its commitment to

offering a seamless user experience. BTC Latest Price Action

Meanwhile, Bitcoin hasn’t shown any significant move in the past

week. Instead, the largest crypto asset by market capitalization

has recorded sluggish movement up by only 1.7% in the past 7 days.

Over the past 24 hours, BTC has seen a 0.1% loss. At the time of

writing, Bitcoin currently trades at $27,849 after trading slightly

above $28,000 on Sunday. Bitcoin’s trading volume has plunged a bit

from $14 billion earlier last week to $12 billion in the past 24

hours indicating less trading activity. Related Reading: JPMorgan

Predicts Bitcoin (BTC) To Revisit $45,000, Here’s Why However, the

asset’s market capitalization has seen a more than $10 billion gain

in the past 7 days. BTC’s market cap has surged from $528 billion

last Tuesday to $539 billion as of today. Featured image from

iStock, Chart from TradingView

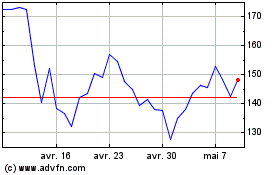

Solana (COIN:SOLUSD)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Solana (COIN:SOLUSD)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024