Investors Shifted Funding From CeFi To DeFi Following Major Crashes

06 Mars 2023 - 5:30PM

NEWSBTC

In the wake of significant collapses in centralized finance (CeFi)

platforms, the crypto industry is witnessing a significant shift in

funding from CeFi to decentralized finance (DeFi) platforms,

according to a recent report by CoinGecko. The report highlights

that investors are increasingly looking towards DeFi platforms due

to their transparency, security, and efficiency compared to CeFi

platforms. Related Reading: Bitcoin Price Turns Red Below $23K,

What Could Trigger A Sharp Decline The Crypto Funding Shift The

CoinGecko report revealed that the risks in the CeFi sector had

increased the number of investors turning to DeFi platforms, which

offer several benefits. These benefits include increased

transparency, where transactions are recorded on a public

blockchain, allowing investors to see how the platforms use their

funds. Moreover, DeFi platforms are more secure since they use

smart contracts to execute transactions rather than relying on

centralized intermediaries. Also, the efficiency of DeFi platforms

contributes to its growing number of investors, as they allow them

to have more control over their funds. This enables them to trade

assets instantly without going through a centralized exchange,

resulting in lower fees and faster transaction times. The CoinGecko

report concludes that the shift toward DeFi funding is likely to

continue in the coming months as investors increasingly prioritize

security, transparency, and efficiency over centralized control.

DeFi And CeFi Funding Activities There were several DeFi and CeFi

funding activities from various crypto organizations to recall in

2022. But according to the report from CoinGecko, Luna Foundation

Guard (LFG) made the most significant DeFi funding in this period,

a $1 billion in sales of the LUNA coin in February 2022. This

remarkable event preceded the fall of TerraClassicUSD and Terra

Luna Classic three months later. Other contributors to the DeFi

funding were Lido Finance, an Ethereum staking protocol, and the

Ethereum-native DEX (decentralized exchange) Uniswap. The report

shows that both companies raised $94 million and $164 million,

respectively. Regarding CeFi funding, the report noted that FTX

U.S. and FTX received the highest portion after raising about $800

million in January. This figure amounts to 18.6% of the total CeFi

funding recorded in 2022. However, after 10 months of regular

operations, the crypto firm collapsed and filed for bankruptcy.

Related Reading: Bitcoin Price Crashes Below $22,000, These Are The

Reasons Some other areas included in the investment include

blockchain technology and blockchain infrastructure companies. Both

sectors raised about $2.7 billion and $2.8 billion, respectively,

and this trend has remained over the last few years. Currently,

it’s not easy to determine how the current trend will affect the

broader market. But many crypto companies may migrate to the DeFi

sector considering its growing trend and benefits. Featured image

from Pixabay and chart from Tradingview.com

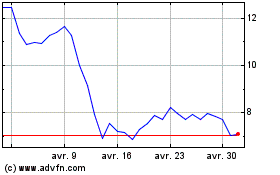

Uniswap (COIN:UNIUSD)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Uniswap (COIN:UNIUSD)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024