Groupe Berkem: Notification of Stabilisation Measures

20 Décembre 2021 - 6:00PM

Business Wire

Regulatory News:

Groupe Berkem (the “Group”), a leading player in plant-based

chemicals (ISIN code: FR00140069V2 – Ticker symbol: ALKEM)

(Paris:ALKEM) has received notification that Joh. Berenberg,

Gossler & Co. KG (Kommanditgesellschaft) (limited partnership)

(“Berenberg”), registered with the Commercial Register

(Handelsregister) of the Local Court (Amtsgericht) of Hamburg under

HRA 42659, acting as Stabilisation Manager in the context of the

first admission to trading of ordinary shares of Groupe Berkem on

Euronext Growth Paris, has undertaken stabilization activities in

relation to the first admission to trading on Euronext Growth Paris

of the following securities:

Issuer:

Groupe Berkem

Securities:

Ordinary shares with a par value of EUR

2.25. (ISIN: FR00140069V2)

Offering Size:

4 935 205 ordinary shares (excluding the

overallotment option)

Offer Price:

EUR 9.30 per ordinary share

Market:

Euronext Growth (Paris)

Stabilisation Manager:

Joh. Berenberg, Gossler & Co. KG

(“Berenberg”)

Pursuant to Article 6, paragraph 2, of Commission Delegated

Regulation (EU) 2016/1052, GROUPE BERKEM, on the basis of the

information disclosed by Berenberg, hereby communicates that

Berenberg has carried out, during the time period from 13 December

2021 until and including 17 December 2021, stabilisation measures

as further specified below:

Execution Date

Intermediary

Buy / Sell

Lowest price (in

EUR)

Highest price (in EUR)

Weighted average

price (in EUR)

Aggregate amount (in

EUR)

Daily total of

shares

13/12/2021

Berenberg

Buy

9.14

9.30

9.2657

59,114.90

6,380

14/12/2021

Berenberg

Buy

9.14

9.30

9.2088

27,782.96

3,017

15/12/2021

Berenberg

Buy

9.10

9.30

9.2948

56,623.74

6,092

16/12/2021

Berenberg

Buy

9.30

9.30

9.3000

23,054.70

2,479

17/12/2021

Berenberg

Buy

9.16

9.30

9.2834

57,631.20

6,208

The detailed list of transactions is available on Groupe

Berkem’s website dedicated to the IPO.

https://www.berkem-finance.com/.

This press release is issued also on behalf of Berenberg

pursuant to Article 6, paragraph 2, of Commission Delegated

Regulation (EU) 2016/1052.

ABOUT GROUPE BERKEM

Founded in 1993 by Olivier Fahy, Chairman and Chief Executive

Officer, Groupe Berkem is a leading force in the bio-based

chemicals market. Its mission is to advance the environmental

transition of companies producing the chemicals used in everyday

lives (cosmetics, food and beverages, construction, public hygiene,

etc.). By harnessing its expertise in both plant extraction and

innovative formulations, Groupe Berkem has developed bio-based

boosters—unique high-quality bio-based solutions augmenting the

performance of synthetic molecules. Groupe Berkem achieved a

revenue of €41 million and an EBITDA margin close to 19% in 2020.

The Group has almost 165 employees working at its head office

(Blanquefort, Gironde) and three production facilities in Gardonne

(Dordogne), La Teste-de-Buch (Gironde), and Chartres

(Eure-et-Loir). www.groupeberkem.com

Disclaimer

This announcement does not, and shall not, in any circumstances

constitute a public offering or an invitation to the public in

connection with any offer in France, United Kingdom, United States,

Canada, Australia, Japan or any other country.

No communication and no information in respect of this

transaction or of Groupe Berkem may be distributed to the public in

any jurisdiction where a registration or approval is required.

This announcement is not a prospectus within the meaning of

Regulation (EU) 2017/1129 of the European Parliament and the

Council of 14 June 2017 (the “Prospectus Regulation”). The

prospectus approved by the AMF is available on the AMF website

(www.amf-france.org) and the company’s website dedicated to the IPO

(www.groupeberkem.com).

The distribution of this announcement is not made, and has not

been approved, by an authorized person (“authorized person”) within

the meaning of Article 21(1) of the Financial Services and Markets

Act 2000. As a consequence, this announcement is directed only at

persons who (i) are located outside the United Kingdom, (ii) have

professional experience in matters relating to investments and fall

within Article 19(5) (“investment professionals”) of the Financial

Services and Markets Act 2000 (Financial Promotions) Order 2005 (as

amended) and (iii) are persons falling within Article 49(2)(a) to

(d) (high net worth companies, unincorporated associations, etc.)

of the Financial Services and Markets Act 2000 (Financial

Promotion) Order 2005 (all such persons together being referred to

as “Relevant Persons”). This announcement is not a prospectus which

has been approved by the Financial Conduct Authority or any other

United Kingdom regulatory authority for the purposes of Section 85

of the Financial Services and Markets Act 2000.

Securities may not be offered or sold in the United States

unless they have been registered under the U.S. Securities Act of

1933, as amended (the “U.S. Securities Act”), or are exempt from

registration. Groupe Berkem does not intend to make a public offer

of its shares in the United States.

The distribution of this document in certain countries may

constitute a breach of applicable law. The information contained in

this document does not constitute an offer of securities for sale

in Canada, Australia or Japan. This announcement may not be

published, forwarded or distributed, directly or indirectly, in the

United States, Canada, Australia or Japan.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211220005642/en/

Groupe Berkem Olivier Fahy,

Chief Executive Officer Anthony Labrugnas, Chief Financial Officer

Tel.: +33 (0)5 64 31 06 60 berkem@berkem.com

NewCap Investor Relations

Mathilde Bohin / Nicolas Fossiez Tel.: +33 (0)1 44 71 94 94

Berkem@newcap.eu

NewCap Media Relations

Nicolas Merigeau Tel.: +33 (0)1 44 71 94 94 Berkem@newcap.eu

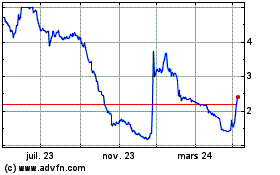

Groupe Berkem (EU:ALKEM)

Graphique Historique de l'Action

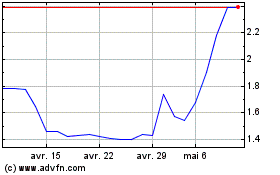

De Mar 2024 à Avr 2024

Groupe Berkem (EU:ALKEM)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024