Confirmation of terms and conditions - Unieuro

PRESS RELEASE

Ivry-sur-Seine, France — October 25, 2024, 3:30

p.m. CEST

THE RELEASE, PUBLICATION OR DISTRIBUTION OF THIS

PRESS RELEASE IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IS NOT

PERMITTED IN OR INTO THE UNITED STATES OF AMERICA, AUSTRALIA,

CANADA, JAPAN OR ANY OTHER COUNTRY WHERE SUCH COMMUNICATION WOULD

VIOLATE THE RELEVANT APPLICABLE REGULATION

END OF THE TENDER PERIOD TODAY AT 5:30

PM

- Reminder of

the terms of the Offer:

Consideration equal to €9.0 in cash +

0.1 Fnac Darty share, representing a unique opportunity for Unieuro

shareholders to benefit from an attractive value

proposal:

– 42% premium to unaffected share

price1

– 20% premium to analysts’ average

target price pre-announcement

-

A reopening period might occur upon the terms described

below.

NOTICE PURSUANT TO ARTICLE 36 OF THE REGULATION

ADOPTED BY CONSOB BY RESOLUTION NO. 11971 OF MAY 14, 1999, AS

SUBSEQUENTLY INTEGRATED AND AMENDED (THE “ISSUERS’

REGULATION”).

Reference is made to the voluntary public tender

and exchange offer (the “Offer”) pursuant to Articles 102 and 106,

paragraph 4, of the Italian Legislative Decree no. 58 of February

24, 1998, as subsequently integrated and amended (the “CFA”),

launched by Fnac Darty SA (“Fnac Darty”) and RUBY Equity Investment

S.à r.l. (“Ruby” and together with Fnac Darty, the “Offerors”) for

all of the ordinary shares of Unieuro S.p.A. (“Unieuro” or the

“Issuer”) not already held by the Offerors, including the treasury

shares directly or indirectly held, from time to time, by

Unieuro.

It is reminded that, as announced to the market

on 7 October 2024 pursuant to Articles 36 and 43 of the Issuers’

Regulation, the Offerors have given notice of their decision to

amend the Minimum Threshold Condition, lowering the shareholding

required for its fulfilment from an amount higher than 90% to an

amount at least equal to 66.67% of Unieuro’s share capital.

All terms not defined in this press release

shall have the same meaning given to them in the offer document,

approved by Consob with resolution no. 23231 of 23 August, 2024,

and published on August 24, 2024 (the “Offer Document”) among

others, on the website of Unieuro (www.unieurospa.com) and on the

website of Fnac Darty (www.fnacdarty.com).

It is hereby reminded that - according to

Article 40-bis, Paragraph 1, let. a) of the Issuers’ Regulation,

which, as indicated in the Offer Document, is applied on a

voluntary basis by the Offerors - the Reopening of the Tender

Period, at unchanged terms, may occur in the following cases:

-

if the Offerors reach a stake between 66,67% and 90,00% by the end

of the Tender Period;

-

if the Offerors decide to waive the Minimal Threshold Condition at

the end of the Tender Period,

provided in any case that the Offer becomes

effective as a result of the fulfillment or waiver of the

Conditions Precedent (other than the Authorization Condition, which

has been already waived on 24 October, 2024, as communicated to the

market), including the Minimum Threshold Condition (as lastly

amended on 7 October 2024).

If one of these cases occurs, the Reopening of

the Tender Period will take place between November 4th

and 8th 2024.

In case the Offerors reach a stake above 90% at

the end of the Tender Period, the Reopening of the Tender period

will not occur as the requirements for the fulfillment of the

Obligation to Purchase under Art. 108, Par. 2, of the CFA or for

the fulfillment of the Obligation to Purchase under Art. 108, Par.

1, of the CFA and the exercise of the Right to Squeeze-out pursuant

to Art. 111 of the CFA (if a stake at least equal to 95% is

reached) will be met.

*****

Legal Disclaimer

The Offer is being launched exclusively in

Italy and will be made on a non-discriminatory basis and on equal

terms to all holders of Unieuro shares, as set out in the notice

published pursuant to Article 102 of Italian Legislative Decree No.

58 of February 24, 1998 and as further described in the Offer

Document that will be published in accordance with the applicable

regulations.

The Offer has not been and will not be made

in the United States of America (including its territories and

possessions, any state of the United States of America and the

District of Columbia) (the “United States”), Canada, Japan,

Australia and any other jurisdictions where making the Offer or

tendering therein would not be in compliance with the securities or

other laws or regulations of such jurisdiction or would require any

registration, approval or filing with any regulatory authority

(such jurisdictions, including the United States, Canada, Japan and

Australia, the "Excluded Countries"), by using national or

international instruments of communication or commerce of the

Excluded Countries (including, by way of illustration, the postal

network, fax, telex, e-mail, telephone and internet), through any

structure of any of the Excluded Countries’ financial

intermediaries or in any other way. No actions have been taken or

will be taken to make the Offer possible in any of the Excluded

Countries.

Copies, full or partial, of any documents

relating to the Offer, including this press release, are not and

should not be sent, or in any way transmitted, or otherwise

distributed, directly or indirectly, in the Excluded Countries. Any

person receiving any such documents shall not distribute, send or

dispatch them (whether by post or by any other mean or device of

communication or international commerce) in the Excluded Countries.

Any document relating to the Offer, including this press release,

do not constitute and shall not be construed as an offer of

financial instruments addressed to persons domiciled and/or

resident in the Excluded Countries. No securities may be offered or

sold in the Excluded Countries without specific authorization in

accordance with the applicable provisions of the local law of the

Excluded Countries or a waiver thereof.

This press release is not an offer to sell

or a solicitation of offers to purchase or subscribe for

shares.

This press release and the information

contained herein are not for distribution in or into the United

States. This press release does not constitute, or form part of, an

offer to sell, or a solicitation of an offer to purchase, any

securities in the United States. The securities of Fnac Darty have

not been and will not be registered under the U.S. Securities Act

and may not be offered or sold within the United States absent

registration or an applicable exemption from, or in a transaction

not subject to, the registration requirements of the Securities

Act. There is no intention to register any securities referred to

herein in the United States or to make a public offering of the

securities in the United States.

About Fnac Darty

Operating in 13 countries, Fnac Darty is a

European leader in the retail of entertainment and leisure

products, consumer electronics and domestic appliances. The Group,

which has almost 25,000 employees, has a multi-format network of

more than 1,000 stores at the end of December 2023, and is ranked

as a major e-commerce player in France (more than 27 million unique

visitors per month on average) with its three merchant sites,

fnac.com, darty.com and natureetdecouvertes.com. A leading

omnichannel player, Fnac Darty’s revenue was around €8 billion in

2023, 22% of which was realized online. For more information:

www.fnacdarty.com.

CONTACTS

ANALYSTS/INVESTORS

Domitille Vielle – Head of Investor Relations –

domitille.vielle@fnacdarty.com – +33 (0)6 03 86 05 02

Laura Parisot – Investor Relations Manager –

laura.parisot@fnacdarty.com – +33 (0)6 64 74 27 18

PRESS

Marianne Hervé – mherve@image7.fr – +33 (0)6 23

83 59 29

1 Based on the spot volume-weighted average closing price as of

July 15, 2024.

- 20241025_PR reopening period_v15h30

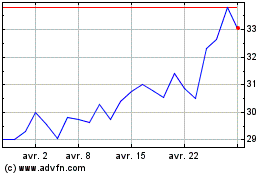

Fnac Darty (EU:FNAC)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Fnac Darty (EU:FNAC)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024