First half 2021-2022 results

First half net profit up 60% to €117.8

million

On May 25, 2022, the Board of Directors chaired by Mr. Daniel

Derichebourg approved the financial statements for the six months

ended March 31, 2022. During the meeting, the Chairman and CEO

praised the Group’s ability to integrate acquisitions rapidly, as

evidenced by Ecore’s impressive contribution to first half results

reflected in proforma2 rolling 12-month EBITDA of €559 million.

Consolidated revenue

Consolidated revenue for the first half was €2.5 billion, up 54%

year on year. The increase was driven mainly by the Environmental

Services division (up 70%) and, to a lesser extent, by the

Multiservices division (up 9%).

|

(in thousand tons) |

H1 2021-2022 |

H1 2020-2021 |

Change |

|

|

|

|

|

|

Ferrous metals |

2,395.5 |

1,998.3 |

19.9% |

|

Non-ferrous metals |

396.0 |

322.1 |

22.9% |

|

Total volumes |

2,791.5 |

2,320.4 |

20.3% |

|

|

|

|

|

|

(in millions of euros) |

H1 2021-2022 |

H1 2020-2021 |

Change |

|

|

|

|

|

|

Ferrous metals |

1,003.7 |

578.7 |

73.4% |

|

Non-ferrous metals |

916.3 |

505.6 |

81.2% |

|

Services |

159.6 |

135.9 |

17.4% |

|

Environmental Services revenue |

2,079.6 |

1,220.3 |

70.4% |

|

Multiservices revenue |

467.6 |

429.2 |

8.9% |

|

Holding company revenue |

0.5 |

0.5 |

0.0% |

|

Total half-year revenue, Derichebourg Group |

2,547.7 |

1,649.9 |

54.4% |

Environmental Services

The volume of ferrous metals sold was up 19.9%

due to the consolidation of Ecore volumes. Excluding Ecore, volumes

processed by the Group were down approximately 10%.

The decline in underlying volumes stemmed primarily from the

drop in automotive production caused by semiconductor

shortages.

The volume of non-ferrous metals sold was up

23%. Excluding Ecore, volumes were stable year on year.

Note that prices were firmer over the first half

for virtually all the non-ferrous metals processed by the

Group.

Multiservices

Revenue was up for all solutions, with the 8.9% overall increase

outstripping market growth:

- Services Solutions: up 4.3%

- Industry Solutions: up 42.3%, driven by an increase in assembly

rates at the main customer of the Derichebourg Aeronautics Services

subsidiary

- HR Sourcing: up 7.4%

- Urban Area: up 16.7%.

Recurring EBITDA1

First half recurring EBITDA was €250.6 million,

up 45.2% year on year. Growth was primarily driven by an

improvement in unit margins in the Recycling business, partly

offset by cost increases (mainly energy and fuel), and by Ecore’s

contribution.

Derichebourg Group proforma recurring EBITDA2

amounted to €559 million on a rolling 12-month basis. This figure

excludes the impact of pending asset disposals as part of the

commitments made to the European Commission.

Recurring operating profit

(loss)3

After €76.2 million in depreciation and

amortization over the first half, recurring operating profit

amounted to €174.6 million, up 55.4% year on year.

Operating profit (loss)

First half non-recurring items included €4.0

million of costs directly related to the Ecore acquisition, a

positive €1.4 million impact arising from the revaluation of joint

ventures with Ecore, which are now consolidated, and the expected

€0.4 million loss on disposal of a subsidiary.

Operating profit amounted to €171.3 million, up

48.3% year on year.

Pre-tax profit (loss)

After €11.3 million in financial expenses

and other financial income of €2.6 million, Group pre-tax

profit came to €162.5 million, up 49.2% year on year.

Consolidated net profit

(loss)

After a corporate income tax charge of

€45.5 million implying a corporate tax rate of 28%,

consolidated net profit was €118.3 million, including €117.8

million attributable to the shareholders of the consolidating

entity (up 60% year on year).

Acquisition of a minority stake in

Elior

On May 19, 2022, the Company announced that it

had signed a memorandum of understanding with BIM, a company

controlled by Sofibim, the holding company of Elior Group (“Elior”)

founder Robert Zolade, and Gilles Cojan with a view to acquiring a

minority stake in Elior. The transaction demonstrates

Derichebourg’s confidence in Elior. It represents a real

opportunity for Derichebourg to invest in one of the world’s

leading operators in contract catering and support services, with

strong potential and proven attractiveness.

Under the terms of the agreement due to be

completed by June 30 at the latest, Derichebourg is to acquire a

14.7% stake from BIM and Gilles Cojan at a price of €5.65 per Elior

share, with a possible earn-out of up to €1.35 per share based on

the change in Elior’s share price between January 1, 2023 and

December 31, 2024. Derichebourg, which already held 4.9% of Elior’s

capital, will see its stake increase to a total of 19.6%.

Derichebourg is committed to being a long-term

shareholder and to supporting the strategy implemented by Elior’s

Board of Directors.

The investment will allow Derichebourg to take

up two seats on Elior’s Board of Directors.

Derichebourg does not intend to file a public

offer for Elior’s remaining shares.

Outlook

The European Union’s desire to spearhead the

industrial decarbonization movement is triggering initiatives among

a number of European steel manufacturers to replace heavy

greenhouse gas emitting blast furnaces with electric furnaces.

Consumption of raw materials derived from recycling will increase

in the future, whereas collection is not expected to change much,

leading to upward pressure on ferrous scrap metal prices.

Derichebourg remains highly confident in the

future of the recycling industry and in its industrial and

financial outlook. We will reap the benefits of the commercial and

operational synergies generated by the Ecore acquisition and the

investments made in Spain will enter production.

In the short term, the current economic

situation is fueling uncertainty about growth due to the

geopolitical events that have unfolded in Europe over the last

three months. An economic slowdown would have a temporary impact on

Group earnings.

Meanwhile, Multiservices revenue is expected to

enjoy further growth driven by strong commercial momentum. The

increase in second half profit margins will depend on the Group’s

ability to pass wage increases on to customers or reduce the cost

base accordingly. The improvement in the aeronautics segment is

expected to continue.

INCOME STATEMENT

|

(in millions of euros) |

H1 2021-2022 |

H1 2020-2021 |

Change |

|

|

|

|

|

|

Revenue |

2,547.7 |

1,649.9 |

54.4% |

|

of which Environmental Services |

2,079.6 |

1,220.3 |

70.4% |

|

of which Multiservices |

467.6 |

429.2 |

8.9% |

|

|

|

|

|

|

Recurring EBITDA |

250.6 |

172.6 |

45.2% |

|

of which Environmental Services |

232.0 |

153.3 |

51.4% |

|

of which Multiservices |

23.8 |

24.0 |

(0.8%) |

|

|

|

|

|

|

Recurring operating profit |

174.6 |

112.3 |

55.4% |

|

of which Environmental Services |

170.0 |

107.1 |

up 58.8% |

|

of which Multiservices |

11.5 |

11.6 |

(0.9%) |

|

|

|

|

|

|

Non-current items, net |

(3.3) |

3.2 |

na |

|

|

|

|

|

|

Operating profit |

171.3 |

115.5 |

48.3% |

|

|

|

|

|

|

Net financial expenses |

(11.3) |

(7.2) |

56.9% |

|

Other financial items |

2.6 |

0.6 |

333.3% |

|

|

|

|

|

|

Profit before tax |

162.5 |

108.9 |

49.2% |

|

|

|

|

|

|

Income tax |

(45.5) |

(33.4) |

36.2% |

|

Share of profit (loss) of associates and joint ventures |

1.3 |

(0.8) |

na |

|

Net profit (loss) attributable to non-controlling interests |

(0.5) |

(1.1) |

(54.5%) |

|

|

|

|

|

|

Net profit attributable to shareholders |

117.8 |

73.6 |

60.1% |

BALANCE SHEET

|

(in millions of euros) |

03-31-22 |

09-30-21 |

Change (%) |

|

Goodwill |

496.9 |

266.2 |

|

|

Intangible assets |

6.0 |

5.6 |

|

|

Property, plant and equipment |

687.6 |

501.1 |

|

|

Right-of-use assets |

253.3 |

216.1 |

|

|

Financial assets |

11.8 |

10.2 |

|

|

Investments in associates and joint ventures |

11.4 |

12.5 |

|

|

Deferred taxes |

43.7 |

26.7 |

|

|

Other assets |

0.0 |

0.4 |

|

|

Total non-current assets |

1,510.7 |

1,038.8 |

45.4% |

|

Inventories and WIP |

302.5 |

136.6 |

|

|

Trade receivables |

570.6 |

396.6 |

|

|

Tax receivables |

3.4 |

6.6 |

|

|

Other assets |

112.6 |

78.5 |

|

|

Financial assets |

23.5 |

19.4 |

|

|

Cash and cash equivalents |

374.5 |

787.5 |

|

|

Financial instruments |

1.5 |

0.1 |

|

|

Total current assets |

1,388.6 |

1,425.2 |

(2.6%) |

|

Total non-current assets and asset groups held for

sale |

54.8 |

0.0 |

|

|

Total assets |

2,954.1 |

2,464.0 |

19.9% |

|

(in millions of euros) |

03-31-22 |

09-30-21 |

Change (%) |

|

Group shareholders’ equity |

773.3 |

703.1 |

|

|

Non-controlling interests |

5.5 |

3.8 |

|

|

Total shareholders’ equity |

778.9 |

706.9 |

10.2% |

|

Loans and financial debts |

825.5 |

826.0 |

|

|

Provision for pensions and similar benefits |

48.1 |

44.1 |

|

|

Other provisions |

39.6 |

34.9 |

|

|

Deferred taxes |

28.1 |

25.5 |

|

|

Other liabilities |

6.4 |

6.3 |

|

|

Total non-current liabilities |

947.8 |

936.8 |

1.2% |

|

Loans and financial debts |

178.2 |

157.3 |

|

|

Provisions |

8.5 |

2.3 |

|

|

Trade payables |

684.8 |

374.2 |

|

|

Tax payables |

12.0 |

7.1 |

|

|

Other liabilities |

311.1 |

277.1 |

|

|

Financial instruments |

0.0 |

2.2 |

|

|

Total current liabilities |

1,194.7 |

820.3 |

45.6% |

|

Total liabilities related to a group of assets held for

sale |

32.7 |

0.0 |

|

|

Total equity & liabilities |

2,954.1 |

2,464.0 |

19.9% |

CHANGE IN NET FINANCIAL DEBT FROM September 30, 2021 TO

March 31, 2022

|

Net financial debt at September 30, 2021 |

195.7 |

| Recurring

EBITDA |

(250.6) |

| Capital

expenditure |

78.0 |

| Net financial

expenses |

11.3 |

| Corporate income

taxes |

35.3 |

| Dividends |

51.1 |

| Acquisitions |

422.6 |

| Net debt related to

assets held for sale |

(14.2) |

| Other |

(1.8) |

|

Subtotal |

331.7 |

| Change in working

capital |

97.7 |

| New IFRS 16

right-of-use assets |

4.1 |

|

Net financial debt at March 31, 2022 |

629.2 |

1 Recurring EBITDA = Recurring operating profit + net

depreciation and amortization on property, plant and equipment,

intangible assets, and right-of-use assets

2 Allowing for consolidation of Ecore over 12 months

3 Recurring operating profit (loss): operating profit (loss) +/-

non-recurring items

- First half 2021-2022 results

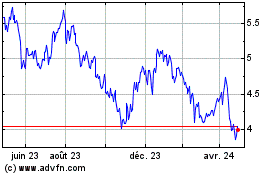

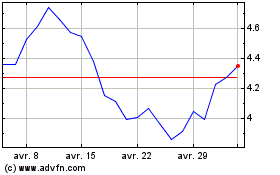

Derichebourg (EU:DBG)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Derichebourg (EU:DBG)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024