Quarterly financial information as of March 31, 2022

IFRS - Regulated information - Not audited

Cegedim: 2022 off to a

promising start

- Q1 2022 revenues

grew 5.5%

- All operating

divisions contributed to growth

- A final agreement

with investors to acquire a stake in Cegedim Santé is expected

in May

Boulogne-Billancourt, France, April 28, 2022, after the

market close

Cegedim generated

consolidated Q1 2022 revenues of €129.2 million, an increase of

5.5% as reported and 5.0% like

for

like(1)

compared with the same period in 2021.

“Our first-quarter performance, including growth

of 5.5%, was in line with our expectations. The fact that all

operating divisions contributed to growth testifies to our solid

foundations—a resilient, relevant business model and talented,

motivated teams. Three major social protection groups are acquiring

a €65 million stake in Cegedim Santé, which will enable it to

achieve its goals. The deal values Cegedim Santé at over €360

million. Given the current geopolitical and public health backdrop,

we remain vigilant but confident, and we continue to strengthen our

sales and R&D teams,” says Laurent Labrune, Cegedim

Group Deputy Managing Director.

Revenue

|

|

|

First quarter |

Change T1 2022 / 2021 |

|

in millions of euros |

|

2022 |

2021 |

Reported |

Like for like (1) |

|

Software & services |

|

71.2 |

68.8 |

+3.5% |

+2.7% |

| Flow |

|

22.6 |

21.0 |

+7.5% |

+7.3% |

| Data &

Marketing |

|

22.5 |

19.9 |

+12.7% |

+12.7% |

| BPO |

|

12.3 |

11.7 |

+5.0% |

+5.0% |

| Corporate and

others |

|

0.7 |

1.0 |

-33.3% |

-33.3% |

|

Cegedim |

|

129.2 |

122.5 |

+5.5% |

+5.0% |

Analysis of business trends by division

Q1 2022 division revenues came to €71.2 million,

up 2.7% like for like compared with the same period in 2021.

All of the division’s activities turned in solid

performances with the exception of the healthcare professional

computerization business in the UK which, as expected, is still

gearing up for recovery.

__________(1) At constant scope

and exchange rates. The positive currency impact of 0.4% was mainly

due to the pound sterling. The positive scope effect of 0.1% was

attributable to the first-time consolidation (at June 30, 2021) of

Kobus Tech.

Q1 2022 division revenues came to €22.6 million,

up 7.3% like for like(1) compared with the same period in 2021.

The process digitalization and digital data flow

business experienced strong growth in France and posted clear

recoveries in the UK and Germany. The healthcare flow business

related to healthcare reimbursements in France also grew.

Q1 2022 division revenues came to €22.5 million,

up 12.7% like for like(1) compared with the same period in

2021.

Data activity in France and digital

communication solutions in France still have good momentum, posting

double-digit growth. Futuramedia, a digital communication solutions

expert, continues to roll out its offering in UK pharmacies.

Q1 2022 division revenues came to €12.3 million,

up 5.0% like for like(1) compared with the same period in 2021.

The business of providing services for insurance

companies and mutual insurance providers was stable. On the other

hand, the division got a boost from strong demand for BPO services

from HR departments.

Q1 2022 division revenues came to €0.7 million,

down 33.3% like for like(1) compared with the same period in

2021.

Highlights

Apart from the items cited below, to the best of

the company’s knowledge. there were no events or changes during Q1

2022 that would materially alter the Group’s financial

situation.

The Group does not do business in Russia or

Ukraine and has no assets exposed to those countries.

-

Cegedim in exclusive talks with

Malakoff Humanis, Groupe VYV, and

PRO BTP regarding acquisition of an equity stake in

Cegedim Santé

On March 1, 2022, Cegedim and social protection

groups Malakoff Humanis, Groupe VYV, and PRO BTP announced that

they were in exclusive talks regarding acquisition of an equity

stake in Cegedim Santé, the Group subsidiary specialized in digital

solutions for healthcare professionals and patients. As part of the

deal, Cegedim Santé will acquire Groupe VYV subsidiary MesDocteurs,

which specializes in telehealth.

It is expected that an investment agreement will

be signed in May 2022. The €65 million reserved capital increase

will likely take place before June 2022. The deal values Cegedim

Santé post-deal at €360.9 million. Cegedim will continue to fully

consolidate Cegedim Santé.

Cegedim, jointly with IQVIA (formerly IMS

Health), is being sued by Euris for unfair competition. Cegedim has

asked the court to dismiss the case against the Group. On December

17, 2018, the Paris Commercial Court granted Cegedim’s request,

which IQVIA then appealed. On December 8, 2021, the Court of

Appeals upheld the judgement in favor of Cegedim. IQVIA filed

another appeal on February 19, 2022.

After consulting its external legal counsel, the

Group had decided not to set aside any provisions.

Significant transactions and events post March 31,

2022

To the best of the company’s knowledge, there

were no post-closing events or changes after March 31, 2022, that

would materially alter the Group’s financial situation.

__________(1) At constant scope

and exchange rates.Outlook

Based on Q1 2022 revenues up 5.0% like for

like(1), and despite the public health,

economic, geopolitical and

monetary uncertainty facing the world, the Group

is confident it can grow revenues.

Thus, in 2022 Cegedim expects like-for-like

revenue growth(1) of around 5%. Considering the

inflationary risk stemming from the current geopolitical situation,

particularly pertaining to wages, the Group is temporarily

suspending its communication regarding its 2022 recurring operating

income(2) target.

The Group does not expect to make any

significant acquisitions in 2022.

|

WEBCAST ON APRIL 28, 2022, AT 6:15 PM (PARIS

TIME) |

|

The webcast is available at:

www.cegedim.fr/webcast |

| |

The Q1 2022 revenues presentation is available:

- On the website:

https://www.cegedim.fr/finance/documentation/Pages/presentations.aspx

- And on the Cegedim

IR smartphone app, available at

https://www.cegedim.fr/finance/profil/Pages/CegedimIR.aspx

|

|

|

The Audit Committee met on April 27, 2022. The

Board of Directors, chaired by Jean-Claude Labrune, met on April

28, 2022.

2022 financial calendar

|

2022 |

June 17 at 9:30 amJuly 28 after

the closeSeptember 20 after the

closeOctober 27 after the close |

Shareholders’ meetingSecond-quarter 2022 revenuesFirst-half 2022

resultsThird-quarter 2022 revenues |

|

DisclaimerThis press release is available

in French and in English. In the event of any difference between

the two versions, the original French version takes precedence.

This press release may contain inside information. It was sent to

Cegedim’s authorized distributor on April 28, 2022, no earlier than

5:45 pm Paris time.The figures cited in this press

release include guidance on Cegedim's future financial performance

targets. This forward-looking information is based on the opinions

and assumptions of the Group’s senior management at the time this

press release is issued and naturally entails risks and

uncertainty. For more information on the risks facing Cegedim,

please refer to Chapter 7, “Risk management”, section 7.2, “Risk

factors and insurance”, and Chapter 3, “Overview of the financial

year”, section 3.6, “Outlook”, of the 2021 Universal Registration

Document filled with the AMF on April

1st, 2022, under number

D.22-0232. |

|

About Cegedim:Founded in 1969, Cegedim is an innovative

technology and services company in the field of digital data flow

management for healthcare ecosystems and B2B, and a business

software publisher for healthcare and insurance professionals.

Cegedim employs more than 5,600 people in more than 10 countries

and generated revenue of €525 million in 2021. Cegedim SA is listed

in Paris (EURONEXT: CGM).To learn more, please visit:

www.cegedim.frAnd follow Cegedim on Twitter @CegedimGroup, LinkedIn

and Facebook. __________(1) At constant scope

and exchange rates.(2) See 2021 Universal

Registration Document Chapter 4 “Consolidated Financial Statements”

section 4.6 Note 2 on Alternative performance

indicators. |

|

Aude

BalleydierCegedimMedia Relations

and Communications ManagerTel.: +33 (0)1 49 09 68

81aude.balleydier@cegedim.fr |

Jan

Eryk

UmiastowskiCegedimChief

Investment and Investor Relations OfficerTel.: +33 (0)1 49 09 33

36janeryk.umiastowski@cegedim.com |

Céline

Pardo .BecomingMedia

Relations Tel.: +33

(0)6 52 08 13 66cegedim@becoming-group.com |

|

Annexes

Breakdown of revenue by quarter and

division

|

in € thousands |

|

Q1 |

Q2 |

Q3 |

Q4 |

Total |

|

Software & services |

|

71.2 |

|

|

|

71.2 |

|

| Flow |

|

22.6 |

|

|

|

22.6 |

|

| Data &

marketing |

|

22.5 |

|

|

|

22.5 |

|

| BPO |

|

12.3 |

|

|

|

12.3 |

|

| Corporate and

others |

|

0.7 |

|

|

|

0.7 |

|

|

Group revenue |

|

129.2 |

|

|

|

129.2 |

|

|

in € thousands |

|

Q1 |

Q2 |

Q3 |

Q4 |

Total |

|

Software & services |

|

68.8 |

71.4 |

71.3 |

80.4 |

292.0 |

|

| Flow |

|

21.0 |

20.7 |

19.8 |

22.7 |

84.2 |

|

| Data &

marketing |

|

19.9 |

24.8 |

21.8 |

31.9 |

98.4 |

|

| BPO |

|

11.7 |

11.2 |

11.4 |

13.0 |

47.3 |

|

| Corporate and

others |

|

1.0 |

0.5 |

0.5 |

0.7 |

2.7 |

|

|

Group revenue |

|

122.5 |

128.7 |

124.8 |

148.7 |

524.7 |

|

Breakdown of revenue by geographic zone, currency and

division at March 31, 2022

|

as a % of consolidated revenues |

|

Geographic zone |

|

Currency |

| |

France |

EMEAex. France |

Americas |

|

Euro |

GBP |

Others |

|

Software & services |

|

83.2% |

16.7% |

0.1% |

|

86.1% |

12.0% |

1.9% |

| Flow |

|

92.5% |

7.5% |

0.0% |

|

95.7% |

4.3% |

0.0% |

| Data &

marketing |

|

97.5% |

2.5% |

0.0% |

|

97.5% |

0.0% |

2.5% |

| BPO |

|

100.0% |

0.0% |

0.0% |

|

100.0% |

0.0% |

0.0% |

| Corporate and

others |

|

99.4% |

0.6% |

0.0% |

|

100.0% |

0.0% |

0.0% |

|

Cegedim |

|

89.0% |

11.0% |

0.1% |

|

91.1% |

7.4% |

1.5% |

Revenue comparison, sector vs. division

|

|

|

Q1 2022 |

|

in millions of euros |

|

Health insurance, HR and e-services |

Healthcareprofessionals |

Corporateand others |

Total |

|

Software & services |

|

35.7 |

35.5 |

0.0 |

71.2 |

| Flow |

|

22.6 |

0.0 |

0.0 |

22.6 |

| Data &

Marketing |

|

22.5 |

0.0 |

0.0 |

22.5 |

| BPO |

|

12.3 |

0.0 |

0.0 |

12.3 |

| Corporate and

others |

|

0.0 |

0.0 |

0.7 |

0.7 |

|

Cegedim |

|

93.1 |

35.5 |

0.7 |

129.2 |

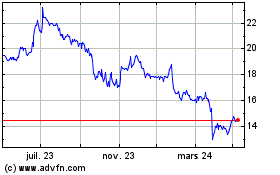

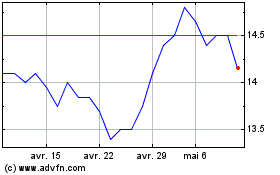

Cegedim (EU:CGM)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Cegedim (EU:CGM)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024