Carmila: Signature of an Agreement for the Sale of a Portfolio of Assets with Batipart and ATLAND Voisin

12 Avril 2022 - 6:18PM

Business Wire

Regulatory News:

Carmila (Paris:CARM) has reached an agreement with Batipart and

ATLAND Voisin on the creation of a joint venture to acquire a

portfolio of assets currently owned by Carmila.

The portfolio consists of 6 assets, all of which are located in

France: Mondevillage, Meylan, Mont St Aignan, Nantes St Herblain,

Rambouillet and St Jean de Vedas.

The agreed sale price of the portfolio is EUR 150 million,

including transfer taxes. It is in line with appraisal values at

end 2021.

Carmila will retain a 20% stake in the joint venture, with an

LTV including transfer taxes of no more than 50%, and provide asset

management, leasing and property services for the joint

venture.

The sale is expected to close in June 2022.

The agreed sale is the first transaction of the asset rotation

programme announced at Carmila’s December 2021 Capital Markets Day.

Carmila is targeting an aggregate amount of disposals of €200M in

total in 2022 and 2023 and intends to continue disposing of assets

beyond 2023. The proceeds of disposals will finance new investments

and share buybacks.

Marie Cheval, Chair and Chief Executive Officer of Carmila

commented:

“This is an important step for Carmila as it marks the beginning

of the asset rotation strategy announced at our Capital Markets

Day. This agreement demonstrates the liquidity of our assets at

favourable conditions and the appetite of real estate investors for

retail assets.”

INVESTOR AGENDA 21 April 2022 (after market close): Q1

2022 Financial Information 12 May 2022: Annual General

Meeting

ABOUT CARMILA

The third largest listed owner of commercial property in

continental Europe, Carmila was founded by Carrefour and large

institutional investors in order to transform and enhance the value

of shopping centres adjoining Carrefour hypermarkets in France,

Spain and Italy. At 31 December 2021, its portfolio was valued at

€6.21 billion, comprising 214 shopping centres, all leaders in

their catchment areas.

Carmila is listed on Euronext-Paris Compartment A under the

symbol CARM. It benefits from the tax regime for French real estate

investment trusts (“SIIC”).

IMPORTANT NOTICE

Some of the statements contained in this document are not

historical facts but rather statements of future expectations,

estimates and other forward-looking statements based on

management's beliefs. These statements reflect such views and

assumptions prevailing as of the date of the statements and involve

known and unknown risks and uncertainties that could cause future

results, performance or events to differ materially from those

expressed or implied in such statements. Please refer to the most

recent Universal Registration Document filed in French by Carmila

with the Autorité des marchés financiers for additional information

in relation to such factors, risks and uncertainties. Carmila has

no intention and is under no obligation to update or review the

forward-looking statements referred to above. Consequently, Carmila

accepts no liability for any consequences arising from the use of

any of the above statements.

This press release is available in the

“Financial Press Release” of Carmila’s Finance webpage:

https://www.carmila.com/en/finance/financial-press-release

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220412005929/en/

INVESTOR AND ANALYST Jonathan Kirk – Head of Investor

Relations jonathan_kirk@carmila.com +33 6 31 71 83 98

PRESS Kenza Kanache – Marie-Antoinette PR Agency

kenza@marie-antoinette.fr +33 6 35 47 82 08

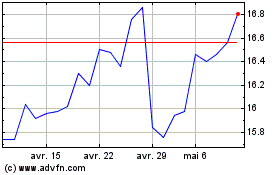

Carrefour Property Devel... (EU:CARM)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Carrefour Property Devel... (EU:CARM)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024