2022 annual results

Activity

- Annual revenue: €753.3 million, up 2.9% (-1.1% at

CER1)

- Steady momentum in Asia and for Interventional Imaging;

negative impact of production delays at the Raleigh site

Profitability in line with

expectations

-

- The restated EBITDA margin2 is 13.8%, at the top of the range

of 13% to 14% announced last October

2023 outlook

-

- Revenue: expected growth above 5% on a like-for-like basis and

at CER1

- Restated EBITDA margin3 expected around 11% before returning in

2024 to a level higher than in 2021 (14.4%)

Villepinte, March 22,

2023: Guerbet (FR0000032526 GBT), a global specialist in

contrast agents and solutions for medical imaging, has published

its consolidated financial statements for the 2022 fiscal year.

Revenue for the year was €753.3 million, up 2.9% from 2021,

including a favorable forex effect of €29.3 million, almost

half of which (€14.2 million) was due to the appreciation of

the dollar. At constant exchange rates (CER1), the Group’s activity

was down 1.1% over the past year.

This change in revenue was the result of:

- The one-off decrease in production rates at the Raleigh (North

Carolina, USA) plants due to recruitment difficulties in the first

half of the year and the time necessary to train new hires,

- Adaptation of the production lines to prioritize manufacturing

of EluciremTM, which received its market authorization from the FDA

on September 21, authorization obtained via the “fast track”

process. This strategic decision mainly affected the production of

Optiray® and pre-filled syringes references and related sales in

many markets worldwide.

1 Constant exchange rates (CER): the exchange

rate impact was eliminated by recalculating sales for the period on

the basis of the exchange rates used for the previous fiscal

year.

2 Excluding extraordinary costs relating to optimization of the

operational structure and changes in the sales model in China and

excluding compensation received in connection with the termination

of the contract with Merative.

3 Excluding extraordinary costs relating to optimization of the

operational structure and changes in the sales model.

In the Americas in particular,

the decrease in annual revenue (-7.5% at CER) was entirely due to

the contraction in volumes attributable to production delays in

Raleigh.

In the EMEA region, activity

was down -1.9% at CER last year in connection with the regulatory

price reductions in France and the shutdown of the commercial

activity in Turkey in November 2022.

In Asia, the very strong growth

(+8.5% at CER) was driven by the acceleration of sales in China

(+45.6%), a market that fully benefited from the direct

distribution model rolled out starting in the second quarter.

By activity, the change in annual revenue in

Diagnostic Imaging (-2.2% at CER) resulted

from:

- For MRI, an increase in sales (+1.7% at CER)

due to higher volumes and against a backdrop of negligible price

erosion, despite the arrival of generic Dotarem® in the United

States.

- For X-ray, an annual decline (-4.4% at CER)

due to lower volumes of Optiray®, while sales of Xenetix® remained

strong throughout the year.

In Interventional Imaging, the

momentum also remained very positive in 2022 (+8.1% at CER) thanks

to Lipiodol® sales, which accelerated steadily from the second

quarter.

|

In millions of eurosConsolidated financial

statements (IFRS) |

2021Reported |

2022Reported |

|

Revenue |

732.1 |

753.3 |

|

EBITDA * |

105.1 |

103.1 |

|

% of revenue |

14.4% |

13.7% |

|

Operating income |

38.7 |

(18.2) |

|

% of revenue |

5.3% |

NS |

|

Net income |

32.6 |

(41.1) |

|

% of revenue |

4.5% |

NS |

|

Net debt |

217.8 |

270.4 |

* EBITDA = Operating income + net amortization,

depreciation and provisions.

Note: The audit procedures on the consolidated financial

statements have been completed. The certification report is being

issued.

Good EBITDA margin performance in the

face of inflation

In 2022, Guerbet managed to preserve its

operational profitability by demonstrating great financial

discipline to compensate for the impact of high inflation on

certain costs. These efforts to control costs, reflected in

particular in a contained rise in staff costs (+3.4%) despite wage

tensions in the United States, limited the decline in the EBITDA

margin. Its reported rate was 13.7% of revenue in 2022, compared

with 14.4% in the previous year. In line with the 13% to 14% range

announced last October, the restated EBITDA margin rate was 13.8%.

This aggregation excludes extraordinary costs relating to the

optimization of the operational structure and changes in the sales

model in China as well as compensation (€4 million) received

in connection with the termination of the contract with Merative

(formerly IBM Watson) last November.

Significant asset impairments in

connection with new strategic priorities

As of December 31, 2022, the Group’s

operating result was negative at -€18.2 million, a change

entirely due to items with no impact on cash flow. As announced in

February, and in connection with the new strategic priorities

unveiled at the beginning of the year for Interventional Imaging

and Artificial Intelligence, Guerbet recognized significant asset

impairments in 2022 relating to Accurate Medical Therapeutics,

Occlugel and to software developed with IBM Watson. Impairments on

these three assets totaled €58.8 million.

The Group’s net income amounted to

-€41.1 million for the year after accounting for financial

expenses and stable forex losses. The tax expense was

€12.7 million after the Group accounted for €4.5 million

in items indicated in a notice from the tax authorities. After

examining the tax risks of all its subsidiaries, the Group recorded

an additional tax expense of €4.4 million under IFRIC 23.

Solid financial structure despite

increased inventories; dividend of €0.50 per share

As of December 31, 2022, equity totaled

€380 million, compared with €405 million one year

earlier. At the same time, net debt increased from

€218 million to €270 million, mainly because of the

increase in WCR, fueled by higher inventories. This increase

resulted from inflationary pressures as well as the establishment

of both precautionary stocks on critical materials and stocks of

EluciremTM.

For the 2022 fiscal year, the Board of Directors

will propose a dividend of €0.50 per share to the shareholders at

the General Meeting on May 26, 2023.

2023: acceleration of activity but

operational profitability impacted by inflation

Since the beginning of the year, Guerbet has

been confident in its ability to grow its revenue in an improving

contrast media market, with structural growth in volumes

accompanied by positive price effects for the first time in many

years. The Group is able to address this promising market with an

innovative range of solutions meeting the needs of healthcare

professionals as closely as possible. As announced in January,

Guerbet intends to mobilize its teams around three main priorities

in 2023:

- Stronger positions in Diagnostic Imaging,

where the year will be marked by the commercial launch of

EluciremTM, a new product bringing a major innovation to complement

the MRI offering. The ramp-up is expected by 2024, with a launch

already effective in the United States, while in Europe the

marketing authorization is expected in the second half of the

year.

- Refocusing of the Interventional Imaging activity on

Lipiodol®, with an emphasis on the commercial development

of current innovative indications and an acceleration of R&D

efforts to develop new applications and indications for this

product.

- Acceleration of the Artificial Intelligence

roadmap, where the Group, after having regained full

strategic latitude following the termination of its collaboration

with Merative (formerly IBM Watson), confirmed its ambitions by

acquiring a stake in Intrasense. Licensing agreements are expected

to materialize in the first half of the year with the company,

whose medical imaging software is highly complementary to Guerbet’s

asset portfolio.

Although Guerbet has identified numerous

business opportunities in growing markets, it continues to face a

demanding environment marked by persistent pressure on supply

costs, specifically in Iodine. Certain inflationary effects, with

little impact in 2022, will have a significant negative effect on

the Group’s margins in 2023.

In this context, Guerbet confirms that it

anticipates revenue growth of more than 5% on a like-for-like basis

and at CER for 2023. The Group expects stronger growth in the

second half of the year than in the first, especially with the

industrial activity being brought back up to the required level

standard in Raleigh and the gradual ramp-up of EluciremTM. In terms

of profitability, the restated EBITDA/revenue margin rate3 is

expected to be around 11% before returning in 2024 to a level

higher than in 2021 (14.4%).

3 Excluding extraordinary costs relating to

optimization of the operational structure and changes in the sales

model.

About Guerbet

At Guerbet, we build lasting relationships so

that we enable people to live better. That is our purpose. We are a

leader in medical imaging worldwide, offering a comprehensive range

of pharmaceutical products, medical devices, and digital and AI

solutions for diagnostic and interventional imaging. A pioneer in

contrast media for 95 years, with more than 2,600 employees

worldwide, we continuously innovate and devote 10% of our sales to

research and development in four centers in France, Israel, and the

United States. Guerbet (GBT) is listed on Euronext Paris (segment

B – mid caps) and generated €753 million in revenue in

2022.

Forward-looking statements

This press release may contain forward-looking

statements based on assumptions and forecasts by the Guerbet

Group’s management. Various known and unknown risks, uncertainties,

and other factors could lead to marked differences between the

Group’s future results, financial situation, development, and

performances and the estimates presented in these forward-looking

statements. These factors include those mentioned in Guerbet’s

public documents, available on its website www.guerbet.com. The

Group assumes no obligation to update or revise the forward-looking

statements in this press release to reflect future events or

developments.

Contacts

| Jérôme

EstampesChief Financial

Officer+33 (0)1 45 91 50 00 Claire

LauvernierCommunications Director+33 (0)6 79 52 11

88 |

Financial

CommunicationsMarianne

Py+33 (0)1 80 48 25

31mpy@actifin.fr PressMathias

Jordan+33 (0)1 56 88 11

26mjordan@actifin.fr |

- Guerbet CP RA 2022 V Finale VA

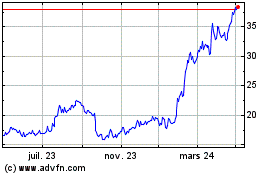

Guerbet (EU:GBT)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

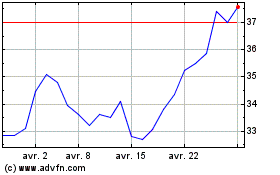

Guerbet (EU:GBT)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024