Why “The Merge” Is Not Priced In, Says Ethereum Inventor Vitalik Buterin

28 Juillet 2022 - 5:34PM

NEWSBTC

Ethereum and the crypto market slightly recovered some gains after

the Federal Reserve (Fed) announced a 75-basis point (bps) interest

rate hike. There was no surprise from the financial institutions,

and the second crypto by market cap might be able to extend the

bullish trend without external distractions. Related Reading

| TA: Bitcoin Price Restarts Increase After Fed Rate Hike But

Resistance Intact At the time of writing, Ethereum (ETH) trades at

$1,640 with an 11% profit in the last 24 hours and a 7% profit over

the past week. The cryptocurrency has reclaimed its position as the

best-performing asset in the top 10 by market cap. In an interview

with Bankless, the inventor of Ethereum spoke about what could be

the most bullish milestone for this blockchain since its inception:

“The Merge”. The event that will complete ETH’s migration into a

Proof-of-Stake (PoS) blockchain with the promise of bringing more

scalability and better performance to the network. For months,

there has been an ongoing debate about the impact of this event on

the price of Ethereum. Some market participants believe “The Merge”

is already priced-in, meaning its impact is currently reflected on

ETH’s price, others believe the opposite. Buterin himself is

amongst the former, he believes “The Merge” is not priced-in from a

market and psychological standpoint. The positive impact of this

event will have implications with the potential to ripple across

the entire Ethereum ecosystem. These effects will kick in when “The

Merge” has been deployed on the mainnet. Buterin said: The Merge is

looking more and more in the review mirror. It’s looking more and

more like “hey, this things is going to actually happen and when it

happens I expect (developer’s) morale is going to go way up (…). I

basically expect that “The Merge” is not going to be priced-in, by

which I mean not just in market terms, but in psychological, and

narrative terms (…). What “The Merge” Could Spell For The Price Of

Ethereum Once “The Merge” has been implemented, Buterin predicts

that Ethereum will change a “lot of minds”. This could potentially

hint at the surge in the adoption of this network’s ecosystem.

There has been a lot of talk about cryptocurrencies and their

alleged negative impact on the environment. “The Merge” is set to

reduce Ethereum’s carbon emissions by 99%. This could translate

into more institutions and capital previously sidelined from the

crypto space because of its environmental footprint thus, why this

event might have profound implications in terms of adoption, price

appreciation, and development. Related Reading | TA: Ethereum

Surges 15%, Why ETH Could Climb Above $1,700 On the latter, Buterin

celebrated Ethereum’s capacity to improve its development speed

across the years. After “The Merge”, ETH core developers will focus

on scalability and building the infrastructure needed for

mainstream adoption.

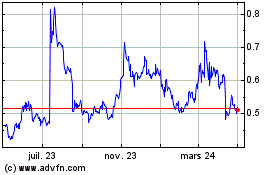

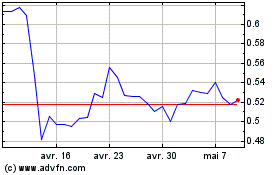

Ripple (COIN:XRPUSD)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Ripple (COIN:XRPUSD)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024