Cellectis Provides Business Update and Reports Financial

Results for First Quarter 2022

Cellectis (the “Company”) (Euronext Growth: ALCLS - NASDAQ: CLLS),

a clinical-stage biotechnology company using its pioneering

gene-editing platform to develop life-saving cell and gene

therapies, today provided a business update and announced its

results for the three-month period ending March 31, 2022.

“Cellectis made progress with our pipeline this

quarter. We took a notable step forward with the first pre-clinical

data on UCART20x22, the allogeneic dual CAR T-cell product

candidate being developed for patients with relapsed or refractory

non-Hodgkin’s lymphoma (NHL). We were proud to see that the data

demonstrated a robust pre-clinical proof-of-concept with strong

activity against tumor cell lines expressing either a single

antigen, CD20 or CD22, or both simultaneously.

We were proud to publish preclinical data in

Nature Communications, providing validation of our product

candidate UCART123, being developed for patients with relapsed or

refractory acute myeloid leukemia (AML). This is the first

preclinical data published on UCART123 supporting the rationale for

using allogeneic CD123-directed CAR T cells to treat AML and

blastic plasmacytoid denditric cell neoplasm (BPDCN). These

preclinical results reinforce our commitment to deliver therapies

for cancer patients with unmet medical needs.

The development of our partnerships was an

exciting highlight for Cellectis. In March, our partner Iovance

Biotherapeutics announced that the U.S. Food and Drug

Administration (FDA) allowed an Investigational New Drug

Application (IND) to proceed for its first TALEN®-edited Tumor

Infiltrating Lymphocytes (TIL) therapy, developed using Cellectis’

technology. In April, we received a $20 million convertible note,

representing the upfront collaboration consideration under our

collaboration agreement with Cytovia Therapeutics. Cellectis is

developing custom TALEN® for Cytovia to develop gene-edited

iPSC-derived Natural Killer cells. These announcements validated

our belief that TALEN®’s status as technology of choice for gene

editing.

Based on our current operating plan, our cash

position of $142 million at the end of the first quarter 2022

(excluding Calyxt, Inc.), is expected to fund our operations into

early 2024.

As we approach several developmental milestones

during the second half of this year, we are excited to expand our

CAR T platform by the expected filing of an IND for UCART20x22, and

release of batches of this product from our in-house manufacturing

facility. UCART20x22 is expected to be Cellectis’ first product

candidate with fully integrated in-house development,” said André

Choulika, CEO of Cellectis.

Pipeline highlights

Cellectis continues to make progress, enrolling

patients throughout its three sponsored Phase 1 dose escalation

trials:

BALLI-01 (evaluating UCART22) in relapsed or refractory

B-cell acute lymphoblastic leukemia (r/r B-ALL)

-

UCART22 is an allogeneic CAR T-cell product candidate targeting

CD22 and being evaluated in patients with r/r B-ALL in the

BALLI-01, multicenter, Phase 1 dose escalation clinical study.

-

BALLI-01 is currently enrolling patients at dose level 3 (DL3) with

Fludarabine, Cyclophosphamide and Alemtuzumab (FCA) preconditioning

regimen.

-

Cellectis plans to initiate dosing patients with UCART22 product

candidate that is expected to be fully manufactured in-house in the

second half of this year.

AMELI-01 (evaluating UCART123) in relapsed or refractory

acute myeloid leukemia (r/r AML)

- UCART123 is an

allogeneic CAR T-cell product candidate targeting CD123 and being

evaluated in patients with r/r AML in the AMELI-01, multi-center

Phase 1 dose-escalation clinical study.

- AMELI-01 is

currently enrolling patients at dose level 2 (DL2) (6.25 × 105

cells/kg) with FCA preconditioning regimen.

MELANI-01 (evaluating UCARTCS1) in relapsed or

refractory multiple myeloma (r/r MM)

- UCARTCS1 is an

allogeneic CAR T-cell product candidate targeting CS1 and is being

evaluated in patients with r/r MM in the MELANI-01, multi-center

Phase 1 dose-escalation clinical study.

- Cellectis is currently enrolling

patients at dose level 1 (DL1) with Fludarabine and

Cyclophosphamide (FC) preconditioning regimen.

UCART Preclinical Data and Programs

UCART123:

- On April 28, Cellectis published two

manuscripts in Nature Communications providing preclinical

validation of UCART123 to treat AML.

Preclinical data showed that:

- Cellectis’

product candidate UCART123 effectively eliminates AML cells in

vitro and in vivo in mouse models with significant benefits in

overall animal survival and minimal impact against normal

hematopoietic progenitors.

- UCART123

demonstrates cytotoxic activity against primary AML samples with

minimum toxicity against normal hematopoietic progenitor

cells.

- Support

Cellectis’ rationale of using allogeneic CD123 CAR T cells to treat

AML.

UCART20x22:

-

UCART20x22 is Cellectis’ first allogeneic dual CAR T-cell product

candidate being developed for patients with relapsed or refractory

non-Hodgkin lymphoma (r/r NHL).

-

On April 8, Cellectis released its first preclinical data at the

American Association for Cancer Research (AACR) Annual Meeting. The

poster presentation highlighted the following results:

- UCART20x22 shows strong activity

against tumor cell lines expressing either a single antigen, CD20

or CD22, or both simultaneously.

- In vivo pre-clinical models

demonstrates that UCART20x22 efficiently eradicates tumors

expressing both or either antigen, and sustained presence of

UCART20x22 cells was observed in the bone marrow after tumor

clearance.

- In vitro assays against primary

cells from NHL patients with diverse CD22 and CD20 antigen levels

demonstrate that UCART20x22 has potent and specific cytotoxic

activity.

-

UCART20x22 would be Cellectis’ first product candidate fully

designed, developed and manufactured in-house from day zero,

showcasing the Company’s transformation into an end-to-end cell and

gene therapy platform from discovery, product development and

manufacturing to clinical development.

-

An Investigational New Drug application (IND) for UCART20x22 is

expected to be filed this year.

Licensed Allogeneic CAR-T Cell Development

Programs

Allogene Therapeutics, Inc.’s CAR T programs

utilize Cellectis technologies. ALLO-501 and ALLO-501A are

anti-CD19 products being jointly developed under a collaboration

agreement between Les Laboratoires Servier (“Servier”) and Allogene

Therapeutics, Inc. (“Allogene”) based on an exclusive license

granted by Cellectis to Servier1. Servier grants to Allogene

exclusive rights to ALLO-501 and ALLO-501A in the U.S. while

Servier retains exclusive rights for all other countries.

Allogene’s anti-BCMA and anti-CD70 programs are licensed

exclusively from Cellectis by Allogene and Allogene holds global

development and commercial rights to these programs.

Servier and Allogene: anti-CD19 programs

- Enrollment in

the Phase 1 ALLO-501A ALPHA2 trial in relapsed/refractory (r/r)

Large B Cell Lymphoma (LBCL) has re-opened with the goal of

offering AlloCAR T™ to patients while Allogene prepares to launch

the pivotal Phase 2 ALPHA2 trial. Allogene has announced that

subject to FDA discussion, including with respect to chemistry,

manufacturing and controls (CMC), Allogene plans to proceed to the

Phase 2 portion of the ALPHA2 trial in adult patients with r/r LBCL

in mid-2022.

Allogene: anti-BCMA and anti-CD70

programs

Anti-BCMA program

- Allogene announced that enrollment

had previously resumed in trials targeting BCMA for the treatment

of patients with r/r multiple myeloma (MM), including the UNIVERSAL

trial with ALLO-715 and the IGNITE trial with TurboCAR™ candidate,

ALLO-605. During the quarter, preclinical data was published

by Allogene demonstrating the superior long-term in vitro

myeloma-killing activity of allogeneic anti-BCMA CAR T cells from

healthy donors compared with anti-BCMA CAR T cells from patients

with MM. The findings were published in Cancer Research

Communications, a journal of the American Association for Cancer

Research (AACR).

- In May 2022, Allogene announced

that U.S. Food and Drug Administration (FDA) has

granted Orphan Drug Designation (ODD) for ALLO-605 for the

treatment of MM. Allogene intends to provide an update on its

CD19 and BCMA programs by the end of the

year.

Anti-CD70 program

- ALLO-316 is Allogene’s first

AlloCAR T candidate for solid tumors. The Phase 1 TRAVERSE trial is

designed to evaluate the safety, tolerability, anti-tumor efficacy,

pharmacokinetics, and pharmacodynamics of ALLO-316 in patients with

advanced or metastatic clear cell renal cell carcinoma (RCC).

Allogene announced that the trial, now in its second dose level

cohort, continues to accrue patients.

- In April 2022, Allogene presented

preclinical data at the 2022 AACR Annual Meeting which support the

ongoing clinical evaluation of ALLO-316 for the treatment of

patients with RCC and other CD70 expressing cancers. The findings

were simultaneously published in AACR’s Cancer

Research.

- In March 2022, Allogene announced

that the FDA granted ALLO-316 Fast Track Designation (FTD) based on

its potential to address the unmet need for patients with difficult

to treat RCC who have failed standard RCC

therapies.

Manufacturing Facilities

-

Cellectis’ starting materials manufacturing facility in Paris,

France is focusing on the production of starting materials

including plasmids and mRNA for our TALEN® gene editing technology,

as well as viral vectors for use in clinical manufacturing.

-

Cellectis’ UCART GMP manufacturing facility in Raleigh, North

Carolina is focusing on release testing of batches of product

candidates UCART22 and UCART20x22 as well as manufacturing

additional batches of these products.

Partnerships:

Iovance Biotherapeutics, Inc. (“Iovance”)

- On March 15,

2022 Iovance announced that the FDA allowed an IND to proceed for

its first genetically modified TIL therapy, IOV-4001, for the

treatment of unresectable or metastatic melanoma and stage III or

IV NSCLC.

- IOV-4001

leverages the gene editing TALEN® technology licensed from

Cellectis to inactivate the gene coding for the PD-1 protein. By

removal of this important barrier for T cells to attack cancer,

IOV-4001 has the potential to become an optimized, next generation

TIL therapy for several solid tumor cancers. Iovance announced that

a clinical study of IOV-4001 in patients with metastatic melanoma

or stage III or IV NSCLC is expected to begin this year.

- A poster

highlighting preclinical activity, clinical-scale manufacturing

process development, and characterization of IOV-4001 was presented

by Iovance at the AACR 2022 Annual Meeting. In the abstract,

anti-tumor activity of IOV-4001 was shown to be superior to

non-edited TIL, as well as to non-edited TIL in combination with

anti-PD-1, in a murine model.

- In January 2020,

Iovance and Cellectis entered into a research collaboration and

exclusive worldwide license agreement whereby Iovance licensed

certain TALEN® technology from Cellectis. The worldwide exclusive

license enables Iovance to use certain TALEN® technology addressing

multiple gene targets to modify TIL for therapeutic use in several

cancer indications.

Cytovia Therapeutics, Inc.

(“Cytovia”)

- On April 27,

2022, Cellectis received a $20 million convertible note (the “2022

Convertible Note”) in payment of the upfront collaboration

consideration provided for pursuant to the research collaboration

and non-exclusive license agreement entered between Cellectis and

Cytovia in February 2021. The 2022 Convertible Note superseded and

replaced the equity compensation initial requirement under the

collaboration and license agreement with Cytovia.

- The terms of the

note provide for conversion into common stock of the combined

company upon completion of the business combination of Cytovia with

Iselworth Healthcare Acquisition Corp., a special purpose

acquisition company. In connection with this convertible note,

Cellectis received a warrant to purchase additional shares of the

combined company representing up to 35% of the shares issued upon

conversion of the note at a predetermined exercise price, with the

number of shares issuable upon exercise and the exercise subject to

certain adjustments.

- Cellectis is

developing custom TALEN®, which Cytovia uses to edit iPSCs. Cytovia

is responsible for the differentiation and expansion of the

gene-edited iPSC master cell bank into NK cells and is conducting

the pre-clinical evaluation, clinical development, and

commercialization of the mutually-agreed-upon selected therapeutic

candidates. Cellectis has granted Cytovia a worldwide license under

the patent rights over which Cellectis has control in this field,

including in China, in order for Cytovia to modify NK cells to

address multiple gene-targets for therapeutic use in several cancer

indications.

Financial Results

The interim condensed consolidated financial

statements of Cellectis, which consolidate the results of Calyxt,

Inc. of which Cellectis owned approximately 56.1% of outstanding

shares of common stock (as of March 31, 2022), have been prepared

in accordance with International Financial Reporting Standards, as

issued by the International Accounting Standards Board

(“IFRS”).

We present certain financial metrics broken out

between our two reportable segments – Therapeutics and Plants – in

the appendices of this Q1 2022 financial results press release.

Cash: As of March 31, 2022,

Cellectis, including Calyxt, had $160 million in consolidated cash,

cash equivalents, current financial assets and restricted cash of

which $142 million are attributable to Cellectis on a stand-alone

basis. This compares to $191 million in consolidated cash, cash

equivalents, current financial assets and restricted cash as of

December 31, 2021, of which $177 million was attributable to

Cellectis on a stand-alone basis. This net decrease of $31 million

primarily reflects (i) $33 million of net cash flows used in

operating, investing and lease financing activities of Cellectis,

(ii) $7 million of net cash flows used in operating, capital

expenditures and lease financing activities of Calyxt and (iii) $2

millions of unfavorable FOREX impact which was partially offset by

(iv) $10 million of net proceeds from capital raise at Calyxt.

Based on the current operating plan, Cellectis excluding Calyxt

anticipates that the cash, cash equivalents, and restricted cash of

$142 million as of March 31, 2022 will fund its operations into

early 2024.

Revenues and Other Income:

Consolidated revenues and other income were $4 million for the

three months ended March 31, 2022 compared to $28 million for the

three months ended March 31, 2021. 99% of consolidated revenues and

other income was attributable to Cellectis in the first three

months of 2022. This decrease between the three months ended March

31, 2022 and 2021 was mainly attributable to (i) a decrease of

revenue pursuant to the recognition of a $15.0 million convertible

note obtained as consideration for a “right-to-use” license granted

to Cytovia and a $5.0 million Allogene milestone during the

three-month period ended March 31, 2021, while revenue related to

collaboration agreements for the three months of 2022 consists of

the recognition of two milestones related to Cellectis’ agreement

with Cytovia for $1.5 million and (ii) a decrease in other revenues

of $5 million relating to the timing of revenue stream from the

Calyxt’s business model for its PlantSpring technology and

BioFactory compared to the Calyxt’s sales in the prior year of

soybean products.

Cost of Revenues: Consolidated

cost of revenues were $0.4 million for the three months ended March

31, 2022 compared to $8 million for the three months ended March

31, 2021. This decrease is driven by Calyxt’s business model for

its PlantSpring and BioFactory compared to the sales of soybean

products under its prior business model.

R&D Expenses: Consolidated

R&D expenses were $29 million for the three months ended March

31, 2022 compared to $31 million for the three months ended March

31, 2021. 90% of consolidated R&D expenses was attributable to

Cellectis in the first three months of 2022. The $2 million

decrease between the first three months of 2022 and 2021 was

primarily attributable to (i) a decrease of purchases, external

expenses and other by $2 million (from $18 million in 2021 to $16

million in 2022) due to lower consumables, subcontracting costs and

depreciation and amortization for the therapeutic segment, and (ii)

a $1 million decrease in social charges on stock option partially

offset by an increase of $2 million in wages and salaries mainly

driven by the increased R&D headcount in the therapeutic

segment.

SG&A Expenses: Consolidated

SG&A expenses were $9 million for the three months ended March

31, 2022 and 2021. 65% of consolidated SG&A expenses was

attributable to Cellectis in the first three months of 2022. The

$0.5 million increase primarily reflects a $1 million increase in

purchases, external expenses and other (from $4 million in 2021 to

$5 million in 2022) and (ii) a $3 million increase in non-cash

stock-based compensation expense mainly explained by the favorable

impact in 2021 of the recapture of non-cash stock-based

compensation from the forfeiture of certain of Calyxt’s former

CEO’s unvested stock options, restricted stock units, and

performance stock units following his departure, partially offset

by (i) a $3 million decrease in wages and salaries and (ii) a $0.3

million decrease in social charges on stock option grants.

Net Income (loss) Attributable to

Shareholders of Cellectis: The consolidated net loss

attributable to shareholders of Cellectis was $32 million (or $0.70

per share) for the three months ended March 31, 2022, of which $28

million was attributed to Cellectis, compared to $12 million (or

$0.28 per share) for the three months ended March 31, 2021, of

which $6 million was attributed to Cellectis. This $20 million

increase in net loss between first three months 2022 and 2021 was

primarily driven by a decrease in revenues and other income of $24

million, a decrease in financial gain of $4 million and a decrease

of $1 million in non-controlling interest, partially offset by a $9

million decrease in operating expenses.

Adjusted Net Income (Loss) Attributable

to Shareholders of Cellectis: The consolidated adjusted

net loss attributable to shareholders of Cellectis was $29 million

(or $0.64 per share) for the three months ended March 31, 2022, of

which $26 million is attributed to Cellectis, compared to a net

loss of $11 million (or $0.26 per share) for the three months ended

March 31, 2021, of which $4 million was attributed to Cellectis.

Please see "Note Regarding Use of Non-GAAP Financial Measures" for

reconciliation of GAAP net income (loss) attributable to

shareholders of Cellectis to adjusted net income (loss)

attributable to shareholders of Cellectis.

We currently foresee focusing our cash spending

at Cellectis for the Full Year of 2022 in the following areas:

- Supporting the development of our

pipeline of product candidates, including the manufacturing and

clinical trial expenses of UCART123, UCART22, UCARTCS1 and new

product candidates, and

- Operating our state-of-the-art

manufacturing capabilities in Paris (France), and Raleigh (North

Carolina, U.S.A); and

- Continuing strengthening our

manufacturing and clinical departments.

CELLECTIS S.A.

(unaudited)

STATEMENT OF CONSOLIDATED FINANCIAL

POSITION

($ in thousands, except per share

data)

| |

|

As of |

| |

|

December 31, 2021 |

|

March 31, 2022 |

| |

|

|

|

|

| |

|

|

|

|

|

ASSETS |

|

|

|

|

| Non-current

assets |

|

|

|

|

|

Intangible assets |

|

1 854 |

|

|

1 698 |

|

| Property, plant, and

equipment |

|

78 846 |

|

|

76 523 |

|

| Right-of-use assets |

|

69 423 |

|

|

67 227 |

|

| Non-current financial

assets |

|

6 524 |

|

|

6 567 |

|

| Total non-current

assets |

|

156 647 |

|

|

152 016 |

|

| |

|

|

|

|

| Current

assets |

|

|

|

|

| Trade receivables |

|

20 361 |

|

|

21 839 |

|

| Subsidies receivables |

|

9 268 |

|

|

10 446 |

|

| Other current assets |

|

9 665 |

|

|

7 524 |

|

| Cash and cash equivalent and

Current financial assets |

|

186 135 |

|

|

155 367 |

|

| Total current

assets |

|

225 429 |

|

|

195 175 |

|

| TOTAL

ASSETS |

|

382 076 |

|

|

347 191 |

|

| |

|

|

|

|

|

LIABILITIES |

|

|

|

|

| Shareholders’

equity |

|

|

|

|

| Share capital |

|

2 945 |

|

|

2 945 |

|

| Premiums related to the share

capital |

|

934 696 |

|

|

937 333 |

|

| Currency translation

adjustment |

|

(18 021 |

) |

|

(21 261 |

) |

| Retained earnings |

|

(584 129 |

) |

|

(696 062 |

) |

| Net income (loss) |

|

(114 197 |

) |

|

(31 911 |

) |

| Total shareholders’

equity - Group Share |

|

221 293 |

|

|

191 044 |

|

| Non-controlling interests |

|

15 181 |

|

|

12 010 |

|

| Total shareholders’

equity |

|

236 474 |

|

|

203 054 |

|

| |

|

|

|

|

| Non-current

liabilities |

|

|

|

|

| Non-current financial

liabilities |

|

20 030 |

|

|

18 345 |

|

| Non-current lease debts |

|

71 526 |

|

|

69 739 |

|

| Non-current provisions |

|

4 073 |

|

|

3 716 |

|

| Non-current liabilities |

|

626 |

|

|

- |

|

| Total non-current

liabilities |

|

96 254 |

|

|

91 800 |

|

| |

|

|

|

|

| Current

liabilities |

|

|

|

|

| Current financial

liabilities |

|

2 354 |

|

|

12 607 |

|

| Current lease debts |

|

8 329 |

|

|

8 408 |

|

| Trade payables |

|

23 762 |

|

|

20 921 |

|

| Deferred revenues and deferred

income |

|

301 |

|

|

581 |

|

| Current provisions |

|

871 |

|

|

578 |

|

| Other current liabilities |

|

13 731 |

|

|

9 242 |

|

| Total current

liabilities |

|

49 348 |

|

|

52 337 |

|

| TOTAL LIABILITIES AND

SHAREHOLDERS’ EQUITY |

|

382 076 |

|

|

347 191 |

|

Cellectis S.A.

UNAUDITED STATEMENTS OF CONSOLIDATED

OPERATIONS

For the three-month period ended March

31,

$ in thousands, except per share

amounts

| |

|

For the three-month period ended March 31, |

|

|

|

2021 |

|

|

2022 |

|

| |

|

|

|

| Revenues and other

income |

|

|

|

|

| Revenues |

|

25 601 |

|

|

1 697 |

|

| Other income |

|

2 365 |

|

|

2 135 |

|

| Total revenues and

other income |

|

27 966 |

|

|

3 832 |

|

| Operating

expenses |

|

|

|

|

| Cost of revenue |

|

(8 145 |

) |

|

(385 |

) |

| Research and development

expenses |

|

(31 004 |

) |

|

(29 479 |

) |

| Selling, general and

administrative expenses |

|

(8 779 |

) |

|

(9 279 |

) |

| Other operating income

(expenses) |

|

56 |

|

|

65 |

|

| Total operating

expenses |

|

(47 872 |

) |

|

(39 078 |

) |

| |

|

|

|

|

| Operating income

(loss) |

|

(19 907 |

) |

|

(35 247 |

) |

| |

|

|

|

|

| Financial gain

(loss) |

|

4 561 |

|

|

490 |

|

| |

|

|

|

|

| Net income

(loss) |

|

(15 346 |

) |

|

(34 757 |

) |

|

Attributable to shareholders of Cellectis |

|

(11 868 |

) |

|

(31 911 |

) |

|

Attributable to non-controlling interests |

|

(3 478 |

) |

|

(2 846 |

) |

| Basic net income

(loss) attributable to shareholders of Cellectis per share

($/share) |

|

(0,28 |

) |

|

(0,70 |

) |

| |

|

|

|

|

| Diluted net income

(loss) attributable to shareholders of Cellectis per share

($/share) |

|

(0,28 |

) |

|

(0,70 |

) |

CELLECTIS S.A.

DETAILS OF KEY PERFORMANCE INDICATORS BY

REPORTABLE SEGMENTS – First

three-months

(unaudited) - ($ in

thousands)

| |

|

For the three-month period ended March 31,

2021 |

|

For the three-month period ended March 31,

2022 |

| $ in

thousands |

|

Plants |

Therapeutics |

Total reportable segments |

|

Plants |

Therapeutics |

Total reportable segments |

| |

|

|

|

|

|

|

|

|

|

External revenues |

|

4 988 |

|

20 613 |

|

25 601 |

|

|

32 |

|

1 665 |

|

1 697 |

|

| External other income |

|

- |

|

2 365 |

|

2 365 |

|

|

- |

|

2 135 |

|

2 135 |

|

| External revenues and

other income |

|

4 988 |

|

22 978 |

|

27 966 |

|

|

32 |

|

3 800 |

|

3 832 |

|

| Cost of revenue |

|

(7 369 |

) |

(776 |

) |

(8 145 |

) |

|

(0 |

) |

(385 |

) |

(385 |

) |

| Research and development

expenses |

|

(3 025 |

) |

(27 979 |

) |

(31 004 |

) |

|

(2 878 |

) |

(26 601 |

) |

(29 479 |

) |

| Selling, general and

administrative expenses |

|

(4 118 |

) |

(4 660 |

) |

(8 779 |

) |

|

(3 216 |

) |

(6 063 |

) |

(9 279 |

) |

| Other operating income and

expenses |

|

(24 |

) |

80 |

|

56 |

|

|

43 |

|

21 |

|

65 |

|

| Total operating

expenses |

|

(14 536 |

) |

(33 336 |

) |

(47 872 |

) |

|

(6 050 |

) |

(33 028 |

) |

(39 078 |

) |

| Operating income

(loss) before tax |

|

(9 548 |

) |

(10 358 |

) |

(19 907 |

) |

|

(6 019 |

) |

(29 228 |

) |

(35 247 |

) |

| Net financial gain (loss) |

|

(290 |

) |

4 851 |

|

4 561 |

|

|

(422 |

) |

912 |

|

490 |

|

| Net income

(loss) |

|

(9 839 |

) |

(5 507 |

) |

(15 346 |

) |

|

(6 441 |

) |

(28 316 |

) |

(34 757 |

) |

| Non-controlling interests |

|

3 478 |

|

- |

|

3 478 |

|

|

2 846 |

|

- |

|

2 846 |

|

| Net income (loss)

attributable to shareholders of Cellectis |

|

(6 361 |

) |

(5 507 |

) |

(11 868 |

) |

|

(3 595 |

) |

(28 316 |

) |

(31 911 |

) |

| R&D non-cash stock-based

expense attributable to shareholder of Cellectis |

|

262 |

|

1 305 |

|

1 567 |

|

|

(11 |

) |

1 680 |

|

1 669 |

|

| SG&A non-cash stock-based

expense attributable to shareholder of Cellectis |

|

(1 295 |

) |

323 |

|

(973 |

) |

|

342 |

|

636 |

|

979 |

|

| Adjustment of

share-based compensation attributable to shareholders of

Cellectis |

|

(1 033 |

) |

1 628 |

|

595 |

|

|

332 |

|

2 316 |

|

2 648 |

|

| Adjusted net income

(loss) attributable to shareholders of Cellectis |

|

(7 394 |

) |

(3 879 |

) |

(11 273 |

) |

|

(3 263 |

) |

(26 000 |

) |

(29 263 |

) |

| Depreciation and

amortization |

|

(604 |

) |

(3 186 |

) |

(3 791 |

) |

|

(708 |

) |

(4 934 |

) |

(5 641 |

) |

| Additions to tangible and

intangible assets |

|

268 |

|

6 332 |

|

6 601 |

|

|

363 |

|

581 |

|

945 |

|

Note Regarding Use of Non-IFRS Financial

Measures

Cellectis S.A. presents adjusted net income

(loss) attributable to shareholders of Cellectis in this press

release. Adjusted net income (loss) attributable to shareholders of

Cellectis is not a measure calculated in accordance with IFRS. We

have included in this press release a reconciliation of this figure

to net income (loss) attributable to shareholders of Cellectis,

which is the most directly comparable financial measure calculated

in accordance with IFRS. Because adjusted net income (loss)

attributable to shareholders of Cellectis excludes Non-cash

stock-based compensation expense—a non-cash expense, we believe

that this financial measure, when considered together with our IFRS

financial statements, can enhance an overall understanding of

Cellectis’ financial performance. Moreover, our management views

the Company’s operations, and manages its business, based, in part,

on this financial measure. In particular, we believe that the

elimination of Non-cash stock-based expenses from Net income (loss)

attributable to shareholders of Cellectis can provide a useful

measure for period-to-period comparisons of our core businesses.

Our use of adjusted net income (loss) attributable to shareholders

of Cellectis has limitations as an analytical tool, and you should

not consider it in isolation or as a substitute for analysis of our

financial results as reported under IFRS. Some of these limitations

are: (a) other companies, including companies in our industry which

use similar stock-based compensation, may address the impact of

Non-cash stock- based compensation expense differently; and (b)

other companies may report adjusted net income (loss) attributable

to shareholders or similarly titled measures but calculate them

differently, which reduces their usefulness as a comparative

measure. Because of these and other limitations, you should

consider adjusted net income (loss) attributable to shareholders of

Cellectis alongside our IFRS financial results, including Net

income (loss) attributable to shareholders of Cellectis.

RECONCILIATION OF IFRS TO NON-IFRS NET

INCOME – First three-months

(unaudited)

($ in thousands, except per share

data)

| |

|

For the three-month period ended March 31, |

|

|

|

2021 |

|

|

2022 |

|

| |

|

|

|

| Net income (loss)

attributable to shareholders of Cellectis |

|

(11 868 |

) |

|

(31 911 |

) |

| Adjustment:

Non-cash stock-based

compensation expense attributable to shareholders of Cellectis |

|

595 |

|

|

2 648 |

|

| Adjusted net income

(loss) attributable to shareholders of Cellectis |

|

(11 273 |

) |

|

(29 263 |

) |

| |

|

|

|

|

| Basic Adjusted net

income (loss) attributable to shareholders of Cellectis

($/share) |

|

(0,26 |

) |

|

(0,64 |

) |

| |

|

|

|

|

| Weighted average

number of outstanding shares, basic (units) (1) |

|

42 866 517 |

|

|

45 486 477 |

|

| |

|

|

|

|

| Diluted Adjusted net

income (loss) attributable to shareholders of Cellectis ($/share)

(1) |

|

(0,26 |

) |

|

(0,64 |

) |

| |

|

|

|

|

| Weighted average

number of outstanding shares, diluted (units) (1) |

|

43 461 047 |

|

|

45 486 477 |

|

(1) When we have adjusted net loss, in

accordance with IFRS, we use the Weighted average number of

outstanding shares, basic to compute the Diluted adjusted net

income (loss) attributable to shareholders of Cellectis ($/share).

When we have adjusted net income, in accordance with IFRS, we use

the Weighted average number of outstanding shares, diluted to

compute the Diluted adjusted net income (loss) attributable to

shareholders of Cellectis ($/share)

About Cellectis Cellectis

is a clinical-stage biotechnology company using its pioneering

gene-editing platform to develop life-saving cell and gene

therapies. Cellectis utilizes an allogeneic approach for CAR-T

immunotherapies in oncology, pioneering the concept of

off-the-shelf and ready-to-use gene-edited CAR T-cells to treat

cancer patients, and a platform to make therapeutic gene editing in

hemopoietic stem cells for various diseases. As a clinical-stage

biopharmaceutical company with over 22 years of expertise in gene

editing, Cellectis is developing life-changing product candidates

utilizing TALEN®, its gene editing technology, and PulseAgile,

its pioneering electroporation system to harness the power of the

immune system in order to treat diseases with unmet

medical needs.

As part of its commitment to a cure, Cellectis

remains dedicated to its goal of providing lifesaving UCART product

candidates for multiple cancers including acute myeloid leukemia

(AML), B-cell acute lymphoblastic leukemia (B-ALL) and multiple

myeloma (MM). .HEAL is a new platform focusing on

hemopoietic stem cells to treat blood disorders, immunodeficiencies

and lysosomal storage diseases.

Cellectis’ headquarters are in Paris, France,

with locations in New York, New York and Raleigh, North Carolina.

Cellectis is listed on the Nasdaq Global Market (ticker: CLLS) and

on Euronext Growth (ticker: ALCLS).

AlloCAR T™ is a trademark of Allogene

Therapeutics, Inc.

For more information,

visit www.cellectis.com Follow

Cellectis on social media: @cellectis, LinkedIn and YouTube.

For further information, please

contact:

Media contacts: Pascalyne

Wilson, Director, Communications, +33776991433,

media@cellectis.com

Margaret Gandolfo, Senior Manager, Communications, +1 (646) 628

0300

Investor Relation contact: Arthur Stril,

Chief Business Officer, +1 (347) 809 5980,

investors@cellectis.com

Ashley R. Robinson, LifeSci Advisors, +1 (617) 430 7577

Forward-looking

Statements

This press release contains “forward-looking”

statements within the meaning of applicable securities laws,

including the Private Securities Litigation Reform Act of 1995.

Forward-looking statements may be identified by words such as

“anticipate,” “believe,” “intend”, “expect,” “plan,” “scheduled,”

“could,” “would” and “will,” or the negative of these and similar

expressions. These forward-looking statements, which are based on

our management’s current expectations and assumptions and on

information currently available to management, including

information provided or otherwise publicly reported by our licensed

partners. Forward-looking statements include statements

about advancement, timing and progress of clinical trials

(including with respect to patient enrollment and follow-up), the

timing of our presentation of data and submission of regulatory

filings, the operational capabilities at our manufacturing

facilities, the potential of our preclinical programs, and

the sufficiency of cash to fund operations. These

forward-looking statements are made in light of information

currently available to us and are subject to numerous risks and

uncertainties, including with respect to the numerous risks

associated with biopharmaceutical product candidate development as

well as the duration and severity of the COVID-19 pandemic and

governmental and regulatory measures implemented in response to the

evolving situation. With respect to our cash runway, our operating

plans, including product development plans, may change as a result

of various factors, including factors currently unknown to us.

Furthermore, many other important factors, including those

described in our Annual Report on Form 20-F and the financial

report (including the management report) for the year ended

December 31, 2021 and subsequent filings Cellectis makes with the

Securities Exchange Commission from time to time, as well as other

known and unknown risks and uncertainties may adversely affect such

forward-looking statements and cause our actual results,

performance or achievements to be materially different from those

expressed or implied by the forward-looking statements. Except as

required by law, we assume no obligation to update these

forward-looking statements publicly, or to update the reasons why

actual results could differ materially from those anticipated in

the forward-looking statements, even if new information becomes

available in the future.

1 Servier is a global independent pharmaceutical group

- 20220512-Q1_2022_EARNINGS _FINAL.pdf

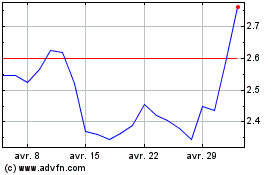

Cellectis Nom Eo 05 (EU:ALCLS)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Cellectis Nom Eo 05 (EU:ALCLS)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024