The End of Bitcoin Woes? BTCUSD Analysis October 11, 2022

11 Octobre 2022 - 9:51PM

NEWSBTC

In this episode of NewsBTC’s daily technical analysis

videos, we examine a possible bottoming scenario in Bitcoin

price based on a potential expanded flat correction and an ending

diagonal. Take a look at the video below: VIDEO: Bitcoin Price

Analysis (BTCUSD): October 11, 2022 Bears and bulls are battling it

out once again, each side trying to take control over daily

momentum. Cycling through indicators like the Bollinger Bands

and the Ichimoku show that Bitcoin isn’t looking very great at the

moment. Only the Parabolic SAR is currently showing any type of

indicator support below daily price action. Why Bitcoin Could Spend

Much More Time Moving Sideways The LMACD shows that bulls still

have the upper hand on the 3-day timeframe, and the last weekly

candle closed with a confirmed bullish crossover on the same

tool. The LMACD turning green from this level has put in the

bottom during past bear markets. But on monthly timeframes, bears

have turned the histogram red after opening pink. Pink is a sign

that bearish momentum is weakening. Unless Bitcoin stages an

extremely fast reversal like 2018, there could be many more months

of sideways ahead. Comparing past bear market bottoms we can see

that it took another 9 months after turning pink to flip green

during the 2015 bear market, while it only took half that time

during the 2018 bear market. With Bitcoin monthly momentum not

even confirmed pink yet, the top cryptocurrency could have anywhere

between 120 days and 275 days to go before things begin to turn

around. Ouch. Linear scale breakout leaves room leftover in log

scale | Source: BTCUSD on TradingView.com The End of The Expanded

Flat Correction Is Near In terms of a bottom, it could be near.

Bitcoin appears to be finishing the last leg of an expanded flat

correction. An expanded flat is an ABC correction with a higher

high during the B wave, and a lower low at the C wave. Expanded

flats form in a 3-3-5 pattern, with two zig-zags and an impulse

wave down. The C wave serves as the impulse wave with 5 sub-waves.

Expanded flats typically terminate in the C wave at the 1.618

Fibonacci extension of the A wave. Taking the Fibonacci retracement

tool set for the golden ratio extension, and the final wave five

could be ending at the exact target. Expanded flats commonly

terminate with an ending diagonal in the fifth wave of the

structure. An ending diagonal has five sub-waves itself, and looks

like a falling wedge – a pattern that could be presently forming in

Bitcoin if you turn on the line chart and remove wicks. With

wicks removed, Bitcoin has made a new low below the wave 3 low, and

could be in the midst of an ending diagonal before reversing. The

supplied diagrams show how the wave counts match up well enough,

but is missing the final blow to bulls before the bottom is finally

in. Don’t believe in such a thing as an ending diagonal? Check

out how the same thing ended the bull market in 2021. The MACD and

linear scale (left) versus the LMACD and log scale (right) |

Source: BTCUSD on TradingView.com Related Reading: Bitcoin Bulls

Snap Back With The Bollinger Bands | BTCUSD Analysis October 5,

2022 Where In The Overall Crypto Cycle Are We? Finally, the last

piece of the diagram we are comparing, is the placement of the

expanded flat correction. Expanded flats appear either at a wave 2

or wave 4 during a larger impulse wave cycle. This means that

either wave 5 is still left, or possibly waves 3, 4, and 5 remain.

In one scenario, Bitcoin bottomed in 2018, and the 2019 peak was

wave 1, followed by wave 2 on Black Thursday. Then, wave 3 began in

2020 into 2021, and we’ve spent all of 2022 in wave 4 so far. The

alternate scenario makes the 2021 rally wave 1 of 5, and this

current correction wave 2. The only way this is possible is if the

entire 2018 bear market was part of a larger Elliott Wave triangle

pattern. A triangle can be drawn, but it doesn’t quite fit the

rules of Elliott Wave Theory. Bitcoin probably has a lot more to go

before a viable breakout | Source: BTCUSD on TradingView.com Learn

crypto technical analysis yourself with the NewsBTC Trading Course.

Click here to access the free educational program. Follow

@TonySpilotroBTC on Twitter or join the TonyTradesBTC Telegram

for exclusive daily market insights and technical analysis

education. Please note: Content is educational and should not

be considered investment advice. Featured image from

iStockPhoto, Charts from TradingView.com

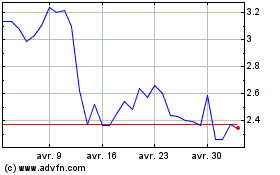

Waves (COIN:WAVESUSD)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Waves (COIN:WAVESUSD)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024

Real-Time news about Waves (Cryptomonnaies): 0 recent articles

Plus d'articles sur Waves