- 1st

HALF 2022 DASSAULT AVIATION GROUP

RESULTS

|

|

H1 2022 |

H1 2021 |

|

Order intake(new aircraft in units) |

€ 16,290 M80 Rafale UAE6 Rafale

Greece41 Falcon |

€ 3,913 M6 Rafale Greece12 Rafale France25 Falcon |

|

Adjusted net sales (*) |

€ 3,098 M7 Rafale Export14 Falcon |

€ 3,107 M13 Rafale Export6 Falcon |

|

|

|

|

|

|

as of June 30,

2022 |

as of December 31, 2021 |

|

Backlog(new aircraft in units) |

€ 34,085 M165

Rafaleof which 125 Rafale Export40 Rafale France82

Falcon |

€ 20,762 M86 Rafaleof which 46 Rafale Export40 Rafale France55

Falcon |

|

|

|

|

|

|

H1 2022 |

H1 2021 |

|

Adjusted operating income (*)Adjusted operating margin |

€ 200 M6.5% of net sales |

€ 175 M5.6% of net sales |

|

Research & Development |

€ 278 M9.0% of net sales |

€ 250 M8.0% of net sales |

|

Adjusted net income (*)Adjusted net margin |

€ 318 M10.3% of net sales |

€ 265 M8.5% of net sales |

|

|

|

|

|

|

as of June 30,

2022 |

as of December 31, 2021 |

|

Available cash |

€ 6,276 M |

€ 4,879 M |

Note: Dassault Aviation recognizes Rafale Export

contracts in their entirety (including the Thales and Safran

parts).

Main aggregates under IFRS in EUR million (see

table of reconciliation below)

|

(*) Consolidated net sales |

3,107 |

3,106 |

|

(*) Consolidated operating income |

218 |

177 |

|

(*) Consolidated net income |

272 |

212 |

Saint-Cloud,

July 20th, 2022

- The Board of Directors, which met today, under the chairmanship

of Mr. Éric Trappier, approved the 2022 half year financial

statements. The Statutory Auditors have performed a limited review

of these consolidated financial statements and have expressed an

unqualified opinion.

“First half 2022 saw a

record-breaking order intake amounting EUR 16.3 billion (86 Rafale

and 41 Falcon) amid supply chain difficulties and a tight and

competitive job market, result of the war in Ukraine and the

persistence of the Covid 19 epidemic.

Regarding the Ukraine-Russia conflict, sanctions

adopted by the European Union and the United States are strictly

enforced by the Company (especially the ban on commercial

transactions and the restriction on financial transactions with

sanctioned persons or entities). A dedicated crisis unit has been

set up. Our locations in Russia, our Moscow office and DFS service

center subsidiary have stopped all commercial activities. Some

contracts were cancelled, in addition, the sanctions have had a

particular impact on the service station business in Europe,

especially TMS.

The Company remains also constrained by the

effects of the Covid 19 pandemic: although the main health measures

were able to be lifted in March 2022, vigilance is still

needed.

The impact of these two major crises has led to

uncertainty over the supply of energy, electronic components and

materials. This has stoked an increase in inflation due to actual

or potential shortages and weakened the supply chain, now an even

acute risk given the increase in our production rate.

In recent weeks, France has held both

presidential and legislative elections. The French President has

talked about the country entering a war economy. The latter will be

further explored by the French Armed Forces Ministry. For Dassault

Aviation, the priority is to be on the side of the French armed

forces to support our Aircraft in service in Air and Naval

forces.

In the military sector, the year began with the

sale to Greece of 6 additional new Rafale. The first down payment

under the contract for 80 Rafale for the United Arab Emirates was

received in April 2022, with this order entering the backlog as a

result. The Rafale order intake for the first half is therefore 86

units. The Rafale backlog is 165 units.

Indonesia signed a contract for 42 Rafale

(6+36). The contract will enter into force upon receipt of the

first down payment and therefore it is not included in the backlog

as of June 30, 2022.

During the six-month period, we delivered 7

Rafale Export and provided support to the French and export fleets.

We also continued the development work on the F4 Standard and the

negotiations and business development for the Rafale.

For the FCAS, of which Dassault Aviation is lead

contractor for the New Generation Fighter demonstrator, work on

phase 1A was completed in the 1st half of 2022.

The next phase of the work, phase 1B, was not

awarded to the parties in the absence of an agreement with Airbus

Defence and Space. Dassault Aviation is prime contractor for pillar

1. The prime contractor/main partner relationship is still to be

clarified. Dassault Aviation is seeking a clear statement of

acceptance of its role as prime contractor by Airbus Defence and

Space for the NGF (in symmetry with Eurodrone).

Work has begun on the Eurodrone contract.

Dassault Aviation is responsible in particular for flight control

systems and mission communications, as a subcontractor of Airbus

Defence and Space.

Regarding the Falcon mission aircraft,

development work is continuing on the Archange and Albatros

programs. Our business development efforts resulted in order intake

for 4 Falcon 2000LXS for the South Korean Air Force.

In the civil sector, the Falcon market was

buoyant during the 1st half of 2022.

We delivered 14 Falcon and booked 41 new Falcon

orders in the 1st half of 2022, vs. 6 deliveries and 25 orders in

the 1st half of 2021.

Development efforts on the Falcon 6X and 10X are

continuing:

-

as expected, the Falcon 6X program completed all the technical

stages for its entry into service mid-2023.

- the first

primary parts have been manufactured for the Falcon 10X. A

full-scale mock-up of this aircraft was unveiled at EBACE. Its

entry into service is scheduled for late 2025. the calendar is

tight because of difficulties related to Covid, with its impact on

the supply chain and collaborative work.

Our 2022 guidance remains unchanged: delivery of

13 Rafale and 35 Falcon; decrease in net sales compared with last

year.”

Éric Trappier,Chairman and Chief Executive

Officer of Dassault Aviation

- 1ST

HALF 2022 ADJUSTED CONSOLIDATED RESULTS

(see reconciliation table in appendix)

1.1 Order

INtake

Order intake for the 1st half

of 2022 was EUR 16,290 million,

vs. EUR 3,913 million in the 1st half of 2021.

Export order intake stood at

97%.

Order intake was as follows, in

EUR million:

|

|

H1 2022 |

% |

H1 2021 |

% |

|

Defense |

14,318 |

88% |

2,500 |

64% |

|

Defense Export |

13,897 |

|

1,907 |

|

|

Defense France |

421 |

|

593 |

|

|

|

|

|

|

|

|

Falcon |

1,972 |

12% |

1,413 |

36% |

|

|

|

|

|

|

|

Total order

intake |

16,290 |

|

3,913 |

|

|

% Export |

97% |

|

82% |

|

The order intake is entirely composed of firm

orders.

Defense programs

During the 1st half of 2022, 86 Rafale

Export were booked.

Defense Export order intake

totaled EUR 13,897 million in the

1st half of 2022, vs. EUR 1,907 million in the 1st half of 2021.

Order intake for the 1st half of 2022 notably includes 80 Rafale

for the UAE (contract signed in 2021, receipt of the first down

payment in the 1st half of 2022), as well as the additional order

for 6 new Rafale for Greece.

Defense France order intake

stood at EUR 421 million in the 1st half of 2022,

compared with EUR 593 million in the 1st half of 2021, when the

order intake included 12 Rafale.

Falcon programs

During the 1st half of 2022, 41 Falcon

orders (net of cancelled Russian aircraft) were received,

compared with 25 in the 1st half of 2021. This explains the

increase in Falcon order intake

to EUR 1,972 million in the

1st half of 2022, vs. EUR 1,413 million in the 1st half of

2021.

1.2 Adjusted

net sales

Adjusted net sales for the 1st

half of 2022 totaled EUR 3,098 million,

compared with EUR 3,107 million for the 1st half of 2021.

Export net sales stood at 77% in

the 1st half of 2022.

Consolidated sales were as follows, in

EUR million:

|

|

H1 2022 |

% |

H1 2021 |

% |

|

Defense |

2,137 |

69% |

2,405 |

77% |

|

Defense Export |

1,452 |

|

2,061 |

|

|

Defense France |

685 |

|

344 |

|

|

|

|

|

|

|

|

Falcon |

961 |

31% |

702 |

23% |

|

|

|

|

|

|

|

Total adjusted net

sales |

3,098 |

|

3,107 |

|

|

% Export |

77% |

|

87% |

|

Defense programs

7 Rafale

Export were delivered during the 1st half of 2022,

compared with 13 Rafale Export for the 1st half of 2021.

This led to a fall in Defense

Export net sales, which totaled EUR 1,452

million in the 1st half of 2022, vs. EUR 2,061

million in the 1st half of 2021.

Net sales for Defense France

stood at EUR 685 million in the

1st half of 2022, compared with EUR 344 million in the 1st half of

2021. The increase is largely due to the delivery of the standard

for the mid-life upgrade of the Mirage 2000.

Falcon programs

14 Falcon were delivered

in the 1st half of 2022, compared with 6 in the 1st half of

2021.

Falcon net sales for the 1st

half of 2022 amounted to

EUR 961 million, vs.

EUR 702 million for the 1st half of 2021. The increase is

primarily due to the number of Falcon delivered (14 vs. 6).

****

The “book-to-bill ratio” (order intake/net

sales) is 5.3 for the first half of 2022.

1.3 Backlog

The consolidated

backlog as of June 30, 2022 (determined in accordance with

IFRS 15) was EUR 34,085 million, vs. EUR

20,762 million as of December 31, 2021. The sharp increase is due

to the high level of order intake in the 1st half of 2022. The

backlog trend is as follows:

|

|

06/30/2022 |

|

12/31/2021 |

|

|

Defense |

29,814 |

87% |

17,633 |

85% |

|

Defense Export |

22,319 |

|

9,874 |

|

|

Defense France |

7,495 |

|

7,759 |

|

|

|

|

|

|

|

|

Falcon |

4,271 |

13% |

3,129 |

15% |

|

|

|

|

|

|

|

Total backlog |

34,085 |

|

20,762 |

|

|

% Export |

75% |

|

58% |

|

-

the Defense Export backlog stood at EUR

22,319 million as of June 30, 2022, vs.

EUR 9,874 million as of December 31, 2021. This figure notably

includes 125 new Rafale and 6 pre-owned Rafale, compared with 46

new Rafale and 6 pre-owned Rafale as of December 31, 2021,

-

the Defense France backlog stood at EUR

7,495 million as of June 30, 2022, vs.

EUR 7,759 million as of December 31, 2021. This figure includes 40

Rafale, the support contracts for the Rafale (Ravel), Mirage 2000

(Balzac) and ATL2 (Ocean), and the Rafale F4 standard,

-

the Falcon backlog stood at EUR

4,271 million as of June 30, 2022, vs.

EUR 3,129 million as of December 31, 2021. It includes 82 Falcon,

compared with 55 as of December 31, 2021.

1.4 Adjusted

results

Adjusted operating income

Adjusted operating income for

the 1st half of

2022 came to EUR 200 million,

compared with EUR 175 million in the 1st half of

2021.

R&D expenses in the 1st half of 2022 totaled

EUR 278 million, equivalent to 9.0% of net sales,

compared with EUR 250 million and 8.0% of net sales in

the 1st half of 2021. These figures reflect the self-funded R&D

effort focused on the Falcon 6X and Falcon 10X programs.

Operating margin was

6.5%, as against 5.6% in the 1st half of 2021, up

despite the increase in R&D expenses.

The hedging rate for the 1st half of 2022 was

$1.19/€, as in the 1st half of 2021.

Adjusted net financial income/expense

Adjusted financial income for

the 1st half of

2022 was EUR -13

million, vs. EUR -11 million for the

same period in the previous year. This financial loss was due to

accounting principle of the long-term military contracts’ financing

component.

Adjusted net income

Adjusted net income for the

1st half of 2022

was EUR 318 million, compared with EUR 265 million

in the 1st half of 2021. The contribution of Thales to the Group’s

net income was EUR 180 million, compared with

EUR 146 million during the 1st half of 2021.

Adjusted net margin thus stood

at 10.3% for the 1st half of 2022, vs. 8.5% for

the 1st half of 2021.

Adjusted net income per share for 1st half 2022

was EUR 3.82 versus EUR 3.19* for 1st half 2021.

*2021 proforma following the stock split.

- 1ST

HALF 2022 CONSOLIDATED RESULTS UNDER IFRS

1.5 Consolidated

operating income (IFRS)

Consolidated operating income

for the 1st half of 2022 came to

EUR 218 million, compared with

EUR 177 million in the 1st half of 2021.

R&D expenses amounted to EUR 278 million in

the 1st half of 2022 and accounted for 9.0% of consolidated net

sales, vs. EUR 250 million and 8.0% of consolidated net sales in

the 1st half of 2021.

Consolidated operating margin

was 7.0%, compared with 5.7% in the 1st half of

2021, up despite the increase in R&D expenses.

1.6 Consolidated

net financial income/expense (IFRS)

Consolidated net financial

expense for the 1st half of 2022 came to EUR

-37 million, vs. EUR -31 million in the

1st half of 2021. This negative financial result is due to the

recognition of the financing component under long-term military

contracts and the fall in market value of hedging instruments which

do not qualify for hedge accounting under IFRS. The market value of

these instruments, purchased because of the efficient economic

hedge they offer the Group, were adversely impacted by movements in

the US dollar rate in the 1st half ($1.0387/€ at June 30, 2022,

versus $1.1326/€ at December 31, 2021).

1.7 Consolidated

net income/expense (IFRS)

Consolidated net income for the

1st half of 2022 was EUR 272 million, compared

with EUR 212 million in the 1st half of 2021. The contribution of

Thales to the Group’s net income was EUR 139 million,

compared with EUR 105 million during the 1st half of

2021.

Consolidated net margin thus

stood at 8.7% for the 1st half of 2022, vs. 6.8%

for the 1st half of 2021.

Consolidated net income per share for the 1st

half of 2022 was EUR 3.36, vs. EUR 2.55* for the 1st half of

2021.

* 2021 proforma following the stock split.

- FINANCIAL

STRUCTURE

1.1 Available

cash

The Group uses a specific indicator called

“Available cash”, which reflects the amount of total liquidities

available to the Group, net of financial debts. It includes the

following balance sheet items: cash and cash equivalents, current

financial assets (at market value) and financial debt, excluding

lease liabilities. The calculation of this indicator is detailed in

the consolidated financial statements (Note 7 of the interim

condensed consolidated financial statements).

The Group’s available cash

stands at

EUR 6,276 million as of

June 30, 2022, vs. EUR 4,879 million as of December 31,

2021. This increase is mainly due to the receipt of the first down

payment under the contract for 80 Rafale for the UAE and the

dynamism of the Falcon business. It is partially offset by the

increase in inventories and work-in-progress. Investments and

dividends paid during the period are offset by the operating

cashflow generated during the 1st half of 2022.

1.8 Balance

sheet (IFRS)

Total equity stood at EUR 5,737

million as of June 30, 2022, vs. EUR 5,300 million as of

December 31, 2021.

Borrowings and financial debt amounted to

EUR 227 million as of June 30, 2022, compared with

EUR 226 million as of December 31, 2021. Borrowings and

financial debt are composed of locked-in employee profit-sharing

funds for EUR 103 million and lease liabilities

recognized for EUR 124 million.

Inventories and work-in-progress increased by

EUR 500 million to stand at EUR 3,980 million

as of June 30, 2022. The increase is attributed to the Falcon

business, particularly with the increased production rate on the

Falcon 6X and future Defense deliveries.

Advance payments received on orders net of

advance payment paid to suppliers, were up

EUR 1,703 million to stand at

EUR 5,890 million. This is mainly due to the receipt of

the first down payment under the contract for 80 Rafale for the UAE

and the dynamism of the Falcon business.

The derivative financial instruments market

value stood at EUR -189 million as of June 30, 2022, vs.

EUR -81 million as of December 31, 2021. The decrease is

mainly due to the change in the US dollar exchange rate between

June 30, 2022 and December 31, 2021 ($1.0387/€ vs. $1.1326/€).

This Financial Press Release may contain

forward-looking statements which represent objectives and cannot be

construed as forecasts regarding the Company's results or any other

performance indicator. The actual results may differ significantly

from the forward-looking statements due to various risks and

uncertainties, as described in the Directors’ report.

CONTACTS

Corporate CommunicationStéphane

Fort - Tel. +33 (0)1 47 11 86 90 -

stephane.fort@dassault-aviation.comInvestor

RelationsNicolas Blandin - Tel. +33 (0)1 47 11 40

27 -

nicolas.blandin@dassault-aviation.comdassault-aviation.com

APPENDIX

FINANCIAL REPORTING

IFRS 8 “Operating Segments” requires the

presentation of information per segment according to internal

management criteria.The entire activity of the Dassault Aviation

Group relates to the aerospace sector. The internal reporting made

to the Chairman and Chief Executive Officer, and to the Chief

Operating Officer, as used for the strategy and decision-making,

includes no performance analysis, under the terms of IFRS 8, at a

lower level to this domain.

DEFINITION OF ALTERNATIVE PERFORMANCE

INDICATORS

To reflect the Group’s actual economic

performance, and for monitoring and comparability reasons, the

Group presented an adjusted income statement of:

-

foreign exchange gains/losses resulting from the exercise of

hedging instruments which do not qualify for hedge accounting under

IFRS standards. This income, presented as net financial income in

the consolidated financial statements, is reclassified as net sales

and thus as operating income in the adjusted income statement;

-

the value of foreign exchange derivatives which do not qualify for

hedge accounting, by neutralizing the change in fair value of these

instruments (the Group considering that gains or losses on hedging

should only impact net income as commercial flows occur), with the

exception of derivatives allocated to hedge balance-sheet positions

whose change in fair value is presented as operating income;

-

amortization of assets valued as part of the purchase price

allocation (business combinations), known as “PPA”;

-

adjustments made by Thales in its financial reporting.

The Group also presents the “available cash”

indicator which reflects the amount of the Group’s total

liquidities, net of financial debt. It covers the following balance

sheet items:

-

cash and cash equivalents;

-

other current financial assets (essentially available-for-sale

marketable securities at their market value);

-

financial debt, excluding lease liabilities.

The calculation of this indicator is detailed in

the condensed consolidated financial statements (see Note 7).

Only consolidated financial statements are

audited by statutory auditors. Adjusted financial data are subject

to the verification procedures applicable to all information

provided in the half-year report.

IMPACT OF ADJUSTMENTS

The impact of the adjustments of income

statement aggregates for the 1st half 2022 is set out below:

|

(in EUR thousands) |

Consolidated income statement H1 2022 |

Foreign exchange derivatives |

PPA |

Adjustments applied by Thales |

Adjusted income statement H1 2022 |

|

Foreign exchange gain/loss |

Change in fair value |

|

Net sales |

3,106,839 |

-6,930 |

-1,499 |

|

|

3,098,410 |

|

Operating income |

217,563 |

-6,930 |

-12,296 |

1,563 |

|

199,900 |

|

Net financial income/expense |

-37,437 |

6,930 |

17,891 |

|

|

-12,616 |

|

Share in net income of equity associates |

141,910 |

|

|

1,566 |

39,739 |

183,215 |

|

Income tax |

-50,525 |

|

-1,445 |

-318 |

|

-52,288 |

|

Net income |

271,511 |

|

4,150 |

2,811 |

39,739 |

318,211 |

|

Group share of net income |

272,511 |

|

4,150 |

2,811 |

39,739 |

318,211 |

|

Group share of net income per equity (in euros) |

3.26 |

|

|

|

|

3.82 |

The impact of the adjustments of income

statement aggregates for the 1st half 2021 is set out below:

|

(in EUR thousands) |

Consolidated income statement H1 2021 |

Foreign exchange derivatives |

PPA |

Adjustments applied by Thales |

Adjusted income statement H1 2021 |

|

Foreign exchange gain/loss |

Change in fair value |

|

Net sales |

3,106,206 |

- 368 |

883 |

|

|

3,106,721 |

|

Operating income |

177,224 |

- 368 |

- 3,865 |

1,688 |

|

174,679 |

|

Net financial income/expense |

- 31,154 |

368 |

19,442 |

|

|

- 11,344 |

|

Share in net income of equity associates |

108,527 |

|

|

1,501 |

39,152 |

149,180 |

|

Income tax |

- 42,798 |

|

- 4,255 |

- 342 |

|

- 47,395 |

|

Net income |

211,799 |

0 |

11,322 |

2,847 |

39,152 |

265,120 |

|

Group share of net income |

211,799 |

0 |

11,322 |

2,847 |

39,152 |

265,120 |

|

Group share of net income per share (in euros) (1) |

2.55 |

|

|

|

|

3.19 |

(1) proforma following the stock split.

- Financial Release H1 2022 EN

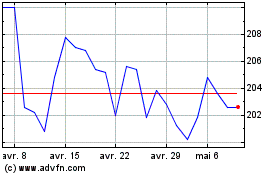

Dassault Aviation (EU:AM)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Dassault Aviation (EU:AM)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024