Atos expects limited impacts from change in its credit rating

13 Juillet 2022 - 9:30PM

Atos expects limited impacts from change in its credit rating

Press Release

Atos expects limited impacts from change

in its credit rating

Paris – July

13, 2022 - Today,

S&P Global lowered Atos credit rating from BBB- with a negative

outlook, to BB with a negative outlook. This rating change should

have limited impacts on its operations and financing.

The impact of this rating change on Atos debt

structure and cost of debt is very limited, as the only current

debt instrument which cost is subject to a rating grid is the €2.4

bn revolving credit facility, that remains almost fully undrawn as

of today. Bond terms remain unchanged.

On June 14th, 2022, Atos presented its project

under study to split into two publicly listed companies and to

implement an ambitious transformation plan. This project, which has

already triggered tremendous motivation and engagement from

employees, and has been very well received by clients, is

unaffected by today’s rating change, and so are the medium-term

financial objectives communicated on June 14th.

On June 28th, Atos mandated two leading banks,

BNP Paribas and JP Morgan, in order to arrange the syndication of

the new debt package outlined on June 14th. This syndication is in

progress.

As highlighted by S&P Global’s statement,

Atos’ liquidity is strong and its financial policy is supportive.

In particular, S&P Global stated that Atos' planned liquidity

should provide the Group with the means to deliver its

transformation plan, with its planned €1.5 billion term loan, €900

million revolving credit facility, reduced commercial paper

utilization, and €700 million in non-core assets disposals.

Nathalie

Senechault, Group

CFO, commented: “Atos’ financing strategy remains

unchanged in light of this credit rating downgrade. Currently, with

its cash and undrawn revolving credit facility, Atos has got ample

liquidity to cater for its needs.”

For full details, please refer to the press

release on S&P Global’s website.

***

About Atos

Atos is a global leader in digital

transformation with 111,000 employees and annual revenue of c. € 11

billion. European number one in cybersecurity, cloud and

high-performance computing, the Group provides tailored end-to-end

solutions for all industries in 71 countries. A pioneer in

decarbonization services and products, Atos is committed to a

secure and decarbonized digital for its clients. Atos is a SE

(Societas Europaea), listed on Euronext Paris and included in the

CAC 40 ESG and Next 20 indexes.

The purpose of Atos is to help design the future

of the information space. Its expertise and services support the

development of knowledge, education and research in a multicultural

approach and contribute to the development of scientific and

technological excellence. Across the world, the Group enables its

customers and employees, and members of societies at large to live,

work and develop sustainably, in a safe and secure information

space.

Contacts

Investor Relations: Thomas Guillois

– thomas.guillois@atos.net - +33 6 21 34 36 62

Media: Anette Rey | anette.rey@atos.net | +33 6

69 79 84 88

- PR - Atos expects limited impacts from change in its credit

rating

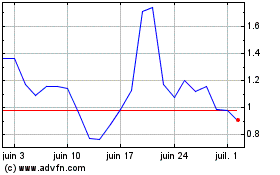

Atos (EU:ATO)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Atos (EU:ATO)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024