Regulated information

March 28, 2022,

10:30 PM

CETMarch 28, 2022,

4:30 PM ET

Breda, the Netherlands / Ghent, Belgium —

argenx SE (Euronext & Nasdaq: ARGX), a global immunology

company committed to improving the lives of people suffering from

severe autoimmune diseases, announced today the closing of its

previously announced global offering of an aggregate of 2,333,334

ordinary shares (including ordinary shares represented by American

Depositary Shares (“ADSs”)). The gross proceeds from the global

offering were approximately $700 million (approximately €637

million).

J.P. Morgan, Morgan Stanley, Cowen and SVB Leerink acted as

joint bookrunning managers for the offering. Wells Fargo

Securities, Kempen & Co, H.C. Wainwright & Co., Raymond

James and Wedbush PacGrow acted as co-managers for the

offering.

The securities were offered in the United States pursuant to an

automatically effective shelf registration statement that was

previously filed with the Securities and Exchange Commission

(“SEC”). A preliminary prospectus supplement relating to the

securities was filed with the SEC on March 22, 2022 and a final

prospectus supplement relating to the securities was filed with the

SEC on March 25, 2022 and are available on the SEC’s website at

www.sec.gov. Copies of the final prospectus supplement and the

accompanying prospectus relating to the U.S. offering may be

obtained for free from J.P. Morgan Securities LLC, c/o Broadridge

Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717,

or by telephone at (866) 803-9204, or by email at

prospectus-eq_fi@jpmchase.com; from Morgan Stanley & Co. LLC,

180 Varick Street, 2nd Floor, New York, NY 10014, Attn: Prospectus

Department, by email at prospectus@morganstanley.com, or by

telephone at (866) 718-1649; from Cowen and Company, LLC, c/o

Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood,

NY 11717, Attn: Prospectus Department, by email at

PostSaleManualRequests@broadridge.com, or by telephone at (833)

297-2926; or from SVB Securities LLC, Attn: Syndicate Department,

53 State Street, 40th Floor, Boston, Massachusetts 02109, by

telephone at 1-800-808-7525, ext. 6105, or by email at

syndicate@svbleerink.com.

In addition, argenx announces the listing of and the

commencement of dealings in its 2,333,334 new ordinary shares on

the regulated market of Euronext Brussels.

This press release is for information purposes only and does not

constitute, and should not be construed as, an offer to sell or the

solicitation of an offer to buy or subscribe to any securities, nor

shall there be any sale of securities in any jurisdiction in which

such offer, solicitation or sale is not permitted or to any person

or entity to whom it is unlawful to make such offer, solicitation

or sale. Reference is also made to the restrictions set out in

“Important information” below. This press release is not for

publication or distribution, directly or indirectly, in or into any

state or jurisdiction into which doing so would be unlawful or

where a prior registration or approval is required for such

purpose.

About argenx

argenx is a global immunology company committed to improving the

lives of people suffering from severe autoimmune diseases.

Partnering with leading academic researchers through its Immunology

Innovation Program (IIP), argenx aims to translate immunology

breakthroughs into a world-class portfolio of novel antibody-based

medicines. argenx developed and is commercializing the

first-and-only approved neonatal Fc receptor (FcRn) blocker in the

U.S. and Japan. The Company is evaluating efgartigimod in multiple

serious autoimmune diseases and advancing several earlier stage

experimental medicines within its therapeutic franchises.

For further information, please

contact:

Media:Kelsey

Kirkkkirk@argenx.com

Joke Comijn (EU)jcomijn@argenx.com

Investors:Beth

DelGiaccobdelgiacco@argenx.com

Michelle Greenblattmgreenblatt@argenx.com

Important information

The preliminary prospectus supplement and final prospectus in

respect of the U.S. offering do not constitute a prospectus within

the meaning of the Prospectus Regulation and has not been approved

by the Dutch Authority for the Financial Markets (Stichting

Autoriteit Financiële Markten) or the Belgian Financial Services

and Markets Authority (Autoriteit Financiële Diensten en Markten)

or any other European Supervisory Authority.

No public offering will be made and no one has taken any action

that would, or is intended to, permit a public offering in any

country or jurisdiction, other than the United States, where any

such action is required, including in the European Economic Area.

In the European Economic Area, the offering to which this press

release relates will only be available to, and will be engaged in

only with, qualified investors within the meaning of the Prospectus

Regulation.

European Economic Area:

No action has been or will be taken to offer the ordinary shares

to a retail investor established in the European Economic Area as

part of the global offering. For the purposes of this

paragraph:

a. The expression

“retail investor” means

a person who is one (or more) of:

|

i. |

|

a retail client as defined in

point (11) of Article 4(1) of Directive 2014/65/EU (as

amended, “MiFID II”); or |

|

ii. |

|

a customer within the meaning of

Directive 2016/97/EU, as amended, where that customer would not

qualify as a professional client as defined in point (10) of

Article 4(1) of MiFID II; or |

|

iii. |

|

not a “qualified investor” as

defined in the Prospectus Regulation; and |

b. the expression “offer”

means any communication in any form and by any means of sufficient

information on the terms of the offer and securities to be offered

so as to enable an investor to decide to purchase or subscribe

these securities.

In addition, in the United Kingdom, the transaction to which

this press release relates will only be available to, and will be

engaged in only with persons who are “qualified investors” (as

defined in the Prospectus Regulation as it forms part of domestic

law in the United Kingdom by virtue of the European Union

(Withdrawal) Act 2018 (the UK Prospectus Regulation) (i) who have

professional experience in matters relating to investments falling

within Article 19(5) of the Financial Services and

Markets Act (Financial Promotion) Order 2005, as amended (the

Order), and/or (ii) who are high net worth companies (or persons to

whom it may otherwise be lawfully communicated) falling within

Article 49(2)(a) to (d) of the Order (all such

persons together being referred to as “relevant persons”). The

securities referred to herein are only available to, and any

invitation, offer or agreement to subscribe, purchase or otherwise

acquire such securities will be engaged in only with relevant

persons. Any person who is not a relevant person should not act or

rely on this communication or any of its contents.

This press release is not an approved prospectus by the

Financial Services Authority or by any other regulatory authority

in the United Kingdom within the meaning of Section 85 of the

Order.

Stabilization

In connection with the offering, J.P. Morgan Securities LLC (the

“Stabilization Manager”), or any of its agents, on behalf of the

underwriters may (but will be under no obligation to), to the

extent permitted by applicable law, over-allot ordinary shares or

ADSs or effect other transactions with a view to supporting the

market price of the ordinary shares or ADSs at a higher level than

that which might otherwise prevail in the open market. The

Stabilization Manager is not required to enter into such

transactions and such transactions may be effected on any

securities market, over-the-counter market, stock exchange

(including Euronext Brussels) or otherwise and may be undertaken at

any time starting on the first trading date and ending no later

than 30 calendar days thereafter.

However, there will be no obligation on the Stabilization

Manager or any of its agents to effect stabilizing transactions and

there is no assurance that stabilizing transactions will be

undertaken. Such stabilization, if commenced, may be discontinued

at any time without prior notice. Save as required by law or

regulation, neither the Stabilization Manager nor any of its agents

intends to disclose the extent of any over-allotments made and/or

stabilization transactions under the offering.

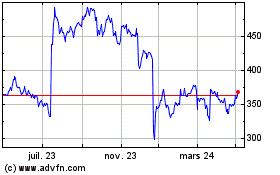

Argen X (EU:ARGX)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Argen X (EU:ARGX)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024