Ageas acquires majority stake in the Indian Life insurance joint venture Ageas Federal Life

20 Mai 2022 - 7:30AM

Ageas acquires majority stake in the Indian Life insurance joint

venture Ageas Federal Life

Ageas acquires majority stake in the Indian Life insurance joint

venture Ageas Federal Life

Ageas announces today that it has signed

an agreement to buy the 25% stake of IDBI Bank in the Indian Life

insurance joint venture Ageas Federal Life Insurance Company Ltd.

(AFLIC).

With this transaction, Ageas will increase its

interest in the joint venture it currently operates together with

IDBI Bank and Federal Bank to 74%. Federal Bank maintains its 26%

share in AFLIC. IDBI exits as a shareholder but remains a

distribution partner. This transaction is a second step up for

Ageas after the increase of its stake from 26% to 49% in December

2020. (read the related press release)

This investment aligns with Ageas’s strategy to

expand in regions in which it is already present and in promising

markets with a low insurance penetration and high potential for

growth such as the Indian Life insurance market.

Ageas will pay IDBI Bank a total consideration

of INR 5.8 billion (EUR 69 million) in cash for the 25% stake in

AFLIC.

The transaction is subject to regulatory

approval and is expected to be closed in the second half of

2022.

|

|

This investment offers Ageas a unique opportunity to take control

of one of its operating entities in Asia. I want to take this

opportunity to express my gratitude to the management and employees

of IDBI Bank for their contribution over the past 16 years in

bringing the company to where it stands today: a highly valued and

profitable Life Insurance business. Our ambition is to continue

this success story together with our long-standing partner Federal

Bank, and to further develop the business in what is one of the

world’s largest and fastest growing economies and a market with

great long-term potential. |

|

|

Hans

De Cuyper, CEO Ageas |

Ageas, IDBI Bank and Federal Bank set up the

Life insurance joint venture IDBI Federal Life Insurance Company

Ltd at the end of 2006, and since that time its gross inflows have

grown consistently to reach EUR 247 million in 2021. Within six

years the company was profitable and has continued to be,

generating a net profit of EUR 9 million in 2021.

Ageas is a listed international

insurance Group with a heritage spanning almost 200 years, offering

Retail and Business customers Life and Non-Life insurance. As one

of Europe's larger insurance companies, Ageas concentrates its

activities in Europe and Asia through a combination of wholly owned

subsidiaries and long-term partnerships with strong financial

institutions and key distributors. Ageas ranks among the market

leaders in the countries in which it operates. It represents a

staff force of about 40,000 people and reported annual inflows

close to EUR 40 billion in 2021 (all figures at 100%).

- Pdf version of the press release

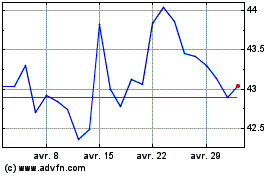

Ageas SA NV (EU:AGS)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

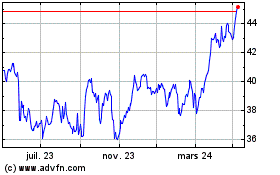

Ageas SA NV (EU:AGS)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024