Elis: Q3 2022 revenue

Continued growth momentum

in Q3 2022: Revenue up +22.8%

Buoyant commercial activity in all our

end-markets

New pricing adjustments implemented in

Q3 to offset the strong

rise in energy costs

Q3 2022

revenue at

€1,031.0m

(+22.8%

o/w

+17.0%

on an organic basis):

Further recovery in Hospitality, very good commercial

momentum in Industry and

in Trade & Services,

additional pricing adjustments tied to

inflation

- In Hospitality, the

summer season was very good, especially in France and in Southern

Europe

- Commercial

development was especially solid in Industry and in Trade &

Services and the churn rate improved

- Commercial dynamics

are still strongly driven by the evolving needs for hygiene,

traceability, and responsible products & services

- No slowdown was

recorded in any country nor any end-market

- Following the

strong inflation on energy costs recorded during summer, Elis has

negotiated additional pricing adjustments, to be implemented

between October 2022 and January 2023

- The total price

effect for 2022 should be c. +7% while cost base inflation is of c.

+11%

Update on 2022 outlook

- Full-year 2022 organic revenue

growth now expected above +20% (previously expected between +18%

and +20%), driven by the pick-up in hotel activity, pricing

adjustments and Elis’ improved growth profile

- The acceleration of inflation in Q3

should lead to c. €35m additional costs for 2022; new pricing

adjustments negotiated since summer should represent a c. €25m

uplift on 2022 revenue

- Consequently, 2022 adjusted EBITDA

margin is now expected at c. 33.0% (previously expected at c.

33.5%)

- 2022 adjusted EBIT

still expected above €530m (vs €388m in 2021)

- 2022 headline net

income per share still expected above €1.45m

- 2022 free cash flow

(after lease payments) still expected at c. €200m

- Financial leverage

ratio as of December 31, 2022 still expected at 2.5x, down 0.5x

yoy

The Group

aims to actively

continue its deleveraging to reach a

financial leverage ratio

of close to 2.0x in 2023 and

below 2.0x in 2024

- As of 30 September

2022, Group financial leverage ratio was at 2.6x compared to 3.1x

at 30 September 2021

- The deleveraging

trajectory that we anticipate should quickly make Elis eligible for

investment grade rating consideration

- Current debt

maturities are spread between April 2024 and June 2032; the entire

debt is at fixed rate and the average cost of debt is c. 2%

Saint-Cloud, 26

October 2022 – Elis, an international

multi-service provider, offering textile, hygiene and facility

services solutions, which is present in Europe and Latin America,

today announces its revenue for the 9 months ended 30 September

2022. These figures are unaudited.

Commenting on the announcement, Xavier

Martiré, CEO of Elis, said:

« With +17% organic revenue growth in Q3 2022,

Elis continued to benefit from the rebound in Hospitality and from

its attractive services offer in Industry and Trade & Services,

with many contracts wins in the quarter.

Furthermore, the Group’s quality of service led

to churn rate improvement and contributed to facilitate

negotiations for new pricing adjustments necessitated by surging

energy costs during the summer,

These new pricing adjustments have been

implemented since October 2022 and represent c. €25m of additional

revenue for full-year 2022, to be compared to a c. €35m additional

impact from summer inflation on the estimated cost base for

full-year 2022. All the pricing adjustments that have been

negotiated to date allow us to already anticipate a 2023 price

effect that will be above the c. +7% that we expect for 2022.

This better-than-expected pricing, Hospitality

recovery and commercial momentum allow us to raise our topline

objective and we now expect organic revenue growth to be above +20%

in 2022.

2022 adjusted EBITDA margin is now expected to

be at around 33.0%, 50bps below what we expected at the end of

July, reflecting the difference between the €35m additional costs

expected for the full-year and the negotiated pricing adjustments

to offset this increase, with only €25m accounted for in 2022.

Our full-year objectives for adjusted EBIT,

headline net income per share, free cash-flow and financial

leverage ratio are confirmed. We notably anticipate an acceleration

in Group deleveraging with a financial leverage ratio that should

be at 2.5x at 31 December 2022. We aim at actively continuing this

deleveraging in the coming years, which should quickly make the

Group eligible for investment grade rating consideration.

The great resilience shown by Elis over the

different recent crisis, its operational know-how, its strengthened

organic growth profile and its circular economy model are major

assets that will enable the company to assert its leadership in all

the countries in which it is present.”

I. Q3 2022 revenue

Reported revenue

| In millions of

euros |

H1 |

2022Q3 |

9M |

H1 |

2021Q3 |

9M |

H1 |

Var.Q3 |

9M |

| France |

564.0 |

319.1 |

883.1 |

420.7 |

272.7 |

693.4 |

+34.1% |

+17.0% |

+27.4% |

| Central Europe |

410.7 |

227.9 |

638.6 |

344.3 |

193.8 |

538.2 |

+19.3% |

+17.6% |

+18.7% |

| Scandinavia &

East. Eur. |

280.2 |

147.1 |

427.4 |

236.1 |

125.8 |

361.9 |

+18.7% |

+17.0% |

+18.1% |

| UK &

Ireland |

224.2 |

129.0 |

353.2 |

155.3 |

105.4 |

260.7 |

+44.3% |

+22.5% |

+35.5% |

| Southern

Europe |

150.3 |

96.8 |

247.1 |

95.1 |

73.1 |

168.1 |

+58.0% |

+32.5% |

+46.9% |

| Latin America |

141.0 |

102.7 |

243.6 |

112.4 |

62.7 |

175.1 |

+25.5% |

+63.7% |

+39.2% |

| Others |

13.5 |

8.2 |

21.7 |

11.6 |

6.0 |

17.6 |

+16.4% |

+37.6% |

+23.6% |

| Total |

1,783.8 |

1,031.0 |

2,814.8 |

1,375.5 |

839.4 |

2,214.9 |

+29.7% |

+22.8% |

+27.1% |

« Others » includes Manufacturing

Entities and

Holdings. Percentage

change calculations are based on actual figures.

Q3 2022 reported growth breakdown

| In millions of

euros |

Q3 2022 |

Q3 2021 |

Organic growth |

External growth |

FX |

Reported growth |

| France |

319.1 |

272.7 |

+17.0% |

- |

- |

+17.0% |

| Central Europe |

227.9 |

193.8 |

+13.7% |

+2.7% |

+1.2% |

+17.6% |

| Scandinavia &

East. Eur. |

147.1 |

125.8 |

+13.2% |

+4.2% |

-0.4% |

+17.0% |

| UK &

Ireland |

129.0 |

105.4 |

+21.4% |

+0.9% |

+0.2% |

+22.5% |

| Southern

Europe |

96.8 |

73.1 |

+32.5% |

- |

- |

+32.5% |

| Latin America |

102.7 |

62.7 |

+7.1% |

+42.2% |

+14.4% |

+63.7% |

| Others |

8.2 |

6.0 |

+37.4% |

- |

+0.1% |

+37.6% |

| Total |

1,031.0 |

839.4 |

+17.0% |

+4.5% |

+1.3% |

+22.8% |

« Others » includes Manufacturing

Entities and

Holdings. Percentage

change calculations are based on actual figures.

9-month 2022 organic revenue growth

| |

Q1 2022 |

Q2 2022 |

Q3 2022 |

9-month 2022 |

| France |

+30.8% |

+37.1% |

+17.0% |

+27.4% |

| Central Europe |

+14.1% |

+18.5% |

+13.7% |

+15.4% |

| Scandinavia &

East. Eur. |

+15.2% |

+19.6% |

+13.2% |

+16.0% |

| UK &

Ireland |

+38.5% |

+38.8% |

+21.4% |

+31.7% |

| Southern

Europe |

+52.9% |

+62.2% |

+32.5% |

+46.9% |

| Latin America |

+10.0% |

+7.6% |

+7.1% |

+8.2% |

| Others |

+19.3% |

+10.2% |

+37.4% |

+22.3% |

| Total |

+24.2% |

+29.0% |

+17.0% |

+23.0% |

« Others » includes Manufacturing

Entities and

Holdings. Percentage

change calculations are based on actual figures.

France

Q3 revenue was up +17.0% (entirely organic).

Hospitality has continued to rebound: the summer season was good

and even excellent in Paris. All end-markets showed very good

commercial momentum, esspecially in Workwear and in Pest control.

Finally, the pricing dynamic was good (+7% on average) in a context

of strong inflation.

Central Europe

Q3 revenue was up +17.6% (+13.7% on an organic

basis) and all countries in the region posted strong organic

revenue growth. Switzerland, where the share of Hospitality is

high, posted strong growth, as did Belux, where all segments were

still well-oriented (Flat linen, Workwear and Hygiene and

well-being). In Germany, pricing momentum was very good in

Hospitality but more subdued in Healthcare and Workwear.

Scandinavia & Eastern

Europe

Q3 revenue was up +17.0% in the region (+13.2%

on an organic basis), and all countries in the region delivered

organic revenue growth of +10% or above, although pricing

negotiations are generally more difficult than in the other

regions. The strong pick-up of Hospitality continued in Denmark and

commercial momentum was still very good in Sweden and in Norway (in

Workwear in both cases).

UK and & Ireland

Q3 revenue was up +22.5% in the region (+21.4%

on an organic basis). Activity in Hospitality continued to pick up

although the pace was slower than in the other regions, especially

in London. However, pricing momentum is well oriented in the

region, especially in Hospitality and in Healthcare. Commercial

momentum remained good with an improvement in churn rate and many

new contract wins in Healthcare and in our Workwear business.

Southern Europe

Q3 revenue was up +32.5% in the region (entirely

organic). The region has a high exposure to Hospitality (more than

60% of 2019 revenue) and the marked rebound in activity continues

to drive growth, on the back of a very summer season. In Workwear,

good commercial momentum and the acceleration of outsourcing

continued. Finally, pricing momentum in the region is still

satisfactory.

Latin America

Q3 revenue was up +63.7% in the region (+7.1% on

an organic basis). The acquisition of a leader in the Mexican

market, consolidated since July 1st, largely contributed to the

strong scope effect in the quarter (+42.2%). Inflation seems to be

past the peak whereas pricing momentum remains strong. Volumes are

slightly down, following the end of temporary contracts signed

during the pandemic. The currency effect remained strongly positive

in the quarter (+14.4%).

II. Refinancing

In May 2022, Elis successfully priced the issue

of €300m aggregate principal amount of senior unsecured notes under

its EMTN (Euro Medium Term Notes) Program. The maturity of the

notes is 5 years, with a fixed annual coupon of 4.125%. The net

proceed of the issue will be dedicated to the refinancing of the

€450 million aggregate principal amount of notes due 15 February

2023, which has a call option at par (without penalties) on 15

November 2022.

In September 2022, Elis successful placed an

offering of bonds convertible into new shares and/or exchangeable

for existing shares (OCEANEs) due 22 September 2029 for a nominal

amount of €380m. The bonds are convertible and/or exchangeable into

new/existing Elis shares and carry a coupon of 2.25% per annum and

a conversion premium of 42.5% over the reference share price

(€12.1537 i.e. an initial conversion price of €17.3190).

Bondholders will be entitled to request an early redemption of

their Bonds at their Principal Amount plus accrued but unpaid

interest on 22 September 2027.

The net proceeds of the offering were used to

finance the partial and simultaneous repurchase of the outstanding

OCEANEs due 6 October 2023 (ISIN: FR0013285707) for c. €196m (the

outstanding balance is meant to be repaid at maturity). The

remainder of the net proceeds will be used for general corporate

purposes.

Debt maturities are spread between April 2024

and June 2032; the entire debt is at fixed rate and the average

cost of debt is currently of c. 2%.

Financial leverage ratio was 2.6x as of 30

September 2022, compared to 3.1x as of 30 September 2021. The Group

aims at actively pursuing its deleveraging to reach a financial

leverage ratio close to 2.0x in 2023 and below 2.0x in 2024. This

deleveraging trajectory should quickly make Elis eligible for

investment grade rating consideration.

III. Other information

The circular economy at the heart of Elis’ business

model

Elis offers its clients products that are

maintained, repaired, reused, and reemployed to optimize their

usage and lifespan. The Group therefore selects its textile

products based on sustainability criteria, to ensure frequent

washing, and also operates repair workshops. Elis’ conviction is

that the circular economy model, which notably aims at reducing

consumption of natural resources by optimizing the lifespan of

products, is a sustainable solution to address today’s

environmental challenges.

The services offered by Elis are a sustainable

alternative to:

- Simple purchase or

use of products: by mutualizing them between several users or

clients, and by constantly looking at improving the industrial

processes linked to their washing. As an example, the use of

workwear operated by Elis leads to a 37% decrease of CO2 emissions

compared to workwear that is washed at home or in a standard

laundry, and to a 48% decrease of water consumption. (Source:

EY)

- Single use /

disposable products: by offering reusable products, which are

mostly maintained locally, hence supporting local employment and

local economic development. As an example, the use of reusable

surgical garments in care facilities leads to a decrease ranging

from 31% to 62% of CO2 emissions compared to disposable clothes.

(Source: Cleaner Environmental Systems)

These alternatives to a linear consumption

approach enable our clients to avoid CO2 emissions and contribute

to a reduction of their own emissions.

The Ellen MacArthur Foundation states that

“circular economy is necessary to reach Net Zero” and that “nearly

10 billion tons of CO2 (i.e., 20% of world emissions) could be

reduced thanks to the transition of our current model towards a

circular economy”.

(https://climate.ellenmacarthurfoundation.org)

Non-financial rating

In H1 2022, Sustainalytics improved Elis’s ESG

rating by 9pts at 15.5 (« low risk »). Elis’s grade with MSCI

reached 7.0 in July 2022 compared to 5.6 in 2020. Furthermore, Elis

obtained an « A » grade in the Verité40 index (Axylia group).

After winning a Gold medal related to the

EcoVadis questionnaire for 5 consecutive years, Elis obtained a

Platinum medal, the highest possible reward. This medal places Elis

within the top 1% of the c. 75,000 companies assessed by

EcoVadis.

In 2021, the Group was rated B by the CDP

(Carbon Disclosure Project), a non-profit organization which

performs independent assessments on the basis of information made

available by companies on their strategy, risk & opportunity

management, climate goals, annual climate performance, etc…

Finally, in 2022, Elis maintained its high

performance with rating agency Gaïa (72/100, which ranks the Group

at the Gold level”.

Our climate

commitment

Conscious of the environmental challenges with

regard to climate change, Elis is committed to an approach to

reduce its emissions that is in line with the Paris Agreement to

contribute to keeping the increase in temperature below 1.5C°

compared to preindustrial levels1. In 2023, the Group will present

climate objectives that are aligned with the methodology of the

Science Based Targets initiative.

These climate objectives will be submitted in a

“Say on climate” resolution at the next General Shareholders

Meeting in May 2023. At the General Shareholders Meeting held on 19

May this year, the Group has already proposed that shareholders

support this strategic step, via an advisory resolution. This

resolution was largely approved.

Financial definitions

- Organic growth in

the Group’s revenue is calculated excluding (i) the impacts of

changes in the scope of consolidation of “major acquisitions” and

“major disposals” (as defined in the Universal Registration

Document) in each of the periods under comparison, as well as (ii)

the impact of exchange rate fluctuations.

- Adjusted EBITDA is

defined as adjusted EBIT before depreciation and amortization net

of the portion of subsidies transferred to income.

- Adjusted EBITDA

margin is defined as adjusted EBITDA divided by revenues.

- Adjusted EBIT is

defined as net income (loss) before net financial income (loss),

income tax, share in net income of equity accounted companies,

amortization of intangible assets recognized in a business

combination, goodwill impairment losses, other operating income and

expense, miscellaneous financial items (bank fees recognized in

operating income) and IFRS 2 expense (share-based payments).

- Adjusted EBIT

margin is defined as adjusted EBIT divided by revenues.

In order to take into account the statement

published by the European Securities and Markets Authority (ESMA)

on 29 October 2021 regarding alternative performance indicators,

the Group added the term “adjusted” to the above definitions. The

content of these indicators remains unchanged compared to previous

financial years.

- Free cash flow is

defined as cash EBITDA minus non-cash-items, minus change in

working capital, minus linen purchases and manufacturing capital

expenditures, net of proceeds, minus tax paid, minus financial

interest payments and minus lease liabilities payments.

- The financial

leverage ratio is the leverage ratio calculated for the purpose of

the financial covenant included in the new banking RCF agreement

signed in November 2021: Leverage ratio is equal to Net financial

debt / Pro forma EBITDA of acquisitions finalized during the last

12 months after synergies.

Geographical breakdown

- France

- Central Europe:

Austria, Belgium, Czech Republic, Germany, Hungary, Luxembourg,

Netherlands, Poland, Slovakia, Switzerland

- Scandinavia &

Eastern Europe: Denmark, Estonia, Finland, Latvia, Lithuania,

Norway, Russia, Sweden

- UK &

Ireland

- Southern Europe:

Italy, Portugal, Spain & Andorra

- Latin America:

Brazil, Chile, Colombia, Mexico

Presentation of Elis’ Q3

2022 revenue

(in English)

Date: Wednesday 26 October 2022 at 5:15pm GMT (6:15pm CET)

Speakers: Xavier Martiré (CEO) and Louis Guyot (CFO)

Webcast link: https://edge.media-server.com/mmc/p/7q3khnib

Conference call & Q&A session link:

https://register.vevent.com/register/BIaac7ec35d24244e79fba3ba9d0dc9f18

An investor presentation will be available at 4:50pm GMT (5:50pm

CET) at this

address:https://fr.elis.com/en/group/investor-relations/regulated-information

Forward looking statements

This document may contain information related to

the Group’s outlook. Such outlook is based on data, assumptions and

estimates that the Group regarded as reasonable at the date of this

press release. Those data and assumptions may change or be adjusted

as a result of uncertainties relating particularly to the economic,

financial, competitive, regulatory or tax environment or as a

result of other factors of which the Group was not aware on the

date of this press release. Moreover, the materialization of

certain risks, especially those described in chapter 4 “Risk

management and internal control” of the Universal Registration

Document for the financial year ended 31 December 2021, which is

available on Elis’s website (www.elis.com), may have an impact on

the Group’s activities, financial position, results or outlook and

therefore lead to a difference between the actual figures and those

given or implied by the outlook presented in this document. Elis

undertakes no obligation to publicly update or revise the Group’s

outlook or any of the abovementioned data, assumptions, or

estimates, except as required by applicable laws and regulations.

Reaching the outlook also implies success of the Group’s strategy.

As a result, the Group makes no representation and gives no

warranty regarding the achievement of any outlook set out

above.

Next information

Full-year 2022 revenue: Monday 30 January 2023

(after market)

Contact

Nicolas Buron - Investor Relations Director -

Phone: +33 1 75 49 98 30 - nicolas.buron@elis.com

1 Reduction in line with the 1.5°C target for direct (Scope 1)

and indirect (Scope 2) emissions, and the well below 2°C target for

other indirect emissions (Scope 3).

- 20221026 - Elis - Q3 2022 revenue (press release)

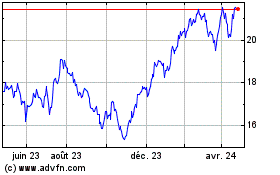

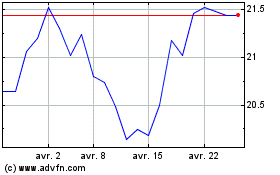

Elis (EU:ELIS)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Elis (EU:ELIS)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024