Q1 2023 Financial results

May 5, 2023

FIRST QUARTER

2023

| STRONG

REVENUE GROWTH AND IMPROVEMENT OF OPERATING

RESULT POSITIVE

ADJUSTED OPERATING FREE

CASH FLOW AT €0.7 BILLION DRIVEN BY

STRONG SUMMER TICKET

SALES |

- Strong demand with

19.7m passengers

onboard, up 35% versus

2022

- Group revenues at

€6.3bn, an

improvement of €1.9bn (+42%)

compared to last year thanks to

continuous strong market

demand

- Group unit

cost1 per ASK

stable at +0.7% versus

2022

-

Operating result at

-€0.3bn

with operating

margin at

-4.8%,

above 2022 level

(-7.9%)

- Positive

Adjusted operating free cash flow

at

€0.7bn

and solid cash at hand at

€9.7bn

- Net debt down by

€0.9bn

euros, compared to end of

2022

- Continued deleveraging: Net

debt/EBITDA ratio at

1.5x

versus 1.8x end of 2022

Commenting on the results, Mr. Benjamin

Smith, Group CEO, said:” In the first quarter, Air

France-KLM further capitalized on the recovery momentum in the

airline industry. I’d like to thank all my colleagues who have

worked tirelessly throughout the quater to ensure we continue on

our path to sustained profitability. The Group continued to show

strong revenue growth as well as robust cash flow generation thanks

to the very encouraging summer ticket sales. This is paving the way

for a busy holiday season across our global network, which all of

our teams are actively gearing upfor. I am also pleased that we

have now fully repaid all State aid, which releases us from the

associated restrictions and gives us back our full strategic

autonomy. We now stand on our own feet. Looking ahead, we remain

focused on further strengthening our balance sheet and delivering

the transformation efforts that will enable us to continue to

improve our competitiveness while accelerating our decarbonization

efforts.“

Operating result improved

by revenue growth

|

|

First

Quarter |

|

|

2023 |

Change |

Change constant currency |

|

Revenues (€m) |

6,329 |

+42.4% |

+40.6% |

|

EBITDA (€m) |

286 |

65 |

83 |

|

Operating result (€m) |

-306 |

44 |

64 |

|

Operating margin (%) |

-4.8% |

+3.0 pt |

+3.4 pt |

|

Net income – Group part (€m) |

-344 |

+208 |

|

|

Adj. operating free cash flow (€m) |

683 |

53 |

|

|

Net debt at end of period (€m)2 |

5,478 |

-859 |

|

In Q1 2023, revenues were up 40.6% against a

constant currency compared to Q1 2022, mainly driven by a higher

capacity and a higher passenger load factor. Operating result

improved compared to last year by €44 million. The operating margin

improved against a constant currency by 3.4 points to -4.8%. Last

year, the operating result benefitted from a €210 million furlough

contribution. Corrected for this furlough contribution, the

improvement of the operating result amounted to €254 million. The

adjusted operating free cash flow amounted to €683 million, an

improvement of €53 million compared to last year, driven by strong

summer ticket sales. The net debt ended at €5.5 billion, down €0.9

billion compared to year end 2022.

|

|

First

Quarter |

|

|

2023 |

Change |

Change constant currency |

|

Passengers (thousands) |

19,651 |

+35.3% |

|

|

Capacity (ASK m) |

69,583 |

+19.8% |

|

|

Traffic (RPK m) |

59,921 |

+38.9% |

|

|

Passenger load factor |

86.1% |

+11.8 pt |

|

|

Passenger unit revenue per ASK (€ cts) |

7.38 |

+36.9% |

+35.3% |

|

Group unit revenue per ASK (€ cts) |

8.20 |

+21.4% |

+20.1% |

|

Group unit cost per ASK (€ cts) at constant fuel |

8.65 |

+17.4% |

+5.2% |

In the first quarter 2023, Air France-KLM

welcomed 19.7 million passengers which is 35.3% above the previous

year. As capacity increased by 19.8% and traffic grew by 38.9%, the

load factor increased by 11.8 points compared to last year. Group

passenger unit revenue per ASK increased by 35.3% against a

constant currency compared to last year. This increase was driven

by both load factor and yield.

Group unit cost per ASK at constant fuel and

constant currency is up 5.2% versus last year due to €210 million

euro furlough contribution last year and inflationnary pressure on

costs in 2023. The inflation started last year after the outbreak

of the Ukraine war and is seen in several cost categories such as

staff costs, handling costs and general expenses. Corrected for

last year’s furlough contribution, the Group unit cost per ASK

against a constant currency and constant fuel price increased

slightly by 0.7%.

Air France-KLM is now relieved from

Covid-19 State aid support and related restrictions

-

In January 2023, Air France-KLM issued Sustainability-linked Bonds

for a total aggregate amount of €1.0 billion.

-

In March 2023, the Group fully redeemed the outstanding €2.5

billion bank loan guaranteed by the French State (PGE) by using the

proceeds of the Sustainability-linked Bonds and €1.5 billion

liquidity.

-

Also in March 2023, Air France-KLM repaid and refinanced €300

million of the €600 million outstanding perpetual hybrid bonds held

by the French State.

-

In April 2023, Air France-KLM and Air France combined and KLM

implemented two new Sustainability Linked Revolving Credit

Facilities (RCF) for a total amount of €2.2 billion.

-

This new RCF for KLM replaced both the remaining direct loan

granted to KLM by the Dutch State and the credit facility

guaranteed by the Dutch State, both of which were cancelled by KLM.

Pursuant to this cancellation, conditions attached to this aid no

longer apply.

-

On April 19th, 2023, Air France-KLM has fully repaid, the €300

million remaining French State hybrid perpetual bonds and paid the

required compensation of the French State for the shares subscribed

in April 2021 without change required of the capital ownership. The

Group has therefore refinanced €407 million with a new issuance of

hybrid perpetual bonds with the French State, without any

restrictions attached, resulting in a full exit of the French

Recapitalization State Aid under the EU Covid-19 Temporary

Framework.

As announced during the Full Year 2022 results

presentation, Air France-KLM intends to restore its balance sheet,

aside from net profit generation, by means of non dilutive

initiatives such as quasi-equity financing instruments (similarly

to the one raised by Air France on a pool of spare engines in July

2022), and/or straight hybrid bonds.Air France-KLM announced

yesterday that it was entering into exclusive discussions with

Apollo Global Management for a €500 million quasi equity financing

into an affiliate owning Engineering and Maintenance (MRO) assets.

This transaction would mark a further step towards the

reinforcement of the Group’s equity. Meanwhile, the Group received

several non-binding offers on quasi equity financing supported by

the Loyalty Program. Discussions are still ongoing with potential

investors.

2023

OUTLOOK

CapacityThe Group expects the

capacity in Available Seat Kilometers for Air France-KLM Group

including Transavia at an index of:

- 90%-95% for the second quarter of

2023

- circa 95% for the third quarter of

2023

- above 95% for the fourth quarter of

2023

- circa 95% for the full year

2023

Transavia will contribute to this growth and

expects to be at circa 135% for the Full Year 2023.All indices

compared to the respective period of 2019.

Unit costThe Group expects for

full year 2023 a stable unit cost, against a constant fuel price,

constant currency and excluding furlough contribution, compared to

FY 2022.

Capital

expenditures (Capex)Full year

2023 Net Capex spending is estimated at 3.0 billion euros.

BUSINESS REVIEW

Network: Significant improvement

in revenues and operating

result

|

Network |

First

Quarter |

|

2023 |

Change |

Change constant currency |

|

Total revenues (€m) |

5,575 |

+43.2% |

+41.9% |

|

Scheduled revenues (€m) |

5,329 |

+45.0% |

+43.4% |

|

Operating result (€m) |

-149 |

+160 |

+178 |

Compared to the first quarter 2022, total

revenues increased by 41.9% at constant currency to €5,575 million.

The operating result improved by €160 million and amounted to -€149

million. The increase in revenues was driven by the network

passenger business while the Cargo revenues declined compared to an

exceptionally strong first quarter last year.

Strong yields and load factors on our

diversified network

|

|

First

Quarter |

|

|

Passenger network |

2023 |

Change |

Change constant currency |

|

Passengers (thousands) |

15,787 |

+32.2% |

|

|

Capacity (ASK m) |

61,975 |

+17.9% |

|

|

Traffic (RPK m) |

52,966 |

+36.3% |

|

|

Load factor |

85.5% |

+11.5 pt |

|

|

Total passenger revenues (€m) |

4,903 |

+64.3% |

+62.5% |

|

Scheduled passenger revenues (€m) |

4,752 |

+65.1% |

+63.0% |

|

Unit revenue per ASK (€ cts) |

7.67 |

+40.0% |

+38.3% |

First quarter 2023 capacity in Available Seat

Kilometers (ASK) was 17.9% higher than last year and at 89% of 2019

first quarter level, which is at the same level as the Group’s

outlook provided during the Full Year 2022 results presentation,

circa 90% versus 2019.

Unit revenue per ASK increased by 38.3% at a

constant currency thanks to strong demand which resulted in an

increase in load factor of 11.5 points and a yield increase of 21%

compared to last year.

During the first quarter we observed the

following trends per area compared to the first quarter last

year:

- North Atlantic: Demand recovery

continued to be driven by point of origin North America with a

positive impact on yield. Corporate traffic recovery maintained at

index ~75/80 vs pre-Covid levels and premium cabins load factor

performing well.

- Latin America: Strong performance

with on average a further 33% increase compared to Q1 2022. Load

factor stood at 90% supporting the high unit revenue levels.

- Asia & Middle East: The

performance benefited from additional capacity with the reopening

of China (Beijing & Hong Kong). Good performance with strong

yields mainly for Greater China, Japan and Korea driven by the

premium cabins. Compared to last year, the yield increase is more

limited than in the other areas due to exceptional high yields in

Asia last year as a result of very limited capacity.

- Caribbean & Indian Ocean:

Capacity has been reduced compared to last year which was already

above pre-Covid level. Yield environment was positive given the

year over year increase of 27%.

- Africa: Strong performance in line

with the previous quarter, driven by West and Central Africa for

Air France and by East & South Africa for KLM. Yields were

maintained at good levels, mainly thanks to the performance in

premium cabins by West and Central Africa.

- Short and Medium-haul: Better yield

trends and higher load factor partly offset for KLM and fully for

Air France the revenue loss linked to capacity decrease.

Compared to the end of 2022 the Group added one

B787-10, five B737-800, five A220-300 and one Embraer 195-E2. The

following aircraft left the fleet, two B737-700, one A321, two A319

and one CRJ-1000, as a result the fleet increased by six

aircraft.

In 2023 and beyond the Group will continue to

invest in new generation aircraft in order to improve its economic

and environmental performance. During the second half of 2023, the

first Airbus A320neo/A321neo will be delivered.

Cargo: Revenues and unit revenues down

compared to an exceptionally

strong first

quarter last year

|

|

First

Quarter |

|

Cargo business |

2023 |

Change |

Change constant currency |

|

Tons (thousands) |

209 |

-11.6% |

|

|

Capacity (ATK m) |

3,291 |

+10.7% |

|

|

Traffic (RTK m) |

1,557 |

-11.8% |

|

|

Load factor |

47.3% |

-12.0 pt |

|

|

Total Cargo revenues (€m) |

672 |

-26.1% |

-26.4% |

|

Scheduled cargo revenues (€m) |

576 |

-27.7% |

-27.9% |

|

Unit revenue per ATK (€ cts ) |

17.51 |

-34.6% |

-34.9% |

Due to the resumption of passenger travel, belly

capacity improved and resulted in an increase in Available Ton

Kilometers of 10.7% versus the first quarter of 2022. After the

first quarter last year the demand for air cargo decreased due to

slower growth of global trade and the partial rebound of sea

freight. The first quarter last year still showed an exceptionally

strong demand and therefore traffic decreased year over year by

11.8%. The yield declined as well resulting in a decrease in unit

revenue per Available Ton Kilometer of almost 35% against a

constant currency. Total revenues dropped by 26.4% against a

constant currency versus the same quarter last year.

At the beginning of April, Air France-KLM and

CMA CGM announced the effective launch of the long-term strategic

air cargo partnership they made public in May 2022. This

partnership will have an initial duration of 10 years and will see

Air France-KLM Martinair Cargo and CMA CGM Air Cargo combine their

complementary cargo networks, full freighter capacity and dedicated

services to build an even more compelling offering thanks to their

unrivalled knowhow and global footprint.

Transavia: Significant increase in

capacity and traffic

|

|

First

Quarter |

|

Transavia |

2023 |

Change |

|

Passengers (thousands) |

3,864 |

+49.7% |

|

Capacity (ASK m) |

7,607 |

+38.5% |

|

Traffic (RPK m) |

6,955 |

+63.0% |

|

Load factor |

91.4% |

+13.7 pt |

|

Total passenger revenues (€m) |

378 |

+52.0% |

|

Unit revenue per ASK (€ cts) |

5.01 |

+9.7% |

|

Unit cost per ASK (€ cts) |

7.26 |

+16.4% |

|

Operating result (€m) |

-172 |

-80 |

Compared to the first quarter 2022, the demand

in leisure traffic in Europe and North Africa continued to grow.

The capacity increased by 38.5%, traffic increased by 63%, and the

number of passengers increased by 49.7% resulting in a load factor

13.7 points above 2022. As the flown capacity in the first quarter

last year was rather limited due to the impact of Omicron virus,

the routes that were operated showed outstanding yields. Therefore

the yield decreased year over year, although the unit revenue per

ASK increased thanks to the higher load factor.

The operating result stood at -€172 million and

decreased by €80 million compared to the same quarter last year.

This decrease was caused by higher costs, mainly related to a

higher fuel price, an increase in handling costs and partly due to

the furlough contribution last year. The operating result was also

impacted by Air Traffic Control strikes in France and grounded

aircraft in the Netherlands.

The fleet of Transavia reached 104 aircraft by

the end of the quarter.

Maintenance business:

Operating result slightly positive

|

|

First

Quarter |

|

Maintenance |

2023 |

Change |

Change constant currency |

|

Total revenues (€m) |

926 |

+11.4% |

|

|

Third-party revenues (€m) |

370 |

+24.4% |

+16.9% |

|

Operating result (€m) |

15 |

-28 |

-32 |

|

Operating margin (%) |

1.7% |

-3.6 pt |

-3.9 pt |

The Maintenance operating result stood at €15

million, a decrease of €32 million against a constant currency

caused by increase in costs. The main cost categories increased

relatively more than the revenue increase. Revenue growth was

hampered by supply chain disruption, in particular on the GE90

engine. Staff costs increased mainly due to the furlough

contribution last year.

Total revenues increased by 11.4% compared with

the same quarter last year while third party revenues increased by

24.4% and 16.9% at constant currency, showing a strong

recovery.

The operating margin stood at 1.7%, which is 3.9

point at constant currency lower than the operating margin in the

first quarter 2022.

Adjusted operating free cash

flow at €0.7 billion leading to a

Net debt/EBITDA ratio at

1.5x

The Group generated an adjusted operating free

cash flow in the first quarter of €0.7 billion driven by strong

summer sales, which is €53 million higher than last year.

| In €

million |

31 Mar

2023 |

31 Dec 2022 |

|

Net debt |

5,478 |

6,337 |

|

EBITDA trailing 12 months |

3,680 |

3,615 |

|

Net debt/EBITDA |

1.5 x |

1.8 x |

Acceleration

in revenue

generation for both airlines

Air France Group

| |

First

Quarter |

| |

2023 |

Change |

|

Revenue (in €m) |

3,924 |

+46.3% |

|

EBITDA (in €m) |

214 |

+236 |

|

Operating result (in €m) |

-181 |

+182 |

|

Operating margin (%) |

-4.6% |

+8.9 pt |

KLM Group

| |

First

Quarter |

| |

2023 |

Change |

|

Revenue (in €m) |

2,522 |

+32.5% |

|

EBITDA (in €m) |

70 |

-164 |

|

Operating result (in €m) |

-128 |

-131 |

|

Operating margin (%) |

-5.1% |

-5.2 pt |

NB: Sum of individual airline results does not add up to Air

France-KLM total due to intercompany eliminations at Group

level

******

The results presentation is available at

www.airfranceklm.com on May 5, 2023 from 7:00 am

CET.

A conference call hosted by Mr. Smith (CEO) and Mr. Zaat (CFO)

will be held on May 5, 2023, at 08.15 am CET.

To connect to the conference call, please dial:

-

France: Local +33 (0)1 70 72 25 50

-

Netherlands: Local +31 (0) 20 703 8211

-

UK: Local +44 (0)330 165 3655

-

US: Local +1 323-994-2093

Confirmation code: 9880361

|

Investor Relations |

|

Press |

|

Michiel Klinkers |

Marouane Mami |

+33 1 41 56 56 00 |

|

Michiel.klinkers@airfranceklm.com |

mamami@airfranceklm.com |

|

Income Statement

|

|

First

Quarter |

|

In million euros |

2023 |

2022* |

Change |

|

Revenues from ordinary

activities |

6,329 |

4,445 |

42% |

|

Aircraft fuel |

-1,780 |

-996 |

79% |

|

Carbon emission |

-32 |

-11 |

191% |

|

Chartering costs |

-90 |

-101 |

-11% |

|

Landing fees and air route charges |

-413 |

-348 |

19% |

|

Catering |

-186 |

-142 |

31% |

|

Handling charges and other operating costs |

-426 |

-320 |

33% |

|

Aircraft maintenance costs |

-648 |

-515 |

26% |

|

Commercial and distribution costs |

-257 |

-154 |

67% |

|

Other external expenses |

-457 |

-333 |

37% |

|

Salaries and related costs |

-2,009 |

-1,522 |

32% |

|

Taxes other than income taxes |

-55 |

-47 |

17% |

|

Other income and expenses |

310 |

265 |

17% |

|

EBITDA |

286 |

221 |

29% |

|

Amortization, depreciation and provisions |

-592 |

-571 |

4% |

|

Income from current operations |

-306 |

-350 |

-13% |

|

Sales of aircraft equipment |

5 |

0 |

nm |

|

Other non-current income and expenses |

-3 |

-6 |

-50% |

|

Income from operating activities |

-304 |

-356 |

-15% |

|

Cost of financial debt |

-158 |

-141 |

12% |

|

Income from cash and cash equivalent |

49 |

-2 |

nm |

|

Net cost of financial debt |

-109 |

-143 |

-24% |

|

Other financial income and expenses |

35 |

-47 |

nm |

|

Income before tax |

-378 |

-546 |

-31% |

|

Income taxes |

41 |

-4 |

nm |

|

Net income of consolidated companies |

-337 |

-550 |

-39% |

|

Share of profits (losses) of associates |

0 |

-2 |

nm |

|

Net income for the period |

-337 |

-552 |

-39% |

|

Non-controlling interests |

7 |

0 |

nm |

|

Net income for the period – Group part |

-344 |

-552 |

-38% |

* Restated figures as the expense corresponding to the

obligation to surrender quotas of the period have been integrated

in “Carbon emission” coming from “Other income and expense”

Consolidated Balance Sheet

|

Assets |

31 Mar

2023 |

31 Dec

2022* |

| In million

euros |

|

Goodwill |

225 |

225 |

|

Intangible assets |

1,126 |

1,127 |

|

Flight equipment |

10,954 |

10,614 |

|

Other property, plant and equipment |

1,372 |

1,375 |

|

Right-of-use assets |

5,304 |

5,428 |

|

Investments in equity associates |

122 |

120 |

|

Pension assets |

41 |

39 |

|

Other non-current financial assets |

1,202 |

1,184 |

|

Non-current derivatives financial assets |

184 |

262 |

|

Deferred tax assets |

777 |

714 |

|

Total non-current assets |

21,307 |

21,088 |

|

Other current financial assets |

572 |

620 |

|

Current derivatives financial assets |

238 |

327 |

|

Inventories |

750 |

723 |

|

Trade receivables |

2,112 |

1,785 |

|

Other current assets |

1,158 |

1,057 |

|

Cash and cash equivalents |

5,823 |

6,626 |

|

Assets held for sale |

81 |

79 |

|

Total current assets |

10,734 |

11,217 |

|

Total assets |

32,041 |

32,305 |

|

Liabilities and equity |

31 Mar

2023 |

31 Dec

2022* |

|

Issued capital |

2,571 |

2,571 |

|

Additional paid-in capital |

5,217 |

5,217 |

|

Treasury shares |

-25 |

-25 |

|

Perpetual |

945 |

933 |

|

Reserves and retained earnings |

-12,136 |

-11,700 |

|

Equity attributable to equity holders of Air

France-KLM |

-3,428 |

-3,004 |

|

Non-controlling interests |

531 |

524 |

|

Total Equity |

-2,897 |

-2,480 |

|

Pension provisions |

1,653 |

1,634 |

|

Non-current return obligation liabilities and provisions for leased

aircraft and other provisions |

4,103 |

4,149 |

|

Non-current financial liabilities |

8,179 |

9,657 |

|

Non-current lease debt |

3,226 |

3,318 |

|

Non-current derivatives financial liabilities |

38 |

21 |

|

Deferred tax liabilities |

1 |

1 |

|

Other non-current liabilities |

1,834 |

2,343 |

|

Total non-current liabilities |

19,034 |

21,123 |

|

Current return obligation liabilities and provisions for leased

aircraft and other provisions |

663 |

740 |

|

Current financial liabilities |

758 |

896 |

|

Current lease debt |

817 |

834 |

|

Current derivatives financial liabilities |

161 |

83 |

|

Trade payables |

2,581 |

2,424 |

|

Deferred revenue on ticket sales |

5,221 |

3,725 |

|

Frequent flyer programs |

882 |

900 |

|

Other current liabilities |

4,815 |

4,057 |

|

Bank overdrafts |

6 |

3 |

|

Total current liabilities |

15,904 |

13,662 |

|

Total equity and liabilities |

32,041 |

32,305 |

* Free CO2 quotas allocated by the State and the

ones purchased on the market recognized as “intangible assets” are

now disclosed in the line “other assets”Statement of

Consolidated Cash Flows from 1 January until

31 March

| In million

euros |

31 Mar

2023 |

31 Mar

2022* |

|

Net income |

-337 |

-552 |

|

Amortization, depreciation and operating provisions |

592 |

571 |

|

Financial provisions |

51 |

35 |

|

Loss (gain) on disposals of tangible and intangible assets |

-4 |

0 |

|

Derivatives – non monetary result |

0 |

-5 |

|

Unrealized foreign exchange gains and losses, net |

-48 |

31 |

|

Share of (profits) losses of associates |

0 |

2 |

|

Deferred taxes |

-39 |

1 |

|

Impairment |

1 |

5 |

|

Other non-monetary items |

-136 |

-43 |

|

Financial Capacity |

80 |

45 |

|

(Increase) / decrease in inventories |

-28 |

-48 |

|

(Increase) / decrease in trade receivables |

-319 |

-411 |

|

Increase / (decrease) in trade payables |

141 |

492 |

|

Increase / (decrease) in advanced ticket sales |

1,477 |

1,245 |

|

Change in other assets and liabilities |

199 |

26 |

|

Change in working capital

requirement |

1,470 |

1,304 |

|

Net cash flow from operating activities |

1,550 |

1,349 |

|

Acquisition of subsidiaries, of shares in non-controlled

entities |

-2 |

0 |

|

Purchase of property, plant and equipment and intangible

assets |

-779 |

-672 |

|

Proceeds on disposal of property, plant and equipment and

intangible assets |

131 |

171 |

|

Decrease (increase) in net investments, more than 3 months |

56 |

5 |

|

Net cash flow used in investing activities |

-594 |

-496 |

|

Perpetual |

20 |

0 |

|

Coupons on perpetual |

-25 |

0 |

|

Issuance of debt |

1,323 |

291 |

|

Repayment on debt |

-2,790 |

-304 |

|

Payments on lease debt |

-219 |

-218 |

|

New loans |

-43 |

-87 |

|

Repayment on loans |

3 |

22 |

|

Net cash flow from financing activities |

-1,731 |

-296 |

|

Effect of exchange rate on cash and cash equivalents and bank

overdrafts (net of cash acquired or sold) |

-31 |

5 |

|

Change in cash and cash equivalents and bank

overdrafts |

-806 |

562 |

|

Cash and cash equivalents and bank overdrafts at beginning of

period |

6,623 |

6,654 |

|

Cash and cash equivalents and bank overdrafts at end of period |

5,817 |

7,216 |

* Restated figures include the change in accounting policy

regarding CO2 quotas moving from “net cash flow used in investing

activities” towards “net cash flow from operating

activities”Return on capital employed (ROCE)

| In million

euros |

31 Mar 2023 |

31*Dec

2022 |

30*Sep 2022 |

30*Jun 2022 |

31* Mar

2022 |

31* Dec

2021 |

30* Sep

2021 |

30* Jun

2021 |

|

Goodwill and intangible assets |

1,351 |

1,352 |

1,350 |

1,361 |

1,363 |

1,380 |

1,384 |

1,392 |

|

Flight equipment |

10,954 |

10,614 |

10,298 |

10,521 |

10,537 |

10,466 |

10,478 |

10,645 |

|

Other property, plant and equipment |

1,372 |

1,375 |

1,349 |

1,358 |

1,378 |

1,402 |

1,418 |

1,453 |

|

Right-of-use assets |

5,304 |

5,428 |

5,536 |

5,439 |

5,205 |

5,148 |

5,061 |

5,033 |

|

Investments in equity associates |

122 |

120 |

111 |

108 |

107 |

109 |

172 |

166 |

|

Financial assets excluding marketable securities and financial

deposits |

169 |

169 |

164 |

162 |

158 |

157 |

147 |

147 |

|

Provisions, excluding pension, cargo litigation and

restructuring |

-4,255 |

-4,347 |

-4,792 |

-4,473 |

-4,240 |

-4,180 |

-4,180 |

-4,033 |

|

WCR, excluding market value of derivatives |

-11,313 |

-9,882 |

-10,359 |

-11,080 |

-9,480 |

-8,185 |

-7,923 |

-7,673 |

|

Capital employed |

3,704 |

4,829 |

3,657 |

3,396 |

5,028 |

6,297 |

6,557 |

7,130 |

|

Average capital employed (A) |

3,897 |

6,253 |

|

Adjusted results from current operations |

1,237 |

-795 |

|

- Dividends received |

-1 |

0 |

|

- Share of profits (losses) of associates |

14 |

-22 |

|

- Normative income tax |

-323 |

230 |

|

Adjusted result from current operations after tax

(B) |

927 |

-587 |

|

ROCE, trailing 12 months (B/A) |

23.8% |

-9.4% |

* Restated figures include the change in accounting principles

for CO2 quotas

Net debt

| |

Balance sheet at |

| In million

euros |

31 Mar

2023 |

31 Dec 2022 |

|

Current and non-current financial liabilities |

8,937 |

10,553 |

|

Current and non-current lease debt |

4,043 |

4,152 |

|

Accrued interest |

-108 |

-127 |

|

Deposits related to financial liabilities |

-104 |

-101 |

|

Deposits related to lease debt |

-99 |

-99 |

|

Derivatives impact on debt |

-21 |

-35 |

|

Gross financial liabilities

(A) |

12,648 |

14,343 |

|

Cash and cash equivalents |

5,823 |

6,626 |

|

Marketable securities > 3 months |

517 |

572 |

|

Bonds |

836 |

811 |

|

Bank overdrafts |

-6 |

-3 |

|

Net cash (B) |

7,170 |

8,006 |

|

Net debt (A) – (B) |

5,478 |

6,337 |

Adjusted operating free cash

flow

| |

First quarter |

| In million

euros |

2023 |

2022* |

|

Net cash flow from operating activities |

1,550 |

1,349 |

|

Investment in property, plant, equipment and intangible assets |

-779 |

-672 |

|

Proceeds on disposal of property, plant, equipment and intangible

assets |

131 |

171 |

|

Operating free cash flow |

902 |

848 |

|

Payments on lease debt |

-219 |

-218 |

|

Adjusted operating free cash flow |

683 |

630 |

* Restated figures include the

change in accounting policy regarding CO2 quotas moving from “net

cash flow used in investing activities” towards “net cash flow from

operating activities”

Bridge from EBITDA to Financial capacity

|

|

First

Quarter |

| In million

euros |

2023 |

2022 |

|

EBITDA |

286 |

221 |

|

Provisions (risk and other) |

-8 |

0 |

|

Correction of spare parts inventory |

0 |

1 |

|

Addition to pension provisions |

33 |

32 |

|

Reversal to pension provisions (cash-out) |

-14 |

-13 |

|

Sales of tangible and intangible assets (excluding

aeronauticals) |

-2 |

0 |

|

Income from operation activities - cash

impact |

295 |

241 |

|

Restructuring costs |

-35 |

-56 |

|

Other non-current income and expenses |

-2 |

-1 |

|

Cost of financial liability |

-263 |

-144 |

|

Financial income |

44 |

-5 |

|

Realized foreign exchanges gain/loss |

38 |

14 |

|

Current income tax |

2 |

-4 |

|

Other elements |

1 |

0 |

|

Self-financing capacity |

80 |

45 |

Unit cost: net cost per ASK

| |

First

Quarter |

|

|

2023 |

2022 |

|

Revenues (in €m) |

6,329 |

4,445 |

|

Income/(loss) from current operations (in €m) -/- |

306 |

350 |

|

Total operating expense (in €m) |

6,635 |

4,795 |

|

Passenger network business – other revenues (in €m) |

-151 |

-105 |

|

Cargo network business – other revenues (in €m) |

-96 |

-114 |

|

Third-party revenues in the maintenance business (in €m) |

-370 |

-297 |

|

Transavia - other revenues (in €m) |

3 |

2 |

|

Third-party revenues of other businesses (in €m) |

-6 |

-6 |

|

Net cost (in

€m) |

6,015 |

4,276 |

|

Capacity produced, reported in ASK* |

69,583 |

58,064 |

|

Net cost per ASK (in € cents per ASK) |

8.65 |

7.36 |

|

Gross change |

|

17.4% |

|

Currency effect on net costs (in €m) |

|

60 |

|

Change at constant currency |

|

15.8% |

|

Fuel price effect (in €m) |

|

438 |

|

Net cost per ASK on a constant currency and fuel price

basis (in € cents per ASK) |

8.65 |

8.22 |

|

Change at constant currency and fuel price

basis |

|

+5.2% |

|

Furlough |

|

+210 |

|

|

8.65 |

8.59 |

|

Change at constant currency and fuel price basis

excluding furlough |

|

+0.7% |

(1) The capacity produced by the transportation activities is

combined by adding the capacity of the Passenger network (in ASK)

to that of Transavia (in ASK).

Group fleet

at 31

March 2023

|

Aircraft type |

AF(incl. HOP) |

KL (incl. KLC & MP) |

Transavia |

Owned |

Finance lease |

Operating lease |

Total |

In operation |

Change /

31/12/22 |

|

B777-300 |

43 |

16 |

|

19 |

16 |

24 |

59 |

59 |

|

|

B777-200 |

18 |

15 |

|

27 |

1 |

5 |

33 |

33 |

|

|

B787-9 |

10 |

13 |

|

4 |

7 |

12 |

23 |

23 |

|

|

B787-10 |

|

8 |

|

1 |

7 |

|

8 |

8 |

1 |

|

A380-800 |

4 |

|

|

2 |

1 |

1 |

4 |

|

|

|

A350-900 |

20 |

|

|

3 |

7 |

10 |

20 |

20 |

|

|

A330-300 |

|

5 |

|

|

|

5 |

5 |

5 |

|

|

A330-200 |

15 |

6 |

|

11 |

|

10 |

21 |

21 |

|

|

Total Long-Haul |

110 |

63 |

0 |

67 |

39 |

67 |

173 |

169 |

1 |

|

B737-900 |

|

5 |

|

5 |

|

|

5 |

5 |

|

|

B737-800 |

|

31 |

100 |

34 |

8 |

89 |

131 |

127 |

2 |

|

B737-700 |

|

7 |

4 |

7 |

|

4 |

11 |

10 |

|

|

A321 |

17 |

|

|

9 |

|

8 |

17 |

16 |

-2 |

|

A320 |

39 |

|

|

4 |

3 |

32 |

39 |

38 |

-1 |

|

A319 |

17 |

|

|

11 |

|

6 |

17 |

16 |

-1 |

|

A318 |

9 |

|

|

5 |

|

4 |

9 |

9 |

|

|

A220-300 |

21 |

|

|

15 |

|

6 |

21 |

21 |

6 |

|

Total Medium-Haul |

103 |

43 |

104 |

90 |

11 |

149 |

250 |

242 |

4 |

|

Canadair Jet 1000 |

5 |

|

|

5 |

|

|

5 |

|

|

|

Canadair Jet 700 |

|

|

|

|

|

|

|

|

|

|

Embraer 195 E2 |

|

15 |

|

|

|

15 |

15 |

15 |

1 |

|

Embraer 190 |

19 |

30 |

|

17 |

4 |

28 |

49 |

49 |

|

|

Embraer 175 |

|

17 |

|

3 |

14 |

|

17 |

17 |

|

|

Embraer 170 |

13 |

|

|

10 |

|

3 |

13 |

13 |

|

|

Embraer 145 |

|

|

|

|

|

|

|

|

|

|

Total Regional |

37 |

62 |

0 |

35 |

18 |

46 |

99 |

94 |

1 |

|

B747-400ERF |

|

3 |

|

3 |

|

|

3 |

3 |

|

|

B747-400BCF |

|

1 |

|

1 |

|

|

1 |

1 |

|

|

B777-F |

2 |

|

|

|

|

2 |

2 |

2 |

|

|

Total Cargo |

2 |

4 |

0 |

4 |

0 |

2 |

6 |

6 |

0 |

|

|

|

|

|

|

|

|

|

|

|

|

Total |

252 |

172 |

104 |

196 |

68 |

264 |

528 |

511 |

6 |

FIRST QUARTER

2023

TRAFFIC

Passenger network activity*

|

|

|

Q1 |

|

|

|

Total Passenger network* |

2023 |

2022 |

Variation |

|

|

Passengers carried (‘000s) |

15,787 |

11,942 |

32.2% |

|

|

Revenue pax-kilometers (m RPK) |

52,966 |

38,866 |

36.3% |

|

|

Available seat-kilometers (m ASK) |

61,975 |

52,570 |

17.9% |

|

|

Load factor (%) |

85.5% |

73.9% |

11.5 |

|

|

|

|

|

|

|

|

Long-haul |

|

|

|

|

|

Passengers carried (‘000s) |

5,939 |

4,381 |

35.6% |

|

|

Revenue pax-kilometers (m RPK) |

44,509 |

32,326 |

37.7% |

|

|

Available seat-kilometers (m ASK) |

51,539 |

43,240 |

19.2% |

|

|

Load factor (%) |

86.4% |

74.8% |

11.6 |

|

|

|

|

|

|

|

|

North America |

|

|

|

|

|

Passengers carried (‘000s) |

1,785 |

1,238 |

44.2% |

|

|

Revenue pax-kilometers (m RPK) |

12,852 |

9,056 |

41.9% |

|

|

Available seat-kilometers (m ASK) |

15,615 |

13,152 |

18.7% |

|

|

Load factor (%) |

82.3% |

68.9% |

13.4 |

|

|

|

|

|

|

|

|

Latin America |

|

|

|

|

|

Passengers carried (‘000s) |

892 |

675 |

32.2% |

|

|

Revenue pax-kilometers (m RPK) |

8,492 |

6,511 |

30.4% |

|

|

Available seat-kilometers (m ASK) |

9,390 |

7,657 |

22.6% |

|

|

Load factor (%) |

90.4% |

85.0% |

5.4 |

|

|

|

|

|

|

|

|

Asia / Middle East |

|

|

|

|

|

Passengers carried (‘000s) |

1,206 |

634 |

90.2% |

|

|

Revenue pax-kilometers (m RPK) |

9,210 |

4,392 |

109.7% |

|

|

Available seat-kilometers (m ASK) |

10,606 |

7,219 |

46.9% |

|

|

Load factor (%) |

86.8% |

60.8% |

26.0 |

|

|

|

|

|

|

|

|

Africa |

|

|

|

|

|

Passengers carried (‘000s) |

1,041 |

816 |

27.6% |

|

|

Revenue pax-kilometers (m RPK) |

6,442 |

4,792 |

34.4% |

|

|

Available seat-kilometers (m ASK) |

7,599 |

6,298 |

20.7% |

|

|

Load factor (%) |

84.8% |

76.1% |

8.7 |

|

|

|

|

|

|

|

|

Caribbean / Indian Ocean |

|

|

|

|

|

Passengers carried (‘000s) |

1,016 |

1,018 |

(0.3%) |

|

|

Revenue pax-kilometers (m RPK) |

7,512 |

7,575 |

(0.8%) |

|

|

Available seat-kilometers (m ASK) |

8,329 |

8,914 |

(6.6%) |

|

|

Load factor (%) |

90.2% |

85.0% |

5.2 |

|

|

|

|

|

|

|

|

Short and Medium-haul |

|

|

|

|

|

Passengers carried (‘000s) |

9,848 |

7,561 |

30.2% |

|

|

Revenue pax-kilometers (m RPK) |

8,457 |

6,541 |

29.3% |

|

|

Available seat-kilometers (m ASK) |

10,436 |

9,331 |

11.8% |

|

|

Load factor (%) |

81.0% |

70.1% |

10.9 |

|

* Air France and KLM

Transavia

activity

|

|

|

Q1 |

|

|

|

|

Transavia |

2023 |

2022 |

Variation |

|

|

|

Passengers carried (‘000s) |

3,864 |

2,581 |

49.7% |

|

|

|

Revenue pax-kilometers (m RPK) |

6,955 |

4,268 |

63.0% |

|

|

|

Available seat-kilometers (m ASK) |

7,607 |

5,494 |

38.5% |

|

|

|

Load factor (%) |

91.4% |

77.7% |

13.7 |

|

|

Total group passenger

activity**

|

|

|

Q1 |

|

|

|

|

Total group** |

2023 |

2022 |

Variation |

|

|

|

Passengers carried (‘000s) |

19,651 |

14,523 |

35.3% |

|

|

|

Revenue pax-kilometers (m RPK) |

59,921 |

43,134 |

38.9% |

|

|

|

Available seat-kilometers (m ASK) |

69,583 |

58,064 |

19.8% |

|

|

|

Load factor (%) |

86.1% |

74.3% |

11.8 |

|

|

** Air France, KLM and Transavia

Cargo activity

|

|

|

Q1 |

|

|

|

|

Total Group |

2023 |

2022 |

Variation |

|

|

|

Revenue tonne-km (m RTK) |

1,557 |

1,766 |

(11.8%) |

|

|

|

Available tonne-km (m ATK) |

3,291 |

2,974 |

10.7% |

|

|

|

Load factor (%) |

47.3% |

59.4% |

(12.0) |

|

|

Air France activity

|

|

|

Q1 |

|

|

|

|

Total Passenger network activity |

2023 |

2022 |

Variation |

|

|

|

Passengers carried (‘000s) |

9,457 |

7,105 |

33.1% |

|

|

|

Revenue pax-kilometers (m RPK) |

31,981 |

23,087 |

38.5% |

|

|

|

Available seat-kilometers (m ASK) |

37,311 |

30,871 |

20.9% |

|

|

|

Load factor (%) |

85.7% |

74.8% |

10.9 |

|

|

|

Long-haul |

|

|

|

|

|

Passengers carried (‘000s) |

3,696 |

2,766 |

33.6% |

|

|

Revenue pax-kilometers (m RPK) |

26,961 |

19,452 |

38.6% |

|

|

Available seat-kilometers (m ASK) |

31,147 |

25,733 |

21.0% |

|

|

Load factor (%) |

86.6% |

75.6% |

11.0 |

|

|

Short and Medium-haul |

|

|

|

|

|

Passengers carried (‘000s) |

5,761 |

4,339 |

32.8% |

|

|

Revenue pax-kilometers (m RPK) |

5,021 |

3,635 |

38.1% |

|

|

Available seat-kilometers (m ASK) |

6,165 |

5,137 |

20.0% |

|

|

Load factor (%) |

81.4% |

70.8% |

10.7 |

|

|

|

|

Q1 |

|

|

|

|

Cargo activity |

2023 |

2022 |

Variation |

|

|

|

Revenue tonne-km (m RTK) |

789 |

907 |

(13.0%) |

|

|

|

Available tonne-km (m ATK) |

1,860 |

1,657 |

12.3% |

|

|

|

Load factor (%) |

42.4% |

54.7% |

(12.3) |

|

|

KLM activity

|

|

|

Q1 |

|

|

|

|

Total Passenger network activity |

2023 |

2022 |

Variation |

|

|

|

Passengers carried (‘000s) |

6,330 |

4,837 |

30.9% |

|

|

|

Revenue pax-kilometers (m RPK) |

20,984 |

15,780 |

33.0% |

|

|

|

Available seat-kilometers (m ASK) |

24,664 |

21,700 |

13.7% |

|

|

|

Load factor (%) |

85.1% |

72.7% |

12.4 |

|

|

|

Long-haul |

|

|

|

|

|

Passengers carried (‘000s) |

2,242 |

1,614 |

38.9% |

|

|

Revenue pax-kilometers (m RPK) |

17,548 |

12,874 |

36.3% |

|

|

Available seat-kilometers (m ASK) |

20,393 |

17,506 |

16.5% |

|

|

Load factor (%) |

86.1% |

73.5% |

12.5 |

|

|

Short and Medium-haul |

|

|

|

|

|

Passengers carried (‘000s) |

4,088 |

3,222 |

26.8% |

|

|

Revenue pax-kilometers (m RPK) |

3,436 |

2,906 |

18.2% |

|

|

Available seat-kilometers (m ASK) |

4,272 |

4,194 |

1.9% |

|

|

Load factor (%) |

80.4% |

69.3% |

11.1 |

|

|

|

|

Q1 |

|

|

|

|

Cargo activity |

2023 |

2022 |

Variation |

|

|

|

Revenue tonne-km (m RTK) |

768 |

859 |

(10.6%) |

|

|

|

Available tonne-km (m ATK) |

1,427 |

1,317 |

8.4% |

|

|

|

Load factor (%) |

53.8% |

65.2% |

(11.4) |

|

|

1 Against a constant currency and constant fuel price and

excluding furlough2 Change versus 31 Dec 2022

- AFKL_Q1_2023_Results_Press_release

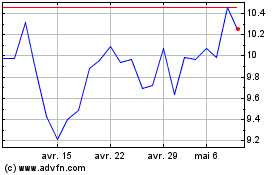

Air FranceKLM (EU:AF)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Air FranceKLM (EU:AF)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024