- Partial exercise of the overallotment option for 679,986

shares, i.e. approximately EUR 6.3 million

- Total amount of the offering increased to approximately EUR

52.2 million

Regulatory News:

Groupe Berkem (the “Group”), a leading player in plant-based

chemicals (ISIN code: FR00140069V2 – Ticker symbol: ALKEM)

(Paris:ALKEM) has received notification that Joh. Berenberg,

Gossler & Co. KG (Kommanditgesellschaft) (limited partnership)

(“Berenberg”), registered with the Commercial Register

(Handelsregister) of the Local Court (Amtsgericht) of Hamburg under

HRA 42659, acting as Stabilisation Manager in the context of the

first admission to trading of ordinary shares of Groupe Berkem on

Euronext Growth Paris, has undertaken stabilization activities in

relation to the first admission to trading on Euronext Growth Paris

of the following securities:

Issuer:

Groupe Berkem

Securities:

Ordinary shares with a par value of EUR

2.25 (ISIN: FR00140069V2)

Offering Size:

4 935 205 ordinary shares (excluding the

overallotment option)

Offer Price:

EUR 9.30 per ordinary share

Market:

Euronext Growth (Paris)

Stabilisation Manager:

Joh. Berenberg, Gossler & Co. KG

(“Berenberg”)

Notification of the end of stabilization measures and details

of stabilisation transactions in accordance with Article 6 (2), (3)

DelReg (EU) 2016/1052

The stabilisation period, which began on 8 December 2021, ended

on 7 January 2022. Groupe Berkem, on the basis of the information

disclosed by Berenberg, hereby communicates that during this time,

stabilisation was carried out in respect of a total number of

60,295 shares in a price range between EUR 9.10 (lowest price) and

EUR 9.30 (highest price) on Euronext Growth Paris (ALXP) and

Off-Exchange (XOFF) as further specified below:

Execution Date

Intermediary

Buy / Sell

Lowest price (in

euros)

Highest price (in

euros)

Weighted average price (in

euros)

Aggregate amount (in

euros)

Daily total of shares

08.12.2021

Berenberg

Buy

No Stabilisation

09.12.2021

Berenberg

Buy

9.30

9.30

9.3000

279,000.00

30,000

10.12.2021

Berenberg

Buy

9.30

9.30

9.3000

46,500.00

5,000

13.12.2021

Berenberg

Buy

9.14

9.30

9.2657

59,114.90

6,380

14.12.2021

Berenberg

Buy

9.14

9.30

9.2088

27,782.96

3,017

15.12.2021

Berenberg

Buy

9.10

9.30

9.2948

56,623.74

6,092

16.12.2021

Berenberg

Buy

9.30

9.30

9.3000

23,054.70

2,479

17.12.2021

Berenberg

Buy

9.16

9.30

9.2834

57,631.20

6,208

20.12.2021

Berenberg

Buy

9.30

9.30

9.3000

3,3200.10

357

21.12.2021

Berenberg

Buy

9.14

9.24

9.1980

2,189.12

238

22.12.2021

Berenberg

Buy

9.30

9.30

9.3000

3,320.10

357

23.12.2021

Berenberg

Buy

9.30

9.30

9.3000

1,553.10

167

24.12.2021

Berenberg

Buy

No Stabilisation

27.12.2021

Berenberg

Buy

28.12.2021

Berenberg

Buy

29.12.2021

Berenberg

Buy

30.12.2021

Berenberg

Buy

31.12.2021

Berenberg

Buy

03.01.2022

Berenberg

Buy

04.01.2022

Berenberg

Buy

05.01.2022

Berenberg

Buy

06.01.2022

Berenberg

Buy

07.01.2022

Berenberg

Buy

For further details regarding all stabilisation transactions

carried out during the stabilisation period, please be referred to

the mid-stabilisation period announcements, which can be found

here: https://www.berkem-finance.com/.

Notification of the partial exercise of the Greenshoe-Option

in accordance with Art.8 (f) DelReg (EU) 2016/1052

In addition, the option granted by the selling shareholders to

the stabilisation manager on behalf and for the account of the

underwriters to purchase up to 740,281 additional shares in Groupe

Berkem at the offer price in connection with overallotments (the

Greenshoe-Option) was exercised by Joh. Berenberg, Gossler &

Co. KG in the amount of 679,986 shares on 7 January 2022.

As a result, the total number of Groupe Berkem shares sold in

its initial public offering amounts to 5,615,191 shares, including

4,719,222 new ordinary shares and 895,969 existing shares, bringing

the total offering size to 52.2 million euros.

After the exercise of the over-allotment option, Groupe Berkem’s

public float amounts to 31.75 % of its total share capital.

Following the offering and the exercise of the over-allotment

option, Groupe Berkem’s share capital will be held as follows:

Shareholders

Shares

%

Kenercy

12,069,833

68.25%

Mr. Stanislas Fahy

1

0.00%

Free float(*)

5,615,191

31.75%

Total

17,685,025

100.00%

(*) Including Danske Bank A/S at 7,30% and Berenberg Asset

Management at 5,74%

Implementation of a Liquidity Contract

Furthermore, Groupe Berkem announces that it has entrusted TP

ICAP (EUROPE) SA with the implementation of a liquidity contract

for its ordinary shares as of January 10, 2022.

This liquidity contract has been drawn up in accordance with the

provisions of the legal framework in force, and more specifically

the provisions of Regulation (EU) No. 596/2014 of the European

Parliament and of the Council of April 16, 2014 on market abuse

(MAR), Commission Delegated Regulation (EU) 2016/908 of February

26, 2016 supplementing Regulation (EU) No. 596/2014, Commission

Delegated Regulation (EU) No. 2017/567 of May 18, 2016

supplementing Regulation (EU) No. 600/2014 of the European

Parliament and of the Council, articles L. 225-207 et seq. of the

French Commercial Code, the General Regulations of the Autorité des

Marchés Financiers (AMF), in particular Articles 221-3 and 241-4,

and AMF Decision No. 2021-01 of June 22, 2021 renewing the

implementation of liquidity contracts for equity securities as an

accepted market practice.

This contract has been concluded for a period of one (1) year,

renewable by tacit renewal. Its purpose is to provide liquidity in

the shares of the BERKEM GROUP, listed on Euronext Growth Paris

(ISIN: FR00140069V2 - mnemonic: ALKEM).

For the implementation of this contract, the following resources

have been allocated to the liquidity account

The execution of the liquidity contract will be suspended under

the conditions set out in article 5 of AMF decision n°2021-01 of

June 22, 2021.

The liquidity contract may be terminated:

- at the end of the first year, at any time by the BERKEM GROUP,

subject to three (3) months' notice

- at the end of the first year at any time by TP ICAP (EUROPE)

SA, subject to three (3) months' notice,

- by operation of law when the parties cannot agree on the

follow-up to be given to the contract.

ABOUT GROUPE BERKEM

Founded in 1993 by Olivier Fahy, Chairman and Chief Executive

Officer, Groupe Berkem is a leading force in the bio-based

chemicals market. Its mission is to advance the environmental

transition of companies producing the chemicals used in everyday

lives (cosmetics, food and beverages, construction, public hygiene,

etc.). By harnessing its expertise in both plant extraction and

innovative formulations, Groupe Berkem has developed bio-based

boosters—unique high-quality bio-based solutions augmenting the

performance of synthetic molecules. Groupe Berkem achieved a

revenue of €41 million and an EBITDA margin close to 19% in 2020.

The Group has almost 165 employees working at its head office

(Blanquefort, Gironde) and three production facilities in Gardonne

(Dordogne), La Teste-de-Buch (Gironde), and Chartres

(Eure-et-Loir). www.groupeberkem.com

This announcement does not, and shall not, in any circumstances

constitute a public offering or an invitation to the public in

connection with any offer in France, United Kingdom, United States,

Canada, Australia, Japan or any other country.

No communication and no information in respect of this

transaction or of Groupe Berkem may be distributed to the public in

any jurisdiction where a registration or approval is required.

This announcement is not a prospectus within the meaning of

Regulation (EU) 2017/1129 of the European Parliament and the

Council of 14 June 2017 (the “Prospectus Regulation”). The

prospectus approved by the AMF is available on the AMF website

(www.amf-france.org) and the company’s website dedicated to the IPO

(www.afyren.com).

The distribution of this announcement is not made, and has not

been approved, by an authorized person (“authorized person”) within

the meaning of Article 21(1) of the Financial Services and Markets

Act 2000. As a consequence, this announcement is directed only at

persons who (i) are located outside the United Kingdom, (ii) have

professional experience in matters relating to investments and fall

within Article 19(5) (“investment professionals”) of the Financial

Services and Markets Act 2000 (Financial Promotions) Order 2005 (as

amended) and (iii) are persons falling within Article 49(2)(a) to

(d) (high net worth companies, unincorporated associations, etc.)

of the Financial Services and Markets Act 2000 (Financial

Promotion) Order 2005 (all such persons together being referred to

as “Relevant Persons”). This announcement is not a prospectus which

has been approved by the Financial Conduct Authority or any other

United Kingdom regulatory authority for the purposes of Section 85

of the Financial Services and Markets Act 2000.

Securities may not be offered or sold in the United States

unless they have been registered under the U.S. Securities Act of

1933, as amended (the “U.S. Securities Act”), or are exempt from

registration. Groupe Berkem does not intend to make a public offer

of its shares in the United States.

The distribution of this document in certain countries may

constitute a breach of applicable law. The information contained in

this document does not constitute an offer of securities for sale

in Canada, Australia or Japan. This announcement may not be

published, forwarded or distributed, directly or indirectly, in the

United States, Canada, Australia or Japan.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220107005418/en/

Groupe Berkem Olivier Fahy,

Chief Executive Officer Anthony Labrugnas, Chief Financial Officer

Tel.: +33 (0)5 64 31 06 60 berkem@berkem.com

NewCap Investor Relations

Mathilde Bohin / Nicolas Fossiez Tel.: +33 (0)1 44 71 94 94

Berkem@newcap.eu

NewCap Media Relations

Nicolas Merigeau Tel.: +33 (0)1 44 71 94 94 Berkem@newcap.eu

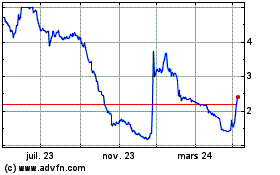

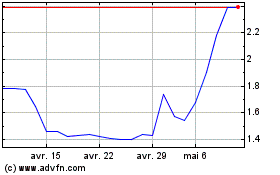

Groupe Berkem (EU:ALKEM)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Groupe Berkem (EU:ALKEM)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024