Exel Industries : Fourth quarter 2020-21 revenue: +5.5% / Full-year 2020-21 revenue: +16.2%

28 Octobre 2021 - 6:00PM

Exel Industries : Fourth quarter 2020-21 revenue: +5.5% / Full-year

2020-21 revenue: +16.2%

PRESS

RELEASE October

28, 2021

|

Fourth quarter 2020-21 revenue:

+5.5%Full-year 2020-21 revenue:

+16.2% |

|

Q4 revenue €m |

2019 - 2020 |

2020 - 2021 |

Change in value |

Change in % |

|

Reported |

Reported |

Reported |

*like-for-like |

Reported |

*like-for-like |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| AGRICULTURAL

SPRAYING |

76.4 |

88.9 |

+12.5 |

+11.8 |

+16.4% |

+15.4% |

| |

|

|

|

|

|

|

| SUGAR BEET

HARVESTERS |

60.4 |

71.7 |

+11.3 |

+12.4 |

+18.8% |

+20.5% |

| |

|

|

|

|

|

|

| GARDEN

WATERING AND SPRAYING |

31.7 |

23.1 |

-8.7 |

-9.7 |

-27.4% |

-30.7% |

| |

|

|

|

|

|

|

| INDUSTRIAL

SPRAYING |

61.2 |

58.7 |

-2.5 |

-2.9 |

-4.1% |

-4.8% |

|

|

|

|

|

|

|

|

| EXEL

Industries Group |

229.7 |

242.4 |

+12.7 |

+11.5 |

+5.5% |

+5.0% |

|

12-month revenue €m |

2019 - 2020 |

2020 - 2021 |

Change in value |

Change in % |

|

Reported |

Reported |

Reported |

*like-for-like |

Reported |

*like-for-like |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| AGRICULTURAL

SPRAYING |

332.1 |

380.9 |

+48.8 |

+53.9 |

+14.7% |

+16.2% |

| |

|

|

|

|

|

|

| SUGAR BEET

HARVESTERS |

114.2 |

135.5 |

+21.4 |

+23.3 |

+18.7% |

+20.4% |

| |

|

|

|

|

|

|

| GARDEN WATERING

AND SPRAYING |

121.1 |

132.4 |

+11.3 |

+10.5 |

+9.4% |

+8.7% |

| |

|

|

|

|

|

|

| INDUSTRIAL

SPRAYING |

187.0 |

227.9 |

+40.9 |

+35.1 |

+21.9% |

+18.8% |

|

|

|

|

|

|

|

|

| EXEL

Industries Group |

754.4 |

876.8 |

+122.4 |

+122.8 |

+16.2% |

+16.3% |

*like-for-like = at constant foreign exchange rates

and perimeter

Fourth quarter 2020-2021

revenue

With revenue of €242.4 million,

the fourth quarter of 2020-2021 saw growth of 5.5%

despite an unfavorable comparison base linked to the strong

recovery in industry and gardening in the fourth quarter of 2020.

At comparable foreign exchange rates and perimeter, billings for

the quarter were up 5.0% at €241.2 million. Foreign exchange rates

negatively impacted revenue by €1.2 million. Despite the supply and

logistics issues affecting all our businesses, the Group managed to

grow sales in this challenging global environment.

-

AGRICULTURAL SPRAYING, revenue of €88.9 million, up €12.5

million (+16.4%).

The business grew thanks to the good

performances in self-propelled sprayers in North America (+10%) and

across all product ranges in Europe (France and Germany in

particular). Rebounds by the various brands in Asia-Pacific also

helped sustain revenue growth. However, the shortage of electronic

components disrupted factories to a greater extent than in Q3,

delaying deliveries by several weeks.

- SUGAR

BEET HARVESTERS, revenue of €71.7 million, up

€11.3 million(+18.8%).

Sales of new machines increased significantly

during the quarter, in France and Germany alike. In addition,

various government subsidy programs continue to drive sales of the

Terra Variant range. Lastly, sales of used machines and spare parts

were fairly stable over the period.

- GARDEN

WATERING AND SPRAYING, revenue of €23.1 million,

down €8.7 million (-27.4%).

The drop in revenue is attributable to several

factors. First, the comparable fourth quarter of 2020 was

exceptionally strong thanks to post-Covid recovery. Second, sales

in the United Kingdom and France were down in August/September, as

the summer was not as dry as previous ones. Also, raw material

shortages and logistics issues disrupted production and

deliveries.

-

INDUSTRY, revenue of €58.7 million, down €2.5 million

(-4.1%).

Despite an unfavorable comparison base due to

the strong recovery in the fourth quarter of 2020, billings in the

industrial spraying and technical hoses business remained solid,

sustained by Asia despite a modest dip in Europe and North America.

The introduction of new product ranges and diversification,

particularly in the wood industry, helped support sales during the

quarter.

Full-year 2020-21 revenue

Full-year revenue was up 16% at

€876.8 million, including a scope effect of €11

million linked to the acquisition of Intec in January 2020 and

negative foreign exchange rate effects essentially related to the

US dollar (-€11.6 million).

Government subsidies and the strong trend in

agricultural commodity prices have encouraged farmers to invest in

replacing agricultural machinery in all geographical areas where

our brands operate. Meanwhile, higher input prices, particularly

for steel and transport, made it necessary to adjust our pricing

policy. Supply chains continue to be disrupted by components

shortages requiring production to be adapted accordingly, although

delays in deliveries are not critical.

Billings for the year were up sharply, as

anticipated in previous quarters. Sugar beet harvester volumes

increased significantly over the year, as did those of Terra

Variant in liquid manure spreading and anaerobic digestion, thanks

to compelling commercial initiatives. Lastly, sugar beet prices

were slightly more favorable in 2021 than in 2020.

- GARDEN

WATERING AND SPRAYING

The good momentum behind our exceptional year in

2020, particularly in the fourth quarter, continued throughout

2021, with sales spread more evenly than in 2020, and a very strong

first half. Continued increases in raw material prices and

logistics issues required us to adjust our pricing. Our service

rate nevertheless remained at an acceptable level.

Underlying markets (automotive, furniture,

construction, industry) benefited from the economic recovery during

the year. However, momentum continues to differ between markets,

especially in the automotive industry. Our sales of technical hoses

are increasing despite difficulties in sourcing plastics.

Profit forecasts or

estimates

AGRICULTURAL SPRAYING

- End of subsidies

in North America in 2021 and by the end of 2022 in Europe

- Agricultural

commodity prices expected to remain high

- Continued demand

driven by the post-Covid economic recovery and performance

improvement requirements

- Order book up

and ahead of FY 2020-21

- Streamlining of

product offerings

- Stabilization of

new machine sales

- Continued

diversification in the Terra Variant range, in new geographies

- GARDEN

WATERING AND SPRAYING

- Business should

be sustained at the beginning of the year at least due to

distributors’ concerns about plastic shortages.

- Underlying markets (automotive,

furniture, construction, etc.) are expected to grow

- Component shortages are likely to

continue disrupting our delivery times

The Group confirms its confidence in the outlook

in general, and in particular thanks to our multi-activity

strategy, which provides stability. In addition, our expansion into

the nautical industry entered its integration phase on October

1.

Upcoming events

December 17, before market opening: Full-year

2020-21 results

January 25 after market closing: Q1 2021-22

sales

About EXEL Industries:

The EXEL Industries group is a listed

family-owned company, founded and managed by Patrick Ballu and his

family since 1952. EXEL Industries is a French industrial group

whose ambition is to design, manufacture and market equipment goods

and associated services that enable its customers to increase

efficiency, productivity, or contribute to the pleasure of living,

and to achieve their environmental and societal objectives.

EXEL Industries employs approximately 3 500

people spread across 34 countries and five continents.

Euronext Paris, SRD

Long only – compartment B (Mid Cap) /

indice EnterNext © PEA-PME 150 (Mnemo EXE / ISIN

FR0004527638)

This press release is available in Frech and in

English on the website www.exel-industries.com

|

Yves BELEGAUDGroup Chief Executive Officer

Yves.belegaud@exel-industries.com |

Thomas GERMAINGroup Chief Financial Officer/ Investor Relations

direction.communication@exel-industries.com |

2.13.0.0

- COMMUNIQUE DE PRESSE T4 2021 Final EN

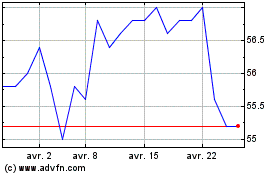

Exel Industries (EU:EXE)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Exel Industries (EU:EXE)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024