Ethereum Burning Reaches New High, Is ETH Warming Up For Another Rally?

03 Février 2023 - 7:30PM

NEWSBTC

While the global cryptocurrency market continues with its

ubiquitous movement, Ethereum seems to be sneaking out to break a

new record. The latest achievement Ethereum obtained is setting a

new high in its burning-per-day mechanism. Per a recent report from

WuBlockchain citing data from oklink, Ethereum’s burning amount

exceeded 3,000 ETH at a figure of 3,040 ETH on February 2. This new

record sets the crypto asset burning rate highest point ever seen

since November 10, 2022. According to the reporter, the primary

source where the burning was aggressive was two popular

decentralized exchanges, Uniswap and OpenSea. Over the past

months, both platforms have recorded significant usage and trading

volumes which correlate with the increased burning of ETH tokens.

Data from CoinGecko shows Uniswap trading volume has moved from

$558 million seen at the beginning of this year to $1.1 billion as

of February 3, up by more than 50% over the last 25 days.

Related Reading: Total Ethereum (ETH) Staked On Lido Finance

Reaches New Milestone Is ETH Warming Up For Another Rally With an

upcoming catalyst like the Shanghai upgrade coming soon to the

Ethereum network, ETH could be in a warm-up stage before another

rally. Following the demand for ETH surging, the crypto asset greed

index has also made some significant movements in the past weeks

ranging above 60 in recent days. The increase in the greed

index signifies a massive level of FOMO and anticipation amongst

ETH investors waiting for the right moment to buy and result in

another rally. Data aside, so far, the Ethereum price chart has

only indicated two possible scenarios, which are to either retrace

a little bit more or proceed with another bullish trend.

Looking at the 1-day time frame of the ETH/USDT price chart, we can

see ETH recently tapped into external liquidity — a move that

signifies a possible retracement to take out the liquidity of the

buyers below. A retracement confirmation could mean ETH returns to

the $1,300-$1,350 region. Meanwhile, should ETH invalidate the

possible retracement and tap into the $1,684 zone declining a

retrace, we could see another upward rally as the crypto asset

appears to be consolidating at the moment, waiting for a

significant movement (expansion) either to the upside or

downside. Related Reading: Bitcoin and Ethereum Whale

Activities Plummet – Are Whales Getting Bored? Ethereum Continues

Recording New Highs Notably, the burning rate hasn’t been the only

new high Ethereum recurred in the past weeks. Last month, NewsBTC

reported the total staked ETH on the Beacon chain reached an

all-time high of over 16.16 million ETH. The figure cumulates to

more than 13.28% of the total Ether supply and represents $26.13

billion at current prices Out of the 16 million ETH staked, about

11.408 million ETH have been staked via staking services providers

such as Lido, Coinbase, and Kraken, among others – representing

70.86% of the total staked on the Beacon chain. Lido dominates ETH

staking with 29.3%, Coinbase controls 12.8%, while Kraken holds

7.6%, and Binance controls 6.3% of the total stake, according to

Glassnode on-chain data. Additionally, Ethereum total validators

recently surpassed the 500,000 benchmarks and currently sit at

512,432 as of February 3, according to data from BeaconScan.

Featured image from Shutterstock, chart from TradingView

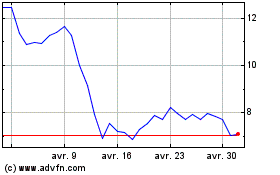

Uniswap (COIN:UNIUSD)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Uniswap (COIN:UNIUSD)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024