- Half-year revenues at €8.3 million (-14% vs. H1 2021) and

gross margin rate at 35% vs. 43% in H1 2021, unfavorable seasonal

revenue effect concerning the contract with Linde, which should be

recovered in H2 2022

- Continued rebalancing of the business model towards direct

sales, representing 36% of new orders in H1 2022 vs. 19% in

2021

- Order intake at €11 million, up 25% vs. H1 2021

- Increased Sales & Marketing investments to support the

development of the direct sales model

- Linde is signing a new order commitment contract for €11.5

million for 2023

Regulatory News:

BALYO (FR0013258399, Ticker: BALYO, PEA-PME eligible)

(Paris:BALYO), a technology leader in the design and development of

innovative robotic solutions for industrial trucks, today announces

its results for the first half of 2022, approved by the Board of

Directors on September 21, 2022.

Pascal Rialland, CEO of BALYO, said: “The first half of

2022 is marked by the speed-up of direct sales and increased

investments, particularly in sales teams, in order to boost the

development of the direct sales channel. 18 months after the start

of marketing BALYO solutions in direct sales, the Company must

continue to build its commercial and operational independence over

the coming months. In 2023, BALYO will be able to rely on a final

order commitment from Linde of €11.5 million. After this date, the

partnership will remain, but without any hard commitment from Linde

as historical partner. With the strong commercial momentum of

direct sales, BALYO expects significant growth in its order intake

in 2023. In this respect, the Company will disclose early next year

its sales and operating profit targets. In the nearer term,

revenues for the second half of 2022 should benefit from the

commitment of orders from Linde and the growing share of direct

sales. As a result, the Company expects a loss slightly higher for

the whole 2022 fiscal year compared to the one recorded for the

first half of 2022.”

First half 2022 activity

As announced on the occasion of the release of the revenues for

the first half of 2022, BALYO reports revenues of €8.3 million,

down by -14% compared to the first half of 2021. This decrease is

mainly explained by an unfavorable seasonal effect concerning

deliveries made to its partner Linde Material Handling. BALYO is

expecting a recovery of its revenues in the second half of

2022.

After taking into account new orders for €4.7 million in the

second quarter of 2022, the order backlog1 as of June 30, 2022

amounted to €11 million, compared to €8.8 million as of June 30,

2021, a strong increase (+25%) compared to the first half of 2021.

It is also important to highlight that more than 50% of direct

orders were generated in the United States.

The United States thus represents now the most important

commercial region for BALYO in terms of direct orders.

At the same time, BALYO has also entered into key partnerships

during the past six months with leading players. The first one with

Bolloré Logistics, with the implementation of BALYO solutions in

the Asia-Pacific zone and the support of its partner towards

operational excellence. BALYO also signed a contract with Auchan to

manage 2,000 of the retailer's pallets within its logistics

platform located in the South-East of Paris.

2022 Half-Year financial results

In € million

H1 2022

H1 2021

Change

Sales revenue

8.29

9.61

-14%

Cost of sales

-5.43

-5.50

-1%

Gross profit

2.86

4.11

-30%

Gross margin rate

35%

43%

-19%

Research and Development

-2.46

-2.00

+23%

Sales and Marketing

-1.48

-1.07

+38%

General and administrative expenses

-3.68

-2.72

+35%

Share-based payment expense

-0.21

-0.11

+91%

Operating loss

-4.98

-1.70

-193%

Financial expense

-0.02

-0.02

-

Net loss

-5.00

-1.72

-191%

Cash position (as of June 30)

6.68

6.37

The decline in revenues during the period, together with a

stable cost of sales compared to last year, resulted in a decline

in gross margin to €2.9 million and a gross margin rate of 35%

compared to €4.1 million and 43% in H1 2021.

Operating expenses amounted to €7.6 million, up 32% compared to

the first half of 2021. This change is mainly due to higher

personnel expenses related to the increase in the number of

employees, travel expenses as well as external services. Expenses

allocated to R&D, Sales and Marketing and General Expenses are

up respectively by 23%, 38% and 35%.

At the end of June 2022, BALYO accounts 150 employees, compared

to 143 employees at the end of December 2021.

After taking these items into account, the operating loss for

the period sets at -€5.0 million, compared with -€1.7 million in H1

2021.

The financial result is stable at -€0.02 million, the latest

includes mainly the interest charges of BALYO.

In total, net loss for the first half of 2022 amounts to -€5.0

million, compared to -€1.7 million in H1 2021.

As of June 30, 2022, the Company’s cash and cash equivalents

position sets at €6.7 million compared to €6.4 million as of June

30, 2021. Given the information currently in its hands and as

already disclosed at the beginning of the year, the Company

considers that it will be able to meet its 12-month maturities at

the closing date of the half-yearly accounts and does not

anticipate a capital increase in 2022.

Master agreement with Linde for an order commitment of €11.5

million in 2023

Since the beginning of 2021, BALYO has been allowed to market

its solutions directly in the market in order to build its

commercial and operational independence. The Company had before an

exclusive commercial relationship with its two industrial partners,

Hyster-Yale and Linde Material Handling.

In 2021, direct orders represented 19% of new orders compared to

36% over the last six months, illustrating the fast-moving success

of the transition towards this new sales model.

BALYO has just negotiated a last contract of order commitment

with Linde Material Handling for €11.5 million for the year 2023.

The partnership between the two companies will continue after this

date, without involving each year firm annual orders.

In the coming months, BALYO plans to continue accelerating

direct sales in order to be commercially independent from 2024

onwards.

Strategy and outlook

In the second half of 2022, BALYO will continue to execute its

business plan with strong growth expected in direct sales,

supported by the strengthening of sales and service teams, which

will continue to reduce commercial dependence on historically

exclusive partners.

With regard to the supply of certain electronic components and

the extension of lead times, BALYO remains cautious in the current

context. The increase in production costs has had an impact, still

limited, on the H1 Company's margins of the robotic kits, in

connection with the increase in raw material prices as well as the

extension of the supply lead times of electronic components as well

as the handling carts for the projects sold directly. The Company

expects an impact on revenues in the third quarter of 2022 which

should be partially offset in the last quarter of 2022. The Company

is not yet in a position to confirm at this stage the exact impact

on 2022 revenues of supply delays.

***

Next BALYO financial release: 2022 Third quarter sales,

October 27, 2022 after market close.

BALYO has made available to the public and submitted to the

Autorité des marchés financiers its half-year financial report as

of June 30, 2022.

The half-year financial report is available on BALYO’s website

at www.balyo.com, in the "Documentation" section.

ABOUT BALYO Humans around the World deserve enriching and

creative jobs. At BALYO, we believe that pallet movements in DC and

manufacturing sites should be left to fully autonomous robots. To

execute this ambition, BALYO transforms standard forklifts into

intelligent robots thanks to its breakthrough Driven by Balyo™

technology. Our leading geo guidance navigation system enables

robots to locate their position and navigate autonomously inside

buildings - without the need for any additional infrastructure. To

accelerate the material handling market conversion to autonomy,

BALYO has entered into two global partnerships with KION

(Fenwick-Linde's parent company) and Hyster-Yale Group. A full

range of globally available robots has been developed for virtually

all traditional warehousing applications; Tractor, Pallet,

Stackers, Reach and VNA-robots. BALYO and its subsidiaries in

Boston and Singapore serve clients in the Americas, Europe and

Asia-Pacific. The company has been listed on EURONEXT since 2017

and its sales revenue reached €21.8 million in 2021. For more

information, visit www.balyo.com.

1 The backlog refers to all orders for projects received but not

yet fulfilled. The backlog evolves every quarter following the

taking into account of new orders, the revenue generated by

projects during the period and the cancellation of orders

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220929005681/en/

BALYO Frank Chuffart investors@balyo.com

NewCap Investor Relations Thomas Grojean / Louis-Victor

Delouvrier Tel : +33 1 44 71 98 53 balyo@newcap.eu

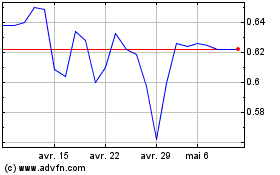

Balyo (EU:BALYO)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Balyo (EU:BALYO)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024